Cashless Evolution

Asking for loose change from passers-by no longer appeals to China’s digitally-savvy beggars. Going cashless, many street dwellers in the modern cities of China are now soliciting alms via QR code printouts to facilitate mobile money transfers from potential donors’ smart phone apps.

Likewise, the age-old tradition of exchanging cash enclosed in red packets or hongbaos during the Chinese New Year festive period has also gone digital in the world’s most populous nation. During this year’s Lunar New Year holidays, for instance, more than 820 million1 mainland Chinese used WeChat (a messaging, social media and mobile payments app) to send and receive electronic hongbaos; essentially doing away with the hassle of handling physical cash.

Elsewhere in the region, such as in South East Asia, the cashless or ‘cash-lite’ transition is also taking place in a big way, owing to a rapid acceptance of mobile payments apps and electronic wallets (or e-wallets).

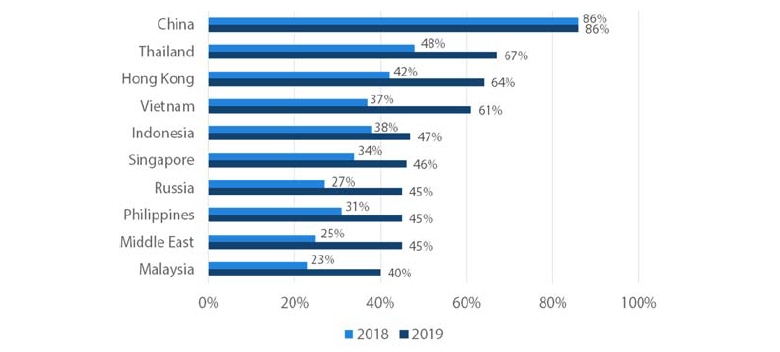

According to the PWC Global Consumer Insights Survey 2019, Vietnam is currently the world’s fastest-growing market in terms of people making mobile payments in stores, while China leads the world in terms of digital payments penetration with 86%2 of consumers polled tapping on mobile payments services (see Chart 1). The PWC survey also named eight Asian countries—China, Thailand, Hong Kong, Vietnam, Indonesia, Singapore, the Philippines and Malaysia—in its 2019 list of the world’s top 10 mobile payments adopters (based on the number of consumers polled who made purchases using mobile payments).

With the increasing proliferation of mobile payments apps and e-wallets in Asia, the region’s digital revolution, which is bypassing the usage of credit/debit cards and banking facilities, is already giving masses of unbanked Asians easy access to essential finance and payments services.

Chart 1: World’s Top 10 Mobile Payments Adopters

Source: Global Consumer Insights Survey 2019

On the whole, Asia’s digital evolution is spurring immense growth opportunities for regional e-payments players, such as Alipay, Tenpay, Go-Pay, Mynt, TruePay, PayTM and others, all of which are starting to position themselves to be the new financial service platforms of the 21st century. In our view, these new players stand to take significant market share in the payments industry with their fast-growing and far-reaching digital strategies.

Growth Region for Digital Payments

As evidenced in the developing regions of Asia and Africa, the adoption of digital payments isn’t dependent on a country’s level of economic development. In fact, it has more to do with a nation’s level of mobile phone penetration, the prevalence of traditional payments ecosystem as well as other structural factors, such as demographics and regulatory push.

In emerging-markets (EM), such as China, India and Indonesia as well as those in Africa, where transactions are still predominantly done in cash, the growth potential of digital payments tends to be high due to their large unbanked population, low credit/debit card penetration rates, relatively young demographics, high mobile phone penetration and regulatory efforts to advance e-payments. Whereas in developed markets (DM), the well-entrenched card networks and traditional payments ecosystems could make it harder to incentivise banks, consumers and merchants to change behaviours towards the adoption of digital payments.

In Asia, the adoption of mobile phone usage is also growing at a faster rate than the acceptance of bank accounts and credit/debit cards. To be sure, who needs a bank teller or an ATM to do basic transactions when you have a mobile phone? Empowered with their smartphones, Asians are leapfrogging and bypassing traditional banking, and transitioning straight from cash to mobile payments and digital wallets.

What’s more, transacting with digital payments apps on smartphones give a frictionless experience to users in their payment journey. Digital payments have taken off in a big way in Asia as well as other parts of the world because they eliminate physical barriers, namely checkout lanes and queues, as well as emotional barriers, such as potentially friction-laden interactions with cashiers, bank tellers and sales personnel, who have the tendency to peddle unneeded products. For feature phones, payments solutions can provide even more basic benefits like getting cash to the right recipients without middlemen taking their cut along the way.

