Key points & beliefs

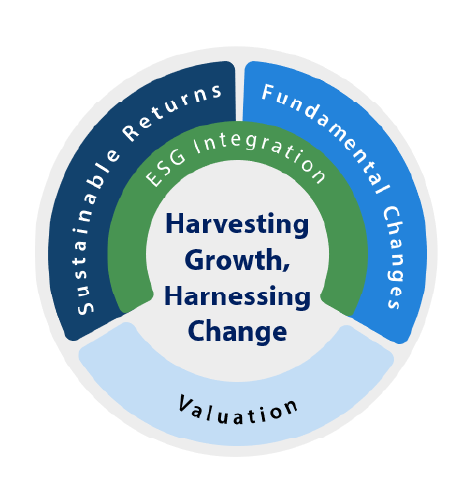

- Change is both more prevalent and significant in Asian markets. Seeking to understand it is essential to deliver sustainable returns.

- We look to identify fundamental change, both positive and negative, that will impact a company’s long-term sustainable return profile.

- Our ideal investment offers high potential sustainable returns and real fundamental change at a price that undervalues both.

- ESG matters most when it has a material impact on shareholder returns. Its assessment works best when fully integrated into the investment process.

- Bottom-up stock selection based on thorough fundamental research is the best way to identify future winners.

Harnessing change to deliver sustainable returns in Asia

Charles Darwin’s theory of evolution implies that it is not the strongest of the species that survives, nor the most intelligent; it is the one most adaptable to change. We believe this statement is particularly applicable to the investment environment in Asia—one of the most dynamic and complex regions in the world. There are multiple drivers of change in Asia, such as political reforms, a rising middle class, innovation, new company creation and rising Environmental, Social and Governance (ESG) awareness.

And although market observers often refer to the region as a single entity, the truth is that Asia’s rich diversity means there is no such thing as a one-size-fits-all approach. Instead, we find dozens of individual ecosystems— interconnected yet distinctly different. Each has unique idiosyncrasies, from government and culture to

demographics and economic development. Without a deep understanding of how these factors intersect, and without a mindset built around change, it is more challenging to deliver long-term above-market returns.

demographics and economic development. Without a deep understanding of how these factors intersect, and without a mindset built around change, it is more challenging to deliver long-term above-market returns.

Change brings risk, but it can also carry its more prosperous sibling—opportunity. To capitalise on these requires a firm grasp of the nuances within Asia’s markets. Such a level of knowledge must extend beyond the current state of each territory to form a view of how they will look in the future. It is precisely because people are reluctant to accept change or underappreciate its significance that it is often mispriced.

In fast-changing Asian markets, we firmly believe our focus on identifying undervalued companies capable of generating high sustainable returns and undergoing significant positive fundamental change will enable us to deliver superior alpha over the longer term. We call our approach: “Harvesting Growth, Harnessing Change”.

An investment philosophy for a fast-evolving ecosystem

In a dynamic region like Asia, companies are constantly emerging, adapting, and changing their standing in the corporate hierarchy. And this can take place in a matter of years or even months.

At Nikko AM, we believe that bottom-up stock selection based on thorough fundamental research is the best way to identify future winners. In a region where rapid change is the norm—and one undergoing unprecedented levels of transformation as we speak—owning the market will mean investing in both the winners and losers from these changes, which is a suboptimal strategy.

By definition, fundamental changes take time to play out, for market participants to then take note, and to then appropriately price these changes. We assess fundamental changes that impact a company’s longer term (3 years plus) returns and growth profile. To achieve our goals, we search for companies that can attain and sustain higher-than-average returns—as measured by return on equity, earnings growth, and the durability of both.

Identifying the forces of fundamental change at play

We think of positive fundamental change as developments that lead to a sustained improvement in profitability or the earnings growth profile of a company. While these include changes at a country, industry, and societal level, we focus the bulk of our efforts on fundamental transformation at a company level.

What is it about company-level change that makes it so compelling? The main reasons are that it is hardest to identify and quantify, requiring comprehensive resources, an active on-the-ground presence, and a deep understanding of local markets. Identifying strategy and innovation changes require regular engagement with management teams and a core understanding of the sector and environment in which they operate. While change via capital initiatives, as well as changes to management and ownership, may be easily observed, understanding the significance of these shifts is much more challenging [1,2,3,4,5].

We also consider external fundamental change. These developments are outside of a company’s control but will impact its operating environment and prospects. We find the most relevant are industry dynamics, policy and regulations, and country or macroeconomic factors. These can have profound implications for long term returns, superseding company fundamentals from time to time. As Warren Buffett has observed, “when a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact".

Identifying and piecing together such opportunities takes patience, dedication, experience, and knowledge. Pinpointing such changes before the market does—and correctly assessing their significance—creates the potential for significant stock-specific returns.

We have found little academic or investment research looking specifically at fundamental change, particularly within Asia and emerging markets. This excites us because it suggests that such opportunities are less well understood.

Singapore Marina: Then and now

Source: Kouo Shang-Wei collection, National Library, Singapore and Shutterstock

Source: Kouo Shang-Wei collection, National Library, Singapore and Shutterstock

Attaining and sustaining high returns

While anticipating and harnessing change can offer attractive investment performance, these gains can be significantly enhanced by the long-term compounding effect of consistent, high, returns. Our assessment of the sustainability of returns includes:

1. Gauging the strength of a company’s franchise

A large part of a company’s ability to maintain its competitive position over a prolonged period will be underpinned by competitive advantages, capital allocation, management team, and culture. Collectively, these factors comprise our view of a firm’s franchise strength. There is ample literature supporting the central role these factors play when assessing a business—including from some of the most successful investors over the decades [6,7,8].

Asia is young, dynamic, and hungry for success. It is creating a growing number of genuinely global franchises: from about 3-5 in the 1990s to between 40 and 50 at present, with new names continuously emerging. The increasing number of international firms led by Asians is also noteworthy. Key decision makers and ownership structures are critical for long-term success and Asia has distinct nuances versus other regions [9,10,11].

2. Assessing financials

Steady and improving returns and growth are favoured over volatile return profiles. Assessing financials is as much about identifying risks and avoiding the pitfalls as it is about identifying the long-term winners.

As such, efficient management of capital structures is highly desirable—the most attractive companies can sustainably fund their operational expansion rather than persistently tapping capital markets to fund future growth.

3. Accounting for ESG factors in Asia

That ESG analysis is relevant to generating sustainable alpha should no longer be disputed. While it is true that, in some respects, Asia is at an early stage of its ESG journey relative to developed markets, this paradoxically makes it even more important, as positive change can reap greater rewards for all stakeholders over the longer term [12].

ESG matters most when it has a material impact on shareholder returns, and thus, we believe its assessment works best when fully integrated into the investment process. We focus on what is relevant in Asia today as well as what could matter in the future [13,14].

4. External Drivers

An assessment of a company’s prospects would not be complete without analysing external drivers. This is the environment a company operates in and whether it is favourable to growth, has visibility and can be long lasting.

We like companies with large potential addressable markets and pricing power. These businesses should also be in the early-to-mid stages of their industry or country lifecycles and enjoy favourable regulatory and competitive tailwinds [15,16]. Together these conditions allow the best companies to maximise returns and sustain growth.

Fitting valuation into the change equation

Where do equity valuations fit in with our fundamental analysis toolkit? No doubt it is crucial - our valuation assessment is the sealant that binds our fundamental analysis together. We believe that securities are ultimately priced according to their long-term earnings potential and profitability. Evaluating companies on their sustainable return and fundamental change characteristics allows us to estimate their intrinsic value, which we then compare with the current market price.

Just as Asia’s diversity precludes a one-size-fits-all passive approach, the same applies to valuations. No metric or model applies to all investments [17,18]. The valuation approach depends on the degree to which fundamental change or sustainable returns are relevant to the investment thesis. For example, an innovative biotech company may be judged using a pipeline-probability earnings model as the investment thesis is primarily based on fundamental change. Meanwhile, a bank in a mature credit system is more oriented toward sustainable returns that are modelled on its return on equity and growth versus its price-to-book ratio.

However, what is consistent is our valuation template: our assessment of a company’s fundamentals and its prospective growth and returns profile vis-à-vis its cost of capital, in order to identify any divergence between our estimate of its intrinsic value and its current market price. This provides a sense of the potential returns that will accrue over the long term, driving our conviction, our evaluation of relative attractiveness, and the final investment decision [19,20,21].

The best returns are achieved when significant fundamental change is recognised at an early stage, and companies then sustain and develop their transformative advantages. This maximises valuation re-ratings and underpins the positive effects of compounding – characteristics we feel the market consistently underappreciates in the longer term.

