Summary

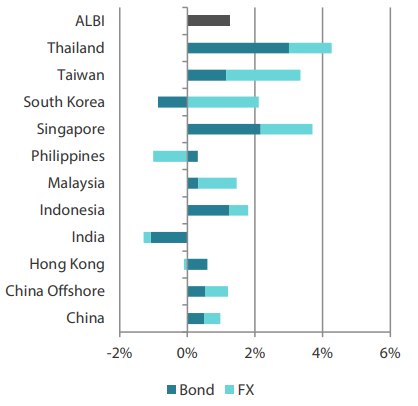

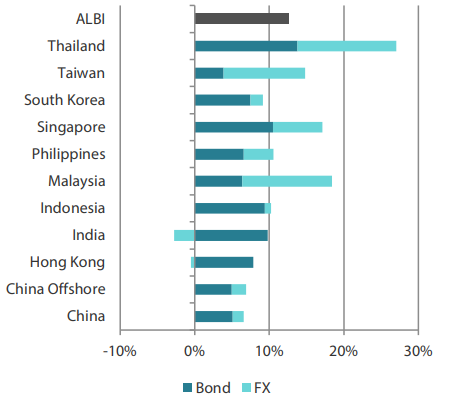

- In June, Asian local government bond yields broadly declined, tracking the movement in US Treasury (UST) yields. On a total return basis, Thai and Singapore government bonds outperformed, while India and South Korean bonds lagged. Meanwhile, most regional currencies strengthened against the US dollar, buoyed by a broadly weaker greenback.

- Within Asia, central banks in India and the Philippines lowered their policy rates in June. Inflation remains low and stable across most economies.

- We continue to believe that Asia’s local government bonds are positioned to perform decently, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Within the region, we expect investor appetite to remain firm for higher yielding bonds such as those of Malaysia, India, Indonesia and the Philippines relative to their regional peers.

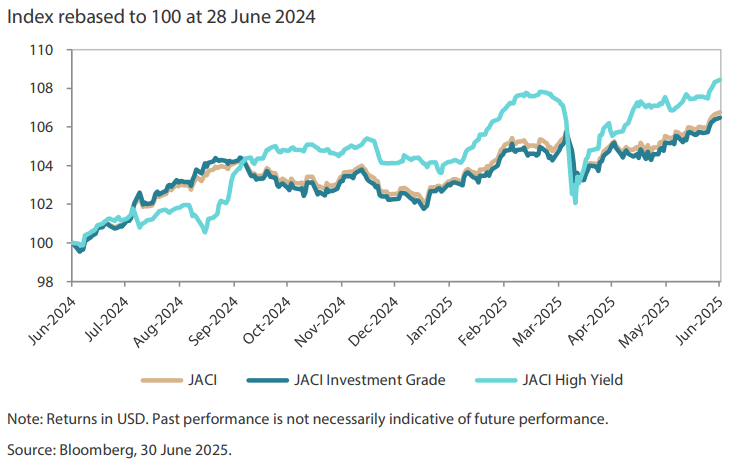

- Asian credits saw total returns of 1.16% in June, driven by gains in USTs, while credit spreads were effectively unchanged. Asian investment grade (IG) credits outperformed Asian high-yield (HY) credits, with IG credits returning +1.22%, even as spreads widened by 2.4 bps. Asian HY credits rose 0.83%, despite spreads widening by 6.1 bps.

- The quick retracement of Asia credit spreads to slightly below pre-Liberation Day levels amid the still uncertain macroeconomic backdrop puts a dent on the valuation angle. While credit fundamentals and decent demand-supply technicals are supportive, we are wary of trade and geopolitical re-escalation risks. We are therefore inclined to take a more cautious and defensive approach over the near term.

- UST yields initially rose in early June, but dovish remarks from a couple of Fed governors in support of a July rate cut, falling oil prices following the Iran-Israel truce, and downward GDP revisions reflecting softer consumer spending pressured yields lower eventually. At the end of June, the benchmark 2-year and 10-year US Treasury (UST) yields were at 3.72% and 4.23%, respectively, about 18 basis points (bps) and 17 bps lower compared to the end of May.

