Summary

- US Treasuries (USTs) rallied in November as various data points signalled an economic slowdown and hawks on the US Federal Reserve (Fed) Board of Governors hinted that they could be comfortable with less aggressive monetary policy. At the end of November, the benchmark 2-year and 10-year yields settled at 4.68% and 4.33%, respectively, 40.7 basis points (bps) and 60.4 bps lower compared to end-October.

- 2024 looks to be a year of higher returns and lower volatility for Asian local government bonds with UST yields expected to stabilise and start easing. We expect sentiment toward Asia’s bond markets to turn increasingly positive, attracting capital inflows and providing technical support that was largely lacking in 2023. Meanwhile, we believe that the broad theme of stronger Asian currencies against the dollar will dominate in 2024, as we see waning demand for the greenback as the Fed’s rate-hiking cycle comes to an end.

- Asian credits registered strong gains in November as credit spreads tightened about 9 bps and UST yields moved sharply lower. Asian high-grade (HG) credit returned 3.53% with spreads narrowing about 12 bps, while Asian high-yield (HY) credit gained 4.71%, despite spreads widening 3 bps.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay resilient on the back of fiscal buffers, although slower economic growth appears to loom over the horizon. Asian banking systems remain strong, with their stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Asian rates and FX

Market review

USTs rally in November

USTs rallied in November as various data points signalled an economic slowdown and hawks on the Fed Board of Governors hinted that they could be comfortable with less aggressive monetary policy. The US central bank held steady on rates for a second straight time in November, keeping the Fed Funds Rate target in the range of 5.25% to 5.50%. Meanwhile, US nonfarm payrolls increased by 150,000 in October—a sharp decline from the downwardly revised 297,000 gain in September and falling short of forecasts for a rise of 170,000—and the unemployment rate rose to 3.9%. These, together with the announcement of a smaller-than-expected Treasury refunding requirement, triggered a rally in risk assets and USTs in the first half of November. Thereafter, the decline in yields was supported by October consumer price index (CPI) and producer price index (PPI) data, which were both weaker than expected. Throughout the month, comments from Fed officials became increasingly dovish. However, it was the shift in tone from Fed governors Christopher Waller and Michelle Bowman—officials who are among the most hawkish policy makers—which fuelled a further drop in UST yields and prompted broad-based US dollar weakness. At end-November the benchmark 2-year and 10-year UST yields settled at 4.68% and 4.33%, respectively, 40.7 bps and 60.4 bps lower compared to end-October.

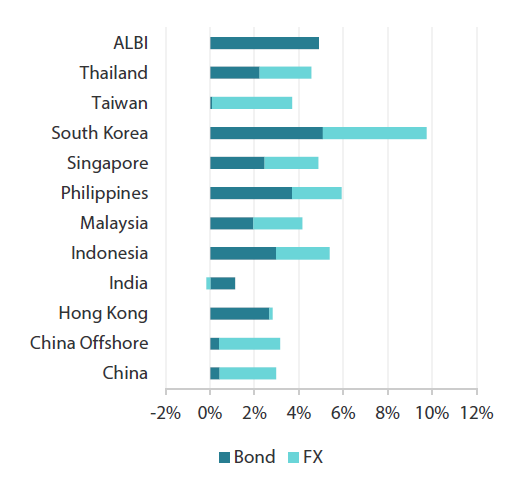

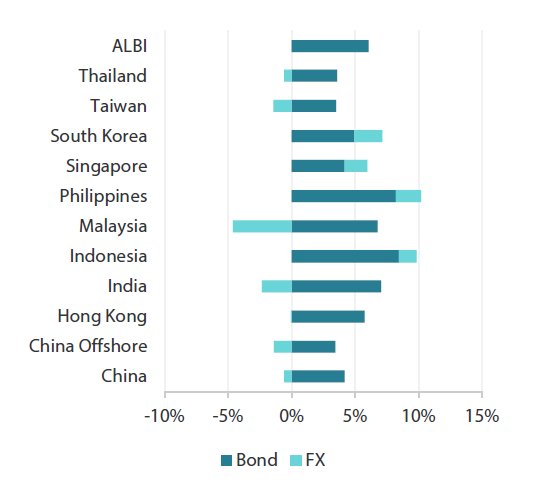

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 November 2023 | For the year ending 30 November 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 November 2023.

