Snapshot

The shift in market narratives continues to gather pace, matching the increase in volatility of the economic cycle seen since the beginning of the pandemic. Central banks are generally aiming to smooth the economic cycle, but this time they may be adding to the volatility of the cycle instead. They have stayed exceedingly accommodative for an extended period and are now attempting to reverse course quite aggressively to ensure inflation expectations remain anchored.

US GDP growth has been disappointing in the first half, but this is likely more a function of companies adapting to fast-changing patterns of demand—such as from goods to services. Current headwinds include excessive inventories that are a natural drag to manufacturing, contributing to the narrative that the US economy is on the cusp of a recession—notwithstanding a still-healthy labour market. As if this outcome was a fait accompli, markets are positioning for easing by the Federal Reserve (Fed) by early 2023, with such expectations credited as the main factor behind a powerful rally in US equities seen through July.

A simpler explanation is that markets were oversold in June; furthermore, the current earnings season has not been nearly as bad as many expected. In terms of levels, today’s inflation appears to be the closest to conditions seen in the 1970s. However, although inflation lifted wages and compressed profit margins in the 1970s, this does not appear to be the case currently; profit margins remain healthy and are contributing to the high levels of inflation. Inflation will likely decline in the coming quarters, but the question is by how much and whether it would be enough for the Fed to ease their foot off the tightening brake. We are still undecided, but while so many seemingly remain deeply bearish and may be positioned as such, we believe that it would be reasonable to cautiously consider a more benign scenario.

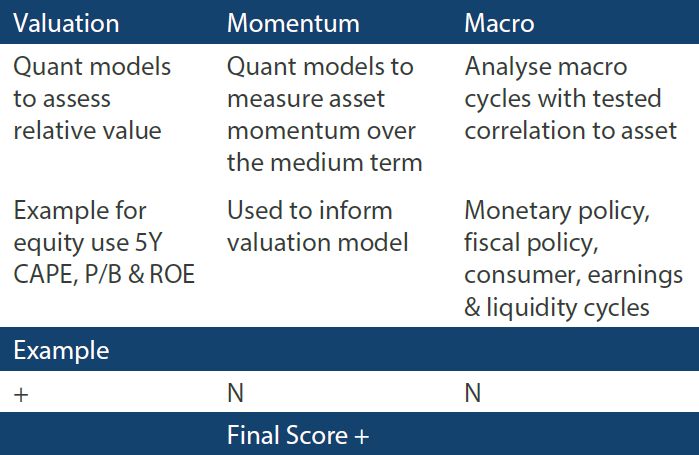

Cross-asset 1

We maintained our cautious view on both growth and defensive assets. US inflation again surprised to the upside in June and this seemed to indicate that price pressures were indeed broadening. Nevertheless, the market seemed more content to hold the notion that peak inflation is likely behind us and that any recession ahead will likely be relatively shallow. While COVID-19 introduced wildly volatile economic data, the markets seem increasingly willing to price through the cycle—in other words, inflation will slow and the Fed will pivot to more dovish policy to achieve a relatively soft landing. Although this narrative may sound overly optimistic, it could become the prevailing one that forms the basis for a new bull market given that negative sentiment is yet to drive investors to capitulate.

The upcoming earnings season will be critical for gaining a clearer perspective on the outlook. While it would seem odd for the markets to stay resilient given downgrades are just beginning in the shadow of a hawkish Fed, the bar may be low considering the already very negative sentiment, and earnings could be surprisingly solid.

We downgraded our view on commodity-linked equities as signs of slowing demand begin to surface despite continuing supply-side constraints. The balance was mostly reallocated to REITs and listed infrastructure, with a small lift to developed market (DM) equities in more defensive sectors. On the defensive side, we reduced allocations to emerging market bonds and gold in favour of DM sovereigns and a small amount of high yield credit.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Markets are forever humbling investors and this has perhaps never been more evident than in June and July. An epic hawkish pivot by the Fed—showing a willingness to hike rates into recession in order to tame inflation—hit both equity and bond markets but this was soon followed by expectations for the central bank to ease as early as the end of 2022. Such a notion seemed absurd to many, including ourselves, but the markets squeezed higher on low volumes anyway.

Inflation worsened in June, and when the pertaining data was reported in mid-July, tight financial conditions were reaching their peak. Financial conditions have gradually eased since (presumably against the wishes of a hawkish Fed), and risk assets began to rally more broadly. The earnings season was better than feared, and respecting the easing conditions and the potential fall in inflation amid the fast decline in energy prices, we began to take a more favourable view towards risk exposure. Of course, the rally has continued following the lower-than-expected July US inflation print as many still bearish investors were seemingly caught wrong-sided.

Where are we now? Pending more data releases, clearly the Fed—in order to avoid a policy mistake—has scope to ease the pace of tightening and perhaps pause later in the year to see how tighter policies pan out. The economy appears to be cooling, outside a perplexingly strong job market. No doubt some inflationary pressures were transitory, so why rush to a recession? Still, the slight easing of annual inflation to 8.5% in July from 9.1% in June is not reason enough to suggest that the fight against inflation should be over. Nevertheless, near-term relief can continue, in our view.

Inflation hedging still makes sense

Market participants have gravitated heavily to yesterday’s winners such as the high tech and growth sectors, which appears to make sense given the compression in long-term rates which peaked in June. Earnings were better than expected as top lines and profit margins remain healthy, and companies provided decent outlooks in their guidances. We expected profits to wane, partly driven by inflation dynamics, but so far there is little evidence that wage pressures have done much to dent profits as they did in the 1970s. If the Fed stops tightening monetary policy before the economy falls into a recession and rates thereby stay stable, perhaps this segment of the market can still find support (despite still arguably expensive valuations). But short of a recession, inflation hedging make sense as well, in our view.

So far, the key driver behind falling inflation has been declining energy prices. This trend is clearly supportive of declining inflation, but given the continuing supply-side disruptions, most, including ourselves, believed that only significant demand destruction (i.e., a recession) would be a viable means of lowering prices based on limited supply.

Has there been demand destruction? We would say only partially as the markets have been pricing in such an outcome. Clearly, consumption habits have changed and lowered demand—but not to levels seen during a recession, and the current fall in prices is likely to lift demand. On the supply side, Strategic Petroleum Reserve releases have helped, but this is a temporary fix as the measures are due to expire in November.

While we have believed that many facets of inflation are likely to be transitory, deglobalisation trends and supply-side disruptions, including those in energy, are likely to continue. Therefore, inflation may not decline to the Fed’s 2% target. This may not be a near-term focus for the markets, but we think it would be prudent to be prepared in case inflation turns out to be stickier than many now expect.

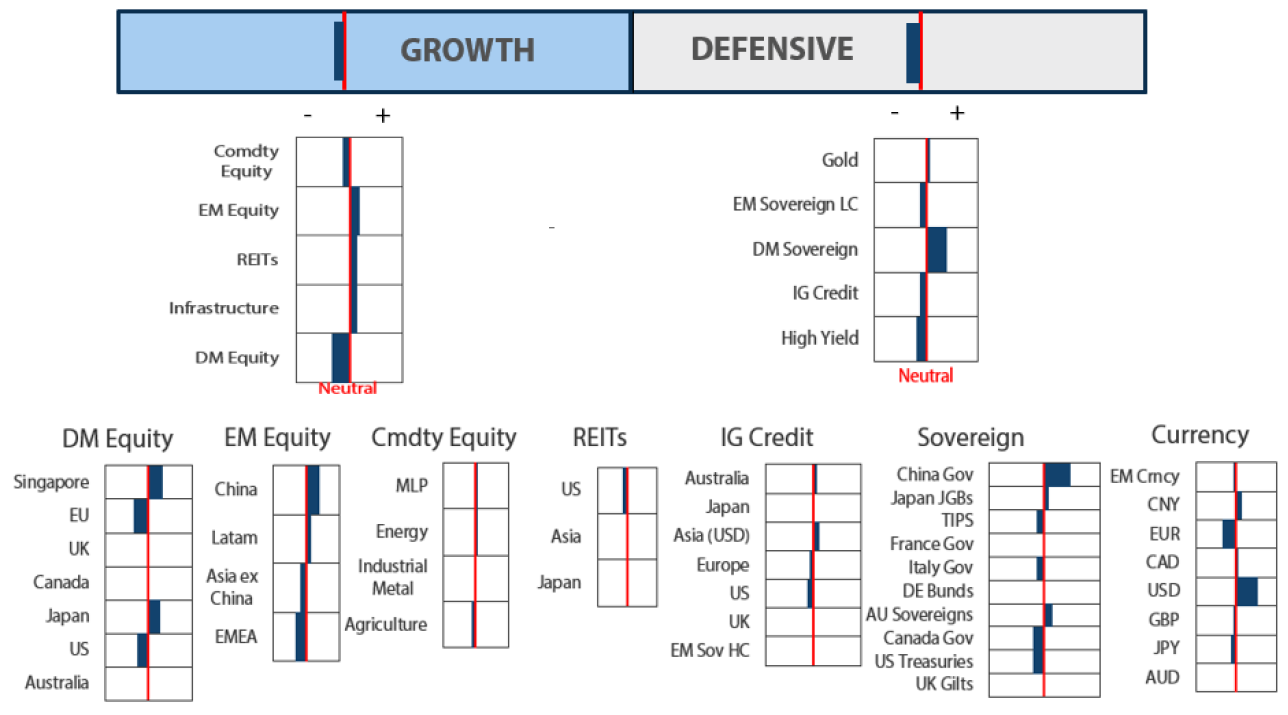

Energy stocks fell deeply in the wake of the Fed’s ultra-hawkish pivot in June, and they have also followed the decline in energy prices that have continued into early August. Typically, earnings fall with the price of oil, usually through a combination of falling prices and demand, which tends be the gravest during global recessions such as the 2008 GFC and the global demand shocks of 2015. But while earnings continue to soar, the current price of USD 93 per barrel does not really depict such a demand shock.

Chart 1: S&P Global Energy (EPS) vs WTI Crude

Source: Bloomberg, August 2022

Energy stocks proved intensely volatile in the sharp sell-off that began in June. In our view, however, this was partly due to the heavy positioning in the assets, which created positive momentum against virtually all other asset classes that were negative. When positions were unwound when the sell-off began in June, a deep recession was a concern at the time. However, such worries are yet to be realised. Oil prices could continue to weaken, but short of another hawkish bite from the Fed, the dynamics driving the move would not be clear.

We stay cautious given the high levels of volatility, but if financial conditions stay easy, we believe that the asset class will look favourable alongside other commodity-linked equities against a background of still-elevated inflation pressures.

Conviction views on growth assets

- Neutral on China: Last month, we wrote of our preference for China over other equity markets for its lower inflation and easing policy stance. We noted risks such as lockdowns and renewed property-related concerns and while we still believe these headwinds will abate, we have been perhaps surprised by the degree of stress in the property sector that looks to grind on without offsetting stimulus.

- Near-term constructive on growth: Given the degree of angst surrounding inflation which has been building for the last three years coupled with an increasingly hawkish Fed, it is not a surprise to see relief owing to the seeming peak in inflation. With more stable inflation and rates, and perhaps a Fed that may be willing to pause on tightening in the coming months, we see scope for further support. However, we do believe there is another looming risk which is that inflation will not return to historical norms.

Defensive assets

We maintained our cautious view on sovereign bonds but see a gradually improving outlook. Central banks continued their fight against inflation with substantial rate hikes, even as the markets began to worry about the potential drag on global growth. As a result, the US yield curve has already inverted, signalling slower growth ahead. Global yields have become hypersensitive to economic data releases as central banks move away from forward guidance towards being more data driven. Weaker survey data and lower oil prices have provided some support for sovereign bonds after a very difficult first half.

In contrast, we have tempered our view on emerging market sovereign bonds. The outlook has become more negative as a persistently strong dollar, falling global demand and lower commodities prices expose the vulnerabilities of emerging market assets. Improving China demand can help at the margin, but so far, the balance is relatively negative as a renewed China demand story has yet to find traction.

We retain our negative view on credit relative to government bonds even though spreads performed better last month across both investment grade and high yield. The European Central Bank delivered a surprise 50 basis point hike to begin its tightening campaign while other central banks are set to deliver further hikes in the coming weeks. Global demand is likely to moderate in the face of tighter policy and begin to erode credit quality.

We remain cautiously optimistic on gold even though it has been under pressure from higher real yields and a stronger US dollar. However, markets may be underestimating the persistence of inflation risks along with rising recession risks. Gold can be a good hedge for both risks and current prices are better value than earlier in the year.

