“Hottest on record” is on repeat

In scenes now repeated every summer, not a day seems to go by without headlines of record-high heat somewhere on the planet, whether in Europe, Asia, Africa or North America. The World Meteorological Organization said it was “extremely likely” that July 2023 will be the hottest on record1. As temperatures climb, news images of raging wild fires have become all too common, along with other hallmarks of extreme weather such as violent storms and destructive flooding.

We have been spared the worst of extreme weather patterns here in Tokyo. Nevertheless, we have acutely felt the impact of climate change. In Tokyo this August the mercury rose above 30 degrees Celsius every day of the month for the first time since records started being kept in 1875. As the country becomes more tropical in climate, long-standing traditions are being challenged. An example is in baseball, Japan’s national pastime. The sport is usually played without any breaks. However, a “cooling time” rest period was introduced for the first time at the 105th edition of the National High School Baseball Championship, a nationwide tournament held annually in August. This break with tradition caused a national debate, with many of us wondering if children in the future will even be able to enjoy pastimes long associated with the summer in this country such as tennis, soccer and rugby?

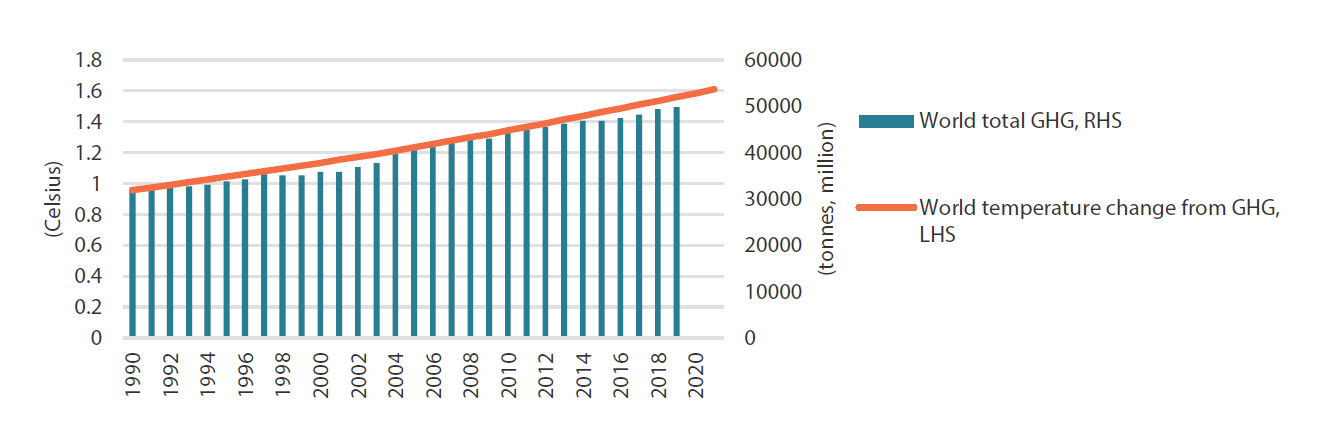

It is no secret that greenhouse gas (GHG) emissions play a role in global warming. Yet, despite pledges by governments around the world to reduce GHG output, global emissions have been increasing steadily (Chart 1). Our tendency to ignore a looming catastrophe was satirized in the 2021 movie Don’t Look Up. Two astronomers played by Leonardo DiCaprio and Jennifer Lawrence discover a comet hurtling towards earth and warn the world of the impending disaster, but to no avail. In desperation, the two scientists beg the world via social media to just look up, but the US president, portrayed by Meryl Streep, advises to do just the opposite, telling people “don’t look up”.

Chart 1: Global GHG emissions and corresponding temperature change

World total GHG: Total greenhouse gas emissions including land-use change and forestry, measured in million tonnes of CO2-equivalents.World temperature change from GHG: Change in global mean surface temperature (in °C) caused by greenhouse gas emissions.

