Summary

- US Treasury (UST) yields rose in October, with the benchmark 2-year and 10-year yields ending the month at 4.485% and 4.050%, respectively, 20.5 basis points (bps) and 21.8 bps higher compared to end-September.

- Inflationary pressures for the region generally remained elevated in September. During the month, the Monetary Authority of Singapore (MAS) tightened its foreign exchange (FX) policy. Central banks in Indonesia and South Korea raised their key policy rates.

- China’s Communist Party held its 20th National Party Congress in October, and the primary focus was on policy continuity. Elsewhere, Malaysia will hold a general election on 19 November.

- We prefer Singapore, South Korea and Indonesia government bonds. For currencies, we favour the Singapore dollar (SGD), as we see further room for its outperformance against other regional currencies.

- Asian credits retreated 3.66% in October, as spreads widened about 61 bps and UST yields adjusted higher. Asian high-grade (HG) declined 2.67%, outperforming Asian high-yield (HY), which fell 9.20%.

- Going forward, despite some expected moderation amidst the slowdown in global growth, we believe the macro and corporate credit fundamentals across much of Asia will remain robust enough to ease the pressure of credit spread widening. We do expect some modest widening in the near-term when factoring in the global market risks.

Asian rates and FX

Market review

UST yields climb further in October

The UST yield curve shifted higher in October, with long-dated Treasury bonds underperforming. Resilient US jobs growth, together with hawkish rhetoric from several top officials, drove anticipation of a protracted campaign by the US Federal Reserve (Fed) to fight inflation. This prompted UST yields to rise sharply across the curve at the start of October. Subsequently, the upward pressure on yields was supported by reports of consumer price index (CPI) in the US and the UK surpassing market consensus. Notably, the benchmark 10-year UST yield decisively breached 4% mid-month, as markets priced in the possibility of the Fed Funds rate exceeding 5%. There was an abrupt change in sentiment towards month-end, following reports suggesting the Fed may temper the pace of its interest rate increases after its November meeting amidst increasing signs of economic slowdown and the European Central Bank (ECB) deferring its discussions on quantitative tightening. Hopes that the Fed might hike by just 50 bps in December prompted UST yields to partially reverse the earlier rise. At the end of the period, the benchmark 2-year and 10-year UST yields were at 4.485% and 4.050%, respectively, 20.5 bps and 21.8 bps higher compared to end-September.

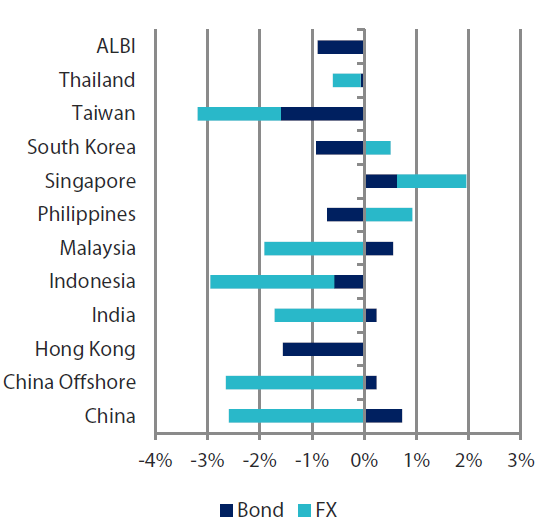

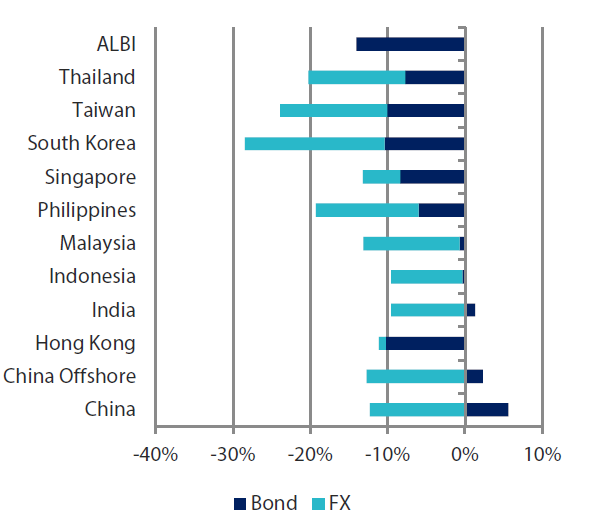

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 October 2022 | For one year ending 31 October 2022 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 October 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Headline CPI prints remain elevated in September