Neutral rate is matter of perspective

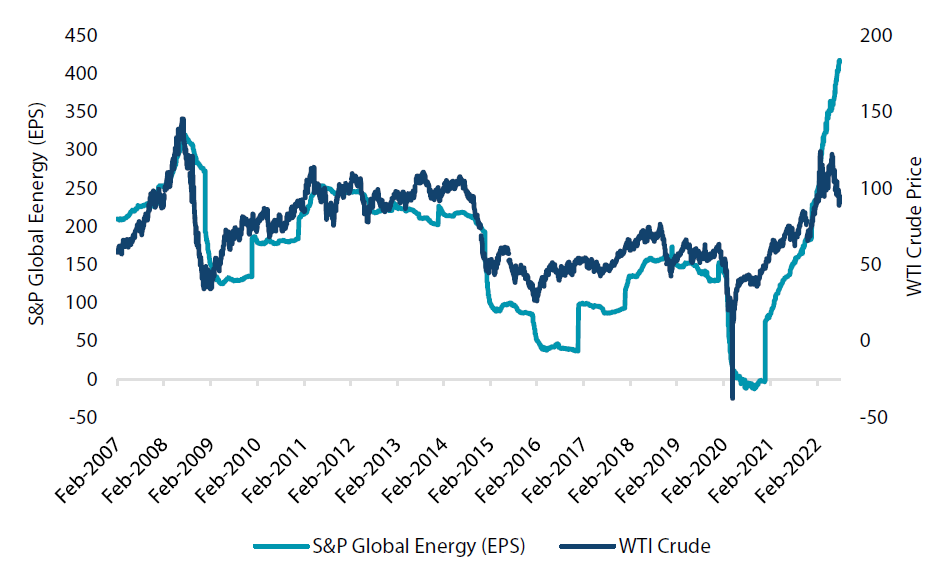

As market analysts continue to debate the path ahead for the Fed Funds rate and its eventual terminal rate for this cycle, another long running debate is also heating up. In the press conference following the Fed’s July meeting, Chair Jerome Powell referred to the current Fed Funds rate range of 2.25% to 2.5% as “right in the range of what we think is neutral”. The neutral rate that Powell was referring to is essentially the Fed Funds rate that is neither accommodative nor restrictive, but just right to promote full employment and price stability. It cannot be observed directly so therefore is more of a theoretical concept. It is important in the current climate because surmising where the Federal Open Market Committee (FOMC) sees the neutral rate can provide a reference point for how monetary policy may evolve.

Chart 2 shows the FOMC members’ projections for the longer-run Fed Funds rate, a component of the “dot plot” contained in June’s Summary of Economic Projections. While these projections are not specifically referred to as neutral rates, it is perhaps the closest estimates we have and presumably formed the basis for Powell’s comments above. The range is essentially 2.25% to 2.50%, with the highest number of members projecting 2.50%. The inference to draw here is that the Fed is likely to see further rate hikes above the current rate of 2.50% as becoming restrictive.

Chart 2: FOMC longer-run Fed Funds projections

Source: US Fed Summary of Economic Projections, June 2022

With the Fed’s view on the neutral rate on the table, there was bound to be some conflicting views from prominent commentators and former Fed officials. One such view came, not surprisingly, from the former US Treasury Secretary, Larry Summers. In his view, Powell’s belief that the current fed funds rate of 2.50% was in the range of neutral was “indefensible” with current inflation so high. Strong criticism, but more than a little unfair in our view.

