The BOJ’s YCC tweak was a surprise, but focus moves beyond ultra-loose policy

The Bank of Japan (BOJ) took the markets by surprise in December 2022, unexpectedly widening the permitted range of the 10-year Japanese government bond (JGB) yield to 50 basis points (bps) on either side of 0%. The range was previously 25 bps on either side of 0%. While markets reacted with shock, BOJ Governor Haruhiko Kuroda said the tweak to the yield curve control (YCC) scheme was “aimed at improving market functions”—it’s worth noting that JGB market liquidity has dried up on the BOJ’s incessant bond buying under YCC. He also emphasised that the move will not lead to an exit from easy policy. The BOJ is the last major central bank still sticking to an ultra-loose monetary policy and has seen numerous challenges to its stance, such as Japan’s inflation shooting above its 2% target. However, most market observers were not expecting the BOJ to begin implementing new measures until Kuroda’s tenure ended in April 2023.

The BOJ’s decision to tweak YCC was inexplicable as much as it was a surprise. While it seems inevitable for the central bank to eventually normalise monetary policy, the process was expected to be accompanied by improving fundamentals, such as data showing rising wages, partially in response to labour union requests for higher pay. However, the BOJ appears to have acted before such support fully materialised, making its policies less forecastable in the eyes of investors and reducing confidence in the central bank. That said, the YCC tweak will likely help revive the functions of the bond market. For example, higher yields would make corporate bonds more acceptable to investors. This could help revive market functions by allowing corporate bond issuers to issue debt with less difficulty. Inflation in Japan remaining above the BOJ’s 2% target in 2023 is becoming the market consensus view and we expect the economic backdrop to be compatible with higher yields.

There are two factors that could support a rise in wage levels towards the spring of 2023. The first is external demand for Japanese products, which has remained strong for over a year. This may prompt export-related companies, such as manufacturers, to offer higher wages to retain their employees. The second is corporate capex, which has been expanding amid the steadiness in exports. It is no longer enough for many companies to simply maintain their current facilities and strong external demand has resulted in fresh capex, creating more labour opportunities and forcing employers to hike wages to attract workers. More companies may try and borrow funds for capex despite higher yields, paving the way for the BOJ to discontinue its negative interest rate policy.

If the BOJ eventually hikes rates and allows yields to rise, it would be doing so on the back of expectations for a steady increase in wages; in other words, improving fundamentals should be the cause of rate hikes, with monetary policy normalisation being the effect. Japan’s departure from an ultra-loose monetary policy in such a manner would increase the relative attractiveness of its equities, in our view. Government borrowing under those conditions may be accompanied by increased tax revenue and improve Japan’s fiscal health. No longer held down by ultra-low interest rates, government bonds would offer higher returns to investors, which may also boost Japan’s investment appeal.

Factors to watch in 2023 for Japan equities

Of the numerous factors that are seen impacting Japan equities in 2023, we turn our attention to monetary policy, the yen and the country’s economic growth prospects and provide a brief overview of each.

Monetary policy

Japan equities are expected to remain relatively well supported even if the BOJ begins tapering its easy monetary policy. While the central bank may signal a policy shift, monetary easing will not disappear immediately as inflation rates are likely to remain above actual yields for the foreseeable future. This means that the real interest rate will remain at a relatively low level and therefore shield returns generated by equities.

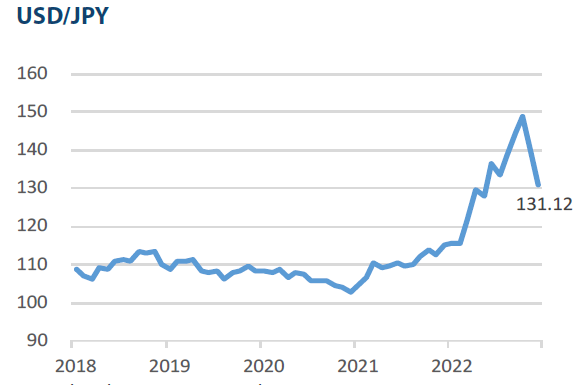

The yen

A weak yen, which had been considered a blessing as it was perceived as a boon to Japanese exporters, depreciated so much in 2022 that it was widely blamed as a factor behind the unwelcome rise in the cost of imports. The yen has partially bounced back against the dollar in 2023. However, rather than debate the potential impact such a move could have on equities it may be worth pointing out that, apart from a period during the Abenomics era when a rise in equities went hand in hand with the yen’s weakening, the correlation between the two has been weakening. A weaker yen may improve the income statements of some exporting firms, but while profits from such gains may boost bonuses, it may not lead to longer-term wage increases. Exporters, rather, are likely to remain focused on the actual amount of goods they can sell abroad and the economic conditions affecting such demand.

