Snapshot

Markets have become choppy, particularly toward month-end, and we expect more of the same given the nearly unrelenting strong run in risk assets since late March 2020 that gained fresh momentum early in November following the US elections. In early January, markets cheered yet again for the so-called “blue wave” when Democrats gained control of the Senate to add to its control of the House of Representatives and the White House. While short of a clear mandate, the new Biden administration certainly has greater capacity to pursue even richer stimulus. In addition, the rollout of COVID-19 vaccines could normalise demand starting in the second half of the year.

What’s not to like? Certainly, the backdrop supports a strong reflationary story, but such impressive stimulus on top of large injections of liquidity will undoubtedly bring unintended consequences including rich pockets of asset price bubbles that rightfully keep markets on edge.

Recent volatility does seem like a one-off—call it a crowdsourced retail rebellion that managed to squeeze hedge funds in a small collection of heavily shorted stocks that sparked forced deleveraging. The “David versus Goliath” story is tantalizing, but as quickly as the stress mounted, the obvious retail-induced bubble created in the process itself has burst, allowing Wall Street to get back to business as usual—for now.

Still, while this volatility event seems to have passed, it demonstrates two things: (1) there is ample liquidity in the system that enabled the event in the first place, and this excess liquidity is still out there blowing bubbles; and (2) the populace is increasingly angry for the obvious reason that the wealth gap has only accelerated during the pandemic with stimulus generally benefiting the few and not the many.

Nevertheless, we remain optimistic and still favour growth assets, long believing in the reflation trade that benefits a broad array of risk assets as demand normalises on the back of very generous monetary and fiscal support. But such heavy measures always result in unintended consequences. Sloshing liquidity is good for back-stopping demand but is also a clear risk in the form of asset bubbles and potentially less benign inflation down the road.

The hope is that a Biden administration can heal deep divisions in the US, but the order is tall given the increasing numbers that feel unfairly treated by the system. We will closely follow these dynamics, and their potential to lift volatility, and stand ready to add downside protection as needed.

Cross-asset1

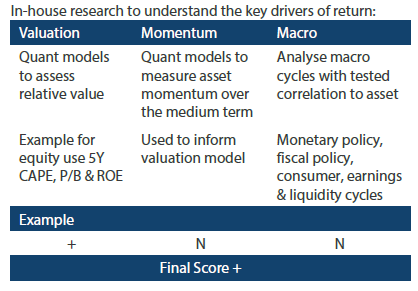

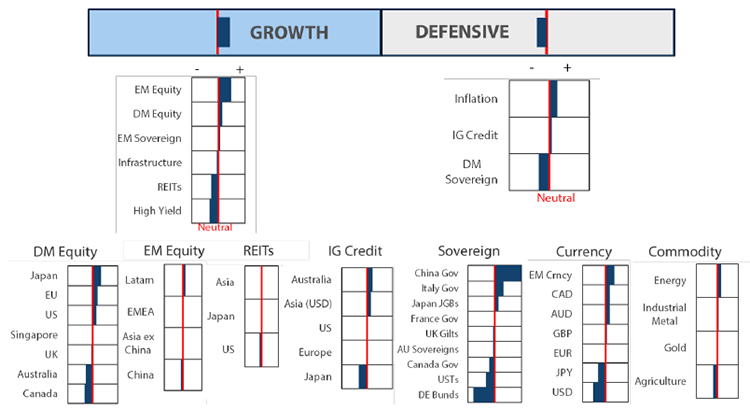

We continue to favour growth over defensive assets, with relatively small adjustments across asset classes. The US “blue wave” of Democrat control means even more fiscal stimulus lies ahead while the US continues to make steady progress in rolling out the vaccine, such that herd immunity could be achieved during the summer months. The vaccine rollout in Europe has run less smoothly, while other parts of the world have achieved varied success but are still on course to achieve broad rollouts by year-end. While risks remain, it seems reasonably clear that some sense of normalcy will be returning by the second half of the year and, in its wake, unleashing pent-up demand supported by high savings and ample liquidity. We continue to nudge our asset class scores to reflect the course to recovery, again decreasing the underweight to REITs, this time funded from developed market (DM) equities and High Yield (HY), which are showing less upside potential given the strong run since late last March. All other positions remain unchanged, where we still like equities and emerging markets in particular. We also favour emerging market (EM) sovereign over alternatives. On the defensive side, we still favour inflation assets and investment grade (IG) over sovereigns.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

1Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Inflation expectations continue to rise on the promise of fresh fiscal stimulus, still very accommodative monetary policy and the vaccine promise. While the reflation trade still feels well supported by these fundamentals, the extreme consensus that is still willing to look through weak near-term data may be at risk of a pullback in the near term if any of these drivers hit a speedbump.

