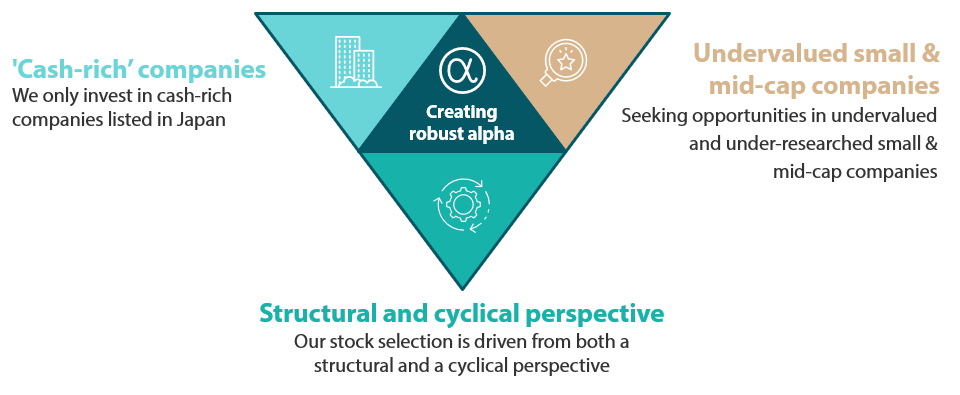

Investment philosophy

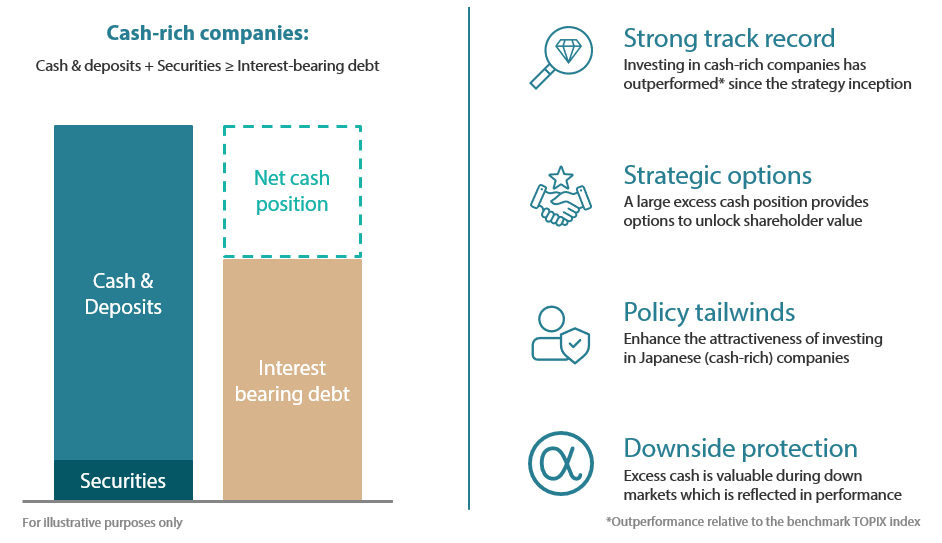

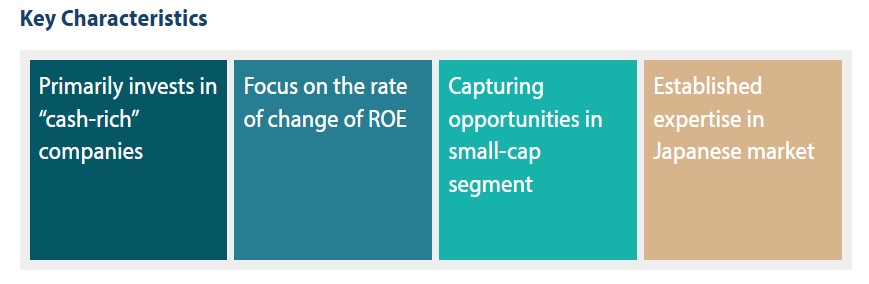

The Japan Cash-Rich Company Equity Strategy primarily invests in “cash-rich” companies, or firms which have a high level of liquid reserves. There is a particular focus on whether such reserves can be used effectively towards growth and the enhancement of shareholder returns. The strategy also emphasises the identification of catalysts; when investing in undervalued stocks, the investment team avoids falling into value traps by looking for companies with catalysts that could move their stock higher.

The strategy doesn’t limit its investments in terms of market cap segments or sectors, but instead looks at all Japanese domiciled companies that are likely to see earnings recovery or growth, or for which we have high expectations of a change in their capital management policy. While investing across all market cap segments, the strategy has a tilt toward undervalued small and medium-sized companies that are often under-researched.

Why invest in cash-rich companies?

