Global economic recovery likely in line with consensus

Out of the six macro-economic scenarios presented, our committee agreed on a scenario in which the global economy matches the market consensus for solid growth with stable overall conditions. Based on this backdrop, our fixed income and equity teams delivered targets that, once again, estimate good performance for global equities, with moderate weakness for global bonds. Although we continue to realize that variants present some risk, we estimate that vaccine distribution will, overall, prevent widespread lockdowns and, thus, continue to heighten optimism among investors. We also still think that geopolitical risks will not hamper economic activity or investor sentiment, although the risks are clearly growing in many areas. Meanwhile, we continue to expect the US to enact a moderate fiscal package, with Europe and Japan also increasing fiscal stimulus that will be quite powerful for GDP growth. However, due to continued global supply chain problems and electricity rationing/pollution curtailment in China through the end of the Paralympics in March, we expect that country to remain challenged. Meanwhile, global inflation should remain stubborn in the months ahead at even higher YoY levels, and with commodity prices, excluding oil, rising moderately further, but after the 1Q, global inflation should decelerate.

/while consensus now is below that for the first two quarters, the following two quarters are now above such, with the net effect being close to prior consensus. We also expected inflation to exceed consensus, which it certainly has done for various well-established reasons, including corporations taking advantage of their pricing power to increase profits. We now expect inflation in 2022 to remain higher than usual on a YoY basis, but the 6-month annualized rates should sharply decelerate after the 1Q. Of course, there are obvious upside risks to inflation, as inflationary psychology has taken hold to a significant degree, which is already leading to wage inflation. However, supply chain and labour market healing should reduce prices in several important areas. Notably, although we expected high CPI inflation three months ago, we did not expect rising commodity prices and thanks to a late November dip in energy, the Bloomberg Commodity index fell a bit since our meeting. We now expect commodity prices, excluding oil, to rise moderately, but CPI inflation to be primarily driven by services, especially housing rents.

Our new scenario predicts that globally, GDP will match consensus, with the US up 4.5% at a Half on Half Seasonally Adjusted Annualized Rate (HoH SAAR, as used in all references below) in the 1H and 3.3% in the 2H. Personal consumption should remain strong, especially for auto sales and as we don’t expect major lockdowns, also in the re-opening services sectors. Meanwhile, private capex should continue to improve in most sectors, especially technology. Construction spending outside of the infrastructure sector will likely be constrained, but government spending should contribute to grow due to prior and future government stimulus and increased tax revenue for local governments, while net foreign trade will likely subtract from GDP growth.

Eurozone GDP is rebounding in late 2021 and should grow a further 3.2% in the 1H and 2.8% in the 2H ahead. Japan’s 3Q GDP was hurt by virus/vaccine issues (heightened by the burden of hosting a safe Olympics) and supply shortages, but should grow sharply in the 4Q and a further 4.4% in the 1H and 2.1% in the 2H. Deep consumer fears shifting toward optimism should be particularly pronounced in these two regions, with business confidence also boosting capex to a large degree, especially to solve supply chain issues and improve climate-related mandates. Japan’s economy should, in particular, benefit greatly from continued global tech demand and a rebound from hampered auto production.

On China’s economy, we expect that it will be able to wade through the current troubles, although it will continue to be quite rocky at times. The country has changed direction and such transitions can be very difficult, although often rewarding. Clearly, the real estate industry could not continue to be relied upon for providing rapid economic growth forever. Decreasing the gearing-risk of the property companies certainly makes sense, as it will curtail overall financial industry risks, but such will create additional potholes in what is an extremely opaque and complicated, yet important system. The leadership there likely wishes they had started these efforts earlier, but this process has been years in the making and they seem intent on maintaining the course, confident that they can prevent systemic risk and major negative wealth effect by consumers and corporations. A key question is whether a large number of vacant apartments will be either rented out or sold. Although the former would reduce rents, matching the common prosperity theme, (and coupled with a major government drive to build rental housing), the latter might depress property prices too much.

