Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise - does the company have a sustainable competitive advantage?

Management - does the company make sound strategic and capital allocation decisions?

Balance Sheet - is growth appropriately financed?

Valuation - are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market outlook

Scotland has almost 1,000 mountains and hills, which is a lot for a reasonably small country. They are not always very welcoming at this time of year but offer fantastic views when the weather improves.

It feels like equity investors have just come off the summit of one mountain, formed during the days of Quantitative easing, and are eyeing up the next, if or when any Federal Reserve-induced US recession has passed. The problem is that the weather is currently poor, and visibility is not great. This matters when assessing the depth of the drop between the two summits. In equity parlance, how great might the earnings downgrades be? And what does this mean for where share prices trough?

At the risk of straining this analogy too far, there is probably still a narrow pass threading its way between the two summits (also known as a soft landing) but the chances of Fed policy delivering this to us seem to be dimming and investors are questioning the abilities of their mountain guide.

There is an ongoing tussle between credit markets and the narrative consistently espoused by the Fed. The Fed are adamant that they will need to see services inflation cool, similar to that already seen in goods inflation, and some slack in labour markets before changing tack, but credit markets seem unconvinced—seemingly of the view that enough has been done already and that we are closer to peak rates than the Fed would have us believe. The spread payable on BBB-rated debt, relative to government bonds, has come in during recent months and financial conditions have eased.

Recent equity market action, when an attempted rally was curtailed by more hawkish Fedspeak, would suggest to us that it is too early to call which way the debate will evolve. The fact that concept capital is continuing to plumb new lows as measured by the Renaissance IPO ETF certainly suggests that confidence remains very fragile, and we are not positioning the portfolio for a rapid return to the looser monetary conditions that these companies require to prosper or even survive, in some cases.

If you had invested USD 1 in the S&P 500 on the last day of 2017, you would have USD 1.44 as at the last trading day of 2022. If you had invested the same USD 1 in the hottest IPOs of the day (as measured by the same ETF noted above), you would now have 85 cents and more grey hairs, given the extreme volatility observed in these shares over that period. With private equity markets much less along the price discovery journey than public markets, 2023 does not look like a bumper IPO year either.

According to Mountaineering Scotland’s website, the most important thing if you have no clear path ahead is not to panic. As they say, “Don’t simply start walking in different directions changing bearings every minute or two in the hope that things will be sorted”. This sounds like good advice to us too. We won’t chase north into the unchartered landscape of cashless concept stocks. No more than we’ll head south into deep value.

The four guiding principles of our Future Quality philosophy will remain our investment compass in these challenging conditions. The stocks that satisfy the four requirements represent the middle ground, between the two stylistic extremes noted above and allow us to construct balanced portfolios. Our focus on franchise quality and management quality allows us to look forward with optimism, whilst balance sheet quality and valuation discipline provide something of a safety rope, in case of unplanned slips.

We remain convinced that the future will look very different to the recent past. We believe that delivery of sales and profit growth will be ever more critical to share price performance. It seems unlikely to us that the areas that have sucked in the most capital over the last 10 years will turn out to be those with the most unmet demand - think digital advertising, niche software applications or streaming services. The recent glut of headcount reductions across Big Tech suggests that their management teams may also be beginning to share that view.

Instead, more pressing needs are presenting themselves—many of which have been underinvested over the last decade or longer. Defence and energy security have been very much front of mind over the last 12 months and are likely to remain so in our view. There are likely other areas too, where the stars are starting to align. We continue to spend all of our time attempting to identify these, as part of our bottom-up stock research.

In conclusion and to quote the great Scottish actor and comedian Billy Connolly, “there’s no such thing as bad weather, only the wrong clothes”. Current equity market conditions dictate that you choose your investment attire particularly carefully. In our view, buying profitless technology companies is like going up a Scottish mountain wearing flip-flops. You might get away with it, but the odds are not in your favour. Instead, we prefer the protection afforded by profits (and cash) generated today—not at some unspecified point in the future.