The bout of dollar strength in January might ultimately prove healthy, allowing for some consolidation for the next leg up that began in early February. Earnings continue to come in strong, particularly in technology, so the barbell trade, which balances value (that benefits from reflation) with secular growth (including tech, that continues to disrupt many industries), still makes sense.

As asset managers, sometimes we feel compelled to adjust a view, but sometimes it makes most sense to wait to let the prior view run its course, although being in a consensus trade is never as comfortable as boldly taking a view that others are only slowly gravitating to. For the moment, we boldly wait while standing alert for what might change this broadly sanguine view.

Too much of a good thing?

Since the beginning of the COVID-19 crisis, policymakers made it known that they preferred too much rather than too little in responding to the crisis. Certainly, both monetary and fiscal policy have been generous, but it is reasonable to give pause on the potential risks considering the US is ready to do nearly USD 2 trillion more, just as the vaccine rollout accelerates and herd immunity is due by the summer months.

Is more stimulus needed? Yes. That much? Probably not. Given the high cumulative savings to date, the resilience of manufacturing and the fact that output gaps are already closing fast while vaccine-driven herd immunity could be literally months away, the stimulus feels large.

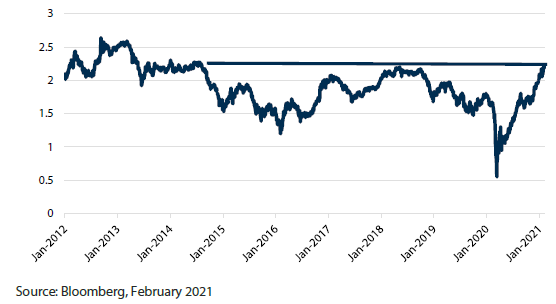

It is certainly hard to be bearish, given that realised inflation is still uncomfortably low while break evens (expected inflation) has only broken to more normal levels, looking back to 2014. Still, as we know expectations follow the motion of a pendulum, overshooting in both directions, so either our policymakers nailed it in terms of returning inflation expectations to their norms seven years ago, or there is a risk of an overshoot, which we think is likely.

Chart 1: Inflation expectations back to 2014 levels

We also note that there is a reasonably high portion of the latest stimulus checks that will be sunk back into the stock market as was experienced in the last two rounds. No doubt, stimulus is finding its way to the factions where it is needed most but, given the shotgun approach, there is a fair amount also making its way to those less desperate meaning that excess savings goes into equities.

We have long subscribed to the reflation trade, but we do grow concerned when it is not only a consensus view, but one with supporting stimulus that policymakers seem happy to continue to layer on—even to excess. Dangers lurk, whether it be a spike in inflation expectations or that asset bubbles become dangerous. We remain constructive but are also looking high and low for potential catalysts that could pull the markets against us.

Conviction views on growth assets

- Downgraded DM in favour of REITs: We still favour DM equities and are cautious on REITs, but we have compressed the spread given rich valuations in pockets of DM and the likely coming support for REITs as societies find herd immunity.

- HY looking rich, also favouring REITs: Absolute yield on US HY is under 4%, which is at an all-time low despite spreads being slightly higher. Most of the return to normal spreads has occurred, which led us to reduce HY to add also to REITs.

Defensive assets

We maintain our negative view on defensive assets. As most developed countries have begun to show success in combatting the third wave of COVID-19 cases through lockdowns and other restrictions, the rollout of vaccination programmes is also gaining momentum. The combination of monetary and fiscal policy has provided much-needed support for the global economy, with pent up demand now waiting to draw down on high savings rates and utilise low borrowing costs to boost the global economy. In this environment, we expect global bond yields to continue trending higher.

