Summary

- US inflation remained at a high level, with July’s CPI print of 8.5% year-on-year (YoY) prompting the US Federal Reserve (Fed) to still prioritise cooling inflation by hiking rates. The pressure to hike rates further was exacerbated by tight labour market conditions; job openings increased in July and two jobs were available for every unemployed person.

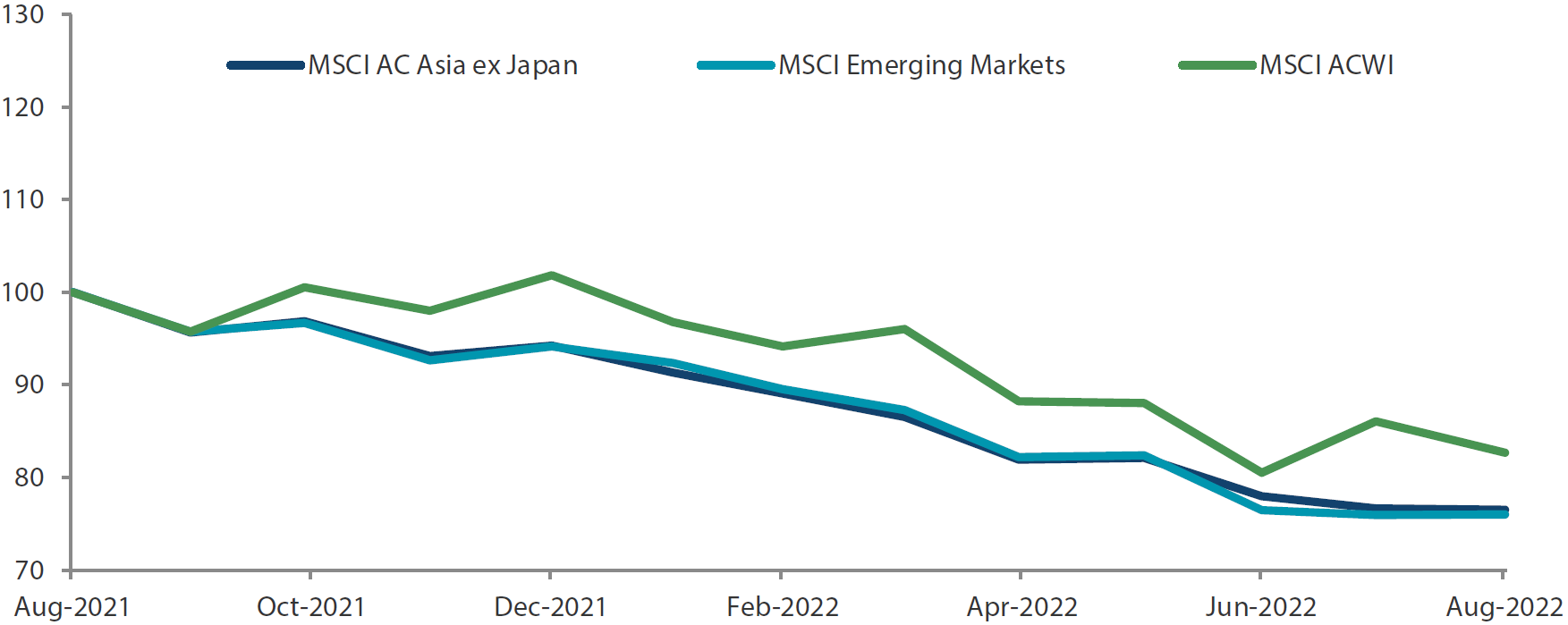

- The regional index of the MSCI AC Asia ex Japan in August was flat at 0.0% in US dollar (USD) terms, recovering after falling into negative territory earlier. The North Asian region was weighed down by foreign currency effects, trailing behind its ASEAN counterpart. India benefitted from its rate hike and lower oil prices.

- Notwithstanding uncertainties around global growth and inflation trajectory, Asia continues to be on firmer footing relative to the West. Inflationary pressure in Asia has hitherto been fairly tame relative to the West for many reasons. In contrast to the chronic shortage of labour in the West, Asia seemingly sits in a position of envy with an abundance of skilled labour. Furthermore, Asia may not experience the same energy shortage that has been plaguing Europe as some parts of the region endeavour to dissociate itself from European geopolitics.

Market review

Regional equities fall flat in August

The regional index of the MSCI AC Asia ex Japan in August was flat at 0.0% in USD terms, recovering after falling into negative territory earlier. US inflation remained at a high level, with July’s CPI print of 8.5% YoY prompting the Fed to still prioritise cooling inflation by hiking rates. The pressure to hike rates further was exacerbated by tight labour market conditions; job openings increased in July and two jobs were available for every unemployed person.