Asian rates and FX

Market review

In June, Asian local government bond yields broadly declined, tracking the movement in UST yields. On a total return basis, Thai and Singapore government bonds outperformed, while India and South Korean bonds lagged. Continued weakness in the US dollar and the resulting strength in the Singapore dollar supported demand for Singapore Government Securities (SGSs). In contrast, Indian government bond yields at the long end rose following the Reserve Bank of India (RBI)’s larger-than-expected 50-bp rate cut and a 100-bp reduction in the cash reserve ratio, which lowered expectations for further open market operations later in the year. Rising oil prices also added upward pressure on Indian yields.

Most Asian currencies strengthened against the dollar in June, as expectations of Fed’s interest rate cuts, along with concerns over US growth and the widening fiscal deficit, weighed on the greenback. Demand for the South Korean won was firm, buoyed by improving risk sentiment amid optimism over trade negotiations. Meanwhile, the Philippine peso was the worst-performing Asian market currency, coming under pressure from rising oil prices.

Central banks in India and the Philippines lower their policy rates; inflation falls across most countries

The Bangko Sentral ng Pilipinas (BSP) cut its policy rate by 25 bps to 5.25% in June, citing a moderating inflation outlook despite recent oil price gains. While acknowledging emerging inflation risks from geopolitical tensions and external policy uncertainty, the BSP remained broadly confident in its inflation outlook, sharply lowering its 2025 forecast to 1.6% (from 2.4%), below the bank’s current 2–4% target range.

Meanwhile, the RBI surprised with a larger-than-expected 50-bp interest rate cut and announced liquidity measures to support the banking system. At the same time, the monetary policy committee shifted its policy stance from “accommodative” to “neutral”. The RBI maintained its FY2026 GDP growth forecast at 6.5%, citing support from private consumption and continued momentum in fixed capital formation. Meanwhile, the RBI revised its FY2026 inflation outlook downward by 30 bps to 3.7%, citing easing price pressures across both food and core inflation components.

Headline CPI readings across the region moderated in May. In the Philippines, annual inflation eased for the fourth consecutive month to 1.3% YoY in May, down from 1.4% in April—its lowest since November 2019 —driven by softer utility and food price gains.

Indonesia’s headline inflation also eased more than expected, falling to 1.60% in May from 1.95% in April, partly due to lower food, drink and tobacco inflation. Core inflation similarly moderated to 2.4%, from 2.50% the previous month.

In Singapore, headline inflation dipped to 0.8% YoY in May from 0.9% in April, reflecting lower transport inflation and slower core inflation. Policymakers expect imported inflation “to remain moderate” going forward.

Meanwhile, Thailand’s headline inflation remained in negative territory for a second month, with headline CPI falling 0.57% YoY in May after a 0.22% decline in April—marking the third consecutive month below the central bank’s 1.0–3.0% target range. Policymakers attributed the decline to lower energy prices and increased agricultural production. As a result, the Commerce Ministry lowered its full-year inflation forecast to a range of 0.0% to 1.0%, down from the previous 0.3% to 1.3%.

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 June 2025

For the year ending 30 June 2025

Source: Markit iBoxx Asian Local Currency Bond Indices, 30 June 2025.

USTs rally in June

The UST yield curve shifted lower in June, with front-end yields outperforming. Yields initially rose following a stronger-than-expected jobs report, with non-farm payrolls increasing by 139,000. Yields then reversed course as escalating tensions between Israel and Iran fuelled risk-off sentiment and a flight to safety.

The June Federal Open Market Committee meeting offered little new direction: the Fed held rates steady, as expected, and maintained a cautious, data-dependent stance. Although the median dot plot still projected two rate cuts this year, visible divisions among policymakers have weakened the credibility of forward guidance. During his semi-annual testimony, Fed Chair Jerome Powell pushed back against expectations for a July cut. However, yields continued to decline, driven by dovish remarks from Fed Governors Christopher Waller and Michelle Bowman in support of a July rate cut, falling oil prices following the Iran-Israel truce easing inflation expectations and downward GDP revisions reflecting softer consumer spending. At the end of June, the benchmark 2-year and 10-year UST yields settled at 3.72% and 4.23%, respectively, about 18 bps and 17 bps lower compared to the end of May.

Elsewhere, the European Central Bank delivered a widely-anticipated rate cut and eased by 25 bps to 2% in early June but signalled a possible pause—if not an end—to its easing cycle.

Market outlook

Remain constructive on higher carry bonds

We continue to believe that Asia’s local government bonds are well positioned for a decent performance, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Concerns over further potential growth shocks from US tariffs are likely to provide additional support for regional bond markets.

