Important Information

This document is prepared by Nikko Asset Management Co., Ltd. and/or its affiliates (Nikko AM) and is for distribution only under such circumstances as may be permitted by applicable laws. This document does not constitute investment advice or a personal recommendation and it does not consider in any way the suitability or appropriateness of the subject matter for the individual circumstances of any recipient.

This document is for information purposes only and is not intended to be an offer, or a solicitation of an offer, to buy or sell any investments or participate in any trading strategy. Moreover, the information in this material will not affect Nikko AM’s investment strategy in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Nikko AM makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this document. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. This document should not be regarded by recipients as a substitute for the exercise of their own judgment. Opinions stated in this document may change without notice.

In any investment, past performance is neither an indication nor a guarantee of future performance and a loss of capital may occur. Estimates of future performance are based on assumptions that may not be realised. Investors should be able to withstand the loss of any principal investment. The mention of individual stocks, sectors, regions or countries within this document does not imply a recommendation to buy or sell.

Nikko AM accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this document, provided that nothing herein excludes or restricts any liability of Nikko AM under applicable regulatory rules or requirements.

All information contained in this document is solely for the attention and use of the intended recipients. Any use beyond that intended by Nikko AM is strictly prohibited.

Japan: The information contained in this document pertaining specifically to the investment products is not directed at persons in Japan nor is it intended for distribution to persons in Japan. Registration Number: Director of the Kanto Local Finance Bureau (Financial Instruments firms) No. 368 Member Associations: The Investment Trusts Association, Japan/Japan Investment Advisers Association.

United Kingdom and rest of Europe: This document constitutes a financial promotion for the purposes of the Financial Services and Markets Act 2000 (as amended) (FSMA) and the rules of the Financial Conduct Authority (the FCA) in the United Kingdom (the FCA Rules).

This document is communicated by Nikko Asset Management Europe Ltd, which is authorised and regulated in the United Kingdom by the FCA (122084). It is directed only at (a) investment professionals falling within article 19 of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005, (as amended) (the Order) (b) certain high net worth entities within the meaning of article 49 of the Order and (c) persons to whom this document may otherwise lawfully be communicated (all such persons being referred to as relevant persons) and is only available to such persons and any investment activity to which it relates will only be engaged in with such persons.

United States: This document is for information purposes only and is not intended to be an offer, or a solicitation of an offer, to buy or sell any investments. This document should not be regarded as investment advice. This document may not be duplicated, quoted, discussed or otherwise shared without prior consent. Any offering or distribution of a Fund in the United States may only be conducted via a licensed and registered broker-dealer or a duly qualified entity.

Singapore: This document is for information only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

Hong Kong: This document is for information only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. The contents of this document have not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

Australia: Nikko AM Limited ABN 99 003 376 252 (Nikko AM Australia) is responsible for the distribution of this information in Australia. Nikko AM Australia holds Australian Financial Services Licence No. 237563 and is part of the Nikko AM Group. This material and any offer to provide financial services are for information purposes only. This material does not take into account the objectives, financial situation or needs of any individual and is not intended to constitute personal advice, nor can it be relied upon as such. This material is intended for, and can only be provided and made available to, persons who are regarded as Wholesale Clients for the purposes of section 761G of the Corporations Act 2001 (Cth) and must not be made available or passed on to persons who are regarded as Retail Clients for the purposes of this Act. If you are in any doubt about any of the contents, you should obtain independent professional advice.

New Zealand: Nikko Asset Management New Zealand Limited (Company No. 606057, FSP22562) is the licensed Investment Manager of Nikko AM NZ Investment Scheme and the Nikko AM NZ Wholesale Investment Scheme.

This material is for the use of researchers, financial advisers and wholesale investors (in accordance with Schedule 1, Clause 3 of the Financial Markets Conduct Act 2013 in New Zealand). This material has been prepared without taking into account a potential investor’s objectives, financial situation or needs and is not intended to constitute personal financial advice, and must not be relied on as such. Recipients of this material, who are not wholesale investors, or the named client, or their duly appointed agent, should consult an Authorised Financial Adviser and the relevant Product Disclosure Statement or Fund Fact Sheet (available on our website www.nikkoam.co.nz ).

