The IntraDay NAV calculations shown are provided by ICE Data Indices, LLC are updated during HKEX trading hours. Powered by FactSet. IntraDay NAV calculations are indicative and for reference purposes only.

The Fund is not sponsored, endorsed, sold or marketed by ICE Data Indices, LLC, its affiliates (“ICE Data”) or their respective third party suppliers. ICE DATA OR ITS THIRD PARTY SUPPLIERS MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE iNAV, IOPV, FUND OR ANY FUND DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, DIRECT, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. You acknowledge that the Data is provided for information only and should not be relied upon for any purpose.

HKEX INFORMATION SERVICES LIMITED, ITS HOLDING COMPANIES AND/OR ANY SUBSIDIARIES OF SUCH HOLDING COMPANIES ENDEAVOUR TO ENSURE THE ACCURACY AND RELIABILITY OF THE INFORMATION PROVIDED BUT DO NOT GUARANTEE ITS ACCURACY OR RELIABILITY AND ACCEPT NO LIABILITY (WHETHER IN TORT OR CONTRACT OR OTHERWISE) FOR ANY LOSS OR DAMAGE ARISING FROM ANY INACCURACIES OR OMISSIONS.

Note: The Prospectus and Product Key Facts (KFS) documents are in English followed by Chinese.

OVERVIEW

The Nikko AM Global Internet ETF is a faster and more affordable option to gain access to the world’s leading internet companies. It invests in the constituents of the iEdge-Factset Global Internet Index, which comprises the top 30 internet companies in the world ranked by market capitalisation.

This fund is suitable for

Investors looking to gain access to a diversified portfolio to spread out risk across this high-growth sector.

Investors who don’t have the time or resources to perform individual stock picking or company research on an industry where it changes rapidly.

Investors who want lower capital investment and experience greater liquidity.

PERFORMANCE

Fund Performance (USD)

| Performance (%) | 3 Mths | 6 Mths | 1 Yr | 3 Yrs | 5 Yrs | Since Inception |

|---|---|---|---|---|---|---|

| NAV-NAV | 2.17 | 12.10 | 31.13 | 24.44 | 10.40 | 15.34 |

| Benchmark | 2.41 | 12.60 | 32.35 | 25.54 | 11.43 | 16.44 |

| Calendar year performance (%) | YTD | Year 2024 | Year 2023 | Year 2022 | Year 2021 |

|---|---|---|---|---|---|

| NAV-NAV | 13.25 | 34.49 | 42.11 | -45.23 | -4.64 |

| Benchmark | 13.66 | 35.72 | 43.38 | -44.75 | -3.75 |

| Performance (%) | NAV-NAV | Benchmark |

|---|---|---|

| 3 Mths | 2.17 | 2.41 |

| 6 Mths | 12.10 | 12.60 |

| 1 Yr | 31.13 | 32.35 |

| 3 Yrs | 24.44 | 25.54 |

| 5 Yrs | 10.40 | 11.43 |

| Since Inception | 15.34 | 16.44 |

| Calendar year performance (%) | NAV-NAV | Benchmark |

|---|---|---|

| YTD | 13.25 | 13.66 |

| Year 2024 | 34.49 | 35.72 |

| Year 2023 | 42.11 | 43.38 |

| Year 2022 | -45.23 | -44.75 |

| Year 2021 | -4.64 | -3.75 |

Source: Nikko Asset Management Asia Limited as of 31 May 2025.

Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested,

if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of

future performance.

# Returns since inception on 24 October 2019.

Tracking Difference

Tracking Difference

Tracking Difference is the return difference between an ETF and its underlying index over a certain

period of time.

Tracking Error

Tracking Error measures how consistently an ETF follows its underlying index. It is the volatility

(measured by standard deviation) of that return difference. Tracking Error is annualized based on the

number of dealing days in the past year when daily tracking difference is calculated.

Rolling 1-Year Tracking Difference: -1.22% (as of 31 May 2025)

Rolling 1-Year Tracking Error^: 0.15 (as of 31 May 2025)

^Annualised based on number of dealing days in the past year when daily Tracking Difference was calculated.

Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Past performance is not indicative of future performance.

FUND DETAILS

| Underlying Index | iEdge-Factset Global Internet Index Net Total Return |

|---|---|

| Listing Date | 24 October 2019 |

| Trading Lot Size | 10 Units |

| Base Currency | USD |

| Trading Currency | USD HKD |

| Distribution Policy* | The Fund currently has no intention to make distributions. |

| Valuation Frequency^ | Daily |

| Listing | Hong Kong Stock Exchange – Main Board |

| Manager | Nikko Asset Management Hong Kong Limited |

| Sub-Manager | Nikko Asset Management Asia Limited |

| Trustee | BNP Paribas, acting through its Hong Kong Branch |

| Auditor | PricewaterhouseCoopers Hong Kong |

| Financial Year End | 30 June |

| Listing Agent | Altus Capital Limited |

| Service Agent | HK Conversion Agency Services Limited |

| Securities Market Makers / Designated Specialists |

Flow Traders Hong Kong Limited Phillip Securities Pte Ltd |

| Management Fee | Currently 0.60% per annum of the Net Asset Value |

| Ongoing charges over a year# | Estimated to be 0.88% |

| Ticker | USD: 9072 HKD: 3072 |

| ISIN Number | USD: HK0000518578 HKD: HK0000518586 |

| Underlying Index |

|---|

| iEdge-Factset Global Internet Index Net Total Return |

| Listing Date |

| 24 October 2019 |

| Trading Lot Size |

| 10 Units |

| Base Currency |

| USD |

| Trading Currency |

| USD HKD |

| Distribution Policy* |

| The Fund currently has no intention to make distributions. |

| Valuation Frequency^ |

| Daily |

| Listing |

| Hong Kong Stock Exchange – Main Board |

| Manager |

| Nikko Asset Management Hong Kong Limited |

| Sub-Manager |

| Nikko Asset Management Asia Limited |

| Trustee |

| BNP Paribas, acting through its Hong Kong Branch |

| Auditor |

| PricewaterhouseCoopers Hong Kong |

| Financial Year End |

| 30 June |

| Listing Agent |

| Altus Capital Limited |

| Service Agent |

| HK Conversion Agency Services Limited |

| Securities Market Makers / Designated Specialists |

| Flow Traders Hong Kong Limited |

| Management Fee^ |

| Currently 0.60% per annum of the Net Asset Value |

| On-going charges# |

| Estimated to be 0.88% |

| Ticker |

| USD: 9072

HKD: 3072 |

| ISIN Number |

| USD: HK0000518578 HKD: HK0000518586 |

*Subject to the Manager’s discretion, the Manager may pay distributions to Unitholders. There is no

guarantee to the payment of distributions or frequency of payment. Distributions will be paid in the

base currency (USD) only . Distributions may be made out of capital or effectively out of capital as

well as income at the Manager’s discretion.

^4:00 p.m. (U.S. Eastern time) on the relevant Dealing Day

i.e. 4 a.m. (Hong Kong time, with U.S. daylight savings time); or 5 a.m. (Hong Kong time without U.S.

daylight savings time) on a day following the relevant Dealing Day

#The ongoing charges figure represents the ongoing expenses chargeable to the Sub-Fund over a 12-month period expressed as a percentage of the Sub-Fund’s average NAV over the same period. The ongoing charges figure is capped at 0.88% of the average NAV of the Sub-Fund. Any ongoing expenses exceeding 0.88% of the average NAV of the Sub-Fund during this period will be borne by the Manager and will not be charged to the Sub-Fund. The figure may vary from year to year.

ABOUT THE INDEX

The iEdge-Factset Global Internet Index selects companies based on their internet-revenue exposure. iEdge (or SGX Index Edge) is an award winning index provider with a business built on technology while Factset has been providing financial data and analytics for over four decades.