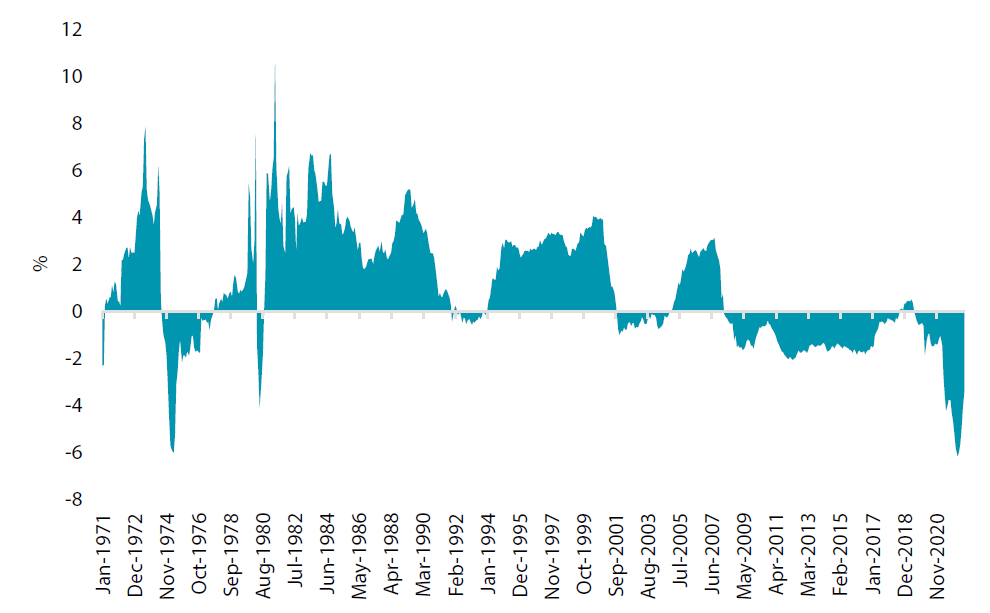

Chart 3: Real Fed Funds rate (Fed Funds target rate less annual CPI ex food and energy)

Source: Bloomberg, July 2022

Chart 3 shows our estimate of the real Fed Funds rate since the 1970s, another period of high inflation. We have simply used the month-end Fed Funds rate and subtracted the annual rate of CPI excluding food and energy. One observation that jumps out is that the current period of negative real rates hasn’t been seen since the mid-1970s. In the last few years, this has resulted from rising inflation and very low interest rates. But getting back to the debate about the neutral rate, we think it is largely about a difference of views on where inflation settles back to over the medium term. We suspect that the neutral rate is likely to be associated with a real Fed Funds rate that is mildly positive, given that negative real rates are thought to be stimulatory and higher positive rate rates contractionary.

The Fed likely believes that the real Fed Funds rate will rise to become positive through a combination of inflation falling back towards its 2% target, and a few more rate hikes in this cycle. Other commentators, like Larry Summers, most likely hold the view that inflation will remain stubbornly high —such that a much higher Fed Funds rate will be required to restore a positive real rate.

Of course, it is possible that either the Fed or its critics will be right on their inflation views, but we think the answer, as it often is, will be somewhere in the middle. We expect inflation to subside in the coming year with a nod to the Fed’s thinking, but we also expect that inflation will not be so easy to vanquish and will stall at levels uncomfortably above the Fed’s target, with a wink to the Fed’s critics.

Conviction views on defensive assets

- More constructive on duration: Signs of weaker US growth have started to appear as inflation looks to have peaked, helped by lower energy prices. The Fed has also become more data dependent and is no longer providing strong guidance on upcoming policy changes.

-

- China bonds back in favour:

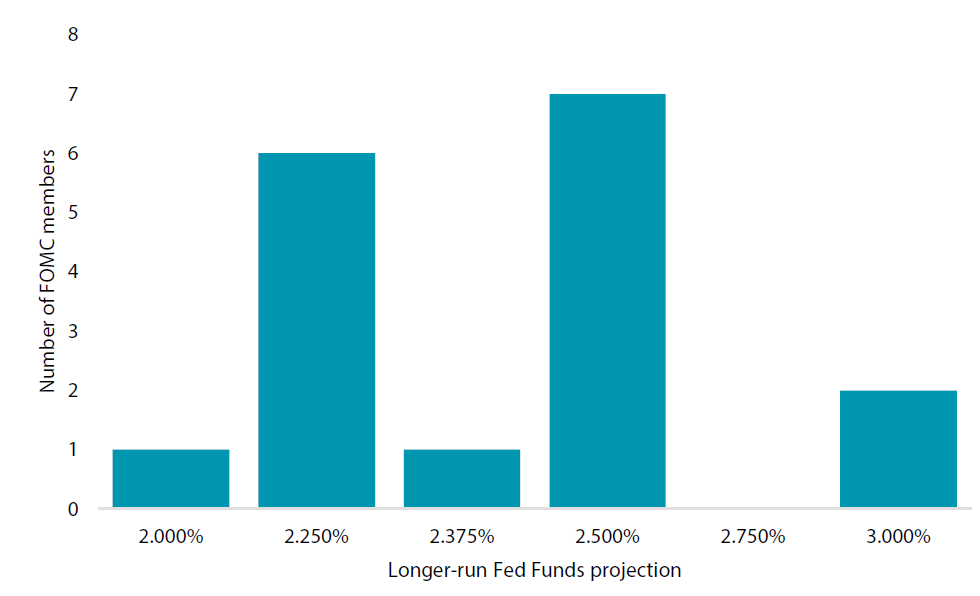

Process

In-house research to understand the key drivers of return: