Summary

- US Treasury (UST) yields rose in September, with the US Federal Open Market Committee finally alluding to moderate its asset purchases as soon as November. The rise in rates was further supported by an escalating power crunch across Europe and China amid surging energy prices prompting concerns about inflation. Risk sentiment was also dampened by worries on China’s growth outlook, threatened by power outages and the possible collapse of China Evergrande. Overall, 2-year and 10-year yields ended the month at 0.28% and 1.49%, respectively, about 6.7 basis points (bps) and 17.8 bps higher compared to end-August.

- Asian credits returned -1.63% in September, as credit spreads widened by 6.8 bps and UST yields rose. There was a marked divergence in performance between Asian high-grade (HG) and their high-yield (HY) counterparts, attributed to the latter being weighed down by immense weakness in the Chinese property sector. At the end of the month, Asia HG returned -0.93%, as the 4.7 bps tightening in spreads was insufficient to offset the rise in UST yields. HY retreated 4.15%, with spreads widening by 48.7 bps.

- Meanwhile, inflationary pressures mostly eased in August. Most central banks in Malaysia, Thailand, Indonesia and the Philippines left policy rates unchanged in September. Chinese Premier Li Keqiang unveiled policies to stabilise economic growth and job growth.

- We have turned cautious on rates markets, as we anticipate UST yields to adjust higher ahead of the Fed’s policy changes and concerns about inflation. Within Asia, we expect low yielders like South Korea, Singapore, Thailand and Hong Kong to underperform. On currencies, we are cautious on the Indian rupee, South Korean won, Philippine peso and Thai baht.

- We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the next six months. However, near-term downside risks and market volatility have increased, which calls for a more gradual and selective approach to adding credit risk over the next few months.

Asian rates and FX

Market review

US Treasury yields rise in September

UST yields traded in a relatively tight range for most of September, with markets focused largely on the US Federal Reserve’s (Fed) taper plans. Towards month-end, the US Federal Open Market Committee finally alluded to moderating its asset purchases as soon as November, and its latest dot plot signalled interest rate increases could come sooner than expected, triggering a meaningful jump in UST yields and broad-based US Dollar (USD) strength. Thereafter, an escalating power crunch across Europe and China amid surging energy prices prompted concerns that inflation will be stickier than first thought, driving a further rise in yields. Risk sentiment was also dampened by worries around downward pressures to China’s growth outlook, threatened by power outages across many of the country’s manufacturing hubs, coupled with the possible collapse of China Evergrande. Overall, 2-year and 10-year yields ended the month at 0.28% and 1.49%, respectively, about 6.7 bps and 17.8 bps higher compared to end-August.

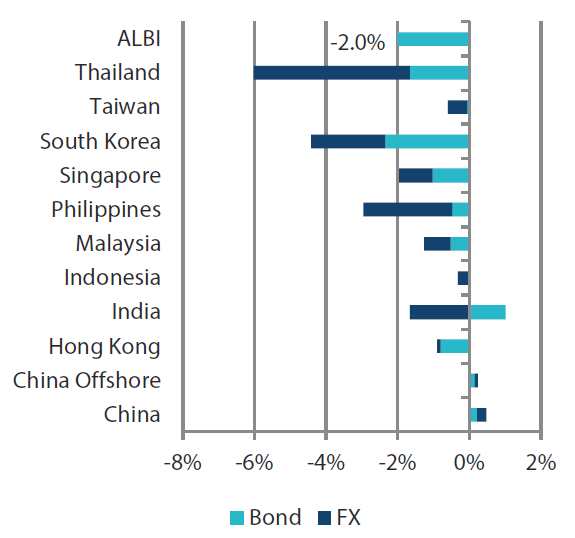

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 September 2021 | For the year ending 30 September 2021 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 September 2021

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Monetary authorities leave interest rates unchanged

Central banks in Malaysia, Thailand, Indonesia and the Philippines left policy rates unchanged in September. Although Bank Negara Malaysia assesses that the reimposition of lockdown measures has dampened growth momentum, it believes this will be partly mitigated by the government’s fiscal stimulus packages and improved adaptability of firms and households. That said, it sees “significant downside risks” to the growth outlook. Meanwhile, Bank of Thailand kept its 2021 gross domestic product (GDP) growth forecast at 0.7% but raised its growth projection for 2022 to 3.9% (from 3.7%). The monetary authority also widened its 2021 current account deficit forecast, prompted by a more cautious view of the recovery in tourist arrivals. Bank Indonesia maintained its 2021 GDP growth forecast range of 3.5-4.3% and 2021 current account deficit range of 0.6-1.4% and reiterated that 2021 headline consumer price index (CPI) inflation is likely to rise to within its 2-4% target. Elsewhere, Bangko Sentral ng Pilipinas revised its CPI inflation forecasts higher. It now expects the headline number to register 4.4% (from 4.1%) in 2021, 3.3% (from 3.1%) in 2022 and 3.2% (from 3.1%) in 2023. In addition, the bank noted that the balance of risks to the near-term inflation outlook were tilted to the upside.

Inflationary pressures mostly ease in August

August headline CPI prints in China, India, Malaysia, Thailand and Singapore eased, while similar gauges of inflation in the Philippines and Indonesia accelerated from July levels. A moderation in both food price and transport price inflation prompted Malaysia’s CPI print to ease in August. In Singapore, lower private road transport inflation contributed to the moderation in headline CPI. Overall inflation in Thailand eased further, undershooting the Bank of Thailand’s target range anew. Meanwhile, headline CPI in Indonesia posted a 1.6% annual increase in August, accelerating slightly from the 1.5% print in July. In the Philippines, headline inflation in August was significantly higher-than-expected at 4.9% year-on-year (YoY), prompted in part by higher food inflation.

China unveils policies to stabilise economic and job growth; PBOC reiterates intention to maintain stable domestic liquidity

Chinese Premier Li Keqiang announced that a renminbi (RMB) 300 billion relending quota will be set up to support local banks extending credits to small- and medium-sized enterprises. Administration fees for businesses will also be reduced to improve business operating conditions, and fiscal spending on select industries will be increased. Separately, the People’s Bank of China (PBOC) emphasised the importance of targeted monetary accommodation to support credit growth and job growth in small- and medium-sized business communities.

Thailand raises its public debt limit; Singapore unveils additional fiscal support package for businesses

The Thai government raised the public debt limit to 70% of GDP (from 60%), citing the need to increase fiscal space and accommodate any potential rise in borrowing needs over the medium term. Separately, the Public Debt Management Office unveiled its FY22 (ending September) bond issuance target, which was meaningfully higher than the FY21 target. Elsewhere, Singapore re-imposed tighter restrictions on social gatherings from 27 September, following a significant increase in the number of COVID-19 community cases. The latest measures are set to last a month and was deemed necessary to avoid stressing the country’s hospital system. Subsequently, the Finance Ministry announced a Singapore dollar (SGD) 650 million support package to help businesses impacted by the latest restrictions.

Market outlook

Cautious on rates markets; expect Philippine peso and Thai baht to underperform regional peers

We have turned cautious on rates markets, as we anticipate UST yields to adjust higher ahead of the Fed’s policy changes and amidst lingering concerns that inflation will be stickier than first thought. That said, we anticipate that policymakers will stay on the path of gradual policy normalisation, to avoid policy mistakes. Within Asia, we expect low yielders like South Korea, Singapore, Thailand and Hong Kong to underperform. On currencies, we are cautious on the Indian rupee, South Korean won, Philippine peso and Thai baht, with surging oil prices likely to weigh on these currencies. Meanwhile, delays in the reopening of major cities to foreign arrivals is expected to further weigh on the baht.

Asian credits

Market review

Asian credits end weaker in September

Asian credits returned -1.63% in September, as credit spreads widened by 6.8 bps and UST yields rose. There was a marked divergence in performance between Asian high-grade (HG) and their high-yield (HY) counterparts, attributed to the latter being weighed down by immense weakness in the Chinese property sector. At the end of the month, Asia HG returned -0.93%, as the 4.7 bps tightening in spreads was insufficient to offset the rise in UST yields. HY retreated 4.15%, with spreads widening by 48.7 bps.

A significant part of the weakness in Asian credit, particularly on the high-yield side, emanated from concerns surrounding the potential default of one of China’s largest real estate conglomerates, China Evergrande Group. Although Evergrande’s distress had already been known over the last few months to those who closely follow the market, the concerns came to a head in September as the negative developments intensified, culminating in further rating downgrades by all three major rating agencies and missed coupon payments on certain USD bonds, with a 30-day grace period to default. In addition to Evergrande, negative headlines of liquidity stress and rating downgrades spread to a few other weaker Chinese property companies. The stronger, investment grade-rated Chinese developers, while not immune to the weakness on the high-yield side and the government’s ongoing tightening of property sector policies, held up better. Markets were also worried about China’s slowing economic growth momentum, including potential spillovers from the real estate sector, and ongoing regulatory scrutiny on other key sectors such as technology. Towards the end of the month, reports of power outages forcing factory shutdowns across many of the country’s manufacturing hubs further weighed on sentiment.

Globally, in addition to the passing impact from the Evergrande situation, risk sentiment was also negatively affected by the sudden jump in major government bond yields triggered by a combination of factors including a hawkish shift by major central banks and surge in energy prices. While risk aversion in developed credit markets was contained, outflows from Emerging Market bond funds did pick up pace towards the end of the month as a result of these negative developments.

Within Asian credit, there was a striking gap between China, which widened 18 bps against all other large country-segments, in which spreads mostly tightened. By sector, considerable spread widening similarly occurred in real estate, while spreads of other sectors ended the month mostly narrower.

