Snapshot

2020 will undoubtedly be remembered as the year of the pandemic. While in financial market terms it is now tempting to think of COVID-19 as old news, the virus still presents substantial risks to the economic outlook. The new year has begun with third waves of viral infections in many countries that far exceed earlier waves and have prompted renewed restrictions and lockdowns. On the surface it may be surprising that economic data has held up better than expected, but we also know that governments and central banks have pulled out all stops to keep their economies afloat. A strong manufacturing cycle recovery and firm demand from China have also offset weakness from pandemic damage. And last but certainly not least, vaccines have been developed in record time and are now being distributed. With all these factors in mind we remain constructive on global demand but wary of potential negative surprises from new strains of the virus and the complexity of vaccinating hundreds of millions of people worldwide.

If this is not enough to worry about, investors have also been keeping a watchful eye on the remaining days of the Trump presidency and the US Senate runoff races in the state of Georgia. The odds of a so-called “blue wave” had been rising as the runoff elections approached and the odds makers were vindicated as both Senate seats went to the Democratic Party. President-elect Joe Biden’s party now has control over both the executive and legislative branches of government, which significantly changes the scope of his agenda and what is now possible. Most notably, additional pandemic relief spending is more likely to be passed and other big spending initiatives have a greater chance of seeing the light of day. While the push to reflate the US and global economy was already well underway, a Biden administration is likely to turbocharge these efforts, putting upward pressure on long term bond yields and in turn potentially weigh on equities.

Now that the drama of US elections can be largely put aside until 2022, extraordinary government support and vaccine distribution will be the focus in coming months. Our view had been that either election outcome would be supportive of a reflationary environment but now the pace of recovery has the potential to be faster under a unified US Congress. The countervailing force to this optimism is the repeated waves of COVID-19 around the world and the sluggish pace of the vaccine rollout so far. This tug of war between the pandemic and government actions will add to market volatility and global economic demand uncertainty. However, we expect reflationary dynamics to prevail in coming quarters, which may be negative for developed market (DM) rates, but positive for global growth.

Cross-asset1

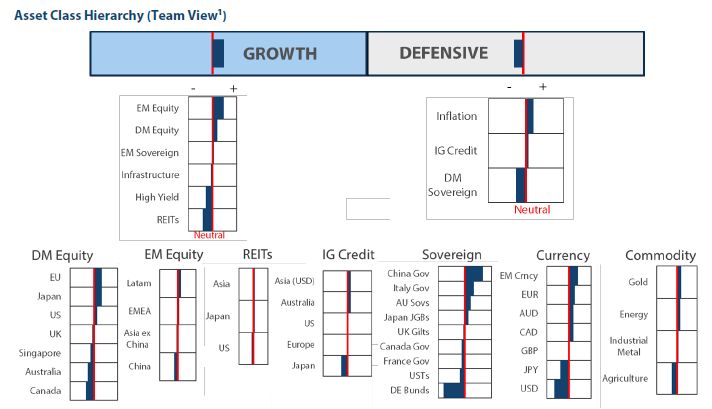

Our overweight view on growth assets and underweight view on defensive assets are unchanged from last month. The trends that took hold following the US elections and sooner-than-expected vaccine approvals, such as the rotation from growth to value stocks and rising sovereign bond yields, continued in December. While the “reflation trade” is gaining in popularity and consensus moves closer to our views expressed over the last few months, we are both heartened but also circumspect. Growth assets have responded well so far to a delayed “blue wave” that has given the Democratic Party control over both the executive and legislative branches of government but recent events at the US Capitol remind us that stability in the world’s most powerful country is not guaranteed.

We continue to lean towards a value orientation in our view on equities and maintain an aversion to duration risk, particularly in US Treasuries (USTs). At the asset class level, we increased our favourable view of emerging markets (EM) equities at the expense of DM equities, with EM fundamentals looking increasingly attractive. Growth outside of the US is being propelled by a weaker US dollar and solid Chinese demand. We have also eased our long-held cautious view on REITs as we look past the deepest scars owing to the pandemic. The worst is likely behind the asset class now as some of its constituents, such as hotels, hold the promise of recovery. This change in view towards REITs was enabled through small reductions in Infrastructure and some sections of EM Bonds.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The outlook for growth assets remains positive, now further supported by the “blue wave” in the US which opens the doors to more stimulus. Conversely, concerns about rising taxes are more distant given that the Biden administration is unlikely to hike rates any time soon for fear of disrupting the nascent recovery amid still-high uncertainty concerning the course of virus.

Clearly, markets are pricing a high degree of optimism. Investors appear willing to look through near-term headwinds caused by the repeated waves of the virus on the premise that, in the coming months, the worst will be behind us at which point pent up demand coupled with vast stimulus will further cement the recovery in global demand.

The risk rally continues unabated, including technology with stretched valuations that have yet to meaningfully correct in light of the steady rise in long-term rates. UST 10-year yields currently stand at 1.14%, nearly 60 basis points (bps) above the rock-bottom levels of 0.55% struck in late July. Our view is that long-term rates will continue to rise as a reflection of returning demand, which poses a risk to those assets with stretched valuations.

Paying up for future growth

We have long been sanguine on the equity outlook for the reflationary conditions on the horizon, especially for the broadening opportunity set extending beyond just growth to value sectors that have underperformed for more than a decade. However, while we have expected more of a rotation from growth to value, growth has held up quite well despite the steady rise in long-term rates.

We remain positive on the outlook of growth sectors, but it is important to stay vigilant as to what could disrupt an otherwise euphoric market where investors are still willing to pay very high premiums. What could be the catalyst? In our estimation, rising long-term rates is the greatest risk that could force high-multiple stocks to de-rate, but could it be different this time?

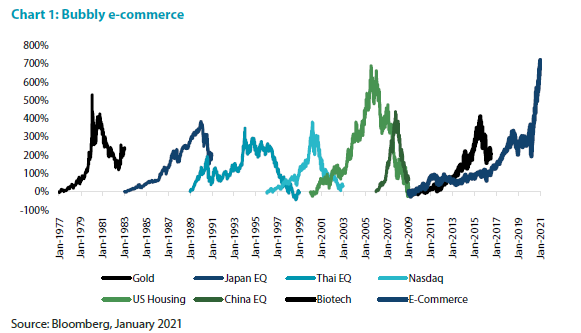

We are living in an era of mass technology disruptions that have spread to virtually all industries. Higher valuations are often justified given the low capital requirements and strong gains in productivity which combine to generate unprecedented levels of profitability. A case in point would be e-commerce companies that, measured by price alone, appear to exceed all other “bubbles” of the last 40 years.

Not surprisingly, such tantalising growth is pricing very rich: 46x forward earnings and 6x forward sales. However, unlike the dotcom bubble where future earnings were speculative at best, e-commerce profits are real, growing and defensible. However, with miniscule dividends, the effective duration of these equity instruments is extremely long, a quality that is shared by most segments within the technology sector.

Yes, UST yields are also miniscule and comparatively favour long-duration exposures, but rates are on the rise, and we remain cautious for the tipping point where high multiples will necessarily compress to compete with higher yielding opportunities elsewhere. The tipping point is difficult to project but yield curve dynamics are clearly a close watch point for when such a dynamic takes hold.

Conviction views on growth assets

- Favour EM over DM:We upgraded EM further at the expense of DM as reflationary forces continue to firm, supported by strong China demand and a robust manufacturing cycle. Demand will accelerate as the vaccine is rolled out, favouring value opportunities that are likely to fare better in a rising rate environment.

- Increasing tilt to value in EM: The growth story remains strong in China and North Asia. However, given that the tech cycle is advanced in North Asia and that China is likely to tighten policy, at least to some degree, in the coming months, we see stronger opportunities in LatAm and EMEA where the recoveries are still very nascent.

Defensive assets

We turned negative on defensive assets back in October 2020 and continue to have a cautious view of sovereign bonds. The global economic outlook is improving as the roll out of vaccines in many countries has begun. Although some hiccups are inevitable for such a massive operation, gaining control over the pandemic through vaccination will allow more economies to reopen, and more importantly, stay open. At the same time, the coordinated monetary and fiscal response to COVID-19 disruptions has been significant and will continue into 2021. In this environment, we expect global bond yields to trend higher as reflation efforts gain traction.

We maintain our more positive view on investment grade credit relative to sovereign bonds. High grade credit spreads have started to level out as they return to pre-pandemic ranges in most regions and in coming months, returns will be held back by rising benchmark yields. However, this will be partly offset by credit spreads where the yield premium of investment grade credit still makes it preferable and we remain overweight within defensive assets.

At the same time, the case for inflation protection is rising as central banks prolong asset purchase programmes and liquidity measures until economic data sustainably improves. Governments also continue to support their economies with additional fiscal spending as many of these programmes have yet to be exhausted. The combination of high savings rates and the distribution of vaccines will be a strong catalyst for global growth and greater pricing power for businesses. This reflationary environment will support both gold and inflation-linked bonds, although gold remains our preferred inflation hedge.

Italy still the pick in Europe

The European Central Bank (ECB) announced back in October that it would “recalibrate” its monetary policy instruments alongside new Eurosystem staff macroeconomic projections at its December meeting. The recalibration involved extending existing programmes and, in some cases, loosening terms to make the programmes more accessible. This was essentially the ECB’s response to the renewed challenges presented by the pandemic across Europe and its downgrade to expected real GDP growth in 2021. The ECB’s key interest rates were left unchanged but the recalibration was intended to ensure that financing conditions remained supportive of economic recovery.

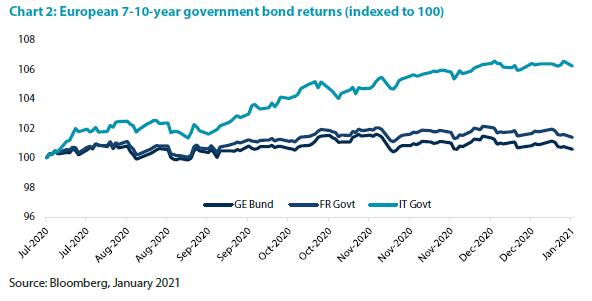

Since the October announcement and the follow through in December, European sovereign bonds have outperformed USTs as eurozone yields resisted the rise in US yields. Among the three largest European government bond markets, Chart 2 shows that Italian bonds outperformed both French and German bonds over the last six months. This is consistent with the positive yields on 7- to 10-year Italian bonds versus the negative yields in the other two countries; however, the magnitude of the performance gap is indicative of significant spread compression across European bonds.

While the ECB’s liquidity programmes have benefited European bonds across the continent, the peripheral bond markets such as Italy have benefited the most. Italy will also benefit greatly from the EUR 1.8 trillion NextGeneration EU fiscal stimulus package financed through the EU’s budget and the issuance of EU bonds, a historic first. Italian 10-year bond yields have recently reached the tightest spread versus German bunds since 2016.

We expect Italian bonds to continue outperforming the core EU bonds markets as the ECB’s renewed efforts to provide liquidity and the EU’s fiscal package disproportionately benefits Italy. This is not to say that Italy is without its potential problems given its enormous debt and rarely stable political landscape, but with ongoing ECB intervention on such a massive scale, EU bond yields will continue to compress.

Conviction views on defensive assets

- Pressure on long-term bonds to continue: We expect yield curve steepening to continue as coordinated monetary and fiscal policy and worldwide vaccination efforts lead to reflation success.

- • Unorthodox sovereign allocations: Our preferred allocations in sovereign bonds are somewhat outside-the-box, with China, Italy, Australia and Japan making up our overweights.

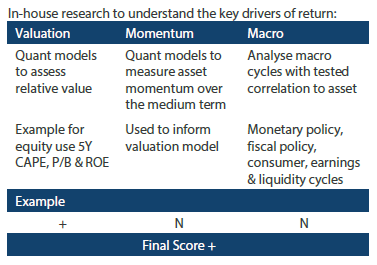

Process