Chart 1: 1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 August 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 August 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

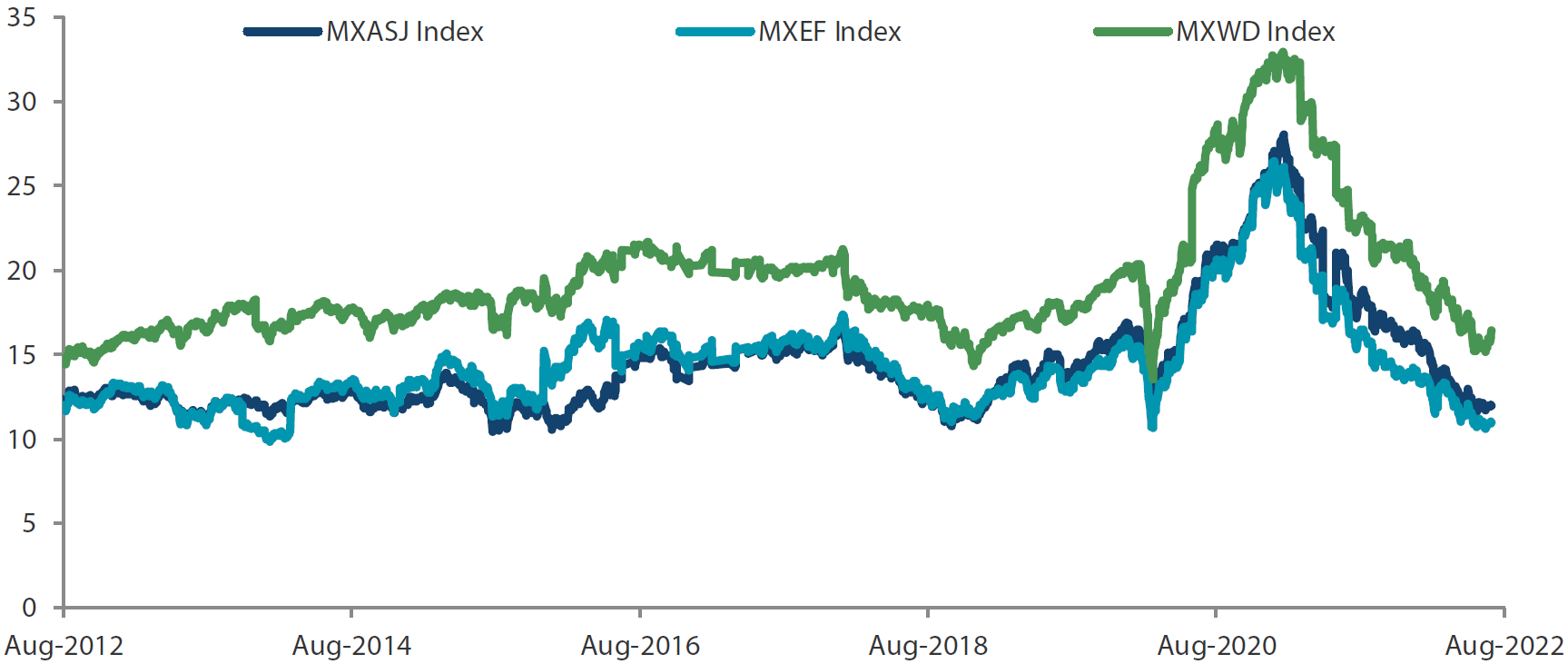

Chart 2: MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 August 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 August 2022. Returns are in USD. Past performance is not necessarily indicative of future performance.

