The Nikko AM Global Green Bond Strategy aims to provide

capital to…

Address the challenges of climate

change

Promote nature and the

protection of eco-systems

Prevent further

biodiversity loss

Our Philosophy

Our world is facing a global environmental crisis, one with such magnitude that it will affect each and every one of us. We believe that green bonds have a vital role to play in mitigating the severity of the global environmental crisis by supporting positive climate change solutions. Our aim is to address climate change by focusing on net zero and energy transition as well as promoting nature conservation, protecting ecosystems, and preventing biodiversity loss. By balancing fundamental and quantitative analysis, we provide a more comprehensive and sophisticated approach to investing in green bonds, ensuring that portfolios are both sustainable and profitable. This approach results in the strategy having the following key features:

Key characteristics

Style: Active Fundamental and Quantitative analysis

Universe: SSA Green Bonds, Corporate Green Bonds, Social, Sustainability & Sustainability Linked Bonds

Benchmark: iBoxx Global Green, Social and Sustainability Bond Index

Target return: Outperform the benchmark by 1% gross over a rolling 3-5 years

Tracking Error Target: 150 -300bps

Duration Range: +/- 2Yrs

UCITS Vehicle Available: SFDR Article 9 Fund

Sustainability focussed themes

Our commitment to sustainability is the driving force behind our investment strategy. In line with this, our portfolio prioritises three key areas when considering a bond to include in our investment portfolio:

Focus on issuers who have set ambitious net zero aspirations and have clear plans to implement them. We believe that investing in companies that are proactively working towards reducing their carbon footprint is crucial in the fight against climate change.

Seek out sectors that are supportive of the transition to a net zero economy. These include areas such as renewable energy, sustainable transportation, and green building materials. By investing in these sectors, we aim to accelerate the transition towards a more sustainable future.

Prioritise bond issuances that promote nature and the protection of ecosystems. We recognise the importance of preserving our natural environment and believe that investing in projects that protect and restore our ecosystems is essential to achieving a sustainable future. Overall, our portfolio aims to promote sustainability-oriented goals by investing in bonds that align with our values and contribute to a more sustainable future for all.

Proprietary bottom-up sustainability assessment

Our unique bottom-up review process applies to every holding in the portfolio. This distinctive approach combines sustainable assessments from three different lenses:

- The issuer’s sustainability strategy

- The pre-issuance bond framework

- The post-issuance allocation and impact report

Through this process, we gather and review both third-party data and source materials to ensure consistency between the issuer’s sustainability strategy and the issuance of a labelled bond but also that the bond itself follows best disclosure standards with transparent and impactful use of proceeds. This qualitative review process is taking place before investing and, if concerns are identified, can lead to the decision not to invest or to conduct enhanced due diligence, through engagement.

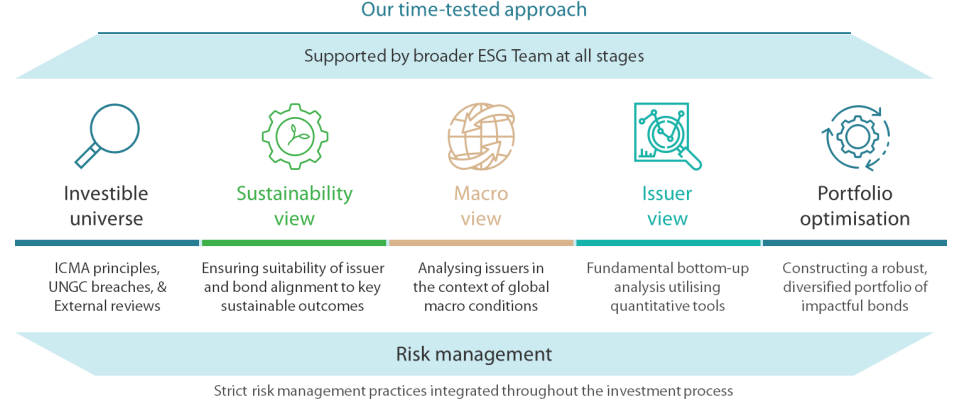

Investment process

Our investment process is designed to integrate sustainability considerations into our investment decisions whilst integrating top-down and bottom-up approaches, leveraging both quantitative analysis and qualitative team input to construct a well-diversified and sustainable green bond portfolio. This is done in conjunction with ensuring that we invest in bonds that align with our commitment to sustainable development and contribute to positive environmental and social outcomes.

Our Team

Our strategy is managed by Steve Williams and Holger Mertens who are supported by a team of portfolio management and research professionals including a dedicated team of ESG Specialists.