1) Undervalued and under researched

Small and medium-sized companies in Japan have less analyst coverage than larger companies, which means there is less information available and greater opportunities for active managers to earn returns. In fact, 47%^ of companies on the TOPIX Index receive zero coverage from equity analysts as compared to 1%^ for S&P1500. As a result, active managers can gain insights not reflected in market prices, helping them to identify mispriced securities before the broader market catches up.

^Source: Bloomberg, as of end-December 2023

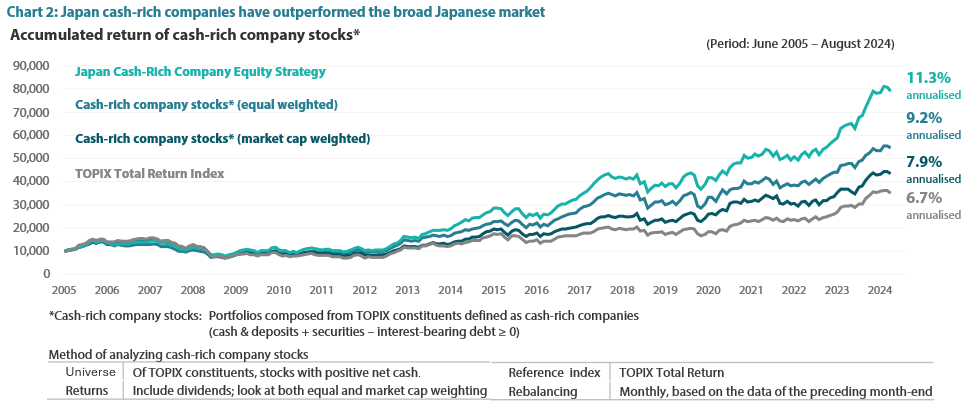

2) Uniquely positioned - Japan cash-rich companies have outperformed the broad Japanese market

Over the decades, Japanese cash-rich companies have consistently outperformed the broader TOPIX, providing strong returns even in tough conditions (Chart 2). We believe that investing in these cash-rich companies is effective, and selecting the right companies can yield even higher returns. In our view, the Fund is uniquely positioned to capitalise on Japan-specific opportunities and benefits from policy-driven corporate governance reforms.

Source: Nikko AM based on data deemed reliable; TOPIX Total Return Index data from JPX Market Innovation & Research, Inc.

The data shown represents past performance and is not a guarantee of future returns.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on Nikko AM Global’s (hereafter referred to as the “Firm”) Japan Cash-Rich Company Equity composite. The Firm claims compliance with the Global Investment Performance Standards (GIPS®). Returns are Japanese Yen based and are calculated gross of advisory and management fees and custodial fees, but are net of transaction costs and include reinvestment of dividends and interest. The composite has no benchmark; however, for this presentation TOPIX Total Return Index is used as a reference index. The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Past performance does not guarantee future returns. GIPS is a registered trademark of the CFA Institute. For more details please refer to the performance disclosures at the end of this document. Source: Nikko AM.