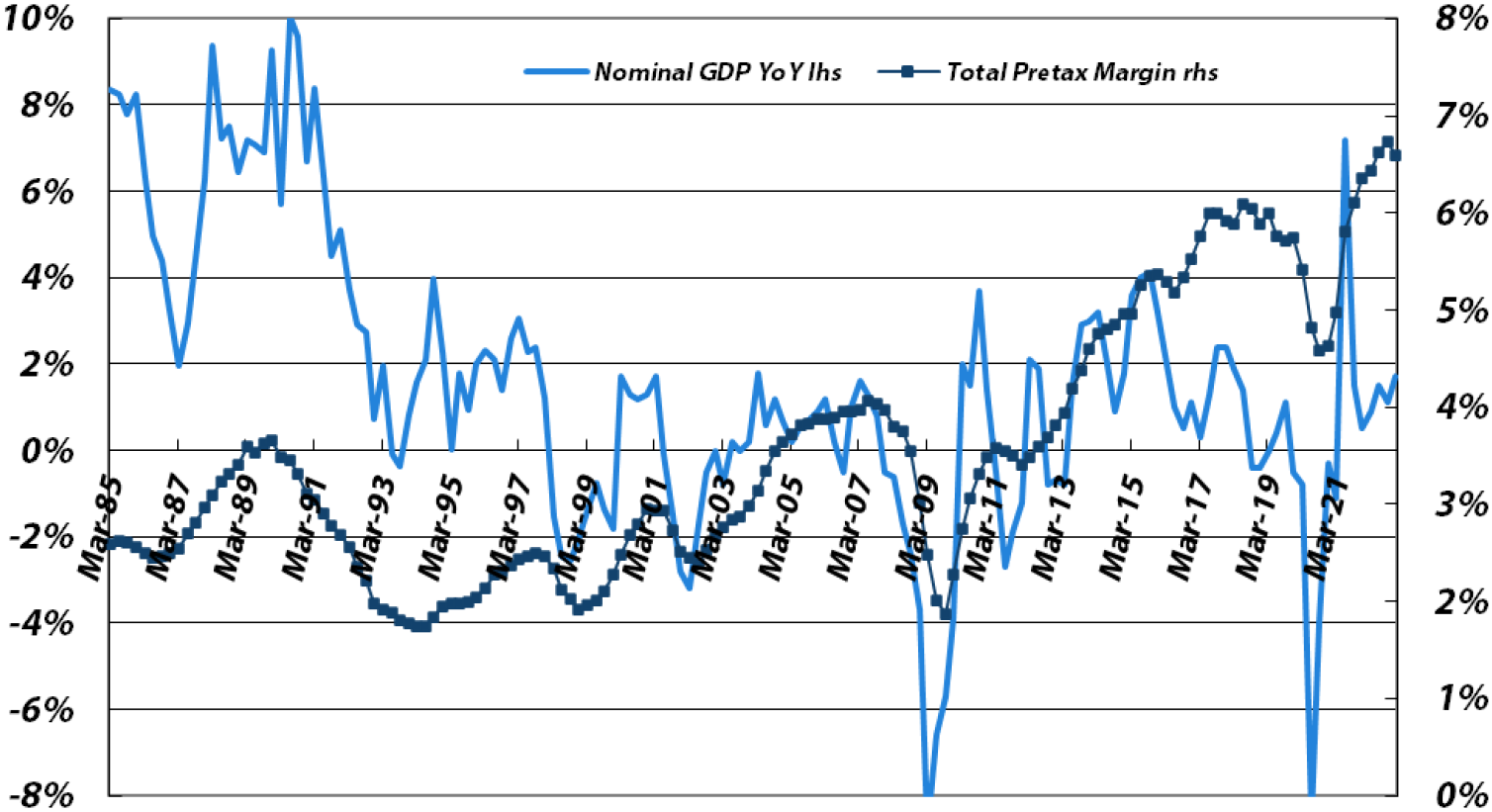

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q22

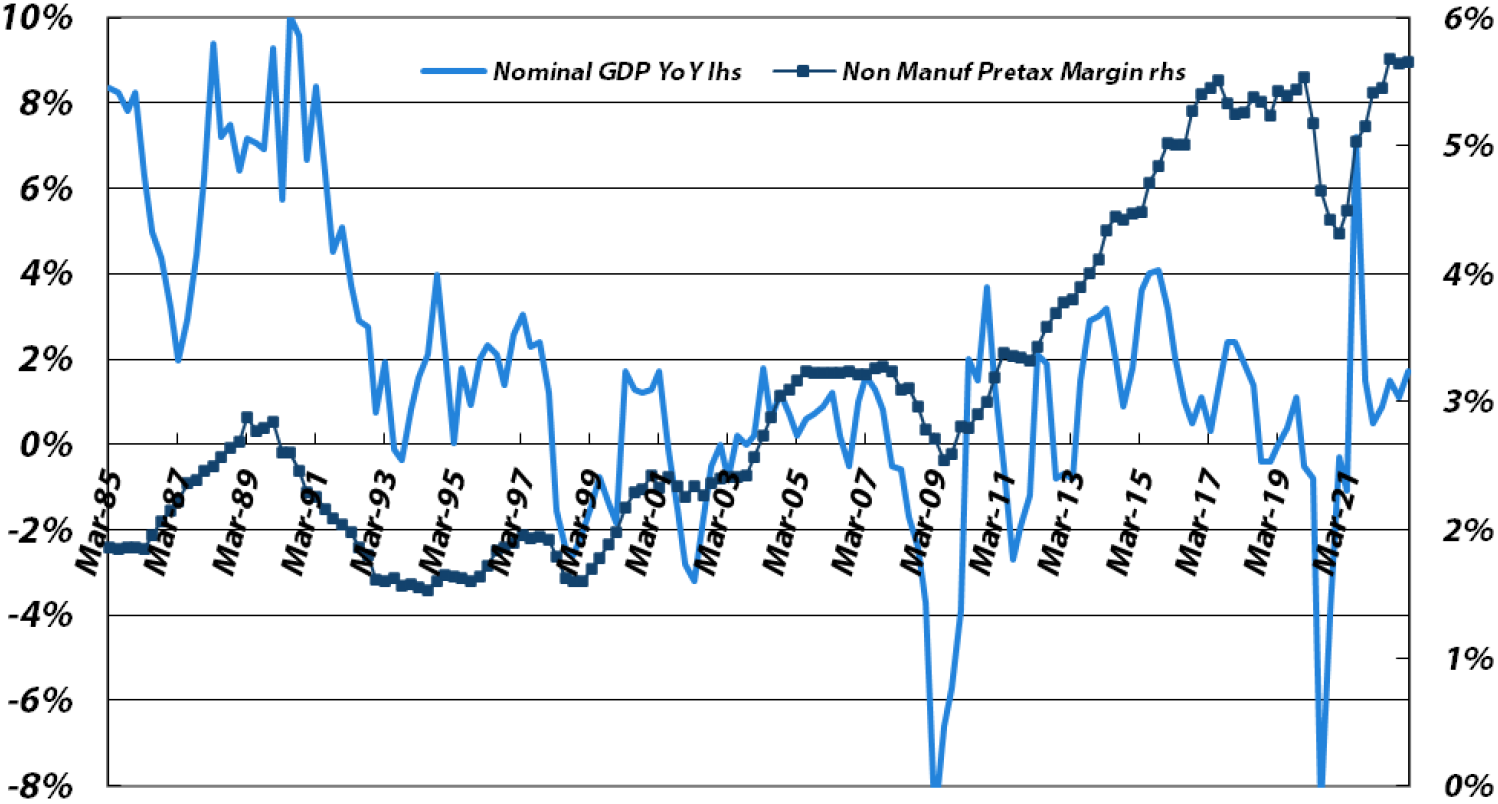

