Overview of Japan’s underperformance

Keeping in line with the overall bullish trend in global equities, Japanese stocks are poised to continue their strong run as the economy benefits from current and future fiscal stimulus and continued structural reform. However, perhaps a lesser known fact is that Japanese equities have not made much headway when viewed through a longer time frame. Chart 1 shows that Japan’s TOPIX (with 1991 as the base year) has essentially remained flat over the past three decades while European and particularly US equities have risen steadily.

Chart 1: Japanese stocks have lagged their US and European peers over the last 30 years

Source: Bloomberg

Source: Bloomberg

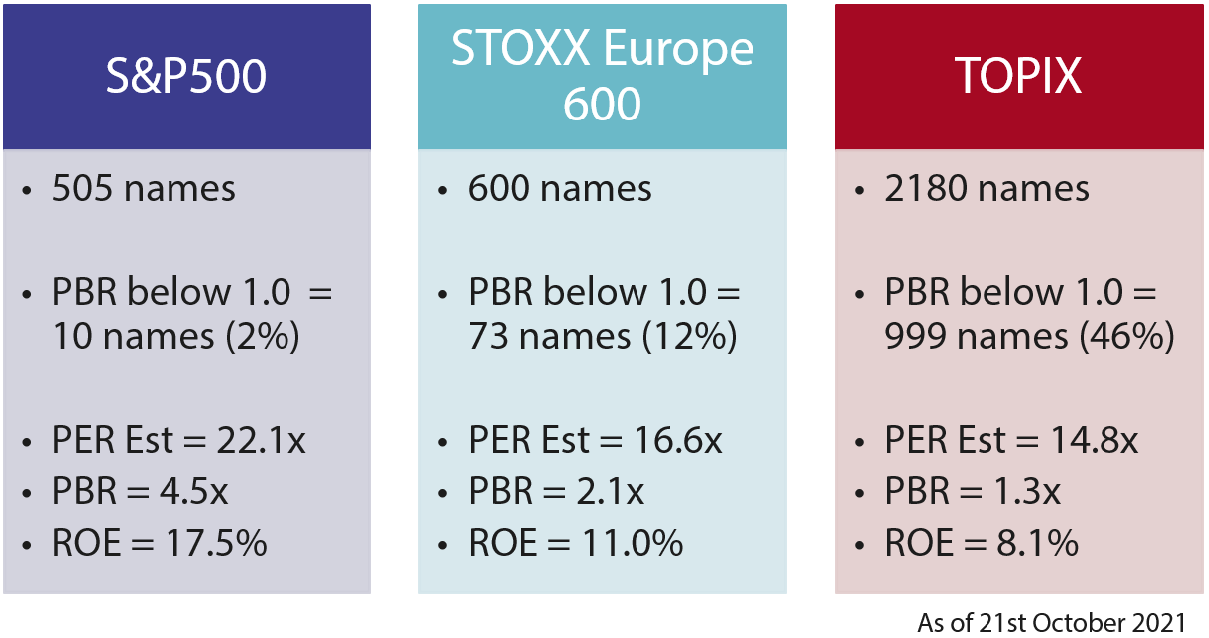

A closer look reveals that Japanese equities are significantly undervalued, with 46% of stocks listed on the TOPIX trading below book, compared to 2% for the S&P 500 and 12% for STOXX 600 (Chart 2).