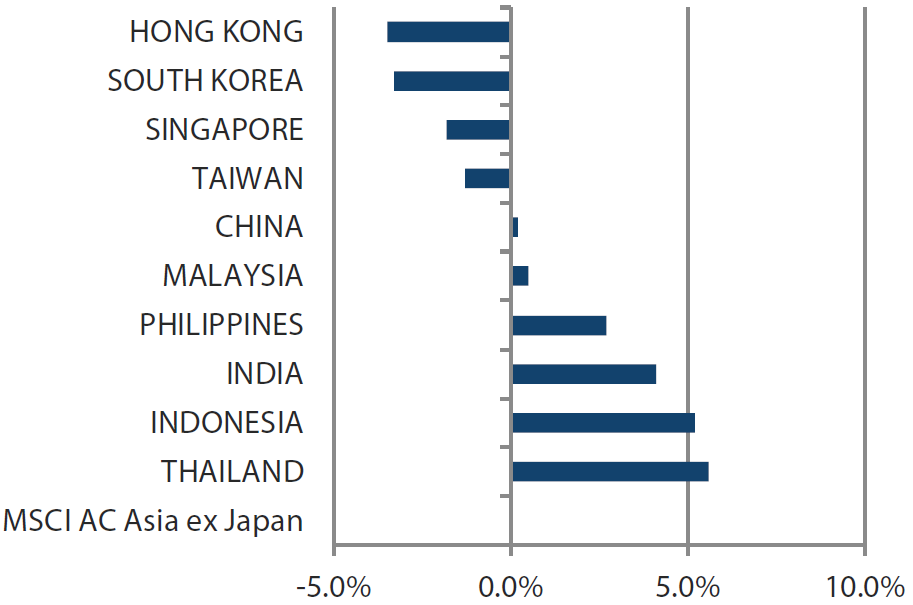

Foreign currency effects weigh on North Asia

The North Asian region was weighed down by foreign currency effects, with Hong Kong being the weakest performer at -3.5% in USD terms as its GDP contracted for a second quarter YoY due to extended COVID-19 restrictions. South Korea was the second biggest laggard at -3.3% as consumer inflation peaked at 6.3% YoY in July. The country responded by raising the benchmark policy rate by 25 basis points (bps) while lifting inflation forecasts and warning that economic growth could wane. In Taiwan (-1.3% in USD terms), exports rose 14.2% YoY in July, slightly lower than the 15.2% growth in June. China edged up 0.2%, despite its CPI rising 2.7% in July YoY in the face of three rate cuts and slowing revenue growth in the first half of 2022. With a fall in profits for industrial firms, and the country’s largest banks reporting an increase in bad debts linked to the property sector, China continues its attempts to rev up its weakening economy with a further 1 trillion yuan of funding from its State Council. Towards the end of the period, with an agreement for cooperation on the inspection of audit work papers of US-listed Chinese companies signed, market sentiment improved as the risk of delisting for American depositary receipts were reduced.

ASEAN markets fare better than North Asian markets

Singapore (-1.8%) lagged as it adjusted its GDP forecast for 2022 downwards—currently at 3% to 4%—as its July core inflation rate hit 4.8% YoY, its fastest pace in more than 13 years. Neighbouring countries Malaysia and Indonesia gained 0.5% and 5.2%, respectively, as their GDP expanded by 8.9% YoY and 5.4% YoY due to increases in demand and strong exports. Indonesia also raised its interest rates by 25 bps, its first rate hike in four years, to tackle inflation and prevent excessive capital outflows. The Philippines gained 2.7% as its president requested a USD 94.4 billion government budget in 2023 to boost growth and alleviate poverty. The gains were capped as the Philippines hiked rates by 50 bps to cool inflation. Thailand (+5.6%) was the largest outperformer despite a 25 bps rate hike. Thailand outperformed on the back of positive forecasts—export growth was revised upwards to 6% to 8% for 2022, and its economy is expected to continue growing as tourism picks up.

Indian stocks benefit from rate hikes and declining oil prices

India advanced 4.1% as rate-sensitive banking, metals and automobile stocks climbed following a hike in the key policy rate and on falling oil prices. The fall in crude oil prices also capped India’s consumer inflation, which eased to 6.7% in July and spurred positive market sentiment.

