Agile and experienced team

The Multi-Asset Portfolio Management Team at Nikko AM is headquartered in Singapore and consists of highly experienced investment specialists with diverse but complementary areas of expertise. The team of portfolio managers, quantitative analysts and a senior strategist is nimble enough to make key decisions quickly. Being in a small team enables each member to take ownership of the investment process, bringing out the best of their diverse skillsets.

Asia-centered, with a global mindset

Most of the Multi-Asset team members reside in the Asia-Pacific region—across Singapore, Tokyo and Sydney—while one member is stationed in New York. The team shares the same investment philosophy, but its members bring a diverse set of skills, capabilities, insights and cultural backgrounds. Being based in Asia, where wealth is burgeoning and markets are less transparent compared to their developed counterparts, gives the team a different perspective.

Pragmatic investment philosophy

Nikko AM’s Multi-Asset investment philosophy captures market inefficiencies through a disciplined Multi-Asset class process, aiming at superior, long-term and repeatable returns. Our investment philosophy is centered on:

- Valuation being the principal driver of future returns.

- A qualitative fundamental process is best supported with quantitative rigour.

- Proactive downside protection produces superior long-term returns.

Bottom-up insights from Nikko AM’s global investment professionals

The Multi-Asset Team is supported by Nikko AM investment professionals around the world. The core team sits alongside the Asian equities and fixed income teams to glean bottom-up insights. It also works closely with the emerging markets bond team in London and the global equities team in Edinburgh to help to paint a mosaic from various perspectives helping to make final decisions. In addition, the alternatives team based in Tokyo provides insights which have allowed the Multi-Asset team to streamline its quantitative inputs.

The investment process

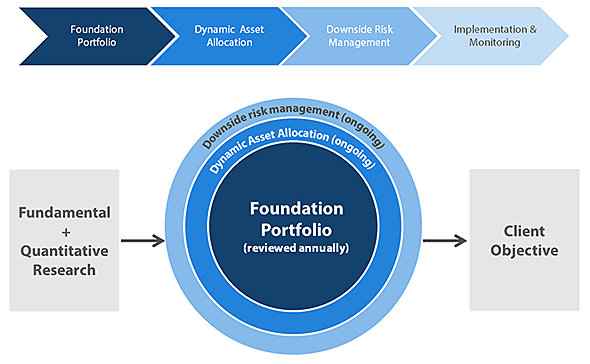

Nikko AM’s Multi-Asset Team’s investment style is a unique, holistic approach to asset management, centered in Singapore and built by the team from the ground up. The key is balance and understanding through multiple quantitative and qualitative lens that lead to efficient decision making.

The investment process includes four distinct phases that lead to the final portfolio.

- Develop the Foundation Portfolio to match the risk/return objective of the Strategy. This component drives the majority of the Strategy’s returns and risks.

- Ongoing asset class research allows the Portfolio Managers to adjust their positioning to capitalise on current market conditions.

- The Team implements a proactive approach to downside risk protection to help limit losses.

- The portfolio is implemented and monitored to ensure the best outcome for the client.

Three key principles

- Understand the real drivers of asset price returns via dedicated in-house research.

- Allocate to appropriately priced risk – disciplined portfolio construction is essential, as asset class diversification is not risk diversification.

- Focus on downside risk – a proactive approach to limiting losses.