Global equity investment philosophy

Our philosophy is centred on the search for “Future Quality” in a company. Future Quality companies are those that we believe will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investment. The four pillars we use to assess the Future Quality characteristics of an investment are:

Franchise - does the company have a sustainable competitive advantage?

Management- does the company make sound strategic and capital allocation decisions?

Balance Sheet - is growth appropriately financed?

Valuation - are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high conviction portfolio with a high active share ratio.

Market Outlook

From our office windows we have a wonderful view of the Scottish Highlands, at least on clear days. However, lately we have been surrounded by grey mist and rain. To be honest, poor FTSE returns, recessionary GDP figures and “dreich” (Scottish for dull or gloomy) weather has led us to dream of sunnier parts of Europe.

Markets have behaved in a rather dreamlike manner, with the Nasdaq, S&P 500, TOPIX, cocoa, uranium, gold and Bitcoin all reaching all-time highs. This strange mix might suggest that speculation is rife. From an investor’s perspective, waves of innovation often pave the way for speculative conditions. But so far equity returns have largely been driven by earnings surprises.

To a large extent, this is due to the fact that FAANG stocks, along with Microsoft, have cash flow margins approaching 30%, whereas growth stocks hover around mid-teen cash flow margins, and the rest of the market sits below 6%. Incremental top line growth is driving significant operational leverage, leading to sizeable upgrades that almost explain the full extent of many share price moves.

The most graphic example of this is NVIDIA Corporation. Its 2025 forecast earnings estimate has gone up 5x, whereas its share price has “only” risen 3x since June of 2023. This indicates a significant de-rating of NVIDIA’s shares.

The sustainability of top line growth will of course be important, and the development of AI Infrastructure is a potential bubble in the making. But in the meantime, AI stocks are not trading anywhere near peaks seen in previous technology bubbles, like those observed in prior technology advancements, such as the mainframe, PC and Internet eras. The challenge lies in monitoring the pace of adoption and ensuring that those involved are generating economic value.

In the meantime, we are in the early stages of a boom in the development of AI Infrastructure, with little indication to date of market saturation. Over time this investment will result in the transformation of just about every industry. Naturally, identifying which industries and companies stand to benefit the most is a primary focus for us.

If AI is to have the effect that many are predicting, it will likely manifest in the earnings of a wide range of corporations and could theoretically offer outsized boosts to productivity, margins and profitability. This phenomenon is still confined to only a small number of companies, but the market is starting to identify second and third-tier winners in the AI space. This includes providers of electrical equipment, server cooling expertise and energy management, reflecting the scale of the energy requirements as AI and data centre expansion progresses.

CEOs of these companies, such as our own Schneider Electric SE, are already highlighting an acceleration in top-line growth and expansion in their total addressable market. This has not gone unnoticed by investors. The strength displayed by industrials is unusual and certainly noteworthy.

Dreams have a place in the world. However, in stock markets, cashflows often serve as gravity when share prices display dream-like behaviour. We do not think we are in a bubble yet, but we could be on our way there.

Fortunately, our Future Quality philosophy, coupled with our consistent process of reviewing the portfolio and ranking stocks, will help us separate dreams from reality. As a result, the portfolio is performing well, especially due to stock selection outside of AI and across all sectors. This includes specialty financials such as Palomar Holdings, Progressive Corporation and Ryan Specialty Holdings, as well as Healthcare stocks such as Encompass Health, Cencora and Masimo Corporation. Each of these has delivered robust results and strong performance in the first quarter.

The Global Equity team will continue to focus solely on one thing —Future Quality—that is, companies with robust balance sheets, proven management teams and the ability to grow returns. We believe that stock picking remains key in today’s market. The divergence within the “Magnificent 7”, driven by underlying cashflow returns, in our view demonstrates the importance of investing in Future Quality companies. We remain convinced that this approach will deliver above-market returns for our clients.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way. There can be no assurance that any performance will be achieved in any given market condition or cycle. Past performance or any prediction, projection or forecast is not indicative of future performance.

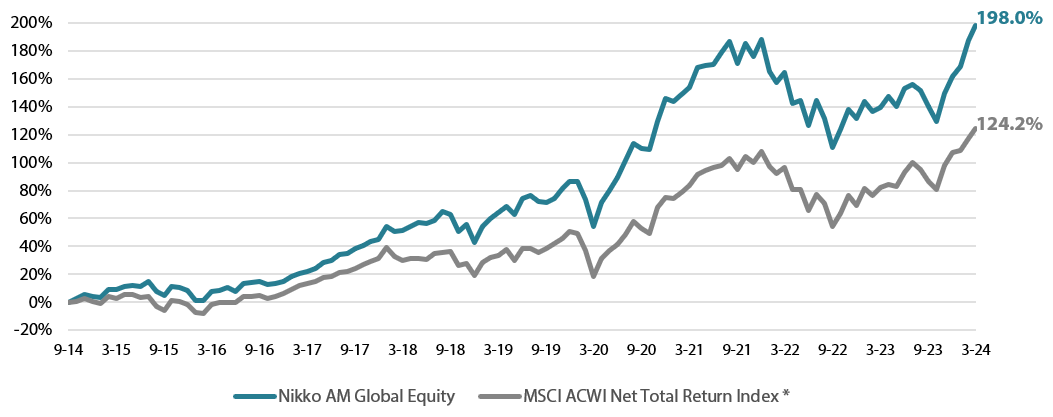

Global Equity strategy composite performance to March 2024

Past performance is not a guide to future returns.

*The benchmark for this composite is MSCI ACWI Net Total Return Index. The benchmark was the MSCI ACWI ex AU since inception of the composite to 31 March 2016. Inception date for the composite is 01 October 2014.

Returns are based on Nikko AM’s (hereafter referred to as the “Firm”) Global Equity Strategy Composite returns. Returns for periods in excess of 1 year are annualised. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest. Copyright © MSCI Inc. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it.. Data as of 30 March 2024.

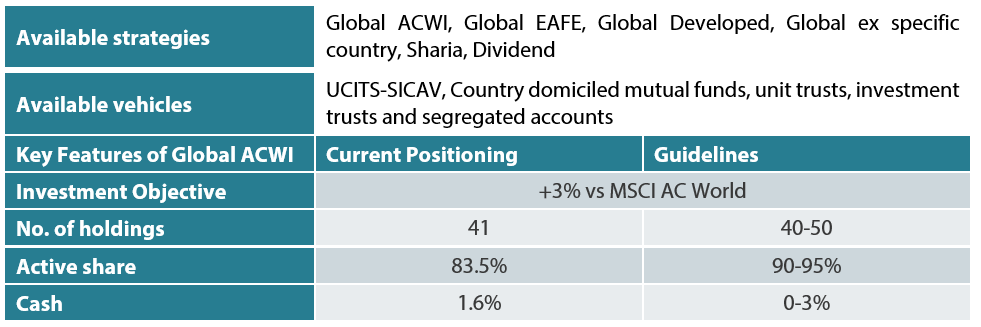

Nikko AM Global Equity: Capability profile and available funds (as at March 2024)

Target return is an expected level of return based on certain assumptions and/or simulations taking into account the strategy’s risk components. There can be no assurance that any stated investment objective, including target return, will be achieved and therefore should not be relied upon. Any comparison to a reference index or benchmark may have material inherent limitations and therefore should not be relied upon.

Past performance is not indicative of future performance. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet

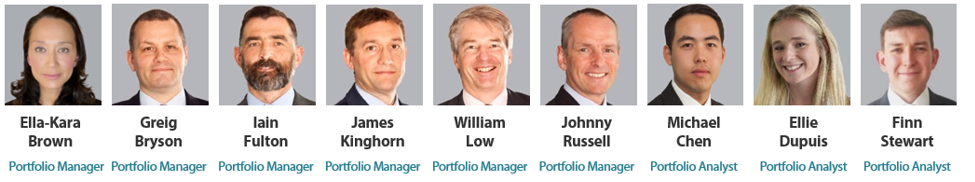

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually “joining the dots” across geographies, sectors and companies, to find the opportunities that others simply don’t see.

There are four key areas that make our strategy different:

– a focus on Future Quality companies – a different and clear philosophy

– a distinctive team culture – a tight-knit team with a process built on openness and respect

– unique execution, including rigorous team challenge of every idea

– differentiated portfolios, with a strong track record in stock-picking and ESG integration

Future Quality companies

We believe that companies with superior long-term returns on investment will deliver better performance. We call these Future Quality companies, and it is only these companies that make it into client portfolios. We search for Future Quality through analysis and financial modelling of companies that we expect to deliver over the next five years, and beyond. This approach is supported by academic evidence that businesses with high and improving returns on invested capital provide superior compound performance over the long term. With this investment time horizon, the sustainability of returns is a crucial ingredient of our Future Quality approach. We have found that companies developing solutions to ESG issues and management teams providing value to all stakeholders are more likely to be successful at sustaining high returns on invested capital over the long-term.

Distinctive team structure and culture

We believe that our collective knowledge and experience are powerful tools for delivering investment performance. Since 2011, we have operated a team-based approach to uncovering Future Quality investment ideas and have fostered a strong group dynamic. Individually, each Portfolio Manager is an expert investor with a broad skillset and experience of many market cycles.

We work in a flat structure, where all our Portfolio Managers have a dual role that combines investment analysis and investment management responsibilities. With individual analytical coverage split along industry lines, each Portfolio Manager is a specialist in the stocks and sectors they cover.

We all actively challenge the ideas and analysis of colleagues throughout the investment process, in an open atmosphere of vigorous and constructive debate. Portfolio Analysts work alongside Portfolio Managers, typically researching thematic trends that could influence and uncover future investment opportunities.

We take collective responsibility for approving stocks for the portfolio, and therefore there is joint accountability for performance. As such, it is in everyone’s interest to ensure that the investment analysis is thorough and that no stone is left unturned in the search for Future Quality.

We believe that the broad experience of our Portfolio Managers and distinctive team-based approach that sees everyone contributing to the strategy, increases the probability of successfully uncovering Future Quality.

Unique execution

Our tight-knit team approach and flat structure enable us to execute in a transparent way, including a rigorous team challenge of every idea. By using our strict Future Quality standards, we can identify long-term winners from the broader universe, to narrow down a comprehensive watch list and around 100 deep dive researched ideas. This is within a unique framework of individual accountability for the underlying analysis and company research, combined with the collective challenging of assumptions at the team level. Our proprietary ranking tool creates a disciplined process to compare and rank attractive opportunities and ensures that at the portfolio construction phase, only our best-ranked ideas receive the most committed weights in client portfolios. We believe our culture is key, and the collective ownership of our research process brings the best portfolio outcomes for clients.

Differentiated portfolios

We deliver a high-conviction Global Equity strategy for clients that is not constrained by benchmarks. As such, Future Quality can be sourced from listed businesses across any geography or sector. And, in a world awash with investment prospects, our disciplined, accountable and transparent process helps us to focus solely on building portfolios from companies that best meet our specific Future Quality criteria.

In terms of balancing risk and reward, our track record shows that we consistently deliver attractive returns on a lower risk-adjusted basis compared with peers and the global reference benchmark. The high active share and concentrated number of holdings help ensure that our Future Quality stock-selection process delivers differentiated portfolios.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the strategy will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.