Chart 2: Japanese stocks are significantly undervalued

Source: Bloomberg

Source: Bloomberg

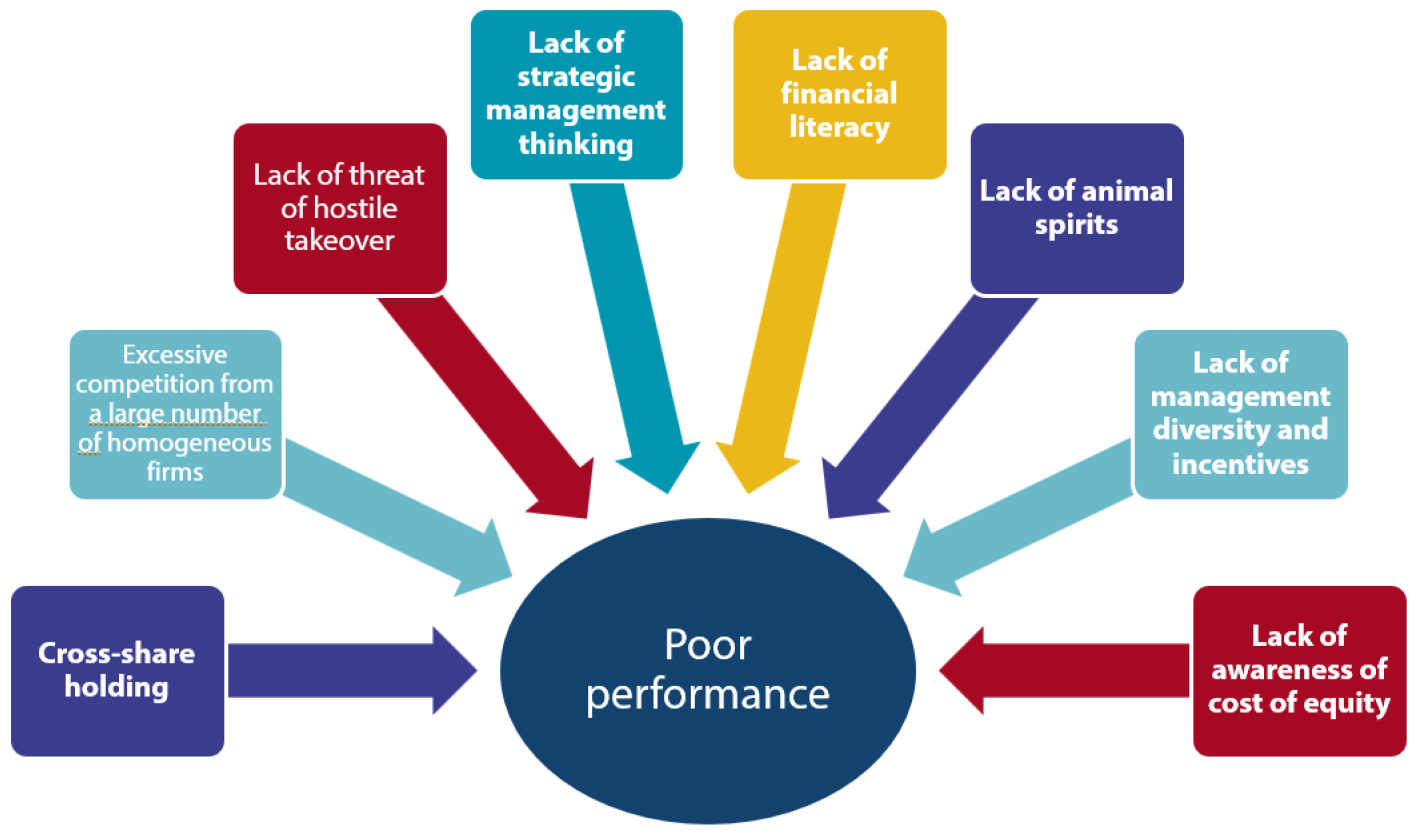

Reasons for the underperformance of Japanese stocks in the last 30 years are numerous and diverse. They range from factors long associated with Japan, such as the tendency for companies to hold excessive cash and engage in cross-shareholding practices, to a lack of diversity and incentives among management—a theme which has come into focus amid the rise in importance of corporate governance (Chart 3).

Chart 3: Factors behind Japanese equities’ underperformance

Negative factors represent value to be unlocked through engagement

Background: The Corporate Governance Code, Stewardship Code and the growing importance of engagement

The list in Chart 3 above may appear dispiriting. However, these negative factors can also be evidence of an untapped gold mine, as they represent value which can be unlocked through engagement between investors and investee companies. This is especially true given the advent of Japan’s Corporate Governance Code and Stewardship Code, which have brought engagement to the fore.

The establishment of the Stewardship Code, one of the key pillars of an economic revival plan initiated by then prime minister Shinzo Abe in 2014, was a watershed in terms of changing how institutional investors interact with the corporations they invest in. One of the Code’s key elements is "constructive engagement with investee companies" that institutional investors are asked to undertake to foster sustainable growth.