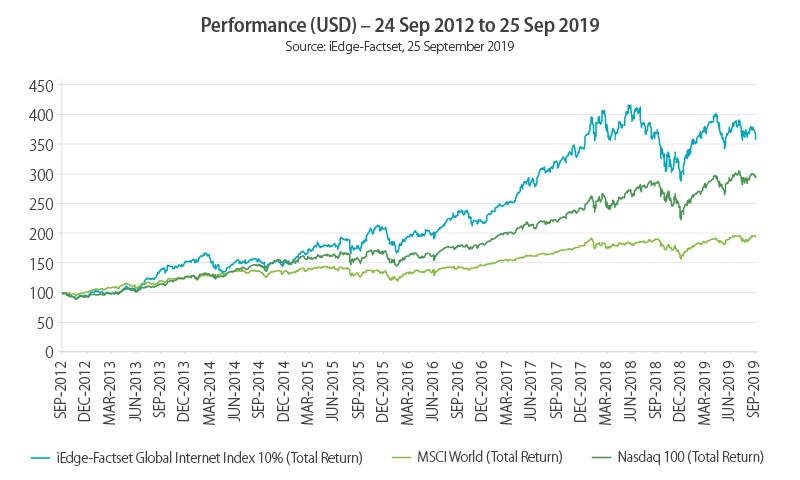

The iEdge-Factset Global Internet Index has outperformed the broader MSCI World and Nasdaq 100 indexes over the last 7 years.

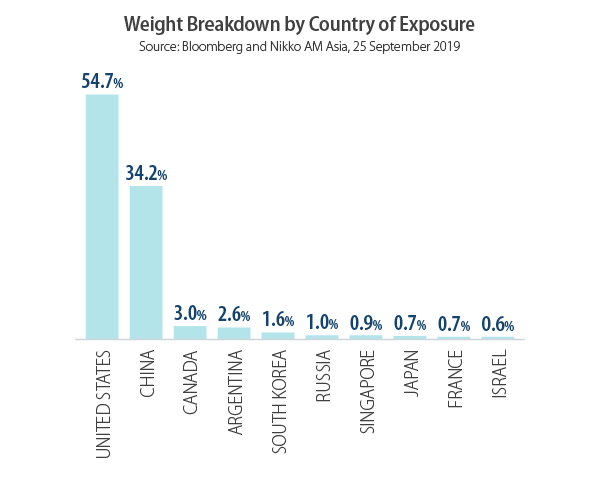

The Index constituents from the world’s leading internet companies, not only from China and US but also from countries Japan, South Korea, Canada, Argentina and Russia.

Note: The Prospectus and Product Key Facts (KFS) documents are in English followed by Chinese.

WAYS TO INVEST

Trade through your authorised stock broker on the Hong Kong Stock Exchange and start investing in the ETF in a process similar to purchasing and selling securities

Regular Savings Plan (RSP)

Invest in the ETF on a regular basis with:

(*transaction fees or charges may apply with the respective parties below. The information is for reference only. For any details and the latest change, please refer to the respective parties website.)

Min. amount: HKD 500

Min. amount: HKD 1,000

Min. amount: HKD 500

Min. amount: HKD 500 or 2 shares

Direct Application by or through Participating Dealers

Subscribe directly to the ETF through any of our participating dealers, subject to minimum unit requirements stated below.

Cash Application of New Units#

For application of new units in the ETF using the cash option, investors need to go through an authorised participating dealer and a minimum of 5,000 units (or such higher number of units in multiples of 1,000) is required.

In-kind Application of New Units#

For application of new units in the ETF using the in-kind option, investors need to go through an authorised participating dealer and a minimum of 50,000 units or multiples thereof.

List of Participating Dealers

- Haitong International Securities Company Limited

- Mirae Asset Securities (HK) Limited

- Nomura Securities (Hong Kong) Limited

- Phillip Securities (Hong Kong) Limited

- Korea Investment & Securities Asia Limited

- KGI Asia Limited

#Dealing Deadline:

Cash Application: 12:30 p.m. (Hong Kong Time)

In-Kind Application: 5:30 p.m. (Hong Kong Time)

Invest with Us

For more information on investing with Nikko Asset Management, please check below: