Summary

- The US Treasury (UST) yield curve moved significantly higher in February. At the end of the month, the benchmark 2-year and 10-year UST yields were at 4.82% and 3.92%, respectively, about 62 basis points (bps) and 41 bps higher compared to end-January.

- Central banks in the region took divergent monetary paths during the month. India and the Philippines raised their respective policy rates, while Indonesia and South Korea maintained their interest rates. The region’s inflation data for January was mixed.

- We are cognizant that rates volatility may remain high in the near-term, with markets increasingly susceptible to surprises in economic data ahead of the US Federal Reserve (Fed) meeting late in March. We prefer the government bonds of Malaysia and Indonesia, as both governments are aiming for fiscal prudence. As for currencies, we expect the Thai baht and Indonesian rupiah to outperform their regional peers.

- Asian credits retreated 1.33% in February, with losses entirely driven by higher UST yields as credit spreads tightened about 8 bps. Asian high-grade (HG) credit returned -1.29%, while Asian high-yield (HY) credit retreated 1.55%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay robust, albeit slightly weaker than in 2022. Given the still resilient fundamentals, we expect Asian credit spreads to stay within a range after the initial tightening at the start of the year.

Asian rates and FX

Market review

The UST yield curve shifts higher in February

After a strong rally in January, USTs sold off—with key rates rising between 28 and 62 bps in February—as markets recalibrated the path forward for interest rates. The month opened to the Fed hiking rates by a quarter point, bringing the Fed Funds Rate to 4.75%. USTs rallied after Fed Chair Jerome Powell acknowledged that price pressures have started to ease. However, the shockingly strong January jobs report released soon after stoked worries that the US central bank could maintain its restrictive monetary policy for longer than initially expected, prompting a reversal in UST yields. Thereafter, weakness in Treasury bonds persisted on the back of the slower-than-expected pace of disinflation in the US. In particular, the January core consumer price index (CPI) moderated to 5.6% on a year-on-year (YoY) basis, falling short of consensus expectations of 5.5%, whereas the personal consumption expenditures (PCE) core price index—the Fed’s preferred measure for inflation—accelerated for the first time since September 2022 to 4.7% YoY. Together with these firm inflation readings, other key economic data confirmed the strong growth momentum at the start of the year, raising the possibility that the Fed may have to do more. At the end of February, the benchmark 2-year and 10-year UST yields were at 4.82% and 3.92%, respectively, about 62 bps and 41 bps higher compared to end-January.

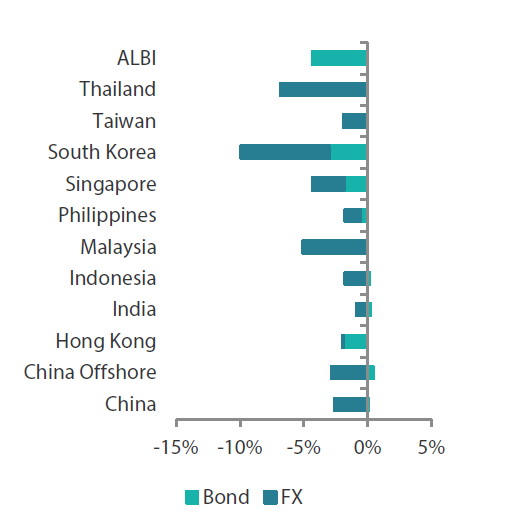

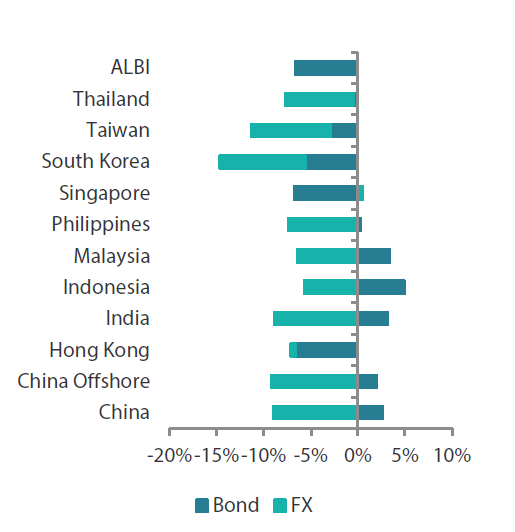

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 28 February 2023 | For one year ending 28 February 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 28 February 2023

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

India and the Philippines hike rates; Indonesia and South Korea leave policy rates unchanged