Asian central banks leave policy rates unchanged

Central banks in South Korea, Malaysia, Indonesia, Thailand and the Philippines kept monetary policy unchanged in November. Bank Negara Malaysia signalled that it may extend the pause on the benchmark rate. It also expects economic activity in 2024 to be supported by resilient domestic demand and inflation to remain modest. In Thailand, the central bank kept its interest rate steady while cutting its 2023 and 2024 economic growth forecasts. The Bank of Thailand (BOT) cut its growth forecast for 2023 to 2.4% from 2.8% and lowered its 2024 growth forecast to 3.2% from 4.4%. However, the BOT said that growth in 2024 is likely to improve to 3.8% if Thailand’s digital wallet policy is implemented. Meanwhile, Bank Indonesia (BI) retained a hawkish tone in its policy statement, pledging to continue strengthening its rupiah exchange rate stabilisation efforts to reduce risks of imported inflation. In South Korea, the central bank kept monetary policy unchanged at its final policy meeting of the year while raising inflation forecasts for 2023 and 2024. It cautioned against any policy easing in the near term, noting that inflation remains sticky. Elsewhere, the Bangko Sentral ng Pilipinas held the benchmark interest rate steady at 6.50%. The central bank said “the inflation outlook has moderated over the policy horizon” but also noted that risks remain “toward the upside”.

Headline CPI prints mixed in October

Headline inflation prints in Indonesia, Singapore and South Korea rose, while those in India, Malaysia, Thailand and the Philippines moderated. The acceleration in Singapore’s overall inflation was prompted largely by higher transport inflation and rising inflation for services, retail and other goods, as well as an increase in electricity and gas costs. Indonesia’s inflation rate climbed to 2.56% year-on-year (YoY) in October, above September’s 2.28%. Stripping out volatile components of the CPI, core inflation eased to 1.91% from 2.00% in September. Price pressures in Malaysia eased, with the headline CPI index moderating to 1.8% YoY in October from 1.9% in September, prompted partly by a higher base and slower growth in food prices. In Thailand, consumer prices fell for the first time since August 2021, owing largely to lower food inflation and falling energy prices due to government support measures. Elsewhere, the October headline inflation rate in the Philippines was far short of expectations, easing to 4.9% YoY from 6.1% in September, prompted largely by lower food inflation.

Regional economies register stable growth in 3Q23

In Malaysia, strong domestic demand compensated for weakening exports, resulting in GDP growth of 3.3% YoY in the third quarter of 2023 (3Q23). The growth exceeded expectations and was an acceleration from the 2.9% rise in 2Q23. In Thailand, third-quarter economic growth rose 1.5% YoY, moderating from 1.8% in the April to June period, owing largely to a deeper contraction in manufacturing. Indonesia’s economy expanded 4.94% YoY in 3Q23, slightly missing market expectations of a 5.0% print and below the 5.17% growth registered in 2Q23. Following the GDP release, Indonesia’s Finance Minister Sri Mulyani Indrawati said that the country’s full-year 2023 growth forecast was revised down to 5.04% from 5.1%, while growth for 2024 was projected at 5.24%. Elsewhere, 3Q23 GDP growth in the Philippines rose to 5.9% YoY from 4.3% in 2Q23. According to policymakers, the main contributors to growth were wholesale and retail trade, vehicle repair, financial and insurance activities and construction.

Market outlook

2024 to be a year of higher returns and lower volatility for Asian local government bonds

2024 is likely to be a year of higher returns and lower volatility for Asian local government bonds with UST yields expected to stabilise and start easing. We expect sentiment toward Asia’s bond markets to turn increasingly positive, attracting capital inflows and providing technical support (through portfolio inflows) that was largely lacking in 2023. We have an upbeat view of long Indian government bonds due to their attractive carry and favourable technicals. The inclusion of Indian government bonds into JP Morgan’s Government Bond Index-Emerging Markets Index (GBI-EM) from June 2024 is expected to provide support for these bonds. Meanwhile, a potential inclusion into the FTSE Russell World Government Bond Index may provide an additional boost for South Korean government bonds.

We believe the broad theme of stronger Asian currencies versus the dollar will dominate in 2024, as we see waning demand for the greenback as the Fed rate hiking cycle comes to an end. The key downside risks to our investment thesis include worse-than-expected Chinese GDP growth, higher-than-expected energy prices and greater geopolitical uncertainty.

Asian credits

Market review

Asian credits rally in November

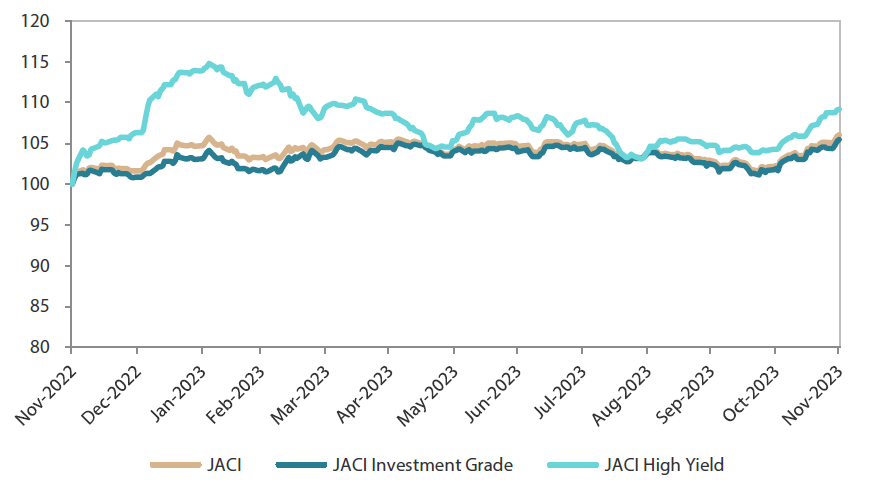

Asian credits registered strong gains in November, as credit spreads tightened about 9 bps and UST yields moved sharply lower. Asian HG credit returned 3.53% with spreads narrowing about 12 bps, while Asian HY credit gained 4.71%, despite spreads widening 3 bps.

