Summary

- We can expect more aggressive policy support from Chinese authorities over the next several months for consumption and business activities, prompted by the still uncertain global trade situation. Despite the ongoing volatility and uncertainty surrounding US-China tariff policies, there are encouraging signs that the situation may improve.

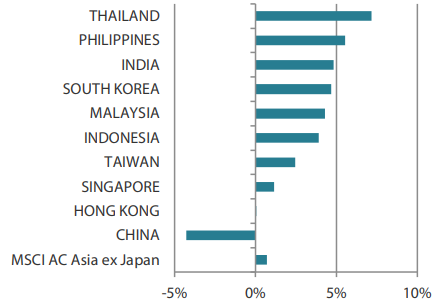

- Markets recovered quickly, following tariff-induced jitters at the start of the month, as negotiations are expected to proceed in earnest. Chinese shares (-4.3%) were the weakest in the region, while Thailand (+7.2%), the Philippines (+5.5%), India (+4.8%) and South Korea (+4.7%) led the gains.

- India could be one of the only large global economies to benefit from US policies. Such a potentially advantageous position, along with “lower-for-longer” energy prices, have formed the foundation of our more constructive view on India recently. Pro-growth consumption policies and structural reforms will also likely enable Indian companies to recover in the year ahead.

- While the stock markets of South Korea and Taiwan are among the most sensitive to trade disruption, we have observed several companies already adapting to limit those risks. In ASEAN, amid uncertainties regarding structural reforms and political issues, we prefer the markets of Singapore, Malaysia and the Philippines with their relatively stable politics and tech-driven economic growth.

Market Review

Markets mostly overcome early losses from April tariff chaos

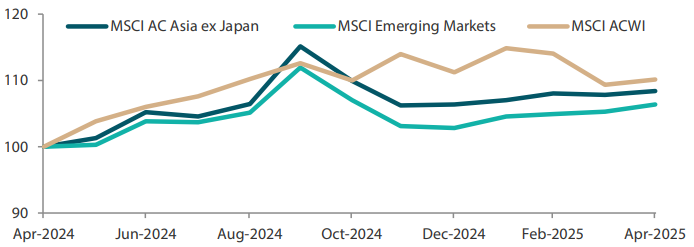

Markets gyrated to the frenetic beat of Washington’s changeable tariffs policy in April, as US President Donald Trump first announced a plan to impose aggressive tariffs on most trading partners, and then paused most of it except those on China. Markets recovered further after the US administration suggested that some trade deals are in the offing, and the MSCI Asia Ex Japan Index finished the month up 0.7% in US dollar (USD) terms. We went into detail about the geopolitical impacts of the tariffs in a separate article .

Chart 1: 1-yr market performance of MSCI AC Asia ex Japan vs. Emerging Markets vs. All Country World Index

Rescaled to 100 on April 2024.

Source: Bloomberg, 30 April 2025. Returns are in USD. Past performance is not necessarily indicative of future performance.

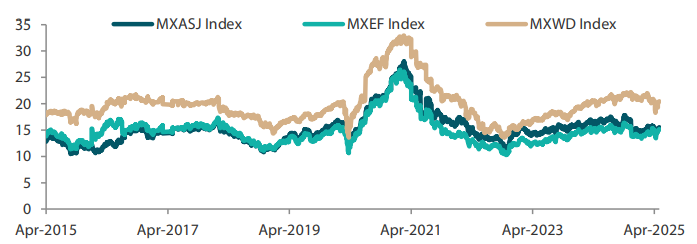

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 30 April 2025. Returns are in USD. Past performance is not necessarily indicative of future performance.

Chinese stocks buck the regional uptrend amid challenging relations with the US

China was the only regional market to end the month in negative territory. According to related data, the country’s manufacturing activity experienced the worst contraction since December 2023. The purchasing managers' index fell to 49 in April as the US and China imposed higher tariffs on each other’s imports. The world’s second largest economy did post a forecast-beating 5.4% GDP growth in the first quarter, in part helped by the momentum of exporters rushing to ship goods to the US ahead of hefty tariffs. China’s top policymakers pledged to support firms and workers most affected by the impact of the tit-for-tat tariffs and urged the country to prepare for worst-case scenarios.

Elsewhere, Thailand, the Philippines, India and South Korea were some way ahead of the broader index. The Thai and Philippine central banks both cut key interest rates by a quarter point, while India’s recovery continued as the nation’s domestically-driven economy and low reliance on exports have lured investors seeking refuge from the trade war. After the chaos of the Yoon Suk Yeol era, epitomised by his ill-fated martial law declaration, South Korea will hold a snap presidential election on 3 June to end a leadership vacuum.

Chart 3: MSCI AC Asia ex Japan Index 1

For the month ending 30 April 2025

For the year ending 30 April 2025

Source: Bloomberg, 30 April 2025.

1 Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

More domestic policy measures needed to boost Chinese market outlook

Market volatility reached record highs after Trump announced what he called a "reciprocal tariff" strategy on Liberation Day (2 April) and subsequent backtracks on many of the tariffs. China has been fighting back with reciprocal tariffs amid the shifts in the global supply chain. Given the still uncertain global trade situation, we can expect more aggressive policy support from Chinese authorities over the next several months to support consumption and business activities. While green shoots were emerging, in both AI-related technology spending and the real estate market which showed signs of stabilising, these developments could face challenges if a protracted trade war ensues.