Source: Out World in Data material compiled by Nikko AM

Japan: a major GHG emitter with room for improvement

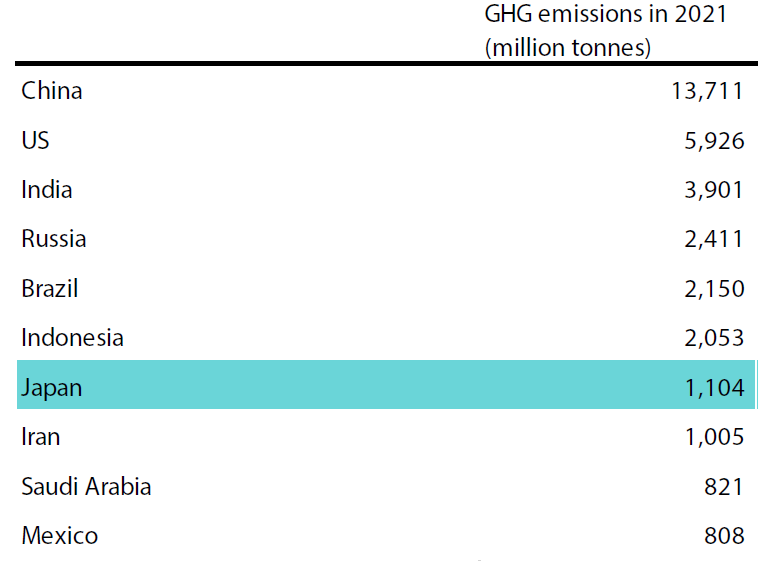

Unlike fictional characters in a movie, in reality we have no option but to look up and consider what is driving climate change. Let us take our home market of Japan as an example. The country was the seventh largest GHG emitter in 2021 (Chart 2). Japan’s significant emissions are a result of its heavy reliance on fossil fuels to generate power, having slashed its dependency on nuclear power plants following the earthquake and tsunami-induced nuclear disaster in 2011.

Chart 2: The world’s top GHG emitters

Source: Our World in Data material compiled by Nikko AM

Seen from a different perspective, being a large GHG emitter means there is plenty of room for Japan to improve its environmental standing. In 2020, the country made an ambitious pledge to reach carbon neutrality by 2050, and in 2021, it set a goal to cut GHG emissions 46% by 2030 from 2013 levels. The share of renewable energy that generates Japan’s electricity has risen to 22.4% in 2021 from 12.1% in 2014, according to the Institute for Sustainable Energy Policies2.

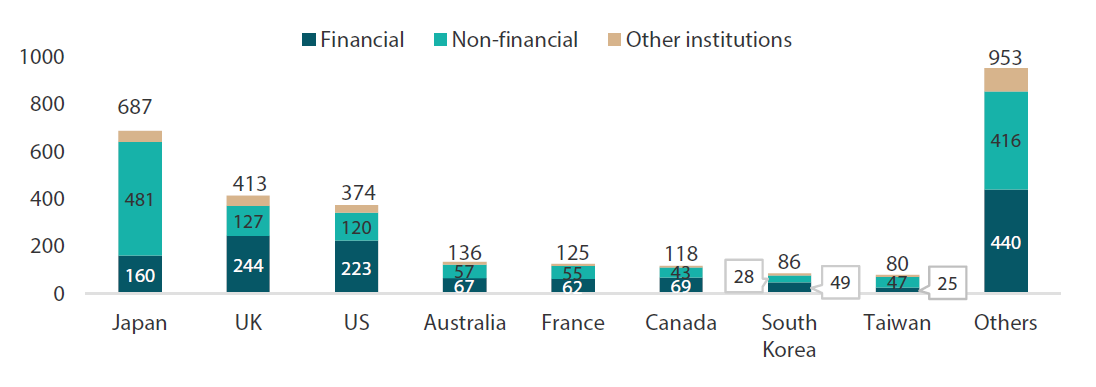

There are other concrete signs that Japan is indeed improving its standing, in particular among its private sector. As Chart 3 shows, Japan has the highest number of companies that support the Task Force on Climate-Related Financial Disclosures (TCFD). Upon request by G20 central bankers and finance ministers, the Financial Stability Board established the TCFD in 2015 to help the financial sector assess and price climate-related risks as well as opportunities. The TCFD Recommendations were released in 2017 and widely credited with shaping the voluntary climate-related financial disclosure landscape. However, whilst support for the TCFD is encouraging, the quality of disclosures still has room for improvement.

Chart 3: TCFD-supporting institutions by country as at July 2023

Source: TCFD Consortium material compiled by Nikko AM

Awareness towards sustainability within Japanese society is expected to increase, with companies taking a more proactive role in promoting it. Interest towards ESG investment is also rising among individual investors, led by those of the younger generation. According to a survey by Japanese news provider QUICK’s ESG Research Center, 48% of respondents in their 20s were interested in ESG investment, compared to 44% in their 30s and 42% in their 40s3 .

Equity strategy focused on climate change

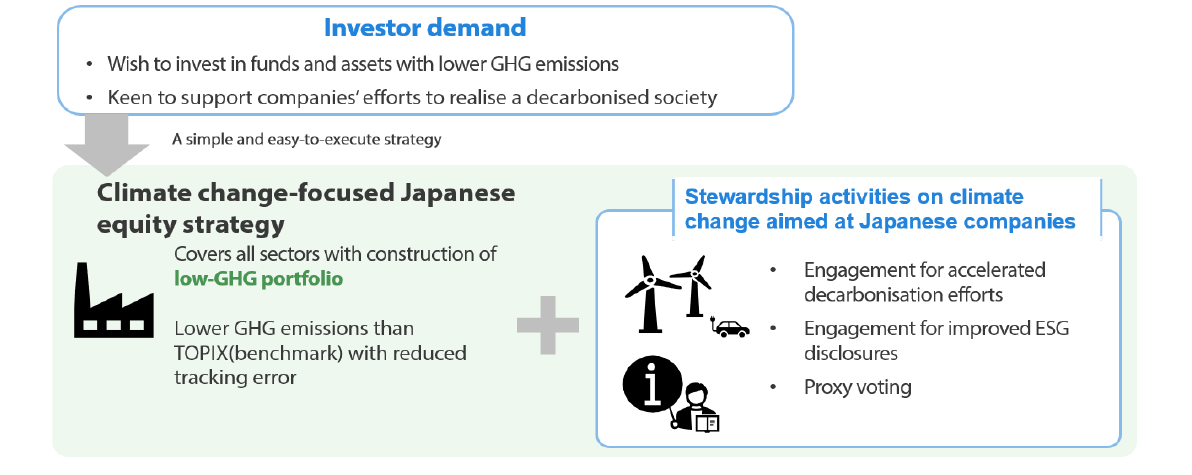

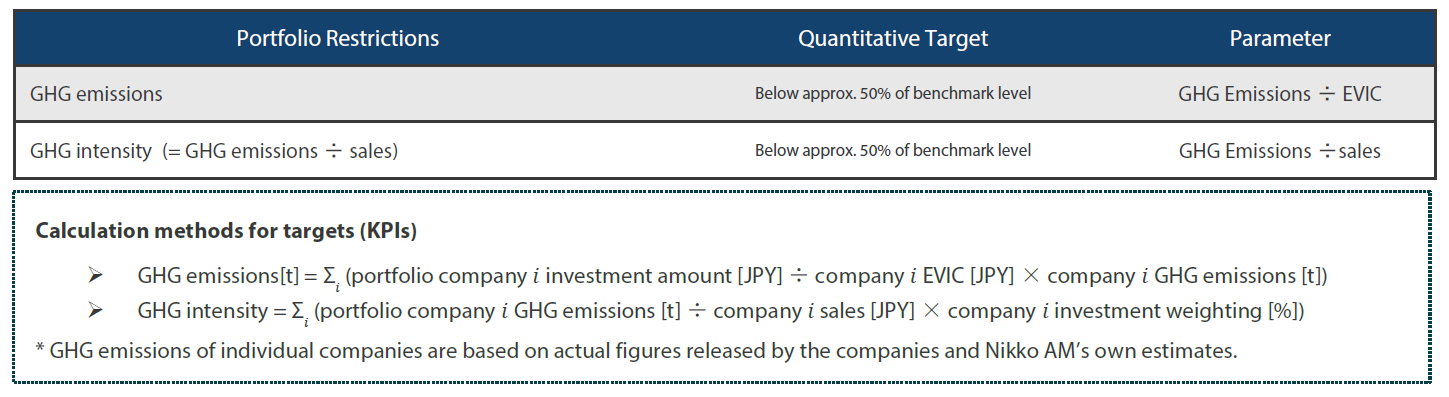

In addition to Japanese companies and individuals, awareness towards sustainability is also increasing among the country’s financial institutions and investors. Until recently, only a few financial institutions disclosed their financed emissions, which are GHG emissions linked to investment and lending activities. However, more such institutions are now hiring sustainability specialists to estimate their financed GHG emissions, and their disclosure is seen gathering pace going forward. Against such a background, we expect increased demand among investors to reduce GHG emissions linked to their investments. One strategy asset managers use to meet such demand for portfolios with lower GHG emissions focuses on urging companies to accelerate decarbonisation efforts via stewardship activities. Nikko AM’s climate change-focused Japanese equity strategy takes such an approach (Exhibit 1).

Exhibit 1: Climate change-focused Japanese equity strategy’s objectives

Source: Nikko AM

The strategy covers all sectors to construct a low-GHG portfolio, providing exposure to Japanese stocks that is similar to the TOPIX while simultaneously aiming to limit financed emissions. As at end-July 2023, the portfolio’s estimated tracking error versus the benchmark TOPIX was 0.34%, of which the estimated risk attributed to industry allocation was a modest 0.13%. GHG emissions and intensity are maintained approximately below 50% of those of the benchmark TOPIX (Exhibit 2); GHG emissions by companies are based on publicly disclosed information as well as estimates calculated using an in-house model.

Exhibit 2: Portfolio-wide GHG restrictions and targets4 (KPIs)

Source: Nikko AM

A key feature is the utilisation of in-house GHG emission estimates, which enable us to expand our coverage significantly from approximately 600 companies to the entire TOPIX universe of roughly 2,100; the weight coverage has also increased from 82% to 100%. We are able to cover almost the entire TOPIX on a market cap basis through the use of our own estimates as well as actual reported results.

