Summary

- The US Treasury (UST) yield curve shifted higher in March, with front-end yields underperforming, as the US Federal Reserve (Fed) communicated its resolve to curb inflation. The UST 10-year bond yield rose 51.4 basis points (bps) to 2.341%, while the 2-year bond yield increased by 90.2 bps to 2.337%.

- Some central banks kept their respective policy rates unchanged. The Bank of Thailand (BOT) and Bangko Sentral ng Pilipinas raised their inflation forecasts. The inflationary picture was mixed across the Asian regions in February.

- During the month, Chinese Premier Li Keqiang said that China would set a gross domestic product (GDP) growth target of “around 5.5%” in 2022 and that consumer price index (CPI) inflation is expected to be within 3.0%. Separately, Vice Premier Liu He announced that the authorities would push to stabilise the financial markets.

- Asian credits retreated 2.03% in March as the rise in UST yield offset gains from spread tightening. Asian high-grade (HG) credits declined 1.91%, with spreads narrowing 7.1 bps. Asian high-yield (HY) fell 2.60%, as spreads contracted by 25.8 bps.

- We have eased our cautious view towards duration as we expect global rates to consolidate from current levels. On currencies, we are positive on the Malaysian ringgit (MYR), Indonesian rupiah (IDR) and Singapore dollar (SGD).

- In our view, the global and regional developments have presented greater downside risks to the macro backdrop and corporate credit fundamentals across Asia, which could result in greater differentiation across countries and sectors. However, this may not lead to a meaningful widening in Asian credit spreads due to existing buffers. We therefore remain cautious and selective towards risk for now.

Asian rates and FX

Market review

UST yields rise in March

The selloff in USTs intensified in March, with yields climbing between 28.6 to 90.2 bps across the curve. Front-end yields underperformed, as the Fed communicated its resolve to curb inflation. Risk-free rates initially fell amidst weak sentiment as the crisis in Ukraine evolved. Subsequent firmer CPI inflation reading from the US heightened expectations that the Fed could accelerate monetary policy tightening, prompting a sharp rise in rates. The continued upward move in yields was further supported by the European Central Bank’s unexpected acceleration in winding down its monetary stimulus. The Fed delivered a well-telegraphed 25 bps rate hike mid-month, with Chairman Jerome Powell hinting that balance sheet reduction could start as early as May. Bond yields moved sharply higher again, as risk assets strengthened and several Fed officials—including the chair—suggested that the central bank is prepared to raise interest rates more aggressively if needed. At the end of March, the benchmark 2-year and 10-year UST yields were at 2.337% and 2.341%, respectively, 90.2 bps and 51.4 bps higher compared to end-February.

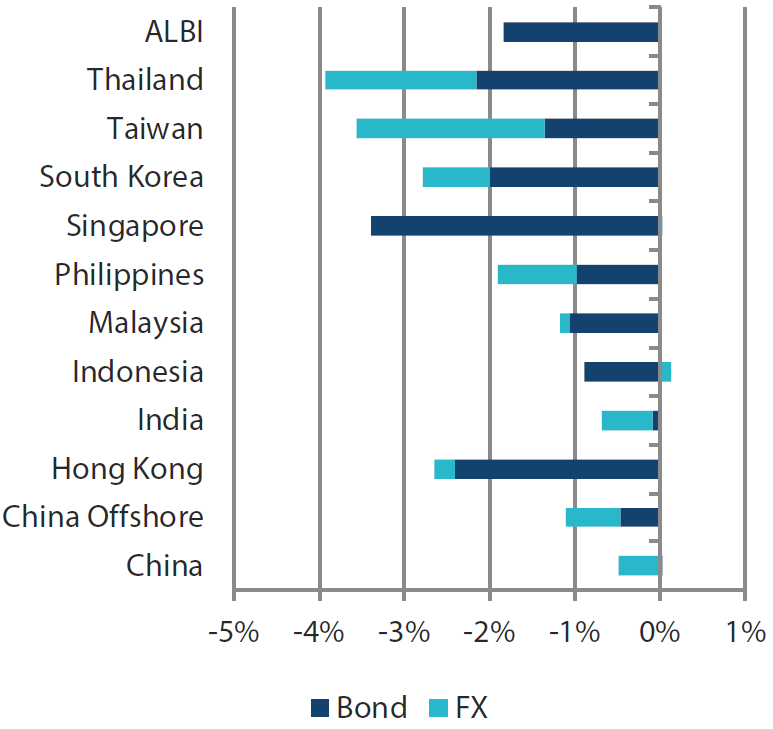

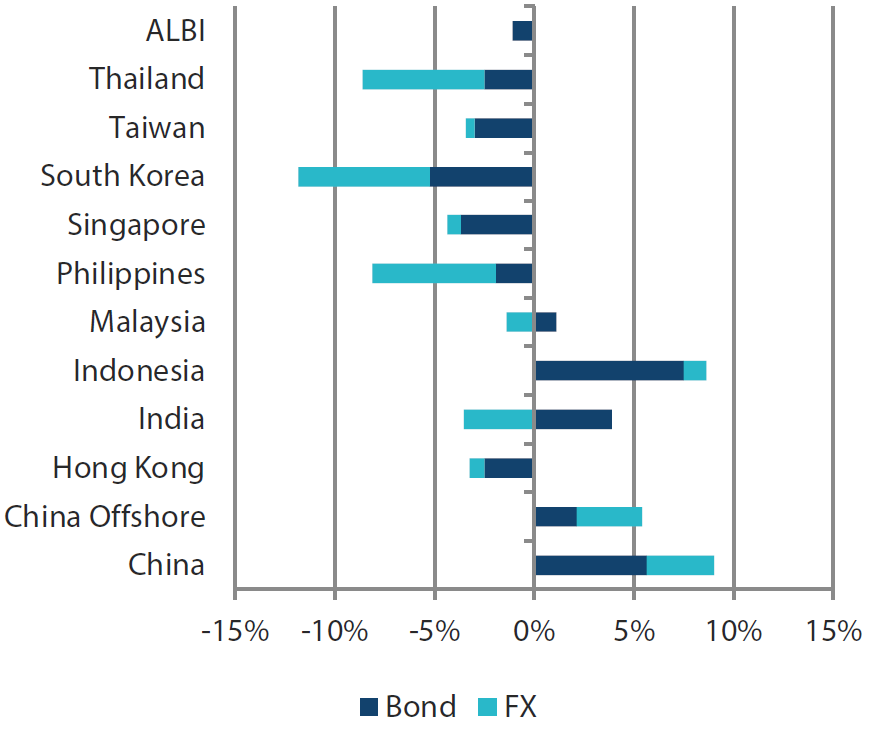

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 March 2022 | For one year ending 31 March 2022 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 March 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary picture mixed in February

Headline CPI inflation in South Korea, India, Thailand and Singapore accelerated, while similar inflation gauges eased in Malaysia and Indonesia and remained unchanged in China and the Philippines. Thailand’s February CPI read at 5.28% year-on-year (YoY), the highest since September 2008. The CPI climbed well above the Thai central bank’s target range amid a rise in fresh food and energy costs. Meanwhile, higher private transport inflation prompted the acceleration in Singapore’s headline CPI. In Malaysia, CPI inflation moderated for the third straight month in February, due partly to slower non-food inflation. Elsewhere, inflationary pressures remained relatively low in Indonesia, with headline CPI easing to 2.06% YoY (from 2.18% YoY), while core CPI rose to 2.03% YoY (from 1.84% YoY).

Monetary authorities raise their inflation forecasts but leave policy rates unchanged

Central banks in Indonesia, Malaysia, Thailand and the Philippines kept their respective policy rates unchanged despite acknowledging risks from rising commodity prices, pledging to support economic recovery. The BOT raised its 2022 CPI inflation forecast to 4.9% YoY (from 1.7% YoY), above its 1-3% target, citing supply-side factors. The BOT also revised its 2022 GDP growth forecast down to 3.2% (from 3.4%), noting higher oil and commodity prices and slower external demand. In the Philippines, the Bangko Sentral ng Pilipinas similarly raised its 2022 CPI inflation forecast above its 2-4% target. It now expects headline CPI to register 4.3% YoY this year, from an earlier forecast of 3.7% YoY, owing to higher oil prices.

China sets 2022 growth target of “around 5.5%” ; policymakers push firmly to stabilise financial markets

Chinese Premier Li Keqiang announced a fairly aggressive GDP growth target of “around 5.5%” for 2022 with CPI inflation expected to be within 3.0%. China’s fiscal deficit target for 2022 was set at around 2.8%. While the target is lower than the 3.2% of 2021, government spending for 2022 will include fiscal savings and SOE profits from the previous year. The government also aims to “step up implementation” of monetary policy, stabilise the housing market and allow more flexibility in annual energy consumption targets. Separately, policymakers made a solid push to stabilise financial markets. Vice Premier Liu He hosted a Financial Stability and Development Committee meeting, during which authorities pledged to mitigate risks surrounding the property sector, complete “rectification work” on internet companies as soon as possible and work on resolving the issue over listing of Chinese firms in US markets. The Ministry of Finance had also decided to defer broader trials of a property tax plan.

Market outlook

Easing cautious view towards duration; favour MYR, IDR and SGD

Global rates rose steeply in March, largely due to concerns around swifter global liquidity withdrawal on the back of upside inflation risks. Markets have now priced in a further 200 bps increase in the Fed funds rate by year-end. We have eased our cautious view towards duration as we expect global rates to consolidate from current levels. We anticipate regional currencies to enjoy relatively greater support going forward, as global rates markets stabilise. Within the region, we continue to favour the MYR and IDR, both of which may continue to benefit from high commodity prices. We also anticipate better demand for the SGD against other regional currencies, as we expect the Monetary Authority of Singapore (MAS) to further tighten its FX policy in April, which would likely lead to a stronger appreciation of the SGD nominal effective exchange rate (NEER) basket.

Asian credits

Market review

A volatile month for Asian credits

Asian credits retreated by 2.03% in total return due to the sharp rise in UST yields, which more than offset the 11.2 bps narrowing in overall credit spreads. Asia HG performed better than its high-yield counterpart, declining 1.91% despite spreads narrowing 7.1 bps. Asia HY returned -2.60%, with spreads contracting 25.8 bps.

Asian credits experienced extreme volatility in March. Overall risk tone was weak at the start of the month, as markets remained focused on the Ukraine crisis. Concerns of inflationary pressures rising further as a result of higher commodity prices prompted the initial rise in spreads. Subsequently, incremental lockdowns in key Chinese cities, news of possible delisting of some Chinese companies from US equities markets and idiosyncratic headlines within the Chinese property sector further weighed on already-fragile market sentiment. Mid-month, sentiment dramatically reversed after Chinese Vice Premier Liu He vowed to roll out policies to support the economy and capital markets. In particular, a re-assurance that the crackdown on internet companies was coming to an end and a declaration that “forceful and effective measures” will be implemented to mitigate risks surrounding property developers led to a strong rebound in Chinese credits which practically erased earlier heavy losses. Investor sentiment improved further after the Chinese central bank pledged to step up monetary policy support and on reports that Chinese authorities are studying a plan for a sizable new stability fund to backstop troubled financial firms.

Spreads of all major geographical-segments, save for Thailand, Singapore and Hong Kong, tightened in March. The outperformance of Indonesian credits was partly attributed to positive domestic macro news, as well as the stabilization of Emerging Market (EM) fund flows and global risk sentiment in the second half of March. On frontier markets, Sri Lanka sovereigns tested record lows as the country’s economic crisis deepened. During the month, the International Monetary Fund (IMF) declared the country’s public debt has risen to “unsustainable levels”, and foreign exchange reserves are insufficient for near-term debt payments.

Primary market activity picks up in the latter half of March

Activity in the primary market picked up in March, with most issuers entering in the latter half of the month as volatility decreased. The HG space saw 28 new issues amounting to US dollars (USD) 15.2 billion, including the USD 2.1 billion three-tranche issue from United Overseas Bank, USD 2.25 billion three-tranche sovereign issue from the Philippines, USD 1.75 billion two-tranche sovereign issue from Indonesia and USD 1.5 billion issue from DBS Bank. Meanwhile, the HY space saw approximately USD 4.7 billion worth of new issues raised from 34 issues.

