Summary

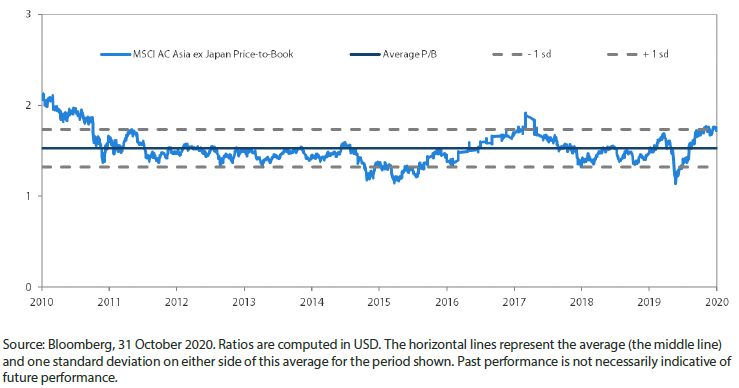

- US presidential election jitters and an uptick in COVID-19 cases in the US and Europe triggered a downturn in global equities in October. Asian stocks, however, managed to turn in decent gains for the month, owing to a slowing pace of COVID-19 infections in the region and growing optimism over China’s economic recovery. The MSCI AC Asia ex Japan Index rose 2.8% in US dollar (USD) terms over the month.

- Indonesia, the Philippines and China were the best-performing markets in October. Indonesia was buoyed by the passing of the controversial Omnibus Law, the Philippines by its Philippine peso (PHP) 4.5 trillion 2021 budget, and China saw its economy expand 4.9% year-on-year (YoY) in the third quarter of 2020.

- The ASEAN region underperformed during the month. Tracking the slump in global equities, Singapore stocks declined 2.7%. Elsewhere, political uncertainties caused Thai and Malaysian stocks to fall 2.3% and 1.3%, respectively, in October.

- One issue we are monitoring is the significant regulatory scrutiny that big tech is coming under, not least the US anti-trust investigation into Google. This is because a number of equity markets worldwide have been propped up almost single-handedly by big-tech stocks.

Market review

Regional stocks outperform their global peers

US presidential election jitters and an uptick in COVID-19 cases in the US and Europe triggered a downturn in global equities in October. Asian stocks, however, managed to turn in decent gains for the month, owing to a slowing pace of COVID-19 infections in the region and growing optimism over China’s economic recovery. Brent crude retreated 8.5% in US dollar (USD) terms in October, while gold and silver held their ground.

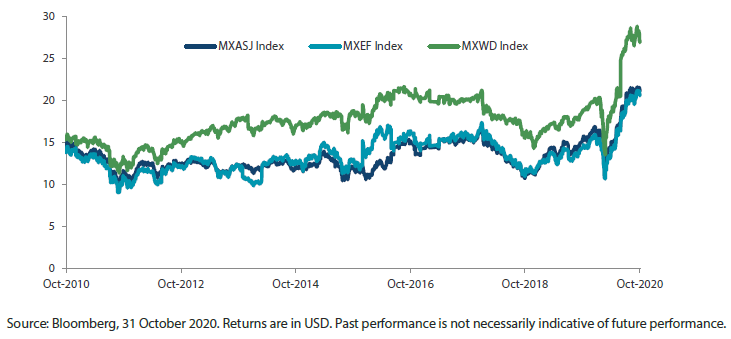

For the month, the MSCI AC Asia ex Japan Index rose 2.8% in USD terms, outperforming the MSCI AC World Index, which slumped 3.1%. Within the region, Indonesia, the Philippines and China were the best performers in USD terms (as measured by the MSCI indices), while Singapore, Thailand and Malaysia were the laggards.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

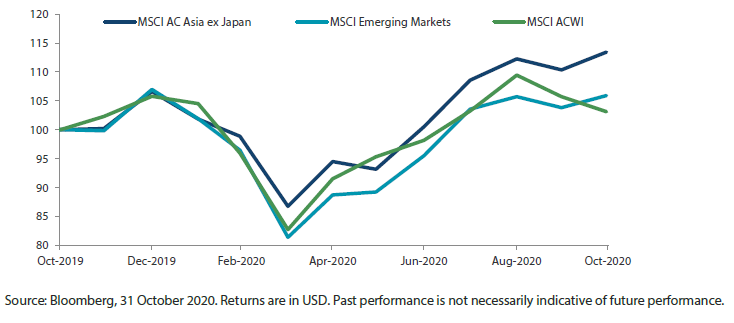

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Indonesia, the Philippines and China outperform

Indonesian stocks surged 8.7% in USD terms in October on the back of easing lockdown curbs in Jakarta. In early October, the Indonesian parliament passed the Omnibus Law, a controversial jobs bill that could cut onerous regulations and boost investment for the coronavirus-hit economy. In the Philippines, stocks jumped 7.9% in USD terms for the month, buoyed by a PHP 4.5 trillion 2021 budget that aims to help the economy recover from the coronavirus pandemic. Other ASEAN markets ended October with USD losses. Tracking the slump in global equities, Singapore stocks declined 2.7%. Elsewhere, political uncertainties caused Thai and Malaysian stocks to fall 2.3% and 1.3%, respectively, in October.