Supporting core portfolio management through data and research analysis

Local ESG Specialists advising on sustainability matters

Ability to draw upon local insights in Singapore, Tokyo, New Zealand

Independent risk management function continuously monitoring the portfolio and client restrictions

Andre Severino, Global Head of Fixed Income

Andre Severino is the Global Head of Fixed Income and a Senior Managing Director in Nikko AM’s London office. Andre has overall responsibility for London’s Global Fixed Income team. Andre originally joined Nikko AM’s New York office in 2007 before transitioning to the London office in 2010, where he took over the management of the team in 2014. In that time, Andre has built a robust investment team and a consistent investment process used across the team helping to generate ideas and construct high conviction portfolios. Additionally, Andre has been responsible for managing Nikko AM’s High Conviction Bond Strategy since April of 2008. Andre has over 30 year’s investment experience with a particular focus in managing assets in Global Macro and in Developed Sovereign markets. Prior to Nikko AM, was with Fairstream Capital Management, a Global Macro hedge fund acquired by Nikko Asset Management Americas in 2007. Prior to Fairstream, Andre worked at Ritchie Capital Management where he focused on macro strategies in the G-10 countries. Andre began his career at Chicago Research and Trading (CRT) in 1990, an options market making boutique. He received his Bachelor of Business Administration, with a major in Finance, from Loyola University in Chicago in 1990.

Steve Williams, Head Portfolio Manager – Core Markets

Steve Williams is the Head Portfolio Manager for Global Core Strategies and a Managing Director in Nikko AM’s London office. He is a member of the fixed income & foreign exchange investment committee as well as the portfolio manager with oversight for the firm’s investment grade, municipal, green bond, global mortgages and global bond business. He joined Nikko AM in 2007 and took over co-management responsibility with Andre Severino for the firm’s flagship global sovereign bond strategy as well as launching the first dedicated Danish mortgage bond strategy into Japan in 2016 and has managed Nikko AM’s Green Bond strategy since 2015. Steve, previously served as a Credit research analyst with New York Life Investment Management in corporate bonds and structured finance as a senior analyst. He has over 20 years of investment experience and holds an MBA from Duke University’s Fuqua School of Business. He received his undergraduate degree from the University of Michigan and is a certified FRM.

Holger Mertens CFA, Head Portfolio Manager – Global Credit

Holger joined Nikko AM in July 2015 to help develop the firm's Global Credit and Sustainable Investment capabilities. Prior to Nikko AM, Holger worked at Lazard Asset Management and held a variety of roles based in both Frankfurt and London, where he was Lead Portfolio Manager for Corporate Bonds. Before Lazard, he worked for Deka Investment Management where he was a Fund Manager/Analyst for Corporate Bonds. Holger began his career at DG Bank as a Fixed Income Trade & Sales assistant. He holds a Masters in Business Management and Economics from the Frankfurt School of Finance & Management and is a CFA® Charterholder.

Our Edge

Green Bond PioneersOur extensive experience and expertise in the green bond space makes us a leader in this field. Nikko AM played a crucial role in creating the world’s first green bond fund in conjunction with the World Bank in 2010. The core investment team has extensive experience in this space and the team has directly engaged with issuers in the structuring and issuance of green bonds for over a decade. With our dedication to sustainability and innovation, we are well-positioned to help shape the future of the green bond market and to support positive environmental change.

Distinctive investment approachNikko AM's core team brings a wealth of expertise and a distinctive investment approach to the table. The backbone of our investment process is a fundamentally focused strategy supported by quantitative tools, which enables the team to identify the most attractive investment opportunities in the market. The investment approach applied is characterised by the harmony between fundamental and quantitative analysis, which the team believes is crucial to successfully identifying and capitalising on market opportunities. By balancing these two lenses of analysis, we can provide a more comprehensive and sophisticated approach to investing in green bonds, ensuring that their clients' portfolios are both sustainable and profitable.

Proprietary Bottom-up Sustainability assessmentThe team has developed a unique bottom-up review process that applies to every holding in the portfolio. This qualitative review process is taking place before investing and, if concerns are identified, can lead to the decision not to invest or to conduct enhanced due diligence, through engagement. Through this process, we ensure consistency between the issuer’s sustainability strategy and the issuance of a labelled bond and also that the bond follows best disclosure standards with transparent and impactful use of proceeds.

Unique decision making processIndependent views collated into a team-wide survey and assessed against market consensus. This ensures that investment decisions are made based on a wide range of opinions, providing a more robust and nuanced approach to portfolio management.

The Nikko AM Global Green Bond Strategy in short

Investing for a sustainable future

Emphasis on funding projects with tangible positive impacts

addressing climate change and protecting nature

Expertise driven by experience

Launched the first dedicated Green Bond fund of its kind in 2010 in collaboration with

issuers, the core team has worked together for over a decade

Distinctive investment approach

The backbone of our investment process, providing a holistic

fundamental focus supported by quantitative tools

Unique decision-making framework

Independent views collated into a team-wide survey,

assessed against market consensus

Harmony between Fundamental & Quantitative analysis

We balance these two lenses of analysis in order to identify the

most attractive investment opportunities in the market