Summary

- Asian stocks suffered losses in July, weighed down by the selloff in Chinese equities following Beijing’s regulatory crackdown on the private tutoring and technology-related sectors. A resurgence of COVID-19 cases across the region also dampened sentiment for Asian stocks. For the month, the MSCI AC Asia ex Japan Index sank 7.5% in US dollar (USD) terms.

- China and the Philippines underperformed. In China, stocks fell 13.8% in USD terms in July, with the drop triggered by growing fears over the Chinese government’s regulations in the education, property and technology (tech) sectors. Philippines stocks plummeted after rating agency Fitch downgraded the country’s outlook from stable to negative.

- Conversely, Singapore and India outperformed, rising 1.3% and 0.9%, respectively, in USD terms. Singapore was supported by robust manufacturing numbers and better-than-expected economic growth, while the Reserve Bank of India upgraded India's GDP growth forecast for FY22 to 10.5% (from 9.5%) as the country stepped up vaccinations against COVID-19.

- With globalisation having peaked some time ago, our focus remains on companies geared to large domestic markets and areas of structural growth, such as pockets of technology, healthcare and decarbonisation.

Market review

Regional equities suffer losses in July

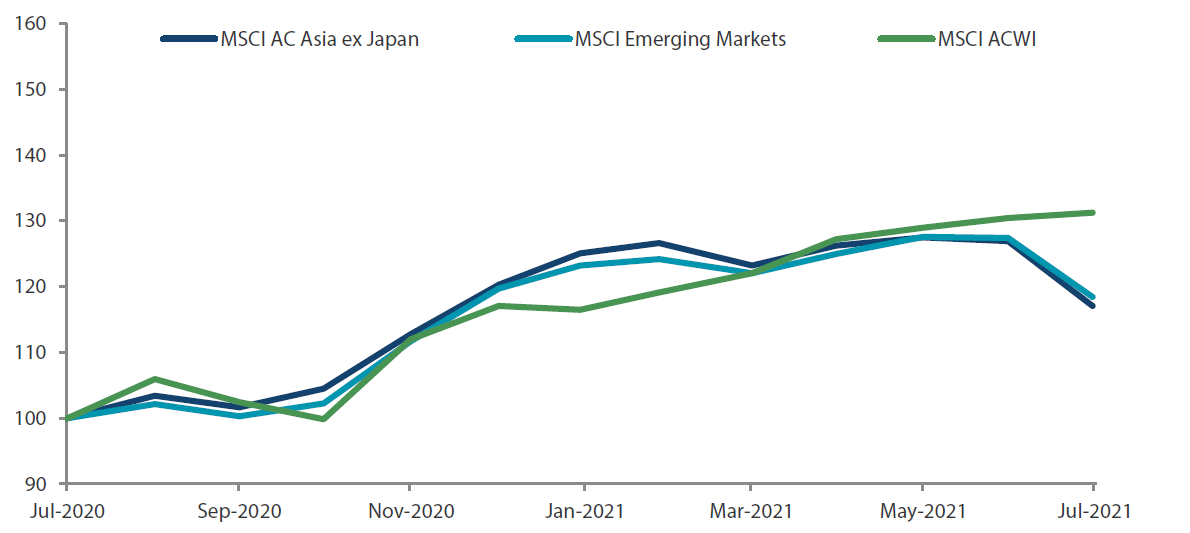

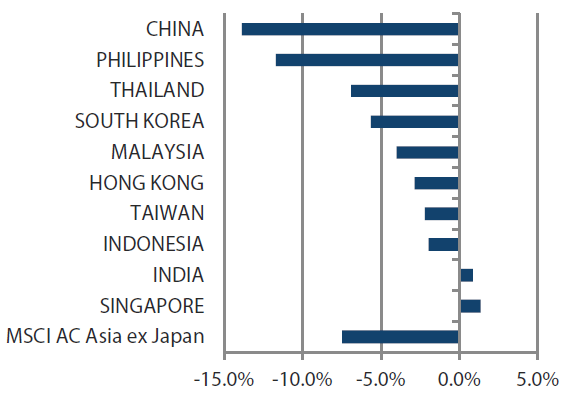

Asian stocks suffered heavy losses in July, weighed down by the brutal selloff in Chinese equities amid Beijing’s regulatory crackdown on the private tutoring and technology-related sectors. A resurgence of COVID-19 cases across the region due to the highly infectious Delta variant and lingering concern about inflation also dampened sentiment for Asian stocks. For the month, the MSCI AC Asia ex Japan Index sank 7.5% in US dollar (USD) terms. Within the region, China, the Philippines and Thailand were the worst performers (as measured by the MSCI indices in USD terms), while Singapore and India were the most resilient markets.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 July 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 July 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

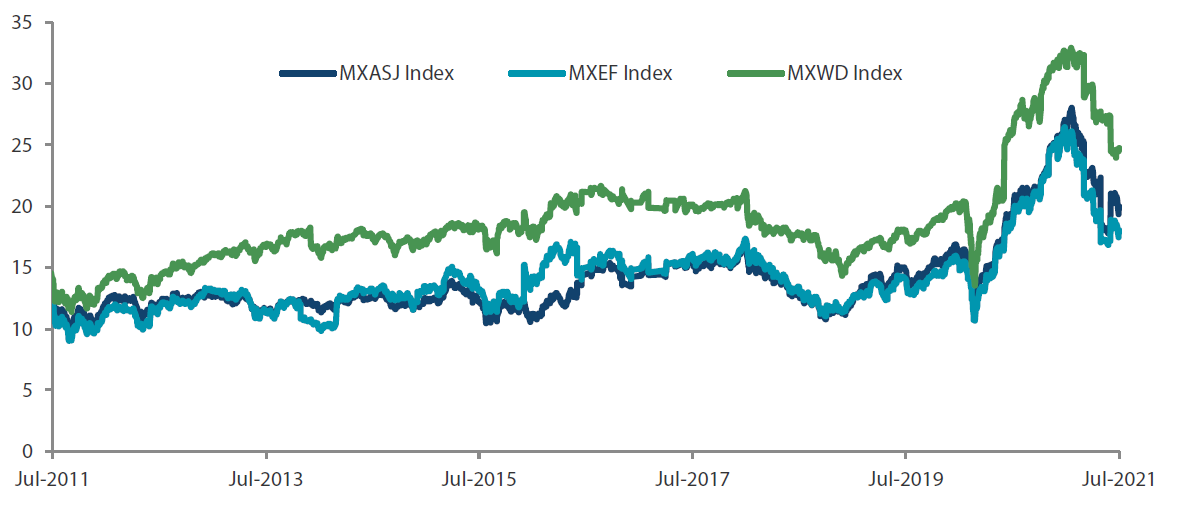

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 July 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 July 2021. Returns are in USD. Past performance is not necessarily indicative of future performance.

China stocks underperform in July

China stocks fell 13.8% in USD terms in July, triggered by growing fears over the Chinese government’s regulations in the education, property and technology (tech) sectors. During the month, Beijing published rules to ban for-profit tutoring in core school subjects. The new regulation caused many Chinese education-related stocks to slump significantly. Adding to more market uncertainties following a cybersecurity investigation into recently listed ride-hailing giant Didi, Beijing also announced that it will step up supervision of Chinese firms listed offshore.

Other North Asian markets track the regional downturn

Other North Asian markets were also negatively impacted by the tightening of China’s regulatory framework. In South Korea, Hong Kong and Taiwan, stocks fell 5.7%, 2.9% and 2.2%, respectively, in USD terms for the month. The stock markets of South Korea and Taiwan were also weighed down by a rebound in cases attributable to the highly infectious Delta variant.

Philippines, Thailand and Malaysia hardest hit in ASEAN; India outperforms

In the ASEAN region, the Philippines (-11.7% in USD terms), Thailand (-6.9%) and Malaysia (-4.0%) were the hardest hit. Stocks in the Philippines plummeted after rating agency Fitch downgraded the country’s outlook from stable to negative, while Thai equities sank following record COVID-19 infections and deaths in the kingdom, mostly driven by the Delta variant. Likewise, Malaysian stocks tumbled in July amid escalating COVID-19 cases, exacerbated by political upheaval (again) as Malaysian opposition leader Anwar Ibrahim filed a motion of no confidence and the United Malays National Organisation called for Prime Minister Muhyiddin Yassin to resign (the prime minister eventually resigned on 16 August). But it wasn’t all doom and gloom in ASEAN as Singapore (+1.3%) and Indonesia (-2.0%) managed to outperform their regional peers in July. Singapore’s stock market was supported by robust manufacturing numbers and better-than-expected growth by the economy, which surged 14.3% year on year in the second quarter.