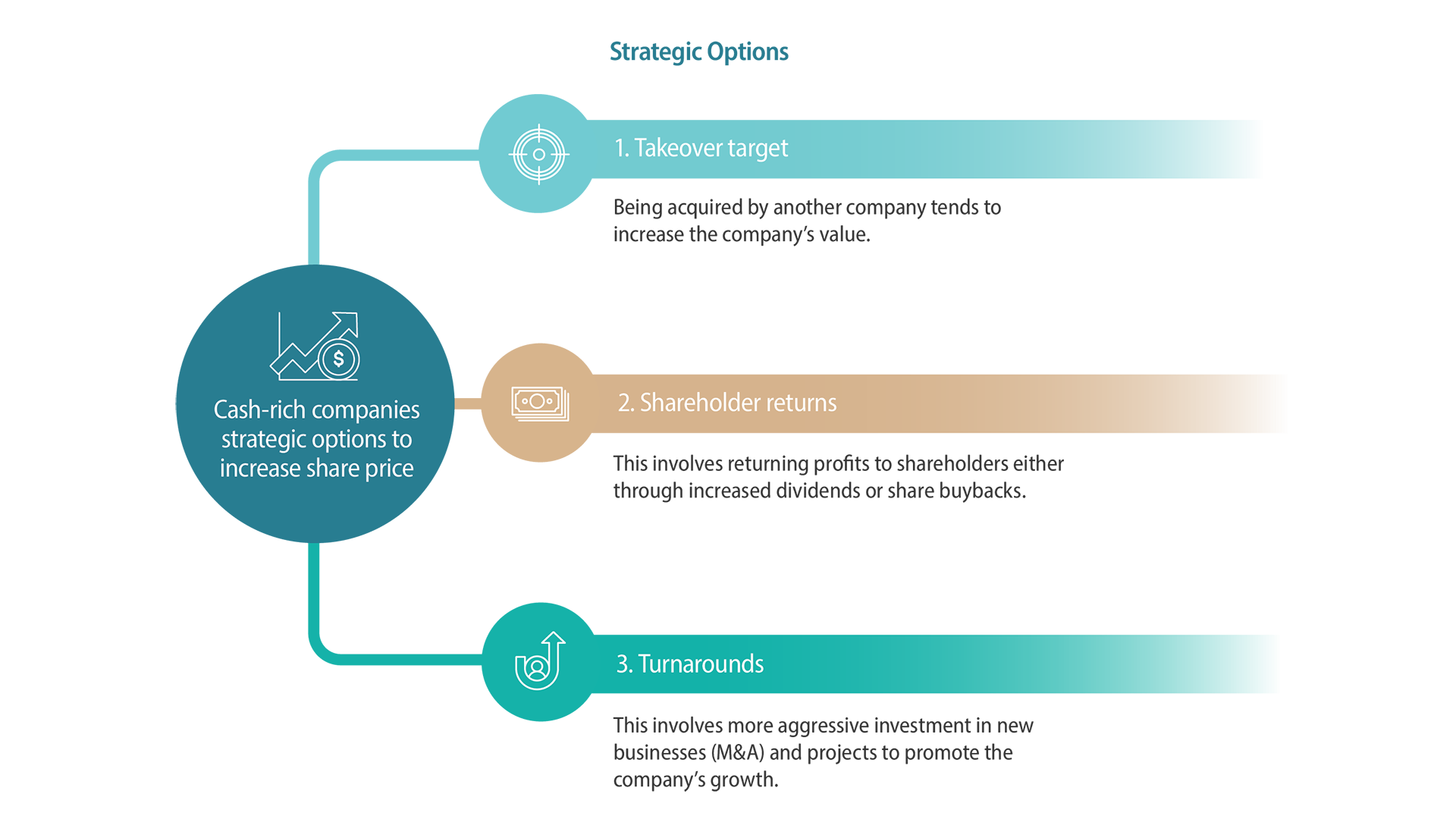

3) Strategic options

We believe investing in Japan cash-rich companies whose share price is undervalued but is expected to benefit from an improved valuation in the future.

- Takeover target: Being acquired by another company tends to lead to an increase in the company’s value.

- Shareholder returns: Returning profits to shareholders either through increased dividends or share buybacks.

- Turnarounds: More aggressive investment in new businesses (Merger & Acquisitions) and projects to promote a company’s growth.

For illustrative purposes only. The diagram does not guarantee future performance.

How do we capture value in Japan’s underinvested cash-rich company space?

Investment Process

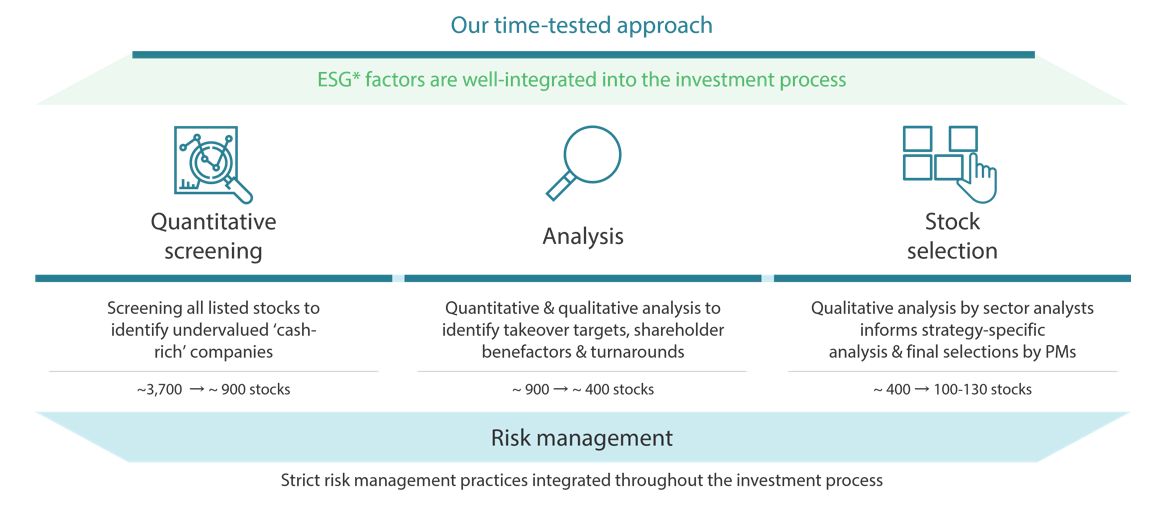

Our three-step process to building a robust portfolio of the best cash-rich companies