Cost savings are one of the main reasons why many people in EM countries are embracing digital payments. Traditional financial services and conventional payments systems, which tend to levy some form of service fees and transaction costs, do not appeal to the vast majority of people in developing nations where transactions amounts tend to be very small. Using their smartphones to perform basic financial transactions at relatively low costs and in a seamless manner—via digital payments apps and e-wallets that facilitate fund transfers, cross-border remittances as well as the buying of basic goods and services—offers a more attractive and cheaper payments alternative to the unbanked masses in Asia and other EM countries.

Moreover, the low credit/debit cards penetration in EM countries is giving digital payments companies an edge in getting consumers to use their mobile payments platforms and e-wallets instead of plastic cards. This is already prevalent in China, a digitally-savvy nation with the world’s largest number of mobile phone users and the undisputed global leader in digital payments3, where Alipay and Tenpay dominate the market in terms of non-cash transactions.

Rise of Mobile Apps and E-Wallets

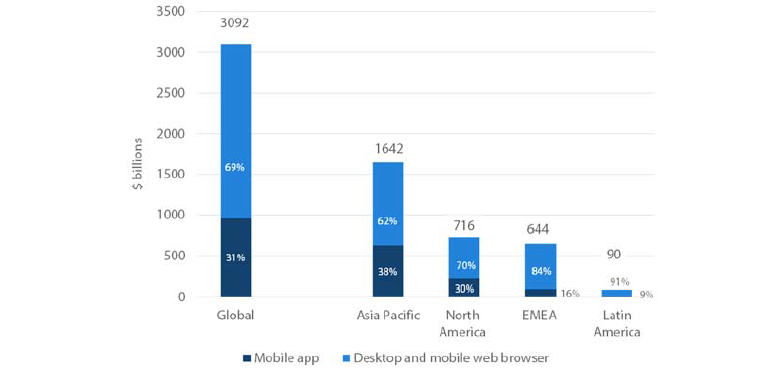

With the rise of smartphone usage, the increasing popularity of online shopping and improvements in network bandwidth, the volume of global digital commerce surpassed the USD 3 trillion mark in 2017 and is expected to more than double by 2022, according to the Global Payments 2018 report by McKinsey & Company.

Asia Pacific, primarily China, accounted for more than 50% of the USD 3 trillion volume in 2017, while mobile apps alone accounted for more than 30% of those global digital commerce sales (see Chart 2). McKinsey & Company estimated that e-wallets added about USD 40 billion to global payments revenues in 2017; China led the way with 40% of in-person spending already on mobile digital wallets.

Chart 2: 2017 Global Digital Commerce Volume Breakdown

Source: GCI Analytics & McKinsey & Company’s report—Global Payment 2018: A Dynamic Industry Continues to Break New Ground,

Gleaning Data

Like oil, which fuelled the age of industrialisation, data is powering today’s digital age, also known as the Fourth Industrial Revolution. Voluminous, varied and valuable; data offers companies across different industries unique perspectives on different aspects of their customers. That’s why the business models of many digital payments companies (like most technology firms) focus on data, which can be utilised for advertising opportunities and new product offerings.

Payment details of customers are one of the richest sources of data, containing key financial information as well as other details, such as locations, spending patterns and habits, and lifestyle choices of individuals. It comes as no surprise that digital payments firms are drawn towards data gleaning, which could bring forth new business inroads into advertising, financial services and other offerings beyond payments.

With insights from data, progressive digital payments companies could offer more customised services, such as automatic bill payments, bill splitting and other unique payment options, as well as personalise the customer interfacing experience and improve functionality of offerings, all of which could lead to higher degree of client satisfaction and loyalty. Furthermore, data-rich e-payments firms that have unique perspectives on their customers’ spending patterns could also venture into targeted advertising as well as develop new platforms for mass market financial services and offerings, such as in the areas of merchant lending, insurance, health and travel.

The extra revenues generated from data-driven personalised offerings also enable e-payments firms to offer more competitive transactional rates for their primary peer-to-peer payments business in order to gain market share. In short, invaluable data could be monetised and augmented by technology-focused companies to create a one-stop shop for customers.

A case in point is the evolution of Jakarta-based Go-Jek, which started as a ride-hailing company but soon ventured into food and grocery delivery, e-wallet services and a whole host of lifestyle offerings. Go-Jek, which has key stakeholders such as Google, Tencent and JD.com, was recently valued by New York-based market intelligence company CB Insights at around USD 10 billion4, which is equivalent to the market capitalisation of the fifth largest bank in Indonesia.

Investing in Asian Digital Payments

Despite enjoying strong growth in revenues, most Asian digital payments companies are still not making profits due to high overheads associated with their drive to expand. But we believe these progressive players, which are currently focused on building scale, getting transactions to flow seamlessly and garnering data, are likely to make money in the future.

Across the region, digital payment companies are disrupting the traditional businesses of the incumbent payments operators, such as banks. Banks and financial institutions need to develop their own e-wallets, have partnerships with mobile payments providers or risk getting left behind in today’s digital age.

Already, we have seen regional banks partnering or taking stakes in digital payments companies, which are entering the turf of banks. Bank Central Asia of Indonesia, for instance, is the principal bank for Go-Jek, whose investors also include Siam Commercial Bank, the biggest bank in Thailand. Of late, the kingdom’s Kasikornbank has also invested USD 50 million5 in Grab, which is Go-Jek’s main rival.

Likewise, Asian telecommunication companies are also looking to tap the growth of digital payments by rolling out their own e-payments companies or via strategic partnerships with e-wallet providers. Telecommunications, often considered as regulated business with unexciting growth, could gain potentially new revenue streams thanks to digital payments.

In the Philippines, for instance, the Manila-based Globe Telecom owns a 45% stake in Mynt, which operates a mobile wallet called GCash that is increasingly moving into lifestyle payments. With over 50,000 merchants on its platform, GCash has around 20 million registered users, who can pay bills, purchase goods and services, send money and make payments using QR codes. Likewise, PLDT, another telecommunication player of the Philippines, has taken strategic stake in Voyager Innovations, which operates e-wallet PayMaya.

For equity investors, however, investing in the mobile payments space isn’t as straightforward as buying a run-of-the-mill stock, as many e-payment entities are either unlisted or part of a bigger listed companies. For instance, Chinese e-commerce giant Alibaba only owns a 33% stake in Ant Financial that operates Alipay, a popular e-wallet in China. As such, buying Alibaba shares will only partially expose investors to the growth of Ant Financial’s digital payments business. The same could be said of Globe Telecom, which owns a 45% stake in Mynt, and PLDT, which has a 49% ownership of Voyager Innovations.

Impact on Valuations

Nonetheless, having a digital payments business could make a massive difference to the valuation of a conventional listed company if its developmental e-payments strategy takes off. A good example is the impact that M-Pesa (a successful African mobile phone-based money transfer service provider) is having on the valuation of its parent company Safaricom (a listed Kenyan mobile network operator). Today, M-Pesa accounts for over 40% of Safaricom’s valuations.

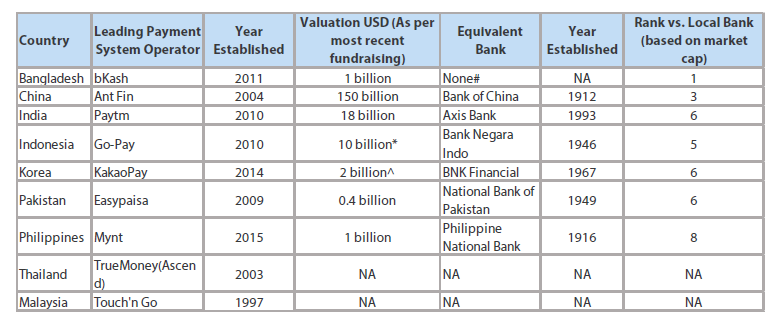

Of late, valuations of some of Asia’s digital payments companies have also surpassed the market capitalisation of long-established banks in their respective countries (see Chart 3). For instance, Ant Financial’s last fundraising in May 2018 valued the company at around USD 150 billion, which is larger than the market cap of Bank of China—China’s third largest bank that has been in operation since 1912.

Chart 3: Valuations of Asian Digital Payments Companies Surpassing Those of Regional Banks

Source: Nikko AM Asia, August 2019

*GoJek’s valuation

^2 times price-to-forward book value

#Valuation of bKash is two times more than those of the biggest banks in Bangladesh.

In South East Asia, GCash’s digital payments business—according to our conservative estimates—could be worth around 5% of Globe Telecom’s valuation by 2020. Looking ahead, GCash is going to grow significantly, and it could be worth as much as one of the top 10 banks in the Philippines. Despite the endless roll out of branches and ATMs, banks in the Philippines have only managed to garner a penetration rate of less than 30%. On the other hand, Globe Telecom has been able to attract 75 million subscribers in a relative short period of time in the Philippines, which has a population of slightly over 100 million. As an established telecom player exposed to the growth of digital payments, Globe Telecom could experience strong and sustainable revenues in the coming years.

In our view, Asian nations like China, India, Indonesia, Thailand and the Philippines, where e-payments solutions are able to meet the financing needs of their large population that are underserved by traditional banks, are likely to be the fastest growing markets in the world for digital payments and e-wallet players. And the prospects for e-payments operators to enjoy strong revenue growth and gain considerable user bases will be huge in these countries.

Footnotes

1. Source: Tencent, February 2019

2. Source: PWC Global Consumer Insights Survey 2019, April 2019.

3. Source: McKinsey Global Institute, Digital China: Powering the Economy to Global Competitiveness, December 2017

4. Source: Bloomberg, April 2019

5. Source: Business Times, July 2019

Reference to individual stocks does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.