Inflationary pressures in Indonesia increased noticeably, with the headline CPI accelerating to 5.95% year-on-year (YoY) in September, from 4.69% YoY in August. The sharp rise reflected the first-round impact of the fuel price hikes from early September. In the Philippines, headline inflation quickened to 6.9% YoY in September from 6.3% YoY recorded in the preceding month, prompted in part by increasing food inflation. In Singapore, headline inflation was unchanged from the previous month, as lower private road transport inflation was offset by higher core and accommodation inflation. The higher core inflation reading reflected the continued rise in food and service inflation. Elsewhere, headline CPI in Thailand and Malaysia both moderated to 6.41% YoY and 4.50% YoY, respectively.

MAS tightens FX policy; Bank Indonesia (BI) and Bank of Korea (BOK) both raise policy rates by 50 bps

The MAS announced that it would re-centre the mid-point of the policy band at the prevailing level of SGD nominal effective exchange rate (NEER) but kept the slope and width of the policy band unchanged. MAS said the policy shift would further reduce imported inflation and help curb domestic cost pressures. Looking ahead, it expects full-year gross domestic product (GDP) growth to come in at 3-4% this year, and “below trend” in 2023. On inflation, MAS anticipates core prices to likely “stay around 5%” for the remainder of the year, averaging “around 4%” for the full year. For 2023—accounting for all factors including the scheduled goods and services tax (GST) increase—it sees core inflation averaging around 3.5-4.5% over the period. In Indonesia, the central bank hiked its policy rate by another 50 bps to 4.75%, maintaining that the move is a “front-loaded, pre-emptive and forward-looking” step to lower inflation expectations. BI left its 2022 GDP growth forecast unchanged but said it now expects headline CPI inflation to be at 6.3% (from 6.6%) by end-2022 and projects core inflation to return to its 2-4% target by H1 2023 (from H2 2023 previously). The BOK also raised its policy rate by 50 bps, to 3%; the central bank flagged further tightening but offered hints that it may slow the pace of its rate hikes.

China’s National Party Congress mainly a political event; Malaysia schedules general elections on 19 November

China’s Communist Party held its 20th National Party Congress in October. The Party Congress report essentially focused on policy continuity. However, there was no mention of the lifting of the zero-COVID policy, nor any announcement of change to the housing market policy. The Party Congress wrapped up with the announcement of its next set of top leaders. Headed by President Xi Jinping, the new Politburo Standing Committee includes Li Qiang, the incumbent Party Secretary of Shanghai, who will hold the second highest rank in the committee. In Malaysia, Prime Minister Ismail Sabri Yaakob dissolved the parliament, with the Election Commission subsequently announcing that the next general elections will be held on 19 November.

Market outlook

Prefer Singapore, South Korea and Indonesia bonds and the SGD

We are shifting slightly towards a more positive view on duration, on the assessment that the Fed and other developed market (DM) central banks have likely passed peak hawkishness. This aligns with our view that most market bond yields have likely peaked. We remain mindful that the current global economic backdrop continues to be uncertain; nonetheless, with 10-year UST yields above 4%, we believe that risk-reward in fixed income has become more favourable. Within the region, we are inclined towards Singapore and South Korean government bonds, given their relatively higher sensitivities to stabilising UST bond yields. Indonesia government bonds are also likely to be better supported for the rest of the year on positive bond supply dynamics. Meanwhile, we see further room for SGD’s outperformance against other regional currencies as sticky core inflation is expected to prompt the MAS to keep the SGD NEER on an appreciating stance.

Asian credits

Market review

Asian credits end lower as spreads widen and UST yields rise

Asian credits retreated 3.66% in October, as spreads widened about 61 bps and UST yields rose. Asian HG credits performed better than Asian HY. Asian HG credits declined 2.67%, with spreads widening about 30 bps. Asian HY credit retreated 9.20%, with spreads widening 319 bps, led by weakness in the Chinese property sector.

Asian credit spreads widened steadily throughout the month. Risk sentiment was initially dampened by rising global rates as markets priced in a more hawkish path for the Fed in the coming months. Thin market liquidity, with China out for the National Day Golden Week holidays, magnified the soft risk tone. The Chinese property sector succumbed to a further sell-off when another property developer defaulted. The event rocked the markets as the entity was among those approved earlier on to issue state-guaranteed debt, overshadowing positive news of an upturn in Chinese consumer spending over the week-long holidays. In the Chinese HG space, news that the US added more companies to its list of those identified as “Chinese military companies” weighed on selected names. The weakness in Asian credits reflected further weakening in risk tone as markets priced in the possibility of the Fed Funds Rate exceeding 5%. China concluded its 20th Party Congress on 22 October, with the Party Congress report essentially focusing on continuity in its policy(s); notably, there was no mention of when the zero-COVID policy would be lifted nor any change to the housing market policy. Thus, despite improving overall risk sentiment towards month-end following dovish DM developments, the lack of clarity on Chinese policy direction prompted a sell-off in Chinese risk assets, including Chinese credits.

All major country segments in Asia, save for Indonesia, widened in the month, with China underperforming. In the frontier markets, Moody’s downgraded Pakistan’s rating to “Caa1/Negative”, citing “increased government liquidity and external vulnerability risks and higher debt sustainability risks” following catastrophic floods in recent months.

Primary market activity moderates significantly in October

Supply was muted, with a total of just 16 new issues in the month. The week-long Chinese holidays together with rates volatility prompted issuers to stay largely sidelined over the period. The HG space saw just nine new issues amounting to USD 4.66 billion, including the USD 2.0 billion three-tranche sovereign issue from the Republic of the Philippines. Meanwhile, the HY space saw just seven new issues amounting to about USD 1.22 billion.

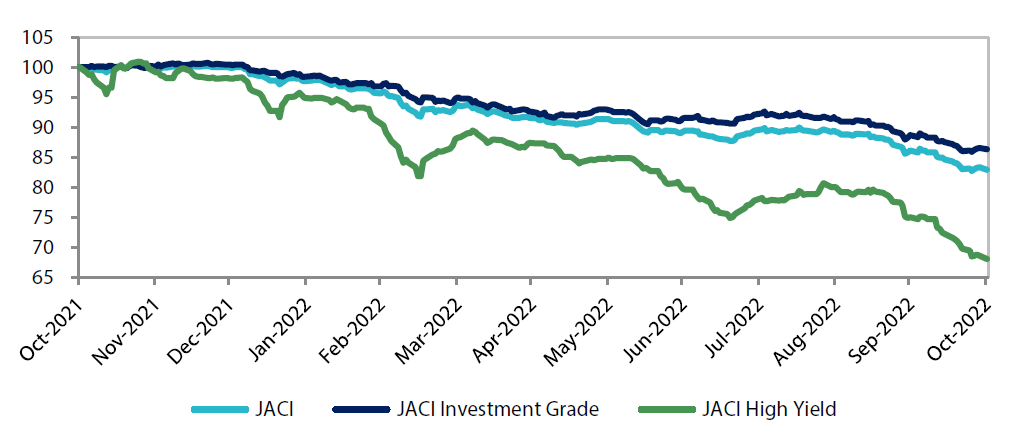

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 October 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 October 2022

Market outlook

Most Asian economies expected to remain resilient despite macro uncertainties

The markets suffered a double whammy of wider credit spreads and higher UST yields as higher-than-expected US inflation numbers and strong signals by the Fed that policy would need to be tightened further caused a significant repricing of the Fed Funds terminal rate and front-end UST yields. We believe that current yield levels have already reflect much of these hawkish surprises, although heightened volatility is likely to persist with various global market developments and economic data exerting opposing pressures. Despite some expected moderation amidst the slowdown in global growth, we believe the macro and corporate credit fundamentals across much of Asia will remain robust enough to alleviate the pressure of credit spread widening. However, given the plethora of global market risks, there is some scope for modest widening in the near-term. Meanwhile, there are still downside risks to China growth with lingering concerns surrounding the real estate sector and duration of China’s zero-COVID policy. The 20th Party Congress focused on policy continuity, which is well underscored by the by election of President Xi for a third term and line up of the new leadership team. While there is unlikely to be any major shift in the direction of economic policies and regulation, mid-term concerns remain on China’s sustainable economic growth path and the rise in the US restrictions on technology transfer to China.