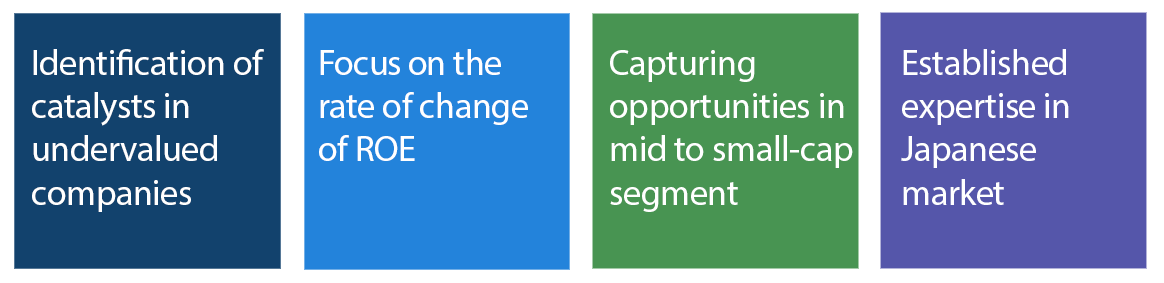

Investment Philosophy

The Japan Active Value Equity Strategy employs a fundamental, bottom up approach with a value style bias. The strategy invests in Japanese listed companies across all sectors and market capitalizations. The strategy’s investment philosophy is based on the belief that higher returns can be achieved by identifying undervalued companies with the potential to drastically turn their current situation around. Research is focused on companies that are likely to exhibit a recovery in earnings, sustainable growth, or undergo a drastic change in financial policy in the future. These companies are likely to witness substantial changes in return on equity (ROE).

Focus on catalysts

The strategy places emphasis on the identification of catalysts. When investing in undervalued stocks, the investment team avoids falling into value traps by looking for companies with catalysts that could move their stock higher.

Capturing opportunities in the mid to small-cap segment

While the strategy is all-cap, the portfolio managers have an additional focus to capture opportunities in the mid to small cap segment overlooked by the market. The Japanese equity market has a wealth of opportunities in this space, as demonstrated in the fact that about 42% of TOPIX companies have no sell-side analyst coverage. Many stocks in Japan remain cheap because they are under-researched and not enough information is available for investors.

Key Characteristics

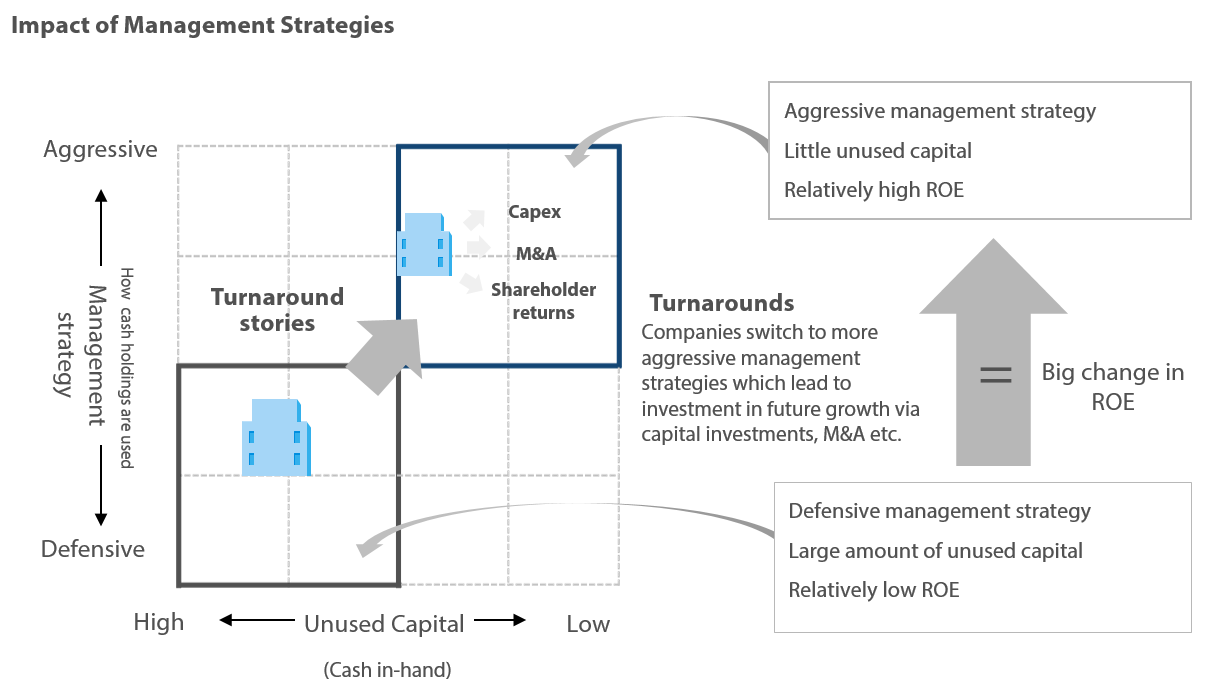

Focus on the rate of change of ROE

Illustrated below is an example of a turnaround situation in which a conservative company with large cash holdings and low ROE is transformed into a high ROE company.

Corporate analysis and stock selection

Broadly speaking, the investment team seeks mispriced stocks from two different perspectives: structural and cyclical. Through this process, they seek stocks that are mispriced due to excessive pessimism, misconception or simply being neglected by the market.

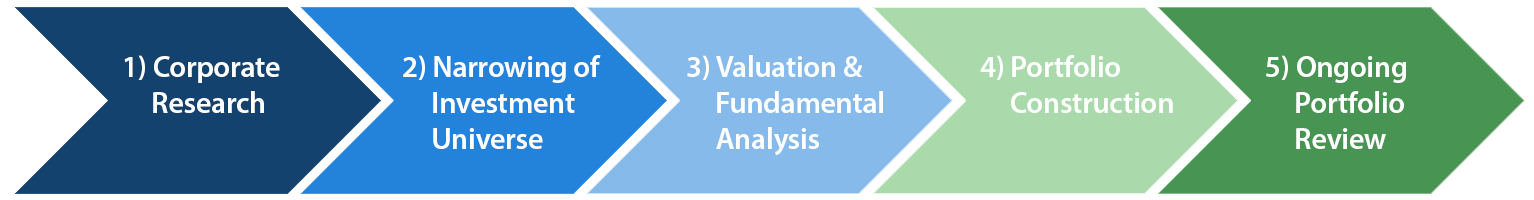

Investment Process