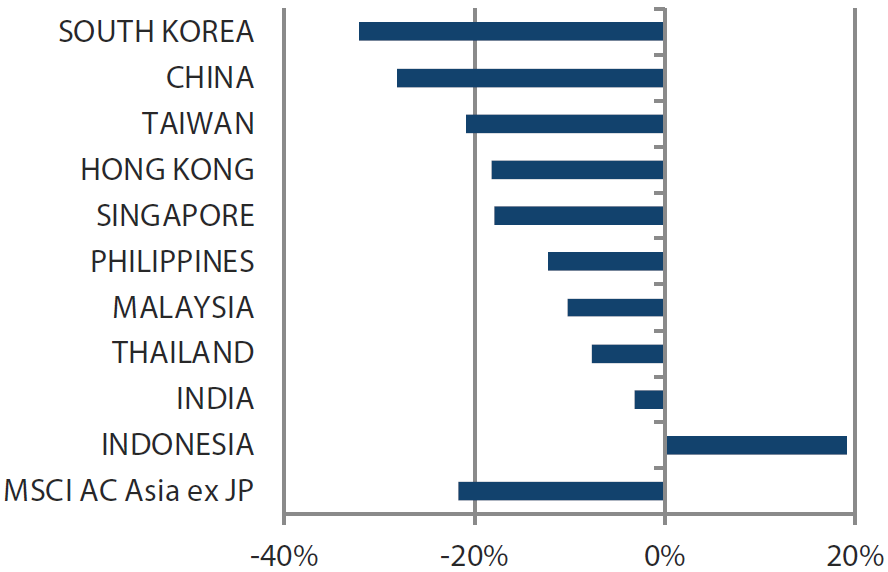

Chart 3: MSCI AC Asia ex Japan Index1

| For the month ending 31 August 2022 | For the year ending 31 August 2022 | |

|

|

Source: Bloomberg, 31 August 2022.

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

With lower inflation and an abundance of skilled labour, Asia on a firmer footing compared to the West

Notwithstanding uncertainties around global growth and the overall inflation trajectory, Asia continues to be on firmer footing relative to the West. Inflationary pressure in Asia has hitherto been fairly tame relative to the West for many reasons. In contrast to the chronic shortage of labour in the West, Asia sits in a position of envy with an abundance of skilled labour. Asia is also unlikely to experience the same energy shortage that has been plaguing Europe as some parts of the region endeavour to dissociate themselves from European geopolitics. However, that is not to say that Asia does not have issues to contend with. Tensions over the Taiwan Strait continue to brew while China equity risk premiums remain elevated as the country remains resolute in its pursuit of a zero-COVID policy ahead of the upcoming 20th National Party Congress. However, it is precisely in times of such uncertainties when long-term investors could be compensated the most for owning some of the highest quality Asian companies with egregiously mispriced long-term sustainable returns and positive fundamental changes.

China’s longer-term focus is clear, but the shorter term remains fraught with self-inflicted struggles

For all the struggles that China finds itself contending with, we believe that much of it is self-inflicted. In our view, concerns in the property market are primarily due to confidence, or the lack thereof, with regards to property developers’ ability to complete projects rather than problems with household balance sheet. While China’s resolve to wean itself off the excesses in the property market is admirable, the government will have to do a lot more to stabilise the market and prevent a negative contagion effect on higher quality developers. The property weakness is, of course, seen to be further exacerbated by the country’s zero-COVID policy. Unfortunately, visibility on any zero-COVID exit strategy is expected to be poor before the 20th National Party Congress. However, what is clearer are the areas the government is focused on for the longer term—greater self-reliance (particularly in technology supply chains), a transition towards cleaner energy through greater energy security and “common prosperity” through better healthcare and greater wealth distribution. Our views are aligned with these thrusts, while we remain watchful for ramifications from political developments.

Opportunities in clear sight for India and ASEAN

India and ASEAN are the demographic powerhouses in Asia. Educational and skill levels in the region have improved significantly over the years while income continues to grow from a low base. With a more productive labour force than many of their emerging market peers, we expect that the region will increasingly become the next factory of the world over the next few decades, with multinational corporates’ China+1 supply chain strategy resulting in strong foreign direct investment inflows for these countries. As the middle class prospers, consumption is expected to grow in step. We retain a favourable view towards large market share gainers, renewable energy companies, miners geared towards transport electrification and energy storage, and digitisation/financial inclusion beneficiaries.

Technology sectors in Taiwan and South Korea face cyclical pressure

Elsewhere, despite cost pressure easing, the technology sector in Taiwan and South Korea continues to be under cyclical pressure as demand for smartphones, personal computers and other electronics slow alongside the softening of global developed economies. Thus, we are selective in our view, with stock-specific fundamentals dominating the narrative.