More specifically, the Stewardship Code encourages engagement between institutional investors (such as asset managers) and investee companies in the following ways:

- Asset owners, such as pension funds, are asked to monitor whether the asset managers investing on their behalf carry out stewardship activities that are in line with the asset owners’ policies, and the quality of dialogue between asset managers and investee companies is a key evaluation point.

- The code emphasises constructive engagement between institutional investors and investee companies to solve governance issues the latter may be facing.

- Institutional investors tasked with passive management are encouraged to actively take charge of engagement and voting (based on the premise that passive management offers institutional investors fewer options to sell investee companies’ shares and therefore they are in a position to promote longer-term corporate value growth).

Engagement has come into focus thanks to its positive impact on all parties involved—asset owners, institutional investors and investee companies. Academic research shows that engagement activity by large institutional investors aimed at companies with potential areas of improvement, such as governance, low ROA and excessive cash holdings, has had a positive impact on target companies. This has resulted in higher ROEs, more independent directors and proportion of shares owned by management. Research has also shown that the emphasis on active engagement, through measures such as the introduction of the Stewardship Code, helps mitigate the free-rider problem by increasing the cost for institutional investors who opt not to actively engage with the companies they invest in.

Numerous other factors support engagement

In light of changes ushered in by the Stewardship Code, there are a number of other developments that support engagement between investors and corporations. These include ongoing corporate governance reform, the forthcoming restructuring of the Tokyo Stock Exchange (TSE) and the rising prominence of ESG.

Corporate governance reform

Soon after the launch of the Stewardship Code, Japan’s Corporate Governance Code (CGC) was introduced in 2015. The CGC, which has played a role in changing the corporate governance of Japanese firms, has already been revised twice; that reforms are continuing after then Prime Minister Shinzo Abe stepped down in 2020 is an encouraging sign. The CGC’s second revision is of particular importance as it encourages companies to actively engage with investors.

TSE restructuring

In April 2022, the TSE’s five segments (1st Section, 2nd Section, Mothers, JASDAQ Standard and JASDAQ Growth) will be restructured into three sections (Prime Market, Standard and Growth) with the aim of increasing corporate value and boosting sustainable growth. The restructuring is significant from an investor’s perspective as companies in the Prime Market will be subject to a more stringent listing criteria and will be required to adhere to certain corporate governance and ESG standards. This is positive from an ESG perspective as companies will be incentivized to maintain or increase ESG standards in order to remain listed.

ESG

ESG made its mark on the Japanese financial markets in 2015, when the Government Pension Investment Fund (GPIF) became a signatory of the UN Principles for Responsible Investment (PRI). The GPIF has since required its external asset managers to integrate ESG factors in investment processes. ESG investing has since expanded in Japan, encouraged by growing market awareness towards stewardship and corporate governance.

Enter the Nikko AM Active Ownership Group

AOG’s primary focus: Engagement

The primary focus of Nikko AM Active Ownership Group (AOG) is engagement. Formed in 2017, when the Stewardship Code was revised for the first time, the AOG engages companies in Nikko AM’s Japanese equity investment universe to gain a deeper insight into their business environment while promoting medium- to long-term corporate value improvement. Since the AOG was formed, the number of companies that Nikko AM engages with increased from about 950 to approximately 2,200. Specifically, the AOG endeavours to (1) promote stewardship through proxy voting, engagement and reporting of stewardship activities, and (2) promote integration of ESG into the investment process.