Meanwhile, the regulatory crackdown on various sectors aims to reduce inequality and veer the culture away from trendy (usually foreign, including Asian) and gaming cultures. Growth in the social media sphere will be moderately curtailed for an indefinite period, but will still likely grow nonetheless. Meanwhile, China is promoting super-high technology fields so as to achieve self-sufficiency in semiconductor production equipment (which will be extremely difficult, as no country has ever achieved such) and other areas where China already has achieved prowess like AI, systems integration and the medical industry. It will also likely try to keep as much foreign business involvement as possible (as long as such does not get political), as such will be needed to support the economy. In sum, we forecast its GDP up 4.7% HoH SAAR in the 1H and 4.0% in the 2H.

Finally, as for the broader outlook, GDP for the US, Eurozone, Japan and China should approximate consensus growth of 3.9%, 4.2%, 2.6% and 4.7% in CY22, but these numbers are, of course, boosted by low base effects. Consensus for China is a bit higher than our forecast, but such includes many stale estimates, with the trend clearly falling in recent weeks, and the major global brokerage houses’ estimates are close to our forecast.

Non-economic factors always concerning but not significantly impactful

There continue to be, as always, valid reasons for concern about many geopolitical issues, especially regarding North Korea, China, the Middle East and now, and perhaps most especially, Ukraine, in which Russia may not trust the West’s efforts to de-escalate. Relations between the West and China remain very tense, but neither side seems willing to cross any red lines, although the threats to certain foreign businesses certainly ratchets up the potential for major economic disruptions. Increased fears about Taiwan certainly should not be ignored either. The G-7 addressing of concerns in China, including the investigation of the origins of the virus, may trigger continued retaliation and the EU-China investment pact remains in jeopardy, while the boycotting of diplomatic attendance of Beijing’s Olympics will increase tensions even further. Meanwhile, the Middle East remains on tenterhooks, especially whether the Iran deal will be completed, as the West’s and Israel’s patience has virtually disappeared and severe “alternative actions” are ready for implementation.

As for national political risk, the US remains mired in conflict, but we still expect a moderate additional stimulus bill via the “reconciliation” method. Social issues will also likely provoke civil unrest, especially leading up to November’s election, in which the outlook points to complete political stalemate. For non-budgetary items, Biden will be less constrained; indeed, he will try to satisfy his left-wing by extensively issuing executive decrees and regulatory mandates to achieve the Democratic agenda (although some of these have already been at least partially blocked by federal judges and more are likely to be so). The net result of these political actions, especially if such includes tax hikes, should make risk markets and business leaders wary in some US sectors, but such will likely boost the economy in other sectors, particularly in the new energy and technology fields.

Our detailed forecasts:

Central banks: Now we are in line with consensus

We continue to expect the Fed to end tapering by April and but only expect a 25 bps hike (down from our 50 bps previous expectation) in the 3Q, followed by another in the 4Q. As for the ECB, we continue to expect it to end its PEPP program as scheduled, which is now increasingly the consensus view, with moderate tightening thereafter. Meanwhile, the BOJ is likely to remain on hold, but with a few minor tweaks and with less dovish rhetoric, especially if the Yen substantially weakens (and the converse, if such occurs). In sum, however, although this hawkishness may give markets indigestion for a while, policy will remain extremely accommodative.

Although the Fed leadership situation is greatly clearer, there remains much uncertainty. Powell will remain, but he will likely be increasingly swayed by more dovish members on the board and has clearly stated that he will defer to others on stricter financial sector regulation. Lael Brainard will likely be approved (by a razor thin majority) as Vice Chair for monetary affairs, and will tend towards the dovish side while promoting much stricter bank regulation. Meanwhile, the Vice Chair, whoever is nominated, for financial supervision likely faces a very difficult Senate vote. This person would likely be a dove monetarily as would any other nominated board members, replacing two Republicans. Furthermore, the early retirement of two regional presidents who leaned recently hawkish, may lead to their replacement (with the D.C. Fed’s leadership input) by their regional boards with doves. So, although the short-term trend is for a hawkish stance, the market cares about the intermediate term, which will likely shift to a very dovish stance, so it will be interesting to see how markets react. Board members have long terms, and can hardly ever be fired, so it will be a long-lasting shift. The effect of much stricter banking regulation, coupled with progressive, including green-oriented, lending mandates, would also have wide ranging implications for the economy and markets.

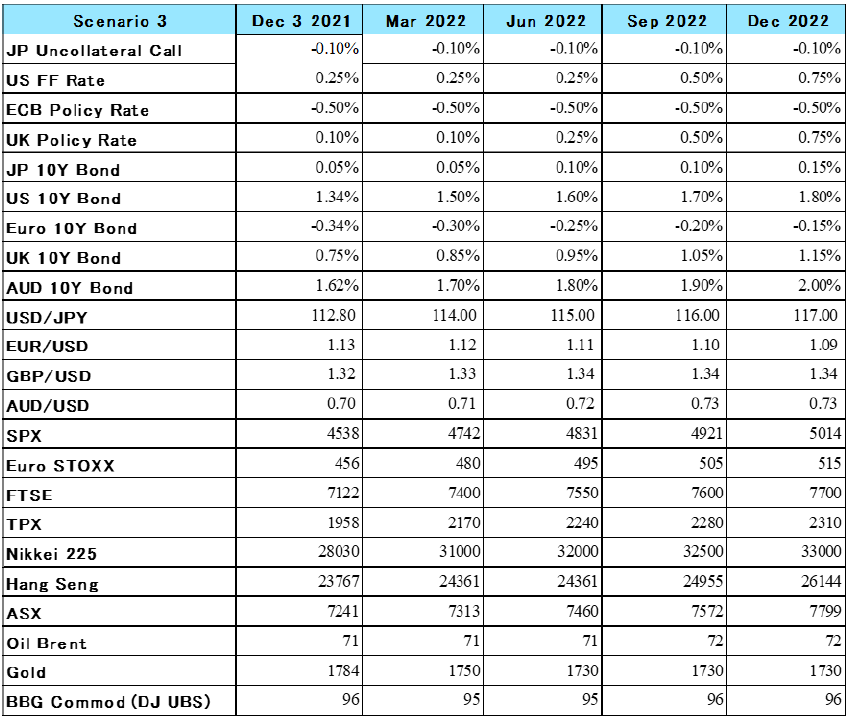

USD slightly stronger; moderately increasing G-3 bond yields

Given our hawkish central banks stance in September, many likely thought our forecast of only mild increases in bond yields was too rosy, but after a wild ride, the US Treasury 10-year yield ended up slightly undershooting our 1.55% end-December estimate, while our European and Japanese forecasts also were a bit too high. The decline in oil prices certainly helped curtail bond yields,as did a late “variant scare” (although such as not deterred hawkish rhetoric by the Fed, and indeed makes “tightening without tantrum” easier). Although strong economic growth with high inflation will be a challenge, coupled with sharply reduced Fed purchases, many bond investors will likely assume that inflation will decelerate, so we don’t expect yields to surge. Bond investors will also worry about virus scares, occasional disappointing economic data, geopolitical flare-ups and other problems during China’s transition. Thus, we expect 10-year yields globally will continue to be somewhat pinned down by low central bank policy rates. For US 10-year Treasuries, our target for end-March is 1.50%, while those for 10-year Bunds and 10-year JGBs are -0.30% and 0.05%, respectively, mildly rising by next June to 1.60%, -0.25% and 0.10%. Regarding forex, we expect the USD to be 114 vs. the yen in March and 115:USD next June, while it should also mildly strengthen vs. the EUR to 1.12 at end-March and 1.11 at end-June.

This all implies that the FTSE WGBI (index of global bonds) should produce a -0.3% unannualized return from our base date of December 3rd through March in USD terms and -0.6% through June. Thus, we continue our unenthusiastic stance on global bonds for USD-based investors. For yen-based investors, this index in yen terms should return +0.7% and +1.4%, during those respective periods, with JGBs returning 0.0% and -0.5%, respectively, so the case for offshore bonds looks much better now for them due to yen weakness, and preferring such to JGBs still seems logical.