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q22

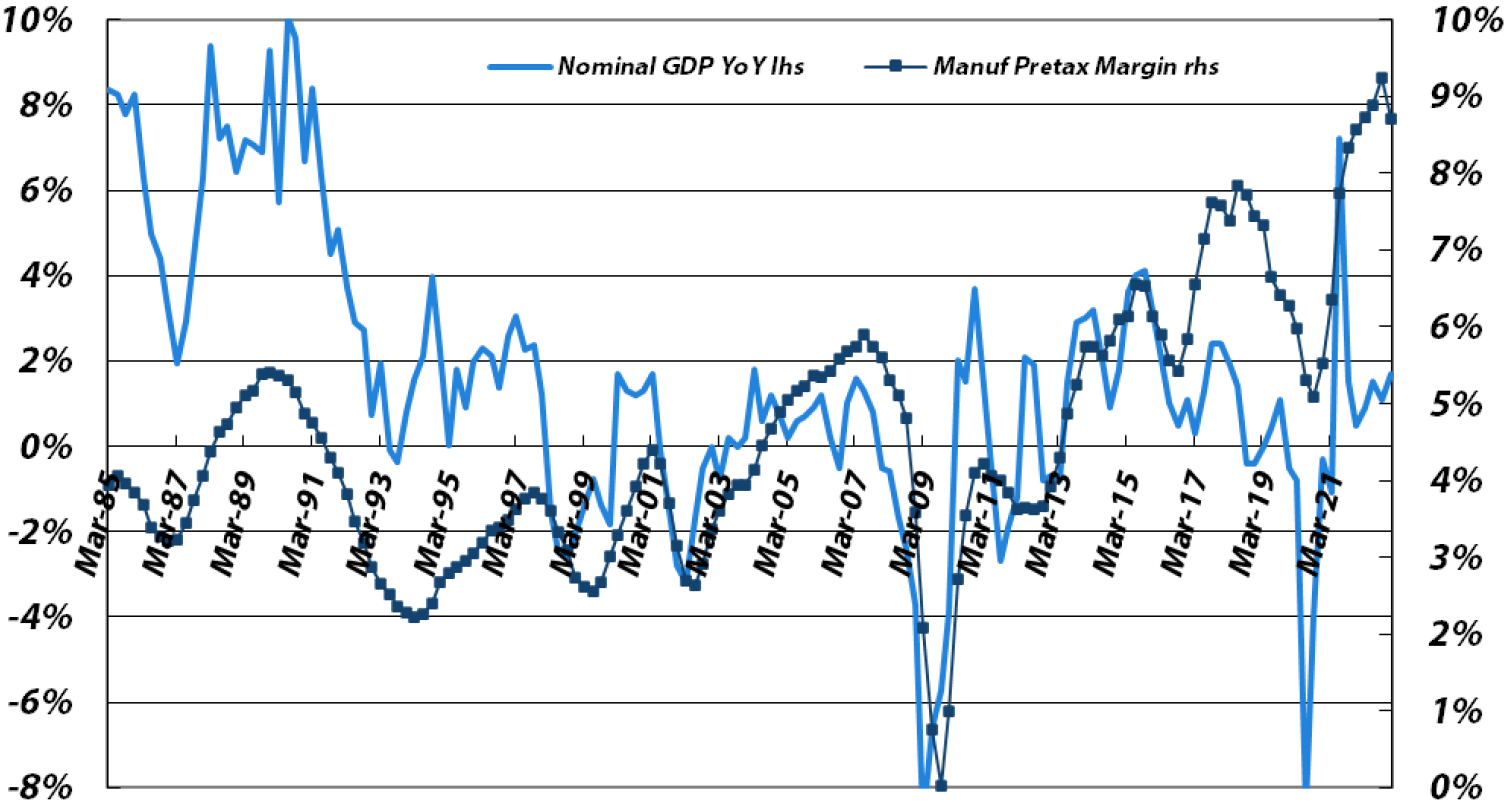

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q22

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q22

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q22

Sources: Japan Ministry of Finance, Bloomberg, data through CY4Q22