Summary

- US Treasury (UST) yields shifted higher in August, with short- to mid-dated Treasury bonds underperforming. This was driven by a strong US jobs report with unemployment rate ticking down and a rise in German bund yields. Hawkish comments from US Federal Reserve (Fed) Chair Jerome Powell included a pledge to “use our tools forcefully” to tame inflation. At the end of the period, the benchmark 2-year and 10-year UST yields were at 3.495% and 3.195%, respectively, 60.8 basis points (bps) and 54.3 bps higher compared to end-July.

- Inflationary pressures continued to remain elevated in July, as the headline consumer price index (CPI) numbers in South Korea, Singapore, Indonesia and the Philippines increased, while those of Thailand and India moderated. During the month, the central banks of Thailand, Indonesia, the Philippines, South Korea and India raised their key policy rates.

- Led largely by higher private consumption and robust overseas trade, Malaysia’s economy expanded 8.9% year-on-year (YoY) in the second quarter of 2022. Indonesia’s gross domestic product (GDP) growth picked up to 5.44% YoY during the same period. Similarly, the Thai economy grew 2.50% YoY. Elsewhere, India’s GDP rose 13.5% YoY over the same period, fuelled largely by domestic demand.

- Chinese authorities unveiled more measures to support growth, such as the People’s Bank of China (PBOC) lowering of their key policy rates. Chinese policymakers declared additional stimulus measures amounting to Chinese yuan (CNY) 1 trillion. There was also support announced for the property sector.

- We prefer India, Indonesia and Malaysia government bonds. As for currencies, given the volatility of the US dollar, we favour high-yielding currencies like the Indian rupee (INR), Indonesian rupiah (IDR) and Philippine peso (PHP), which have been relatively more resilient in the recent period compared to their Asian peers.

- Asian credits retreated by 0.25% in total return as credit spreads tightened about 33 bps amid a sharp rise in UST yields. Asian high-grade (HG) declined, as a 35-bps tightening in spreads was insufficient to offset the rise in UST yields. On the other hand, Asian high-yield (HY) gained with spreads narrowing about 56 bps, led by a strong rally in the Chinese property sector.

- Going forward, we expect growth and corporate credit fundamentals to moderate but remain robust enough to prevent a meaningful widening of credit spreads. However, any global slowdown fears could limit further upside, especially after the strong tightening seen in August. Fund flows into risky assets have turned less negative in general, but volatility in fund flows is likely to persist for a while.

Asian rates and FX

Market review

UST yields rise in August

The UST yield curve shifted higher in August, with short to mid-dated treasury bonds underperforming. Heightened geopolitical tensions following US House Speaker Nancy Pelosi’s visit to Taiwan spurred some flight to quality at the start of the month. Subsequently, the US jobs report revealed that nonfarm payroll employment rose 528,000 in July—more than twice the consensus expectation—while the unemployment rate ticked down to 3.5%. The resilience in job growth softened recession concerns but also heightened expectations of another sizable policy rate hike by the Fed in September, pushing US rates higher. Risk assets rallied mid-month on the back of weaker-than-expected US July inflation prints. Positive sentiment quickly faded, however, following hawkish comments from Fed officials. Additionally, the rise in German bund yields—in response to a record jump in German producer prices—stoked renewed inflation concerns and pushed UST yields higher. Towards month-end, Fed Chair Powell pledged to “use our tools forcefully” to tame inflation, declaring that the central bank may raise rates further into restrictive territory and keep them there for a longer period. At the end of the period, the benchmark 2-year and 10-year UST yields were at 3.495% and 3.195%, respectively, 60.8 bps and 54.3 bps higher compared to end-July.

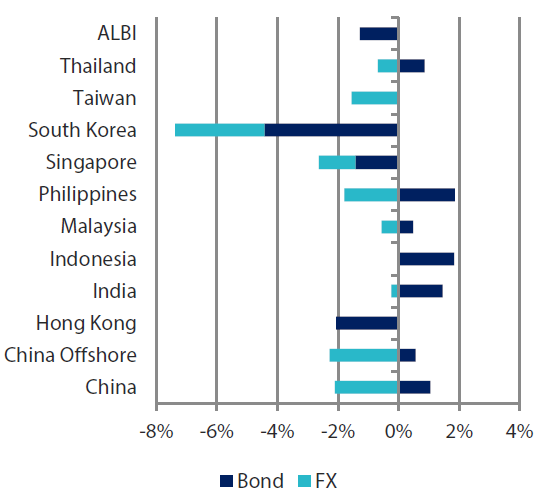

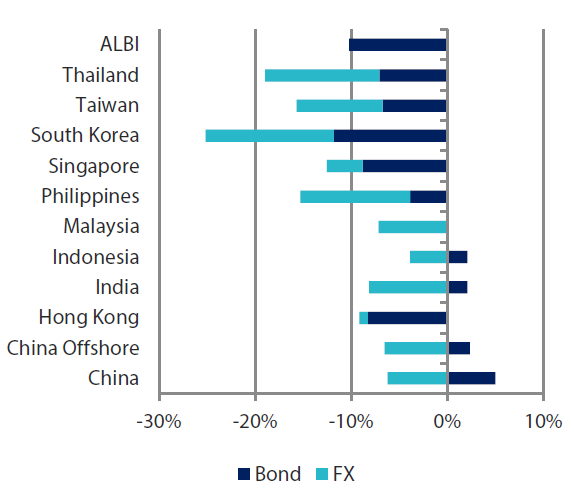

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 August 2022 | For one year ending 31 August 2022- | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 August 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Headline CPI prints remain elevated in July