Primary market activity picks up in September

In September, 67 new issues raised a total of USD 33.1 billion in the market. The HG space saw 40 new issues amounting to about USD 19.86 billion, including a USD 1.95 billion three-tranche issue from Sands China, USD 1.5 billion three-tranche issue from Sinochem Offshore Capital and USD 1.25 billion dual-tranche sovereign issue from Indonesia. Meanwhile, the HY space saw approximately USD 13.24 billion worth of new issues raised from 27 issues, including the USD 1.0 billion dual-tranche issue from JSW Steel Limited.

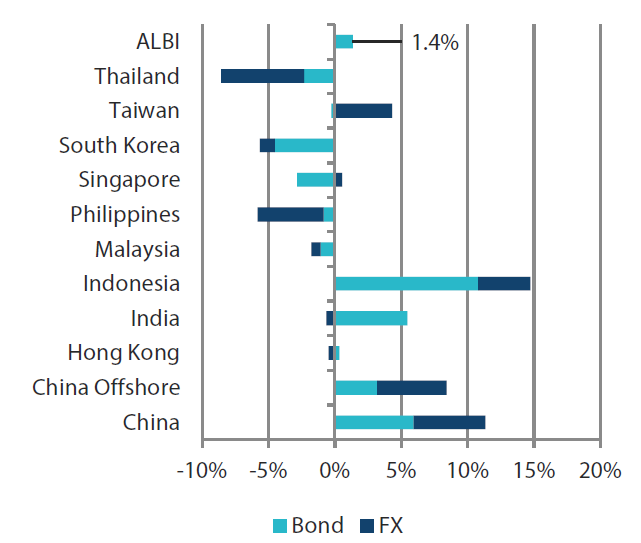

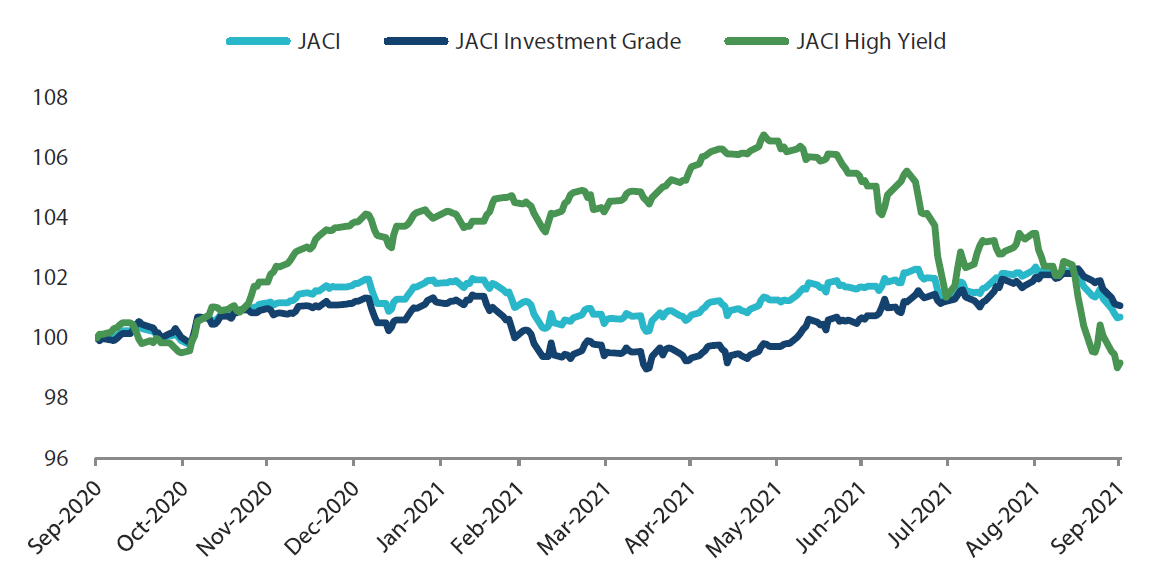

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 September 2020

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 September 2021

Market outlook

Fundamentals supportive of tighter Asian credit spreads, though downside risks have increased

We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the next six months. However, near-term downside risks and market volatility have increased, which calls for a more gradual and selective approach to adding credit risk over the next few months.

The tentative improvement in the COVID-19 situation across many Asian economies reinforces our view that the setback to growth is likely to be temporary. Progress on vaccine rollout, the gradual re-opening in a number of countries, as well as still supportive fiscal and monetary policies, should revive the growth momentum as we head into 2022. Similarly, we expect overall Asian corporate credit fundamentals to remain robust, although the positive earnings momentum in the second half of 2021 could be softer and may vary in degree by sector.

Nevertheless, there are a few downside risks that could derail this constructive outlook, key among which is a deeper China economic slowdown due to factors such as the ongoing tightening in the property sector, regulatory reforms in technology and other sectors, intensifying efforts to reduce carbon emissions and sporadic local COVID-19 outbreaks. A disorderly default by Evergrande, while not our base case, could also roil market sentiment temporarily. Other key risks include a more aggressive tightening of monetary policy by the Fed, a failure by US Congress to raise or suspend the country’s debt ceiling, brewing global stagflation worries due to the shortage in energy supplies and resulting surge in energy prices. Uncertainties relating to US-China bilateral relations also remain in the background.