AOG’s evolving role

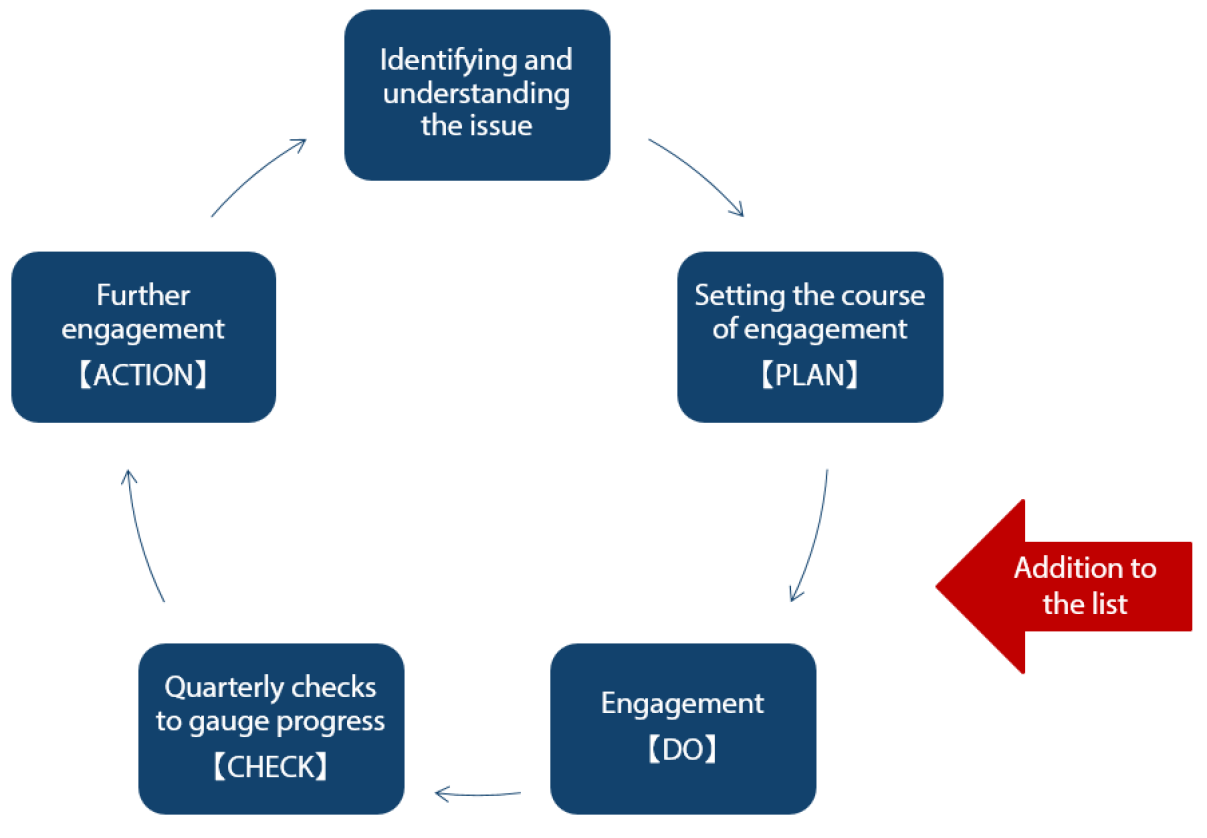

Normally, engagement at Nikko AM has been undertaken separately by its sector analysts, portfolio managers and AOG analysts. Going forward, however, AOG aims to act as an engagement hub within the Japanese equity team at Nikko AM by coordinating with the company’s sector analysts and portfolio managers on engaging mid- to large-cap companies falling into milestone management targets for engagement (Chart 4). Within this system, engagement policies can be set in advance. The process includes (1) planning (setting of engagement policy, identifying areas of improvement, setting of goals and a timeline); (2) the actual engagement; (3) regular checks to gauge progress; and (4) a review to determine whether to continue engaging the company or revise the process. Initiatives such as milestone management will allow the AOG to narrow down the group’s engagement focus and conduct engagement at a deeper level. Under this initiative, the AOG’s four analysts can each effectively and thoroughly engage approximately five investee companies annually for a total of 20 companies p.a.

Chart 4: Milestone management by Nikko AM’s Active Ownership Group

Increasing market interest towards ESG has meant that the AOG’s focus has also evolved since the group’s inception. The AOG’s primary aim is to increase shareholder value by promoting ESG principles through engagement, but they will also contribute to the double-checking of the ESG evaluations by sector analysts within Nikko AM’s Creating Shared Value (CSV) scoring framework which is an important part of ESG integration in the investment process.