The front month Brent oil price fell vs. our expectation in September that it would stay flat at $78. However, the Iran question looms large, both geopolitically and as regards global oil supply. The acceleration away from oil toward alternative energy sources should calm oil prices in the intermediate term, but should not influence short-term prices much as overall global demand continues rising. Prices have risen since we set our targets on Friday the 3rd, but our Brent forecasts are $71 through June and $72 thereafter.

We expect that headline and core CPI measures for the next two quarters will remain high on a YoY basis, although much less so, at 4.0% and 3.3%, respectively, in June (approximating consensus) and both at 2.7% in December. On a 6-month annualized rate both should decelerate to around 2% by June. Housing rent should continue upward, but new and used car prices should decline fairly soon as production resurges. Lastly, corporations still seem to have huge pricing power and use shortages to rationalize price hikes that are higher than needed to maintain current profits, but the Biden Administration will likely criticise price hikes (or product shrinkage) and oligopolistic practices much more sharply, while keeping the pressure on OPEC to increase production. Alleviation of labour and logistical bottlenecks will also likely reduce price pressure.

Global equities should continue upward, especially Japan

Our positive, near-Goldilocks scenario stance on overall global equity markets in our September meeting was quite successful overall, but we did not foresee the US outperforming the world so much. Indeed, all non-US regions undershot our targets, especially Japan, but the MSCI World Index rose 3.4% (unannualized in USD terms) from our base date until our meeting, vs our 3.0% forecast. Strong 3Q earnings seasons globally helped equities although a more hawkish Fed and fears of stagflation hurt valuations moderately. Our new scenario forecasts a solid return for global equities in the quarters ahead. Along with more hawkish central banks, the likelihood of moderately higher taxes ahead for the wealthy, and perhaps for all equity investors too, in the US will hamper investment sentiment, as will higher corporate taxes ahead, but increased US fiscal spending and the global vaccine-driven economic and corporate earnings recovery should more than offset such. The lack of geopolitical events that hurt market sentiment should also support prices, although we admit to “crossing our fingers” on various risks. Moreover, a major positive factor should be 4Q earnings and their impact on CY22 expectations. The last six US earnings seasons were astonishing, with many companies beating consensus “by a mile”. The CY21 SPX EPS estimate rose about 4% since we met, summing to an astonishing 29% YTD. If, as we expect, 4Q EPS forecasts exceed consensus, analysts will have little choice but to be even more enthusiastic in their CY22 forecasts (which they have been surprisingly reluctant to do so far). Thus, although PE ratios look high, the upside to CY22 earnings estimates will likely make valuations much less expensive. We continue to cite the mantra: “the ability of US corporations to beat profit expectations, especially on an adjusted basis, is very impressive and should not be doubted going forward, even under difficult circumstances”. One other thing to note is that EPS growth was artificially high in 2021 due to releases of bank credit reserves, which should disappear in 2022, thus making 2022 EPS growth look artificially low.

In sum, we retain an enthusiastic view on global equities. Aggregating our national forecasts from our base date, we forecast that the MSCI World Total Return Index in USD terms will rise 5.3% through March, 7.8% through June and 12.3% through next December (6.4%, 9.9% and 16.5% in yen terms). 9.9% and 16.5% in yen terms). We expect positive returns in each region, with Japan’s the highest among the regions:

In the US, the SPX’s PER on its CY21 EPS estimate is now about 22, which remains, by historical standards, very high. Its CY22 PER is also a bit high at about 20.0. However, there are clear reasons for such: fixed income yields are low (and bond returns should be disappointing), buybacks are rebounding sharply and earnings growth should exceed the already strong consensus view. The wild valuations among some speculative stocks have moderated, which is encouraging, but remain very high. Although such will likely worsen ahead, Democrats have seemed unwilling to disturb Wall Street or corporate price hikes, while also hoping for asset revaluation, just like Republicans, to aid the economy and, thus, their political approval rating. Government intervention, especially among major tech stocks, is also likely to be a moderate headwind. In sum, we expect the SPX to rise to 4,742 (4.9% total unannualized return from our base date) at end-March, 4,831 at end-June (7.2% return) and 5,014 next December (11.9% return), with yen-based returns being even higher.