One reason we are more constructive on Chinese equities is the country’s positive liquidity dynamics. Low government bond yields were in part a symptom of excess savings seeking a safe haven and should confidence return, could lead domestic institutions to redirect their capital to equity markets for better returns. To that end, China’s securities regulator is further encouraging more investments in the equity market by unveiling measures for state-owned insurance firms to invest 30% of annual premiums from new policies in the domestic A-share markets. Despite the initial uncertainty stemming from US tariffs and retaliatory measures from Beijing, there are encouraging signs that the situation may improve. Given escalated trade concerns, domestic policy support is likely needed to maintain this momentum.

More constructive on the overall outlook on Indian equities as we maintain preference for large-cap stocks

We have become more constructive on India as a result of the events over the past four to five weeks. India is perhaps one of the only large global economies that could benefit from US policies—both through a greater share of incremental manufacturing (see Apple's recent announcement to shift all iPhone production to India) and from “lower-for-longer” energy prices. Pro-growth consumption policies and structural reforms will likely enable Indian companies to recover in the year ahead. We see the recent correction as a healthy occurrence that hopefully presents investors with opportunities to invest in some high-quality companies at much more reasonable valuations. We retain a preference for large-cap equities over small- and mid-cap companies, given much more attractive valuation differentials.

Several companies in South Korea and Taiwan already adapting to Trump’s trade disruptions

Despite the recent political turmoil characterised by leadership instability and public protests, South Korea has delivered impressive index returns of over 7.8% year-to-date on the back of strong corporate results and the “Value-up” programme. South Korean companies continue to grow globally and deliver good returns at reasonable valuations. The stock markets of South Korea and Taiwan are among the most sensitive to trade disruption, and we observe several companies already adapting to limit those risks. One additional consideration is that South Korea may benefit from increased incentives from Chinese policymakers in their efforts to strengthen relationships and facilitate regional trade amid tensions with the US. Unfortunately, this is not something we can say for Taiwan.

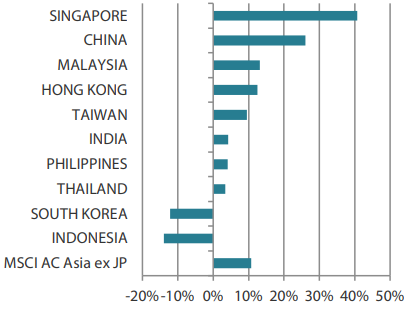

Singapore, Malaysia and the Philippines preferred markets in the ASEAN region

With uncertainties regarding structural reforms and political issues, ASEAN has underperformed China significantly year-to-date but the dispersion within is significant. Singapore, Malaysia and the Philippines remain the preferred countries with relatively stable politics and tech-driven economic growth. We continue to believe that structural drivers of fundamental change remain. Thailand has stood out, showing a significant decline in returns, with its index decreasing more than 12.5% so far this year, driven by a decline in tourism, concerns over high household debt, political uncertainties and corporate scandals. Over the same period, Indonesia’s index delivered a -2.7% return, after seeing a recovery in April following better-than-expected political developments. Notably, Indonesia has not undergone a significant cabinet reshuffle, and state-owned banks are not subject to military influence for now.

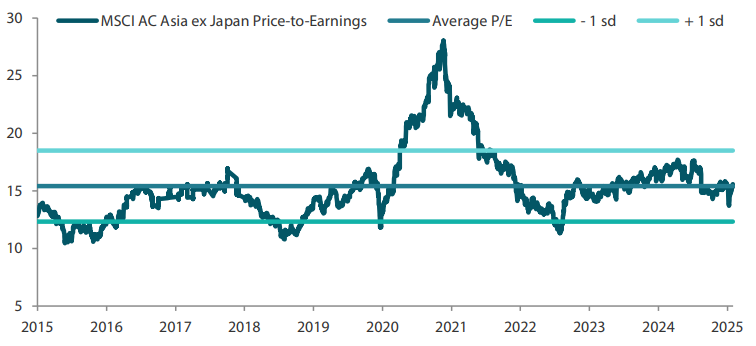

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 30 April 2025. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

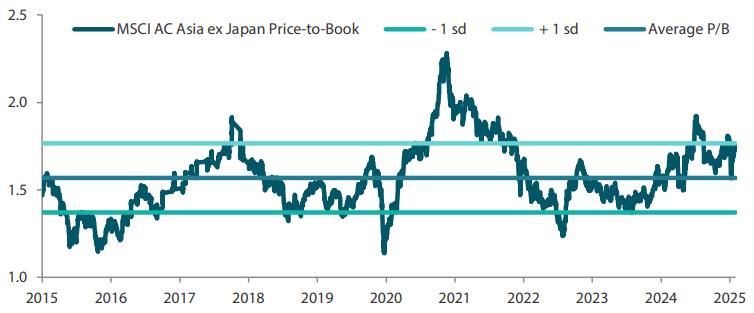

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 30 April 2025. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.