Nikkei’s rise to 33-year high supported by reasonable expectations

The impressive run by Japanese stocks so far in 2023 has continued. As of this writing, the Nikkei Stock Average has gained 26% year-to-date, comfortably outperforming its developed market peers like the S&P 500 (+12%), Germany’s DAX (+13%) and Britain’s FTSE (+0.6%). The Nikkei has topped the 32,000 mark for the first time since 1990, when Japan was at the pinnacle of the “bubble” era. The Nikkei did touch a post-bubble-era high nearly two years ago, but the surge sputtered as the spread of COVID-19 and the social restrictions which followed temporarily derailed hopes of a domestic demand-led recovery. This time, however, internal demand is showing signs of coming back in earnest as the economy has fully re-opened in the wake of the pandemic. That and steady external demand for Japanese exports are seen as the key factors that have enabled the Nikkei’s comeback above 30,000. Strong domestic demand may also be able to offset any declines in external demand should concerns about inflation and high interest rates elsewhere negatively affect Japanese exports.

Hope seems to be driving some of the Nikkei’s rise above 30,000. This includes expectations of ongoing corporate governance reforms (notably the Tokyo Stock Exchange’s drive to raise the price-to-book ratios of underperforming companies), surpluses in employment and capex turning into deficits, the hiking of salaries and wages to levels unseen in decades and hopes that Japan is finally shaking off a deflationary mindset. While driven by optimism, these are nonetheless reasonable expectations that complement the ongoing recovery.

Another market-supportive factor is Prime Minister Fumio Kishida’s leadership. His economic policies have not been perfect; shortly after he took office late in 2021, his new wealth redistribution initiative spooked the domestic stock market. However, success in the diplomatic front has allowed him to enjoy relatively high public support ratings. In May Kishida displayed his diplomatic skills at the G7 summit in Hiroshima, which featured a surprise appearance by Ukrainian President Volodymyr Zelenskyy and the summit was generally hailed as a success. Any kudos gained from the G7 will not directly support his more commendable economic plans such as a re-skilling initiative that aims to improve labour market liquidity. Still, in the longer run decent public support ratings provide the Kishida administration with political capital to follow through with its various initiatives.

Chip renaissance: focus on transformation rather than returning to past glory

Japan has been abuzz with news related to semiconductors, with leading chipmakers from South Korea, Taiwan, the US and Europe announcing plans to form manufacturing and research bases in the country. In addition, many domestic makers have also unveiled their own ambitious plans within Japan. Chipmakers certainly have the financial incentive to set up shop in the country; the government launched a strategy in 2021 to strengthen the chip industry and it has been providing generous subsidies to foreign and domestic players. Japan has also come into focus as geopolitical tensions in the region have highlighted the need among democratic countries for diversified and stable supply chains.

Semiconductor manufacturers moving to Japan could become a trend, considering the strong and persistent global demand for chips driven by innovations such as artificial intelligence. It could take several years before the trend has a visible impact on Japan’s GDP, but the government will be rewarded as revenue from corporate and income taxes is likely to increase. At the same time, however, the government has made exports of semiconductor manufacturing equipment—one of the few remaining high technology areas in which Japan retains an edge—to China more difficult, adding a layer of value chain uncertainty.

It may be tempting to think that an influx of technology and investment from foreign chipmakers could help Japan re-establish itself as global semiconductor powerhouse, a position it ceded to its Asian rivals more than two decades ago. But foreign technology alone is unlikely to reignite Japanese innovation. Rather than focus on returning to past glory, Japan may have an opportunity to transform itself into something new. Japanese industry can focus on its existing strengths, such as gaming, which can be leveraged by teaming up with global chipmakers. Instead of retaining a narrow focus on semiconductors, such synergies could pave the way for Japan to become a technology hub in a broader sense, begetting a labour force, a research hub and a manufacturing base.

Market: Japan stocks gain in May on weak yen, strong earnings and forecasts

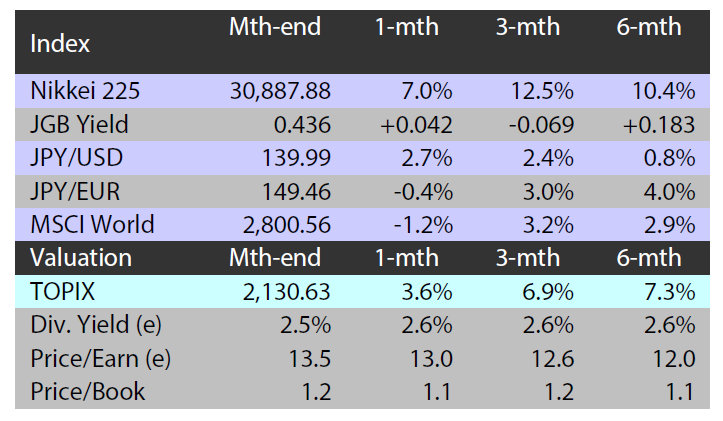

The Japanese equity market ended May higher with the TOPIX (w/dividends) up 3.62% on-month and the Nikkei 225 (w/dividends) rising 7.04%. Stocks were supported by expectations for Japanese exporters’ earnings to improve as the yen weakened against the US dollar, as well as an increasingly optimistic outlook on the back of generally strong domestic corporate earnings results and forecasts. Other positive factors included rising confidence regarding the outlook for the semiconductor industry after a major player in the US semiconductor industry released sales guidance that sharply exceeded market expectations. In addition, as a basic agreement was reached in the negotiations to raise the US debt ceiling an improvement in investor sentiment also boosted stock prices.

Of the 33 Tokyo Stock Exchange sectors, 19 sectors rose, with Electric Appliances, Precision Instruments, and Insurance posting the strongest gains. In contrast, 14 sectors declined, including Marine Transportation, Nonferrous Metals, and Textiles & Apparels.

Exhibit 1: Major indices

Source: Bloomberg, as at 31 May 2023

Source: Bloomberg, as at 31 May 2023

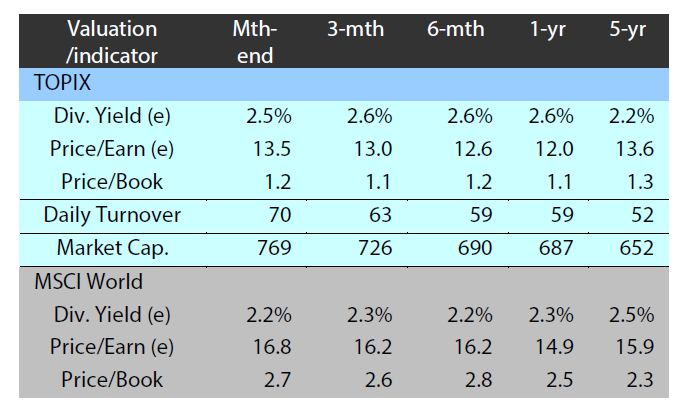

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 31 May 2023

Source: Bloomberg, as at 31 May 2023