Japan’s economic performance

The developed market economies, including Japan, are expected to perform fairly well in 2023 amid slowing US inflation. Funds from foreign investors are unlikely to come flooding into Japan on such a factor alone. But prospects of Japan finally shaking off deflationary pressures, normalising monetary policy and allowing rates to rise may appeal to some investors looking for alternatives to the GAFA-prominent US. In addition to support from exporters, the Japanese economy could receive an additional lift in 2023 as the country fully opens its borders to foreign travelers.

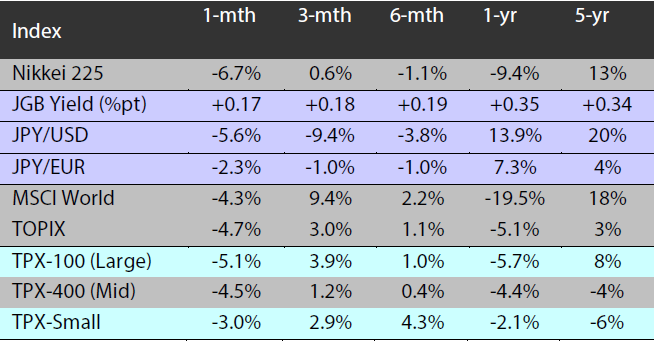

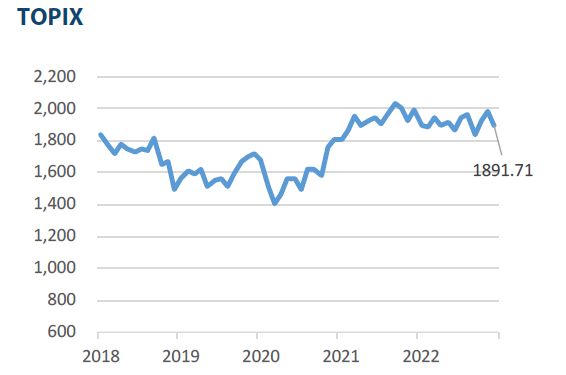

Market: Japan stocks slip in December amid policy uncertainty

The Japanese equity market ended December lower with the TOPIX (w/dividends) down 4.57% on-month and the Nikkei 225 (w/dividends) falling 6.55%. Lower-than-expected growth in the US Consumer Price Index (CPI) somewhat alleviated concerns of a prolongation to US rate hikes, which acted as a tailwind for stocks. However, the market was dragged down overall by a combination of factors including fears that the global economic climate could deteriorate as a result of monetary tightening by the Fed and the European Central Bank, as well as increasing uncertainty regarding the economic outlook for Japan on the back of a rise in Japanese long-term interest rates following the BOJ’s decision at its Monetary Policy Meeting to allow long-term yields to fluctuate within a wider range.

Of the 33 Tokyo Stock Exchange sectors, only seven sectors rose with Banks, Insurance, and Marine Transportation among the most significant gainers. In contrast, 26 sectors declined, including Real Estate, Transportation Equipment, and Precision Instruments.

Exhibit 1: Major indices

Source: Bloomberg, as at 30 December 2022

Source: Bloomberg, as at 30 December 2022

Exhibit 3: Major market indices

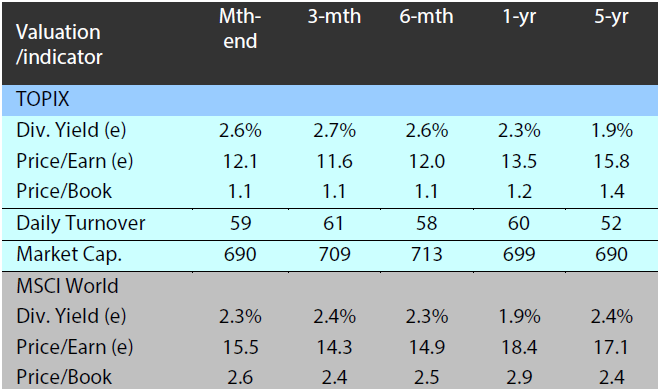

Exhibit 2: Valuation and indicators

(e) stands for consensus estimates by Bloomberg. Turnover and market cap in JPY trillion. Source: Bloomberg, as at 30 December 2022

(e) stands for consensus estimates by Bloomberg. Turnover and market cap in JPY trillion. Source: Bloomberg, as at 30 December 2022

Source: Bloomberg, as at 30 December 2022

Source: Bloomberg, as at 30 December 2022