IG credit spreads were stable this month while settling into pre-pandemic ranges in most regions. The yield premium over sovereign bonds will likely deliver better returns for credit as spreads are supported by economic recovery even though total returns will be held back by rising benchmark yields. Nevertheless, the yield premium of high-grade credit still makes it preferable to sovereign bonds.

We have maintained our overweight view on inflation assets again this month. Future inflation indicators are on the rise with a new US fiscal programme on the horizon and vaccination programmes being rolled out in many countries. Central banks have pledged to ensure highly accommodative conditions until recovery is well underway, most likely erring on the side of loose policy for longer. The case for inflation protection continues to build, increasing demand for inflation hedges such as US Treasury inflation-protected services (TIPs) and gold.

China diverges from the rest of the world

After moving quickly to contain the COVID-19 outbreak, China has the distinction of being the only major economy with positive economic growth in 2020. Because of this, China is also beginning to plot a different course in managing its economy. In December’s Central Economic Working Conference (CEWC), the top leadership group gave clear signals to begin normalising policies in 2021. The indication that fiscal policy needs to be “more sustainable” is a change from its previous “more proactive and effective” stance. This is a modest shift but an important one relative to the full throttle fiscal policy of other major economies.

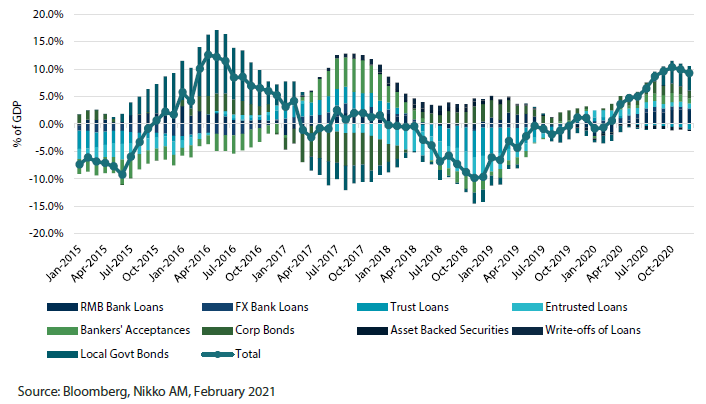

As evidenced by our credit impulse model in Chart 2, this moderation has already started. Overall credit growth has edged lower for two consecutive months since November, driven by decelerations in corporate bond issuance and shadow credit provision. Local government bond issuance is also likely to decline in coming months as the central government tightens overall fiscal budgets. As a result, China’s economic growth may start to slow in coming quarters.

Chart 2: China credit impulse

This is in stark contrast to the rest of world and especially the US. After the Georgia Senate runoff elections secured control of the Senate for the Democrats, the Biden administration was quick to push for another round of fiscal stimulus to the tune of USD 1.9 trillion, despite having just had a Phase IV package in December. Combining this additional spending with demand recovery through vaccinations, the US is likely to have both strong growth and a pick-up in inflation. Other major countries are also pursuing a similar policy mix to support their economies.

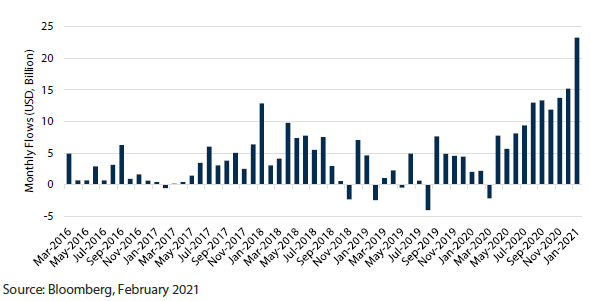

The bond market has already taken notice. The US 10-year yield has risen over 25 basis points (bps) this year so far, compared to only 9 bps for China’s 10-year bond yields. The foreign inflows into Chinese government bonds hit a new record of USD 23 billion in January. In our view, China’s bond yields have already repriced higher ahead of a global recovery and are more attractive at current levels given that China’s growth and inflation have the potential to moderate from here.

Chart 3: Monthly foreign flows in China government bonds

Conviction views on defensive assets

- Global yield curves continue to steepen: The steepening yield curve trend is gaining momentum as coordinated monetary and fiscal policy combines with worldwide vaccination efforts.

- China government bonds are the pick of the bunch: China’s bond yields have already repriced higher ahead of a global recovery and are more attractive at current levels than their peers.

Process