Asian credit spreads traded lower at the start of November, as overall risk sentiment improved after US macro data signalled slowing momentum in the world’s biggest economy. In China, economic data for October was mixed; consumer spending picked up while the contraction in property investment growth deepened further. Credit growth in China rebounded, albeit due largely to a jump in government bond sales, which compensated for weak business and household borrowing. Meanwhile, China’s CPI fell 0.2% YoY in October, after staying flat in the prior month. Elsewhere, GDP releases revealed that growth was generally stable across the rest of Asia in the third quarter. Mid-month, US President Joe Biden and Chinese President Xi Jinping held a summit where they agreed, among other things, to resume communications between their militaries and cooperate over advances in artificial intelligence. The easing of US-China tensions prompted risk assets including Asian credits to rally. Positive risk sentiment was supported thereafter by the softer-than-expected October US CPI print. Towards end-November, a report that Chinese policymakers are preparing new measures to support the country’s struggling real estate industry sparked a significant narrowing in Asian credit spreads. The report alleges that officials have prepared a draft list of 50 property developers eligible for financing support and may allow banks to offer unsecured short-term loans to qualified property developers. Overall, spreads of all major country segments—save for China and South Korea—tightened. Macau credits outperformed, lifted by fund inflows and positive rating actions on some Macau gaming companies.

USTs rallied in November on increasing expectations of a US economic slowdown and hawks on the Fed Board of Governors hinting that they could be comfortable with less aggressive monetary policy. The Fed held steady on rates for a second straight time in November. Meanwhile, the US October jobs report suggested a cooling in the labour market. These, together with the announcement of a smaller-than-expected Treasury refunding requirement, triggered a sharp decline in UST yields. Thereafter, the move lower in yields was supported by October US CPI and PPI data which both fell short of expectations. Throughout the month, comments from Fed officials were increasingly dovish. However, it was the shift in tone from Fed governors Waller and Bowman—officials who are among the most hawkish policy makers—which fuelled another drop in UST yields and prompted broad-based US dollar weakness. The benchmark 10-year UST yield settled at 4.33% at month-end, 60.4 bps lower compared to end-October.

Another month of subdued primary market activity

The primary market was quiet in November, with about USD 7.26 billion being raised during the month. The HG space saw just nine new issues amounting to USD 6.4 billion, including the USD 2.0 billion two-tranche sovereign issue from Indonesia. Meanwhile, the HY space had three new issues amounting to USD 862 million.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 November 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2023.

Market outlook

Favourable Asia macro backdrop, stable credit fundamentals create historical opportunity to lock in yields

The current macro and market backdrop may see little or minor change, with growth expectations for major economies remaining low and some inflation stickiness resurfacing heading into 2024. The resilience of major economies, particularly the US, is prompting the embracing of the “higher for longer” narrative for interest rates. While this is weighing on total returns year-to-date, the sell-off in rates is also increasing the attractiveness for investors to lock in historically high all-in yields with yields at post-Global Financial Crisis highs.

The fundamentals backdrop for Asian credit remains supportive. In China, the recent step-up in fiscal measures suggests that policymakers are aware of the challenging environment. This further raises expectations for policymakers to deliver additional measures to help broaden out China’s recovery and boost economic growth in 2024. Macro and corporate credit fundamentals across Asia ex-China are expected to stay resilient with fiscal buffers despite slower economic growth expectation in the first half of 2024. While non-financial corporates may experience a slight weakening in leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs, we believe there is adequate ratings buffer for most, especially the HG corporates. Asian banking systems remain robust, with a stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Technically, Asia credit is expected to remain well-supported with lower net new supply as issuers continue to access cheaper onshore funding. Meanwhile, demand remains strong for high quality bonds driven by strong onshore support and pension funds and life insurance companies looking to lock in attractive yields and immunise against long-dated liabilities. Moreover, the consistent outperformance of Asia investment-grade (IG) on a risk-adjusted basis may boost demand and make Asia credit attractive amid the region’s favourable macro backdrop and sufficient fundamental buffer. Key risks include sticky inflation and continued US economic resilience potentially forcing the Fed to continue hiking, as well as rising geopolitical risks. On the other hand, a sudden and sharp weakening of the US labour market and economic activity, coupled with rising delinquencies and defaults, may push spreads wider across global credit. This could exert some pressure on the valuation of Asia IG credit, which continues to look slightly stretched versus historical levels.