Within the region, demand for higher yielding bonds in Malaysia, India, Indonesia and the Philippines is expected to remain firm relative to regional peers. Furthermore, government bond yields in Indonesia, India and the Philippines could decline further, as we anticipate further monetary easing by their central banks in the second half of 2025.

Amid the persistent uncertainties associated with the Trump administration, we remain broadly cautious on Asian currencies in near term. Nevertheless, we see the region’s strong economic fundamentals softening the blow stemming from such uncertainties, with the Malaysian ringgit remaining our preferred currency.

That said, oil price volatility remains a key risk and warrants close monitoring. The outcome of ongoing US tariff negotiations will also be critical, as it influences the pace of policy decisions by regional central banks.

Asian credits

Market review

Asian credit markets post gains in June

In June, Asian credits delivered total returns of 1.16%, driven by gains in USTs, while credit spreads were effectively unchanged. The decline in UST yields contributed to the outperformance of IG credits compared to their HY counterparts (the former has longer average duration relative to the latter). IG credits returned +1.22% even as spreads widened by 2.4 bps, while HY credits gained 0.83% even as spreads increased by 6.1 bps.

Asian credit spreads were range bound in June. Early in the month, optimism around US-China trade negotiations prompted spreads to tighten, particularly after reports that US President Donald Trump had called Chinese President Xi Jinping amid concerns over stalled talks. Sentiment was further supported by high-level discussions held in London. Trump later announced that a trade deal had been signed between the two countries. While details were limited, Trump said the agreement involved China easing restrictions on rare earth minerals critical to manufacturing and microchip production. In exchange, the US would allow Chinese students to continue studying at its colleges and universities.

Spreads widened mid-month amid escalating conflict in the Middle East and a resulting surge in oil prices. Meanwhile, China’s May activity data sent mixed signals about the state of the economy as retail sales accelerated while industrial production and fixed asset investment softened. Weakness in the property sector persisted, with both investment and residential sales contracting year-to-date. For the remainder of June, Asian credit spreads remained mostly in narrow range, shaped by geopolitical and tariff-related developments. Spreads tightened in Hong Kong, India, Indonesia, Macau, Malaysia, Singapore and the Philippines, but widened in China, South Korea, Taiwan and Thailand. Hong Kong HY credits rallied as a large developer successfully completed its bank loan refinancing exercise. Sentiment toward Thai credits weakened as confidence in Prime Minister Paetongtarn Shinawatra fell following a leaked call allegedly criticising the military. The political situation worsened with the withdrawal of the second-largest party from the ruling coalition.

Primary market activity remained active in June

The IG space saw 13 new issues totalling USD 9.7 billion, including the USD 3.0 billion two-tranche issue from MTR Corporation Ltd, the USD 1.0 billion issue from Hanhwa Life Insurance, the USD 1.0 billion two-tranche issue from Industrial Bank of Korea, the USD 1.0 billion issue from State Power Investment Corp Company 5 and the USD 1.0 billion sovereign issue from the government of Hong Kong. In the HY space, two new issues raised USD 580 million.

Chart 2: JP Morgan Asia Credit Index (JACI)

Market outlook

Still supportive credit fundamentals and decent demand-supply technicals but valuation less appealing after sharp rally in May

Ongoing trade and tariff-related uncertainties, coupled with question marks over the trajectory of US economic growth and the Fed’s monetary policy, are expected to present some challenges to external demand and Asia’s macroeconomic fundamentals in the near term. Certain country-specific developments, such as potential fiscal policy shifts in Indonesia, also bear monitoring. However, most Asian economies entered this period of higher volatility with relatively robust external, fiscal, and domestic demand conditions, which should provide a good buffer to withstand the challenges ahead.

Chinese authorities continue to roll out comprehensive fiscal and sector-specific policies to support domestic consumption and investments, as well as to stabilise the stock and property markets. In addition, most of Asia’s central banks retain some room to ease monetary policy to support domestic demand. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

The quick retracement of Asian credit spreads to levels slightly below pre-Liberation Day levels, coupled with the still uncertain macroeconomic backdrop, makes the valuation angle somewhat less appealing. While we still see supportive credit fundamentals and decent demand-supply technicals, we are wary of trade and geopolitical risks resurfacing, especially as we near the end of the 90-day pause on reciprocal tariffs. The implementation of these tariffs has been upheld by the US appeals court. We would therefore be inclined to take a more cautious and defensive approach over the near term.