Central banks in the region took divergent monetary paths. The Bangko Sentral ng Pilipinas (BSP) and the Reserve Bank of India raised their respective policy rates, while Bank Indonesia (BI) and the Bank of Korea (BOK) left interest rates unchanged. According to the BSP, its 50-bps hike was needed “to prevent inflation expectations from drifting further away from the target band”. In India, the Monetary Policy Committee voted 4-2 to raise the policy rate by 25 bps and retained its stance at “withdrawal of accommodation”, with post-policy commentary reflecting optimism on growth. In contrast, BI Governor Perry Warjiyo said that the current monetary policy is tight enough to cool inflation without hurting Indonesia’s recovery, adding that both headline and core inflation are easing faster than initially expected. Similarly, the BOK left its policy rate unchanged at 3.5%, with one dissenter voting for a 25-bps hike.

Headline CPI prints mixed in January

The rise in headline CPI numbers in China, South Korea, India, Singapore and the Philippines accelerated, while overall inflation rates in Malaysia, Indonesia and Thailand moderated. The Philippines’ 8.70% YoY headline annual inflation rate was significantly higher than expected, propped up partly by higher utility, food and housing costs. Overall inflation in Singapore similarly quickened, inching up to 6.6% YoY in January from 6.5% YoY in December, as the rise in the goods and services tax (GST) took effect at the start of the year. In contrast, the headline CPI in Thailand moderated to 5.02% YoY in January from 5.89% in December, helped by easing energy and food prices. Indonesia’s headline CPI print also slowed. The 5.28% YoY print was a five-month low and was prompted largely by easing private transport inflation.

Singapore, India and Malaysia unveil expansionary budgets

Singapore’s Finance Minister and Deputy Prime Minister Lawrence Wong announced that the government is projecting a small deficit of Singapore dollar 400 million or 0.1% (of GDP) for fiscal year (FY) 2023. Continued targeted measures to ease the impact of rising inflation were unveiled—including one-off payments, raising the GST Assurance Package and enhancing the GST Voucher Scheme. The government also announced a further expansion of revenue sources including raising property taxes and increasing excise duty on tobacco products. In Malaysia, Prime Minister Anwar Ibrahim unveiled a revised Malaysian ringgit 388.1 billion budget, higher than what the previous administration had budgeted. The fiscal deficit is projected to be 5% of GDP for FY2023, lower than the 5.6% deficit in FY2022, and will be funded in part by higher tax collections, including a new levy on luxury goods. Elsewhere, India’s budget revealed the government’s plan to drive FY2024 growth through capital expenditure and investments. Government expenditure is projected to rise 7.54% YoY in the year, and the fiscal deficit is expected to register 5.9% of GDP.

Market outlook

Prefer Malaysia and Indonesia bonds

The month saw markets adjusting their expected Fed terminal rate higher, with 2-year and 10-year UST yields now back or approaching their highs in late 2022. We are cognizant that rates volatility may remain high in the near-term, with markets increasingly susceptible to surprises in economic data ahead of the Fed meeting scheduled in late March. Against such backdrop, we prefer the government bonds of Malaysia and Indonesia, as both governments aim for fiscal prudence. We anticipate further support for Indonesian government bonds via foreign portfolio inflows once global rates conditions stabilise.

Thai baht and Indonesian rupiah preferred

On currencies, we expect the Thai baht and Indonesian rupiah to outperform regional peers. Optimism of a rebound to healthy current account surplus as Chinese tourists return, bodes well for the Thai baht. Meanwhile, the positive outlook for Indonesia’s foreign direct investment— backed by the government’s long-term plan of becoming a manufacturing hub for electric vehicle batteries—is expected to benefit demand for the Indonesian rupiah.

Asian credits

Market review

Asian credits end lower as UST yields jumped

Asian credits retreated 1.33% in February, with losses entirely driven by higher UST yields as credit spreads tightened about 8 bps. Weak risk tone prompted Asian HG credits to outperform Asian HY. Asian HG credit returned -1.29%, despite spreads tightening about 15 bps, as UST yields rose. Meanwhile, Asian HY credit retreated 1.55%, with spreads widening 23 bps.

The month opened to positive risk sentiment, buoyed by the Fed’s move to downshift the pace of tightening and Fed Chair Powell’s declaration that “the disinflationary process has started”. Sentiment took a turn post the bumper US non-farm payrolls number, as markets priced in a more hawkish US interest rate trajectory. Credit spreads widened at a slower pace in comparison to what we saw in January amid signs of sticky US inflation and resilient consumer spending. That said, Asia credit spread performance remained relatively resilient despite the sharp adjustment higher in UST yields as positive macro news from China provided some offset. In particular, inflationary pressures in China remain subdued notwithstanding the rapid economic re-opening. Prices for new homes held firm—halting a 16-month decline, and new renminbi loans jumped on the back of a meaningful pick up in corporate sector loans. The China Banking and Insurance Regulatory Commission and the People’s Bank of China announced a draft amendment to align the bank capital regulations to the new standard under Basel III which could benefit smaller scale commercial banks in China with a more differentiated regulatory system. As global risk tone softened, fund flows into emerging markets (EM), including Asia, turned negative. There was some initial weakness in the Philippines and Indonesia sovereign and quasi-sovereign names which stabilised as EM fund outflows slowed. There was some weakness among higher beta technology, media, and telecommunications names and private owned enterprise credits, largely resulting from profit taking and idiosyncratic headlines. Overall, spreads of major country-segments in Asia, save for India, Thailand and Macau, tightened in the month.

Primary market quiet in February

New issuances for Asian credits slowed down significantly in February as weak market sentiment prompted issuers to stay on the sidelines. The HG space saw 13 new issues amounting to about US dollar (USD) 7.77 billion, including the USD 2.0 billion dual-tranche issue from Korea Development Bank and the USD 1.3 billion dual-tranche issue from Korea Housing Finance Co. Meanwhile, the HY space had just four new issues amounting to about USD 1.02 billion.

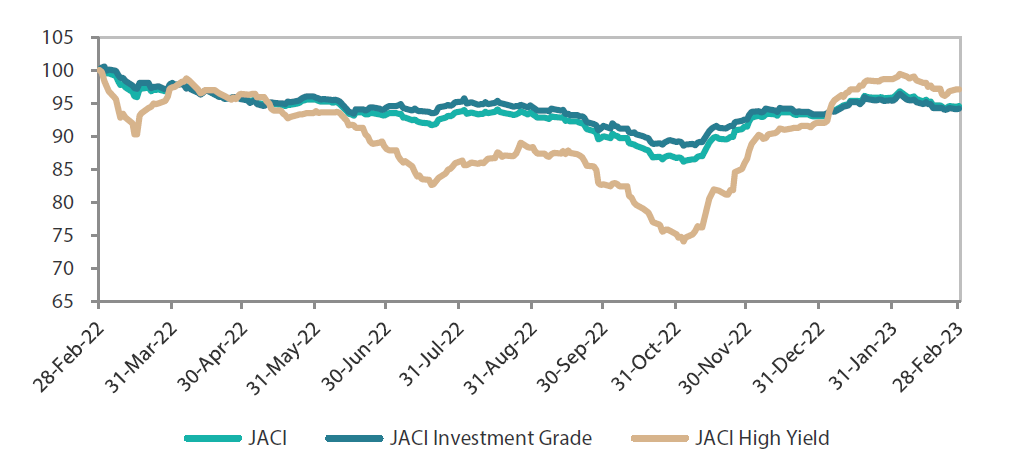

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 28 February 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 28 February 2023

Market outlook

Supportive technicals and resilient fundamentals to stay

Our expectations for Asian credit spreads to tighten in the early part of 2023 have played out, driven by positive catalysts, including China’s policy shifts in key areas. The peak COVID exit wave appears to have passed in major Chinese cities which, coupled with the shift towards a pro-growth and pro-market policy stance across the property and internet platform sectors, suggest an earlier and sharper growth recovery for China. This not only supports market sentiment but also provides meaningful positive spillover for other Asian economies more broadly, for example through tourism flows and support for exports of goods and commodities. We are entering into a more uncertain phase where further spread tightening will be dependent on sustained private consumption in China, bottoming out in the semiconductor downcycle, continued stabilisation in PMIs and recovery in new home sales. Nevertheless, we continue to look to further supportive measures from Chinese leaders to stimulate growth and consumption, and softening in its foreign policy stance. Geopolitical tensions, though, are unlikely to disappear completely.

Macro and corporate credit fundamentals across Asia ex-China are therefore expected to stay robust, albeit slightly weaker than in 2022. Indian and ASEAN economies, supported by tourism rebound and domestic re-opening, are expected to fare better than the export-dependent North Asia. Given the still resilient fundamentals, we expect Asian credit spreads to stay within a range after the initial tightening at the start of the year.

We are nevertheless cognizant of downside risks to the base case scenario, key of which are more persistent-than-expected inflation across major economies (that would lead to a more protracted hiking cycle and a higher terminal policy rate), a more severe economic downturn in the developed economies and increased geopolitical tensions. The materialisation of one or more of these downside risks could lead to the widening of Asian credit spreads from current levels.