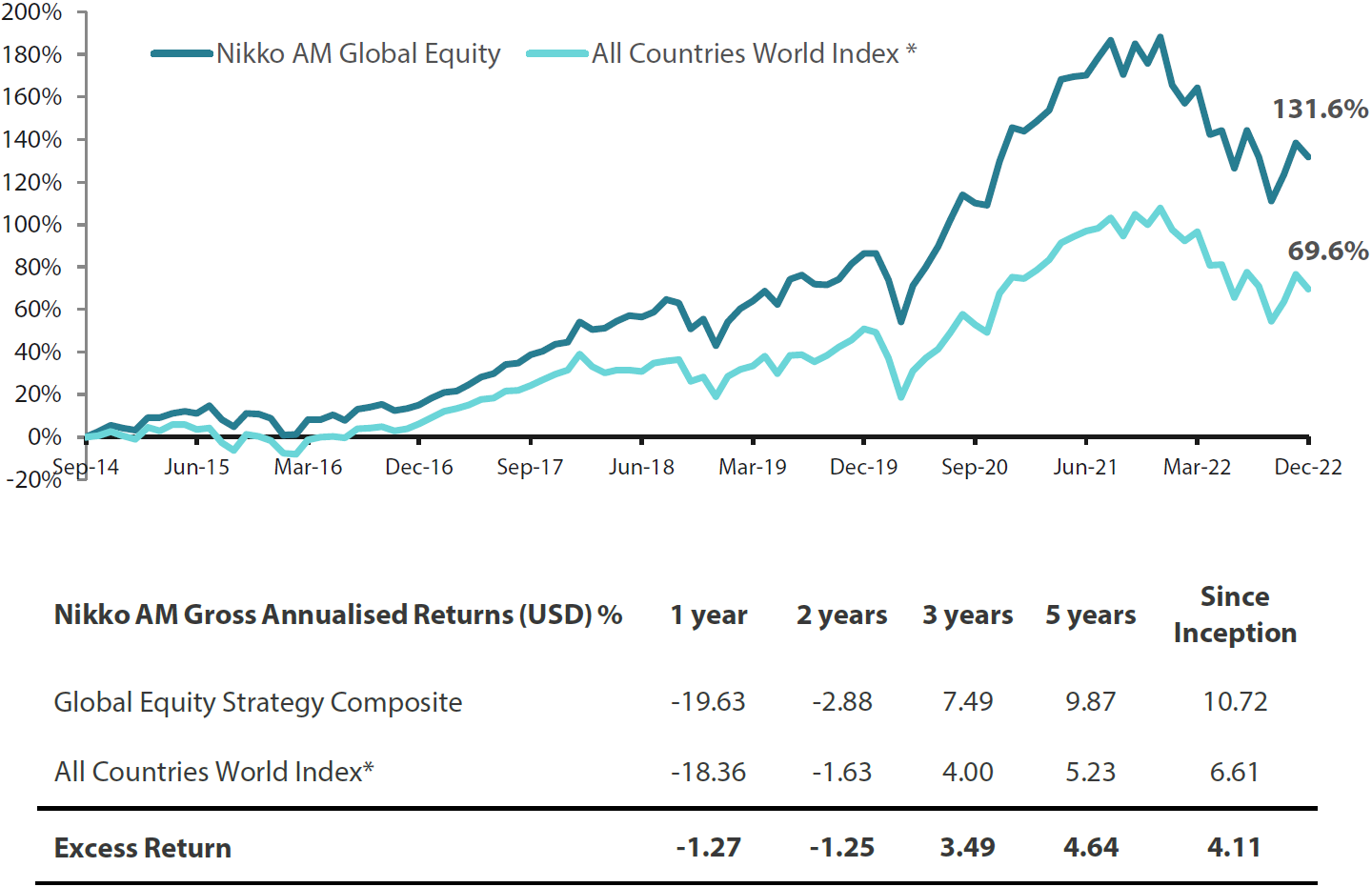

Global Equity Strategy Composite Performance to December 2022

Cumulative Returns October '14 to December '22

*The benchmark for this composite is MSCI All Countries World Index. The benchmark was the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014. Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 31 December 2022.

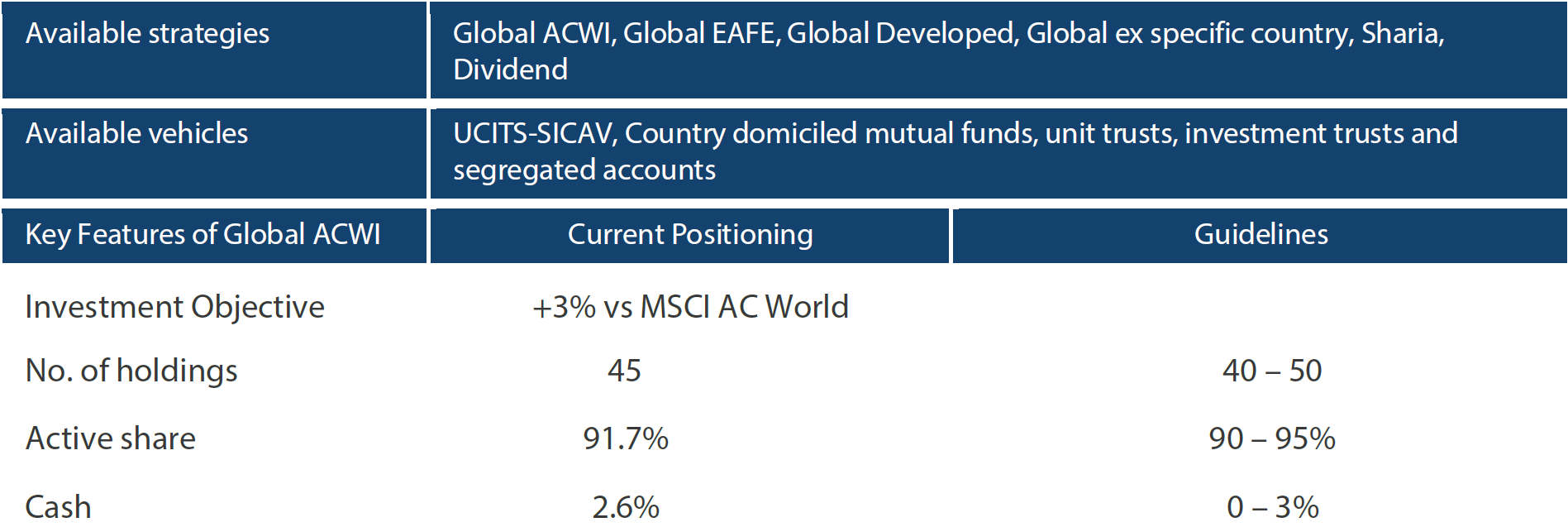

Nikko AM Global Equity: Capability profile and available funds (as at 31December 2022)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

There are four key areas that make our strategy different:

- a focus on Future Quality companies – a different and clear philosophy

- a distinctive team culture – a tight-knit team with a process built on openness and respect

- unique execution, including rigorous team challenge of every idea

- differentiated portfolios, with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone’s interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

UN SDG Risk: In the event the degree of positive impact towards the UN SDGs of a company and/or its technology changes resulting in the Investment Manager having to sell the security, neither the Sub-Fund, the Investment Manager, Management Company nor the Investment Adviser accepts liability in relation to such change.