India’s market was also resilient in July, with stocks climbing 0.9% in USD terms. The Reserve Bank of India upgraded India's GDP growth forecast for FY22 to 10.5% (from 9.5%), even as the country stepped up vaccinations against COVID-19, marking the best month for its inoculation programme so far. IPO momentum also accelerated in India in July, with the debut of Zomato (food delivery start-up) and a host of listings expected from other tech companies.

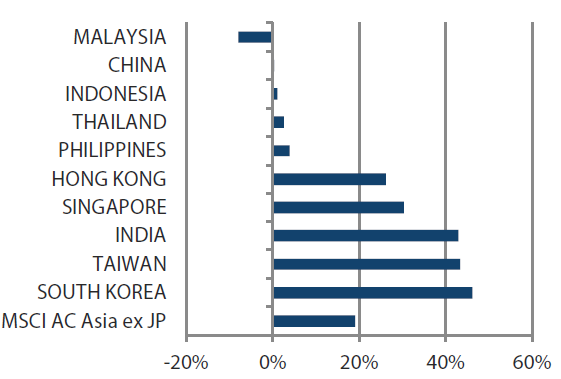

Chart 3: MSCI AC Asia ex Japan Index¹

| For the month ending 31 July 2021 | For the year ending 30 June 2021 | |

|

|

Source: Bloomberg, 31 July 2021

¹Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Focusing on companies geared to large domestic markets and structural growth areas

The ongoing debate on whether inflation will force sooner-than-expected monetary tightening has been joined by the worry that new waves of the Delta variant will delay the anticipated recovery by the economy. Over four years ago, we had presented the argument that "big tech" in China was in fact similar to regulated utilities in other parts of the world—ubiquitous, nearly free, serving a public utility function (ordering food, getting to work, buying groceries, booking restaurants, shopping, and everything else in between), and relying heavily on government support—and therefore, ought to be valued as such. At the time, it was an interesting line of thought, but today, it is a rude reality. That it affects benchmark index heavyweights in the largest market in the Asian/Global Emerging Markets investment universe only magnifies the conundrum facing investors. Against this backdrop, and with globalisation having peaked some time ago, our focus remains on companies geared to large domestic markets and areas of structural growth, such as pockets of technology, healthcare and decarbonisation.

While reality is rarely binary, both these scenarios will have a profound but opposing impact on regional markets. As we read the tea leaves along the way, we continue to lean on our disciplined bottom-up stock picking approach to navigate these uncertain macro conditions, with a strong preference for companies undergoing structural positive changes and sustainable returns. These include companies geared to large domestic markets and structural areas, namely healthcare, environment and areas of technology.

Favouring quality Chinese companies with constructive policy backdrop

China's move to tackle the “three big mountains” ("三座大山" in Chinese) —property, healthcare and education—has forced a fundamental rethink of the risk premium implicit in investing in Chinese equities. This is especially pronounced in sectors that have borne the brunt of China's policies. With collateral damage affecting most companies, we remain focused on domestically oriented quality companies in areas with a more favourable policy backdrop, such as the environment, industrial upgrade and healthcare.

Selective in South Korea and Taiwan

Rising tensions with China (this time owing to the Biden administration's efforts to deepen ties with Taiwan), extended equity valuations, and elevated COVID-19 cases warrant a selective approach in Taiwan. A similarly high COVID-19 caseload and tightening monetary policy necessitate careful navigation in South Korea. Nonetheless, we continue to find attractive opportunities in content creation, healthcare and some of the tech sub-sectors.

Staying positive on India but unenthused about ASEAN

Resurgent waves of COVID-19 have plagued ASEAN and India, stymying any economic recovery, while vaccination rates remain low in these countries. In India, reforms initiated over the past couple of years have not meaningfully benefited the economy, owing to languishing economic growth. The view remains that barring a fresh and deadly wave of COVID-19, India's economy will recover in the coming quarters, albeit in spurts, and the steady formalisation and digitisation of the economy offer opportunities in logistics, real estate, private sector banks and the "new" economy. Indonesia's patchy progress on reform plus continual political debacles in Thailand and Malaysia leave us unenthused. In the ASEAN region, only sporadic opportunities in the digital economy and decarbonisation excite us.