In China, stocks rose 5.3% in USD terms for the month, which saw the world’s second largest economy expanding 4.9% year-on-year (YoY) in the third quarter of 2020, accelerating from the 3.2% YoY growth in the second quarter (2Q). The Chinese Communist Party’s Central Committee concluded China’s fifth Plenum—a four-day meeting on China’s economic and social policy goals for the next five years—with emphasis on a higher quality of growth through to 2025.

South Korea, Taiwan and Hong Kong see mixed returns

Other North Asian markets saw mixed returns. South Korea and Taiwan turned in muted USD gains of 0.6% and 1.3%, respectively, partly weighed down by a correction in global technology (tech) stocks. In Hong Kong, stocks fell 1.2%, tracking the slide in global equities. The liquidity issues plaguing China Evergrande also dampened sentiment for Hong Kong stocks.

India ekes out gains

In India, stocks eked out USD gains of 1.1%, as high frequency economic indicators continued to signal a rebound in the Indian economy. The government unveiled plans to inject USD 10 billion into the economy to spur consumption; investors, however, were underwhelmed as this is expected to boost demand by less than 0.4% of GDP.

Chart 3: MSCI AC Asia ex Japan Index1

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

US presidential election in the spotlight

It appears that Joseph Biden will be the next president of the US, notwithstanding Donald Trump’s reluctance to admit defeat. While a less belligerent stance can be expected from the White House, there is unlikely to be a sea change in the substance of US policy, particularly vis-à-vis China. And, of equal longer-term importance is the significant regulatory scrutiny that big tech is coming under, not least China’s heavy-handed approach apropos Ant Financial, or the US anti-trust investigation into Google. This is because a number of equity markets worldwide have been propped up almost single-handedly by big-tech stocks. Barring a successful vaccine, incremental COVID-19 developments are unlikely to be centrespread material.

Preference for software, automation, healthcare and insurance stocks in China

As we grapple with these issues, China’s fifth Plenum of the Communist Party has concluded, with President Xi Jinping espousing a “dual circulation” policy. At its core, it seeks to drive domestic innovation and consumption, while welcoming foreign capital into the country, as evidenced by recent moves to improve access for foreign investors to domestic capital markets. Given the bipartisan support for policies to check China’s march, especially in tech, Xi’s approach suggests discretion and allows latitude to manage the vicissitudes of US policy toward China. Hence, our preference continues to be for domestic-focused stocks in structural growth areas of software, automation, healthcare and insurance.

On the lookout for opportunities in South Korea and Taiwan

South Korea’s and Taiwan’s tech-heavy economies are in the uncomfortable position of potentially having to choose sides in what is likely to be a long-running US-China spat. While both countries have historically been US allies, the reality is less simple. In these markets, we remain on the lookout for opportunities in esoteric sectors such as clean tech and industrial automation.

Selective in India and ASEAN

In India, labour and agriculture sector reforms are transformational, but as with any such major reforms, the impact will only be felt in the coming years. In the interim, favouring companies that provide growth capital to businesses, i.e. private sector banks, remains the preferred option in addition to favouring companies that reduce the friction of doing business—digital services and logistics.

There is never a dull moment in ASEAN politics, with both Malaysia and Thailand facing different types of turmoil. Vietnam has been the standard bearer in terms of handling COVID-19 and the recovery in economic activity, particularly as supply chains undergo reconfiguration in the new normal. Nonetheless, attractive opportunities are few; thus, we remain watchful.

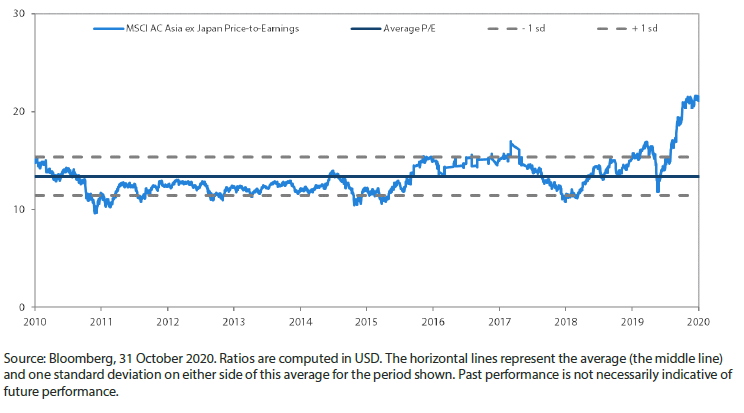

Chart 4: MSCI AC Asia ex Japan price-to-earnings

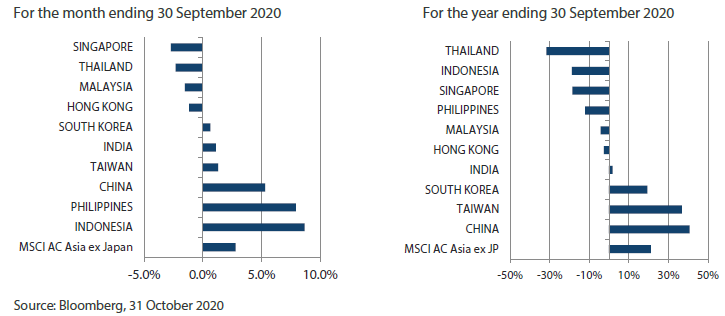

Chart 5: MSCI AC Asia ex Japan price-to-book