European equities underperformed the US in USD terms, with the weak EUR the main factor, but Europeans’ confidence in their intermediate-term economic future has greatly improved. The Euro Stoxx PER, at 15.7 times CY21 EPS equates to its historical average (CY22 PER is about 14.9), and as mentioned above, we expect EPS to be revised upward. The market’s high dividend yield should also continue to attract domestic and global investors. Thus, we expect the Euro Stoxx index to rise to 480 at end-December and FTSE to 7,400, which translates to a return of 5.2% (unannualized from our base date) for MSCI Europe through then in USD terms. We project even better MSCI Europe returns through June, at 8.4%, and at 12.0% through December. As for “known unknowns,” it will be interesting to see how the markets react to Germany’s political shift to the Left, and how fast the ECB will need to pivot away from its ultra-dovish stance.

Japanese equities excelled after a disappointing 2Q. Given the plunge in COVID-19 cases and deaths, the rebound in consumer optimism was lower than expected but looks to rally ahead despite concerns about new variants and the upcoming flu season. The auto sector, which is a major portion of the stock market and economy, has suffered more production troubles than anticipated, but the situation has already sharply improved and should do so greatly further after November. Meanwhile, TOPIX’s CY21 EPS estimates rose nearly 2% since September, as did its CY22 estimates. Meanwhile, Japan has low political risk and structural reform is continuing, especially in digitalization and alternative energy, while existing and future fiscal stimulus should also boost economic growth. TOPIX’s PER fell to 14.1 times its CY21 EPS consensus estimate (from 15.4 last meeting), which is much lower than other regions, and here too, CY22 earnings estimates will likely be marked up, so its PER of 13.2 on such looks particularly attractive. Thus, we will not give up on this market and highlight it as one that should outperform after its recent slumber. Other items that will boost the market are increased share buybacks, strong global GDP growth and the significant alleviation of component shortages in auto and tech production. Notably, the market’s dividend yield, at 2.1%, remains attractive, even by global standards. Indeed, we expect domestic investors to return to the equity market in large fashion, based upon dividend income, and lead the TOPIX to 2,170 at end-March, 2,240 at end-June and 2,310 by next December for total unannualized returns of 10.4% in USD terms (11.5% in yen terms), 13.4% (15.6% in yen terms) and 16.0% (20.3% in yen terms), respectively, from our base date through those periods. As for the Nikkei, it should hit 31,000, 32,000 and 33,000, respectively. These returns are obviously very attractive for both domestic and global investors.

Developed Pacific-ex Japan MSCI: clearly, this region is heavily affected by the various troubles and transitions in China. Although the Biden Administration has maintained Trump’s tough actions on China, it will likely seek to retain current trade relations and accept the multipolar global construct. In fact, there is a major chance that it will eliminate some of Trump’s tariffs fairly soon. However, China’s recent boycott of Western firms that have expressed human rights concerns ratchets up the trade pressure, as do other tensions with global democracies, including relations with Taiwan. Australia’s relations with China remain very poor, but the country is benefitting from strong global demand for commodities like metals, LNG and coal. Hong Kong’s stock market, which is dominated by PRC firms, was hurt by several of China’s regulatory developments, as well as Hong Kong’s own troubles including the continued dearth of tourists. However, vaccines and increased global tourism will eventually help these two economies tremendously ahead. In sum, we only expect modest gains for Hong Kong over the next six months, with a much better rebound after that. Australia still looks very strong to us, however, leading to the region’s MSCI index in USD terms to rise (total unannualized return) 3.6%, 6.7% and 15.3% through March, June and December, respectively.

Investment strategy concluding view

The global economy should match the consensus for strong growth, thanks to vaccinations, continued fiscal stimulus, acceptable global geopolitical conditions, and continued low interest rates despite increasingly hawkish central banks. Such, via increased corporate profits, should allow equity markets to perform very well ahead, with impressive returns in each region, particularly in Japan. Meanwhile we expect continued poor returns for global fixed income. There remains, of course, a significant chance of alternate scenarios, for which we have different market and economic targets, and institutional investors are welcome to contact us for such.