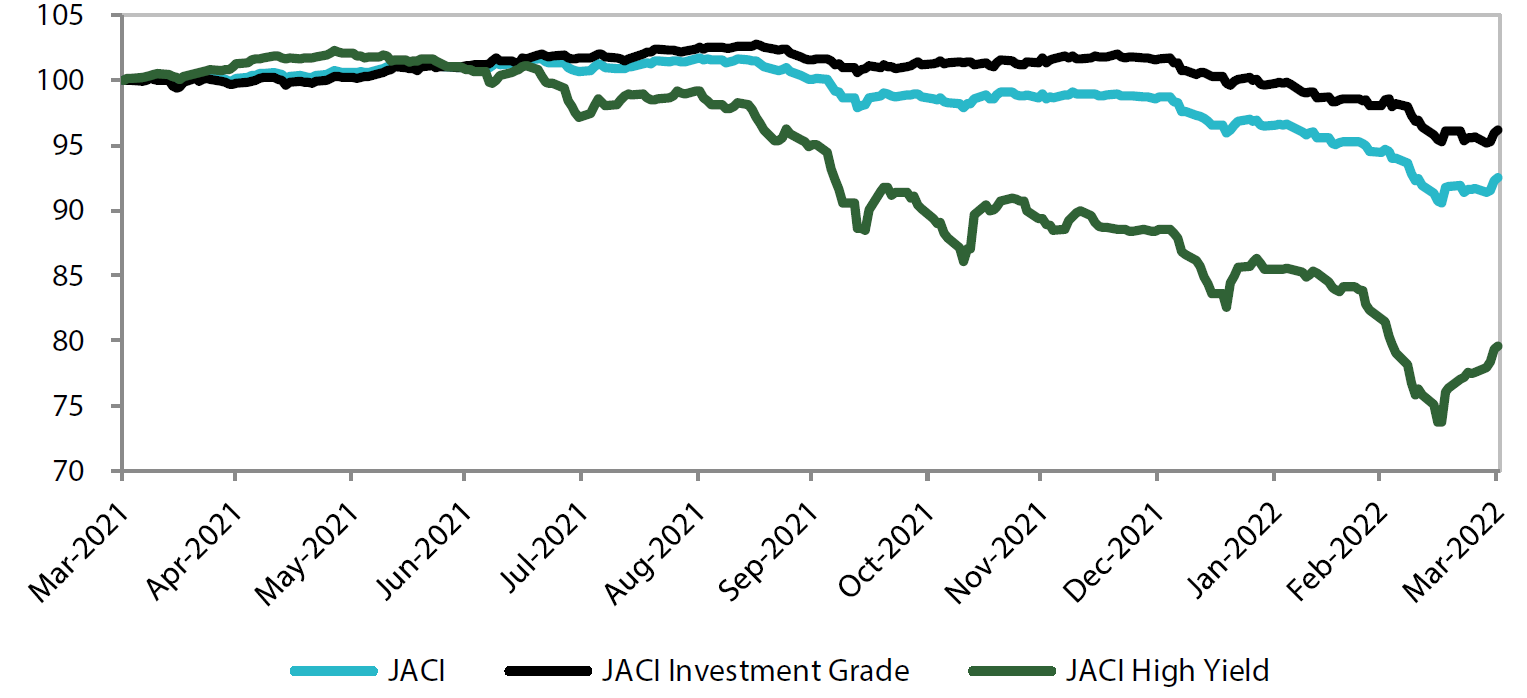

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 on 31 March 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2022

Market outlook

Greater downside risks to fundamentals but existing buffers to prevent meaningful spread widening

Many of the risk factors that adversely affected Asian credits in early March remain in place. However, there have been marginal improvements in some of these factors, and the shock impact on risk sentiment has likely peaked even as the medium-term fundamental impact on growth and inflation remains uncertain. The Russia-Ukraine war continues to drag on, but as of this writing high-level talks have taken place in an attempt to at least reach a ceasefire. In response to the sharp rise in oil and other commodity prices, governments have announced fiscal and other targeted measures to ease the pressure on inflation and household finances. This includes the US government’s decision to release a significant amount of oil from its strategic reserve over the next six months. An aggressive tightening cycle by the Fed seems imminent, but the US rates market has already re-priced significantly and this should limit the upside risk to UST yields from here. Meanwhile, top policy makers in China have provided reassurance to address key issues of concern, including the health of the property sector and listing status of Chinese firms on US stock exchanges, although policy measures announced so far remained modest and somewhat fragmentary, and the new COVID flare-ups in key regions may exert further downward pressure on growth.

These global and regional developments have presented greater downside risks to the macro backdrop and corporate credit fundamentals across Asia, and there will likely be greater differentiation across countries and sectors. However, given existing buffers, we do not anticipate the downward risks to overall fundamentals will lead to a meaningful widening in Asian credit spreads, even if the room to tighten further after the retracement in the second half of March could be limited in the near-term. We therefore remain cautious and selective towards risk for now.