A model that combines diverse elements

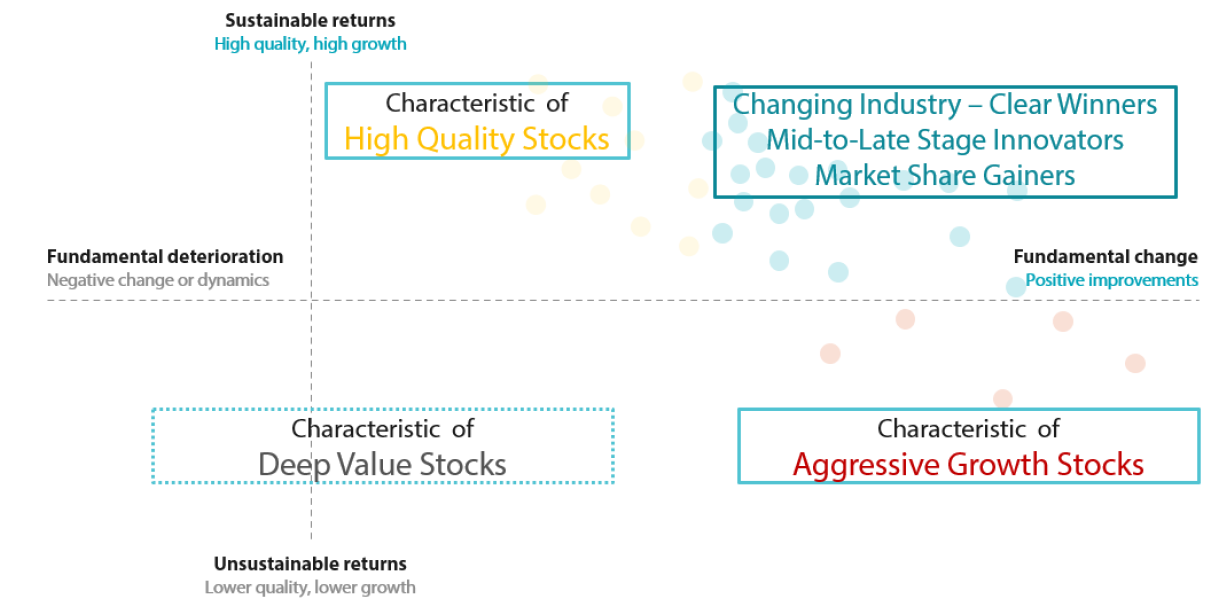

We look to identify fundamental change, both positive and negative, that will impact a company’s long-term sustainable return profile. If we visualise companies along the axis of sustainable returns and fundamental change, they can be divided into four quadrants:

- The lower-left quadrant contains stocks with deteriorating or stagnant fundamentals and unsustainable returns. These often display characteristics of “Value” stocks.

- In the upper-left quadrant are stocks with high sustainable returns but little or even negative fundamental change. These often display characteristics of “Quality” stocks.

- The bottom-right quadrant features names with a high degree of fundamental change but limited sustainable returns. These often display characteristics of sales led “Growth” stocks.

The “sweet spot” is the upper-right quadrant as it combines two key areas that the market often underappreciates – fundamental-change-driven high sustainable returns and growth.

Assessments must be dynamic to match a constantly changing environment. We often find that stocks go on “journeys” as positive fundamental change becomes realised in sustainable returns. Our ideal investment has high sustainable returns and real fundamental change at a price that undervalues both. What differentiates us from investors who favour a particular ‘style’ of investing is our focus on fundamental change, for which there is no style bucket.

“If you realise that all things change, there is nothing you will try to hold on to” — Laozi

Too often, we see capital allocators try to hold on to views and strategies that have worked in the past – but are no longer relevant today [22]. In a fast-changing region like Asia, such a dogmatic approach is likely to result in subpar performance over the long term.

That’s why our entire approach is centred around trying to anticipate and understand change.

But this approach requires rigour especially because all market participants can observe fundamental change. Therefore, beyond just being aware of changes, assessing whether they are fundamental in nature, then understanding their significance and implications, and applying that through our investments requires diverse perspectives and being active in the relevant markets. Ultimately, we feel this is the only way to achieve sustainable long-term returns.

As William Arthur Ward noted, “The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails”.

References

- "Diffusion of Innovations" Everett M. Rogers (1962)

- "The Change Function: Why Some Technologies Take Off and Others Crash and Burn" Pip Coburn

- "Bubbles & Crashes: The Boom and Bust of Technological Innovation" Brent Goldfarb & David Kirsch

- "Engines That Move Markets" Alasdair Nairn

- "When do family firms have an advantage in transitioning economies" ER Banalieva (2015)

- "The Essays of Warren Buffet: Lessons for Corporate America", Lawrence A. Cunningham

- "Measuring the Moat: Assessing the Magnitude and Sustainability of Value Creation"; “Capital Allocation”, Mauboussin and Callahan, Credit Suisse (2014, 2015)

- "Firms and the Competitive Advantage Period" Brett C. Olsen (2013)

- "Family Ownership and financial performance relations in emerging markets" Wang, Kun Tracy & Shailer, Greg, 2017

- "Asian Godfathers" & "How Asia Works", Joe Studwell

- “The Unusual Billionaires” Saurabh Mukherjea

- "ESG and Financial Performance: Aggregated evidence from more than 2000 empirical studies" G. Friede (2015)

- "Investing for long-term value creation" Dirk Schoenmaker (2019)

- "Where ESG Fails" Michael E. Porter, Institutional Investor (2019)

- "Competitive Strategy" Michael Porter (1980)

- “Total Addressable Market" and "The Base Rate Book - Sales Growth: Integrating the past to Better Anticipate the Future” Michael Mauboussin and Callahan, Credit Suisse (2015)

- "Book Value is an Incomplete Measure of Firm Size" Brent Leadbetter (2020)

- “Something of Value” Howard Marks (2021)

- CFA Level II, Volume 4 - Equity

- "What does a Price-Earnings Multiple Mean"; “Estimating the Cost of Capital”, Mauboussin and Callahan, Credit Suisse (2014, 2015)

- “Investment Valuation: Tools and Techniques for Determining the Value of Any Asset” Aswath Damodaran

- “Adaptive Markets Hypothesis” Andrew Lo (2017)