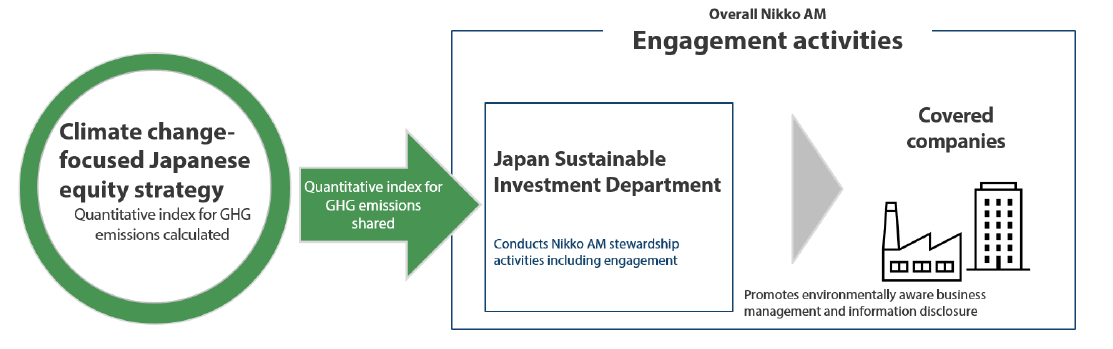

In addition to such a quantitative approach, another important feature is engagement with the investee companies. The quantitative data obtained is utilised in engagement undertaken by Nikko AM’s Sustainable Investment Department. This interaction encourages companies to operate in a more environmentally conscious manner and disclose relevant information (Exhibit 3). The department’s on-the-ground stewardship specialists are well positioned to leverage Nikko AM’s influence on investee companies. Their well-established relationships with local companies give Nikko AM an advantage over foreign peers. In addition, our stewardship activities in all global regions follow the highest international standards, with the firm having been recognised in 2023 for the second consecutive year by the UK’s Financial Reporting Council as a signatory to the UK Stewardship Code. Nikko AM was the first Japanese asset manager accepted to the Code based on a global, firm-wide application.

Exhibit 3: Driving decarbonisation initiatives through engagement

Source: Nikko AM

Engagement example: a major Japanese steel company

- Engagement: The company initially aimed for an 18% reduction of CO2 emissions by FY2024 from FY2013 levels. Considering the company’s standing as a major emitter, we conveyed the need for a more ambitious target by first using existing technology. We also encouraged the company to actively seek government support in its emissions reduction efforts.

- Company response: The company revised its CO2 reduction plan and now aims to reduce its emissions by 30% by FY2030. It explained that the plan would be achievable through the introduction of new procedures, mainly the effective use of raw materials; practical utilisation of digital transformation within the production process is also expected to play a role in reducing emissions.

- Assessment: This is an example of successful engagement as the company responded by proposing concrete measures.

- Future approach: We intend to monitor the progress of the revised plan and encourage the company to further accelerate its emissions reduction efforts, including where required through measures such CO2 capture and storage from 2030 onwards, which would require cooperation with players in other industries.

Summary

The climate change crisis we are witnessing presents both challenges and opportunities. Focusing on the latter from an investment perspective, in our view asset managers are in a position to help facilitate society’s goals of reducing GHG emissions and decarbonising. An important way of meeting investors’ needs for portfolios with a lower carbon footprint is through direct engagement with investee companies. Japan is currently a major GHG emitter but the country’s ambitious plan to become carbon neutral by 2050 has made it necessary for companies to ramp up decarbonisation efforts. The intent is not in short supply as Japan has the highest number of companies that support the TCFD and they are increasing the quality of their data disclosures. We believe strategies focused on climate change-related initiatives in Japan are uniquely placed to help with the construction of a greener portfolio while assisting society as a whole in its decarbonisation efforts.

1 “July 2023 is set to be the hottest month on record”, World Meteorological Organization, 27 July 2023

2 “2022 Share of Electricity from Renewable Energy Sources in Japan (Preliminary)”, Institute for Sustainable Energy Policies, 26 April 2023

3 QUICK sustainability awareness survey, December 2021

4* Figures for reductions in GHG emissions and GHG intensity are target values that could become difficult to achieve due to the market environment, AUM, changes in companies’ emissions or other such factors. The figures are target levels as of the time of portfolio construction and rebalancing. They do not constitute a guarantee that the figures will be constantly maintained within a certain range during the investment management period.

* The above quantitative targets (GHG emissions to be no more than approximately 50% of the benchmark level, etc.) may be subject to change in the case of changes in the market environment, etc.