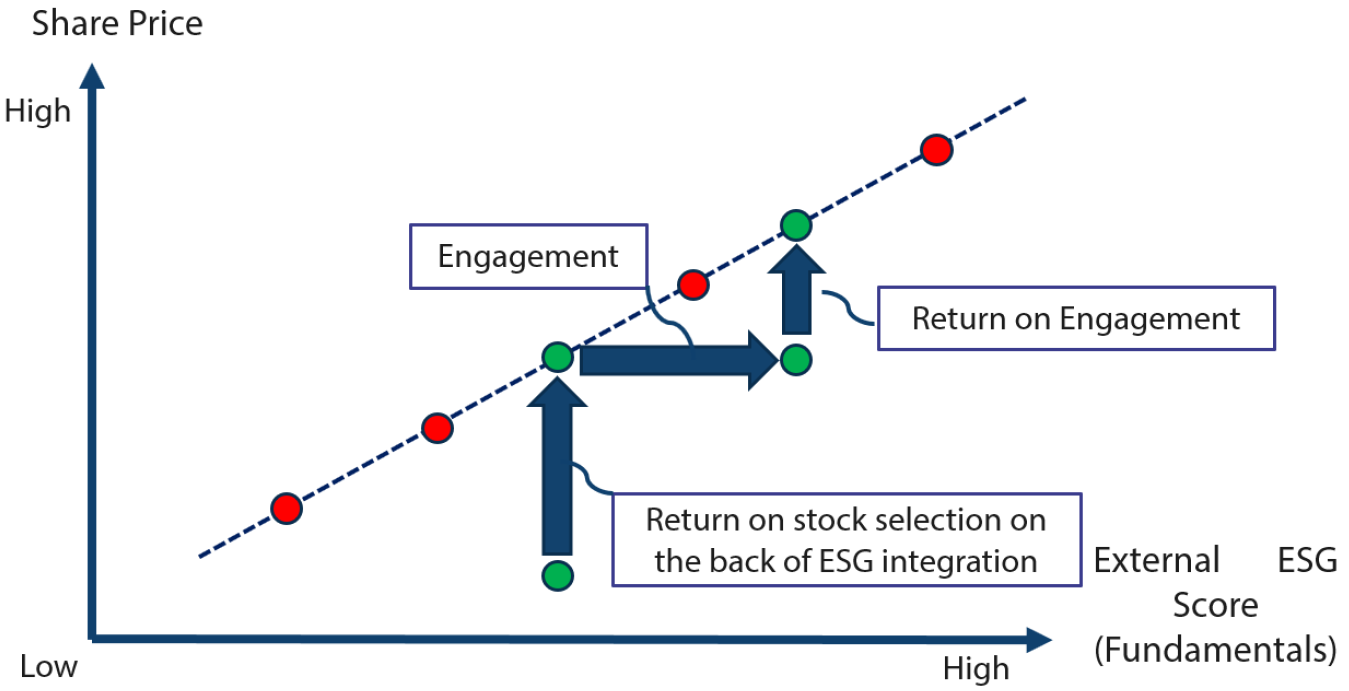

How engagement leads to alpha

Employed in tandem with stock selection, engagement with firms with medium- to long-term potential for improvement from an ESG perspective will improve their value and foster sustainable growth, ultimately contributing to the generation of alpha.

Using the aforementioned CSV scoring framework, Nikko AM’s sector analysts identify undervalued names which have the potential to enhance their value due to ESG-related factors which are not yet reflected in the stock price (Chart 5). Engagement by the AOG analysts with these firms—on issues such as decarbonization, managing human capital, and enhancing their governance frameworks—will improve their fundamentals, enhance their corporate value and ultimately lead to higher returns.

Chart 5: Returns from ESG integration and engagement

Conclusion

Engagement has risen in importance amid the rising prominence of stewardship, corporate governance and ESG in Japan. Within this changing landscape, we believe that engagement is a source of differentiation within a market in which the negative factors also represent hidden opportunities.

We believe that the Japanese equity market, due to its long history of underperformance, has significant value-creation potential that can be unlocked through engagement. Our goal at the AOG is to improve the performance and value of our investee companies through engagement and help increase the attraction of Japanese equity market as a whole in the process.