Headline CPI inflation in South Korea rose to 6.3% YoY, prompted largely by increases in electricity and agricultural prices. In Thailand, the July headline CPI print moderated but stayed relatively high at 7.61% YoY. Similarly, India’s headline CPI inflation moderated to a slightly slower-than-expected 6.71% YoY in July, as food inflation eased. Meanwhile, overall inflation rose to 6.4% YoY in the Philippines in the same month—faster than the 6.1% recorded in June—due largely to higher food inflation. In Singapore, headline CPI inflation increased to 7.0% YoY. Elsewhere, Indonesia’s headline number rose to 4.94% YoY in July, driven partly by higher food and non-subsidized energy prices.

Region’s central banks continue to tighten monetary policies

Monetary authorities in Indonesia and Thailand commenced their rate hiking cycles, each raising their respective policy rates by 25 bps. The Bank of Thailand vote was split 6-1, with the dissenter favouring a 50-bps hike. In Indonesia, apart from raising the policy rate, Bank Indonesia (BI) also announced that it would start selling short-term notes and buying longer-dated instruments—a move that it expects would attract increased foreign inflows and help underpin the rupiah. The Bangko Sentral ng Pilipinas raised borrowing rates by 50 bps to 3.75% and said it now expects inflation to average 5.4% this year, which is above its prior 5% forecast and target band of 2–4%. Meanwhile, Bank of Korea raised its rates by 25 bps, lowered 2022 and 2023 GDP growth projections and sharply raised inflation forecasts for both years. Elsewhere, the Reserve Bank of India (RBI) hiked the repo rate by 50 bps and maintained its “withdrawal of accommodation” stance.

PBOC lowers key policy rates; policymakers declare further support for the economy and property sector

Over in China, July activity and credit data were mostly weaker than expected. The resurgence of COVID cases and ensuing lockdowns, as well as continued weakness in the property sector, were major headwinds to domestic demand. Reacting to the disappointing data, Chinese authorities unveiled more measures to support growth. Apart from trimming key policy rates (including the one-year Medium-term Lending Facility (MLF) loan rate, 7-day reverse repo rate, one-year and five-year Loan Prime Rates), Chinese policymakers declared additional stimulus measures totalling CNY 1 trillion. There was also support for the property sector with select developers being allowed to issue bonds that will be guaranteed and underwritten by state-owned firms. On top of this, the Housing Ministry, Ministry of Finance and the PBOC introduced a joint programme that will offer special loans to ensure the delivery of select property projects to home buyers.

GDP growth picks up in the second quarter of 2022

Malaysia’s economy expanded 8.9% YoY in the second quarter of 2022, up from 5.0% in the first three months of the year, driven largely by higher private consumption and robust overseas trade. GDP growth in Indonesia picked up to 5.44% YoY in the three months ending June 2022 and was similarly led by private consumption and exports. In Thailand, the economy expanded 2.50% YoY in the second quarter, from an upwardly revised 2.30% in the first three months of the year. Elsewhere, India’s GDP rose 13.5% YoY over the same period, fuelled largely by domestic demand.

Market outlook

Prefer India, Indonesia and Malaysia bonds, favour INR, IDR and PHP

The easing of energy and many other commodity prices has been key in moderating headline inflation in some countries, although core readings remain largely elevated or are still rising. This, together with high-frequency indicators which suggest a softening in economic momentum, has led markets across much of the region to scale back expectations of the pace of monetary policy tightening. Forecasts for peak rates have now been lowered.

Against such a backdrop, our preference is for India, Indonesia and Malaysia government bonds. We are positive on Indian bonds as domestic inflation continues to ease gradually and we believe that the RBI’s hawkish stance has kept inflation expectations in check. We think that the real yield offered by Indonesian bonds is attractive. Furthermore, BI remains committed to maintaining FX stability. Meanwhile, Malaysia’s fiscal position will receive a boost as state energy company Petronas doubles its dividend payout to the government. Additionally, we favour the relative stability of the Malaysian ringgit and Malaysian bonds. Separately, given the volatility of the USD, we favour high-yielding currencies like the INR, IDR and PHP which have been relatively more resilient in the recent period compared to other Asian peers.

Asian credits

Market review

Asian credits end lower in August as UST yields rise

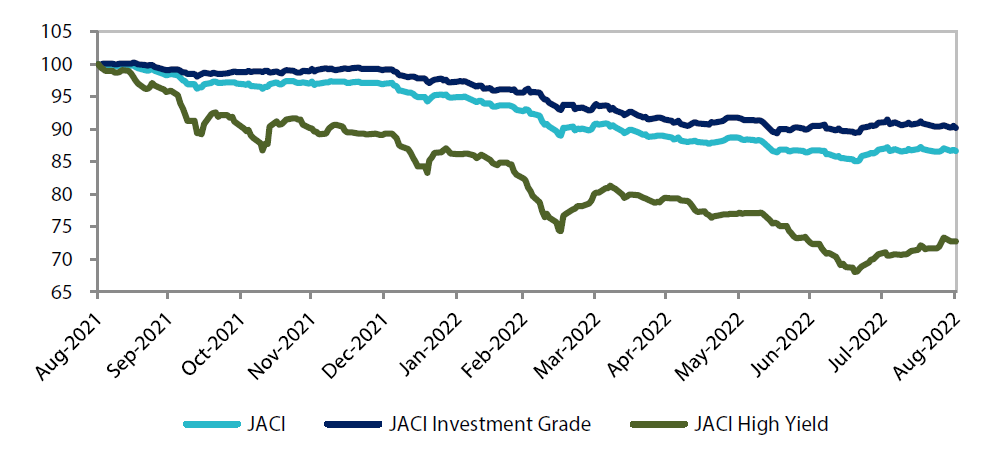

Asian credits retreated by 0.25% in total return, despite credit spreads tightening about 33 bps, as UST yields adjusted sharply higher. Consequently, Asian HG underperformed Asian HY. At end of the month, Asian HG declined 0.80%, as the 35-bps tightening in spreads was insufficient to offset the rise in UST yields. On the other hand, Asian HY gained 2.85% with spreads narrowing about 56 bps, led by a strong rally in the Chinese property sector. Asian credit spreads initially drifted wider amid heightened geopolitical tensions following US House Speaker Pelosi’s visit to Taiwan. Risk sentiment quickly improved, however, after resilient jobs growth in the US softened recession concerns. Subsequently, a moderation in US inflation prints further encouraged positive risk sentiment and flows into Emerging Market (EM) bond funds led to strong performance for Philippines and Indonesia sovereign and quasi-sovereign names.

Over in China, July activity and credit data were mostly weaker than expected. The resurgence of COVID cases and ensuing lockdowns, as well as continued weakness in the property sector, were major headwinds to domestic demand. Reacting to the disappointing data, Chinese authorities unveiled more measures to support growth. Apart from trimming key policy rates (including the one-year MLF loan rate, 7-day reverse repo rate, one-year and five-year loan prime rates) Chinese policymakers declared additional stimulus measures totalling CNY 1 trillion. Support was also on hand for the property sector with select developers being allowed to issue bonds that would be guaranteed and underwritten by state-owned firms. On top of this, the Housing Ministry, Ministry of Finance and PBOC introduced a joint program that would offer special loans to ensure the delivery of select property projects to home buyers. Notably, spreads of Chinese property credits tightened significantly after the announcement of liquidity support from the central government. Moreover, headlines of US and China reaching a preliminary agreement for US officials being able to review audit documents of Chinese corporates listed in the US was another positive development.

There was a negative shift in risk sentiment towards month-end, following hawkish remarks from Fed Chair Powell at the Jackson Hole Symposium, prompting spreads to retrace some of the previous tightening. Overall, credit spreads tightened across most major Asian countries in the month, with China outperforming due largely to gains in the property sector.

Primary market quiet in August

Supply was largely muted—particularly within Asian HG—as a result of the summer lull, with a total of just 22 issues in August. The HG space saw seven new issues amounting to just USD 2.7 billion, while the HY space saw 15 new issues amounting to about USD 1.81 billion.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 August 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 August 2022

Market outlook

Expect moderation to fundamentals but adequate cushion to prevent meaningful spread widening

Asian credits continue to face mixed fundamentals, valuations and technical drivers across different segments. While the strong US payrolls, elevated near-term inflation profile, and Fed Chair Powell’s speech at Jackson Hole raised the risk of a more hawkish Fed response over the next few Federal Open Market Committee meetings, we believe that the US rates market has already re-priced significantly and we expect this to limit the upside risk to UST yields. Meanwhile, China growth risks remain, with lingering concerns surrounding the real estate sector and persistent COVID case numbers that result in mobility restrictions. Nevertheless, China has increased its economic stimulus with CNY 1 trillion of funding mentioned with the government also earmarking Renminbi 200 billion for loans with the aim of completing and delivering unfinished housing projects. The transmission of policy support provided some relief, but more policy catalysts are still needed as physical market recovery remains slow and will take time. Elsewhere across Asia, growth and corporate credit fundamentals are likely to moderate in the second half of the year but remain robust enough to prevent meaningful credit spread widening. However, any global slowdown fears could likely limit further upside, especially after the strong tightening seen in August. Fund flows into risky assets have turned less negative in general, especially for EM fixed income, although volatility in fund flows is likely to persist for a while.