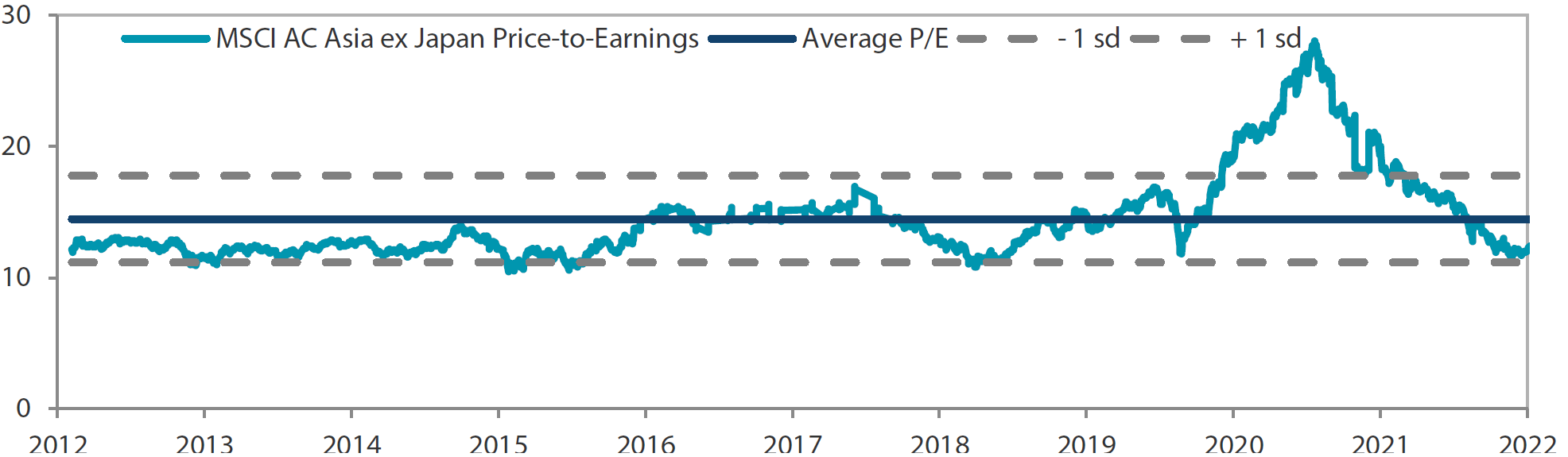

Chart 4: MSCI AC Asia ex Japan price-to-earnings

Source: Bloomberg, 31 August 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.

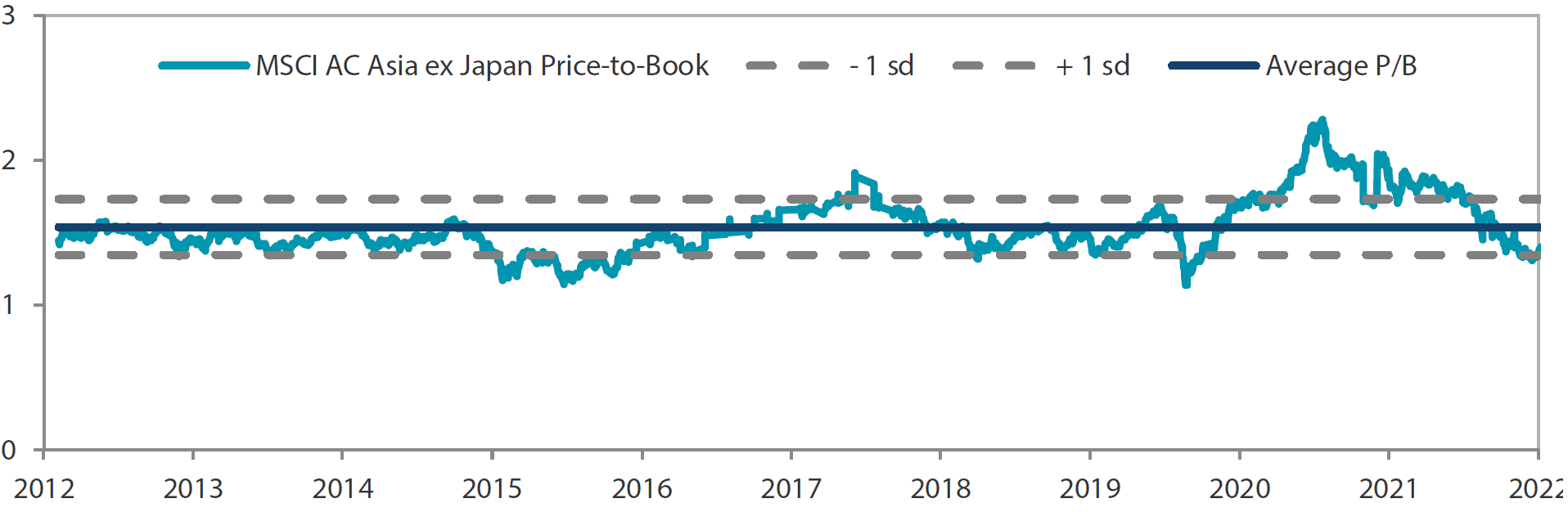

Chart 5: MSCI AC Asia ex Japan price-to-book

Source: Bloomberg, 31 August 2022. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.