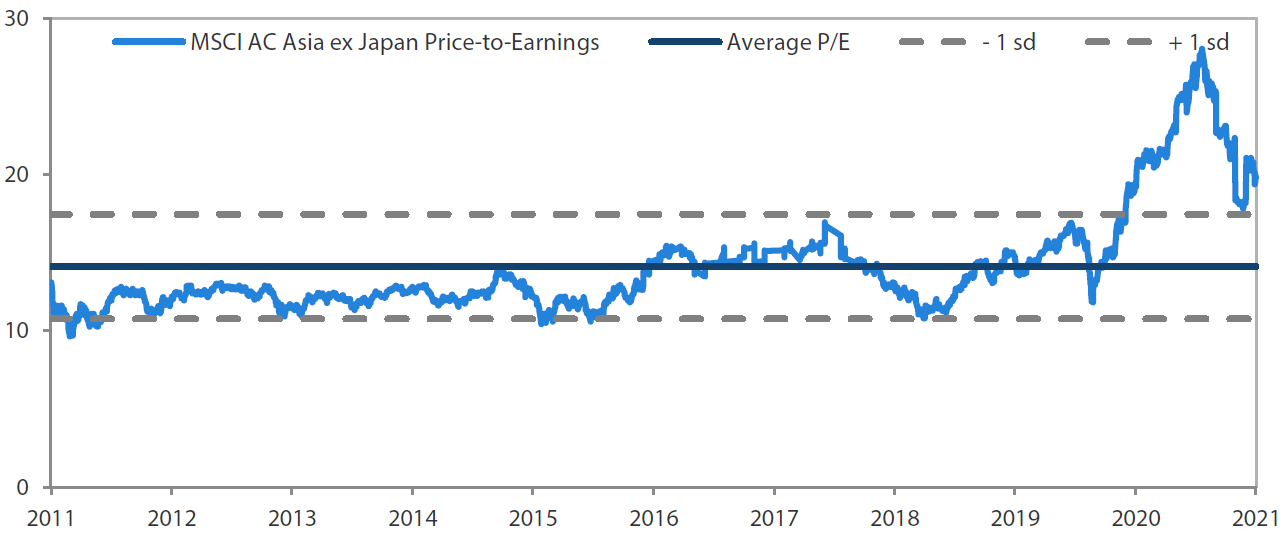

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 July 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 July 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

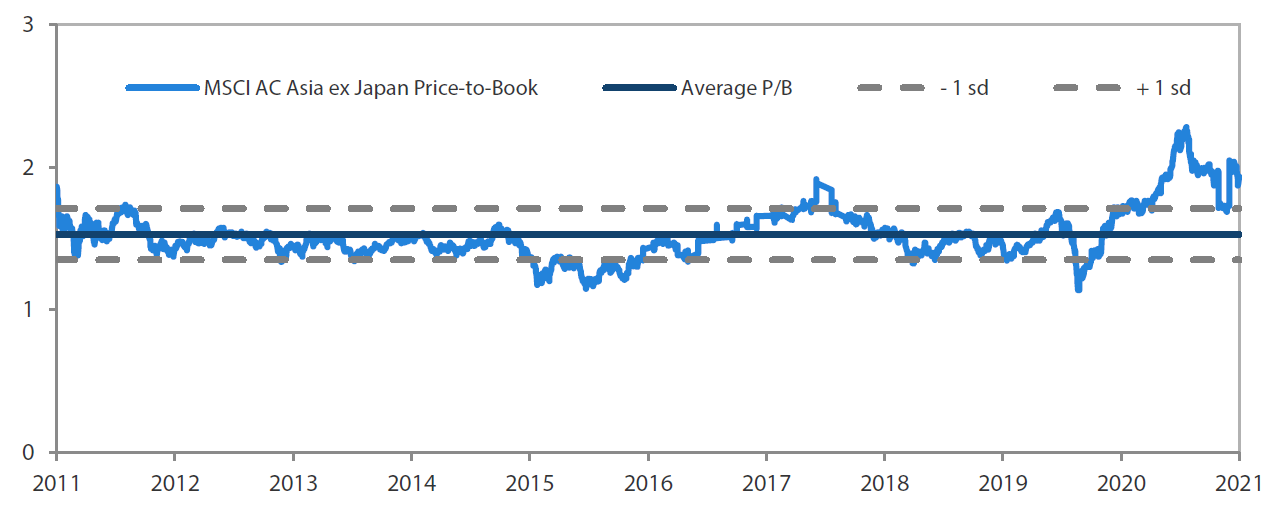

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 July 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 July 2021. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.