A review of 2021

For equity investing in China, 2021 was a year of split fortunes, with multiple indices taking different paths. It was a painful year for offshore investors whose indices are predominantly determined by the MSCI China index, which had declined 18% as of November 2021. On the other hand, onshore investors focusing on stocks in the Shanghai and Shenzhen exchanges had a bumper year in relative terms.

However, by most measures, 2021 was a year of extremism. Mid-caps outperformed the large caps (CSI500 Index easily outperformed the CSI300 Index), sector factor investing (renewables and electric vehicles stocks had outsized returns) became crucial to outperformance and traditional cyclicals (property, steel and shipping) faltered after a strong start. Fortunes definitely favoured the brave who did not stick to the conventional path and moved into uncharted territories in China’s different segments.

The year had begun in the aftermath of a shock government cessation of Ant Financial’s IPO late in 2020, which triggered selling of Chinese internet stocks. The selling was short lived and many Chinese internet stocks reached all-time highs in Q1 2021. However, investors were unprepared for the government’s attempt to balance social goals and economic growth. The resulting implementation of numerous regulations was targeted towards not only the digital economy but also what China feels are the cause of some social ills: the “Three Mountains” of high costs in education, healthcare and property prices.

We believe that investors had definitely underestimated China’s determination towards curbing monopolistic behaviours within the digital economy, protecting data privacy and upholding social commitments. The MSCI China Index (which has more than 40% of its components in internet stocks) was among the worst performing indices globally at one stage, while the predominantly internet focused NASDAQ Golden Dragon Index experienced an even steeper decline. The government was also much more focused on trying to bring down leverage across the corporate sector with significant focus on the property sector. Economic growth has lost significant momentum due to these measures with Q3 2021 GDP slowing down to 4.9% from 7.9% in Q2. Economic data has been mixed as well, with strong exports growth being mitigated by mediocre consumption figures while infrastructure spending was stable.

In the start of 2021, there were hopes that China-US relations would become more cordial after Joe Biden took over the US presidency. Minor progress appears to have been made since Biden came into power but tensions still linger. Huawei CFO Meng Wanzhou did return to China, but Sino-US relations didn’t exactly warm as Xinjiang and Hong Kong continued to dominate headlines while Washington added more Chinese technology companies into its restricted trading list. Issues over Taiwan as well as Chinese companies listed in US are also sources of tension. Taiwan remained a hot topic as China repeatedly warned Taipei not to push the independence agenda; Chinese companies could be delisted in the US unless both US and Chinese regulators can reach a compromise over access to the listed companies’ audit records. These issues are likely to remain contentious for years to come.

Is China still investable? A resounding yes

With a flurry of negative headlines dominating in 2021, investors were constantly questioning whether China is still investable. We would like to highlight a few important points in this debate. Firstly, every two to five years, this question emerges whenever China is viewed negatively. Investors seem to constantly neglect the fact that China, despite its massive size, is still an emerging economy that is constantly evolving. The government is also constantly implementing reforms. However, history has shown that investing when the negatives are overwhelming has been extremely rewarding, such as during the anti-corruption campaign in 2014, the trading suspension scandal during 2015-2016 and the China-US trade war in 2019.

Secondly, it is important to note that China tends to initiate reform, implement regulations and fix economic glitches (in the current case high property leverage) when the country is in a position of strength. The economy has been relatively strong since China recovered from the COVID-19 pandemic earlier than other countries. Employment has been robust and exports are at its strongest ever. Such supportive factors allow China to fix what they view as potential headwinds to future growth.

Thirdly, in term of investing, investors tend to forget that China’s market leaders change every five to eight years, sometimes even earlier. Telecom was the dominant sector (more than 50% of indices) in the early 2000s, subsequently taken over by the banking and commodities sector in the mid-2000s followed by the consumer sector in the early 2010s. And since 2015, the internet sector has dominated every investor benchmark and portfolio. As such, the internet sector has been an easy win for the last five years and investors may have become complacent, neglecting their search for other winners. The internet sector could be peaking but there are still many growing sectors worth investing in China, in our view.

Onshore stocks, and focusing on the right indices and sectors will be key

Our current view is that China continues to have very attractive investment opportunities. But we believe that onshore stocks and focusing on the right indices sectors are the key to outperformance and significant alpha.

Investors in China with the flexibility to position their portfolios generated significant alpha in 2021. Onshore stocks have significantly outperformed offshore stocks and we believe that their outperformance will continue. Onshore stocks have much more structural growth sectors that are expected to drive China’s economy in the next decade. Together with domestic investing merits (such as household portfolio allocation and low penetration of mutual funds) we expect onshore stocks to eventually dominate the portfolios of those investing in China.

As we have been advocating for many years now, the right indices are also important in determining investor portfolios. In our view, an index that has a more favourable tilt towards onshore and mid-caps is a good way to pivot for investors who want to invest in China. Generally, offshore China indices tend to be dominated by one or two sectors while onshore indices are more diversified due to the size of the markets. For example, the market cap for onshore China indices is in excess of USD 10 trillion, spread over more than 4,000 companies; on the other hand, the market cap for offshore China indices is only USD 2.5 trillion, spread over approximately 1,000 investable companies. As new market leaders emerge in China, the indices comprised mostly of the old market leaders might languish until the new leadership stocks (which currently represent less than 10% of indices) catch up.

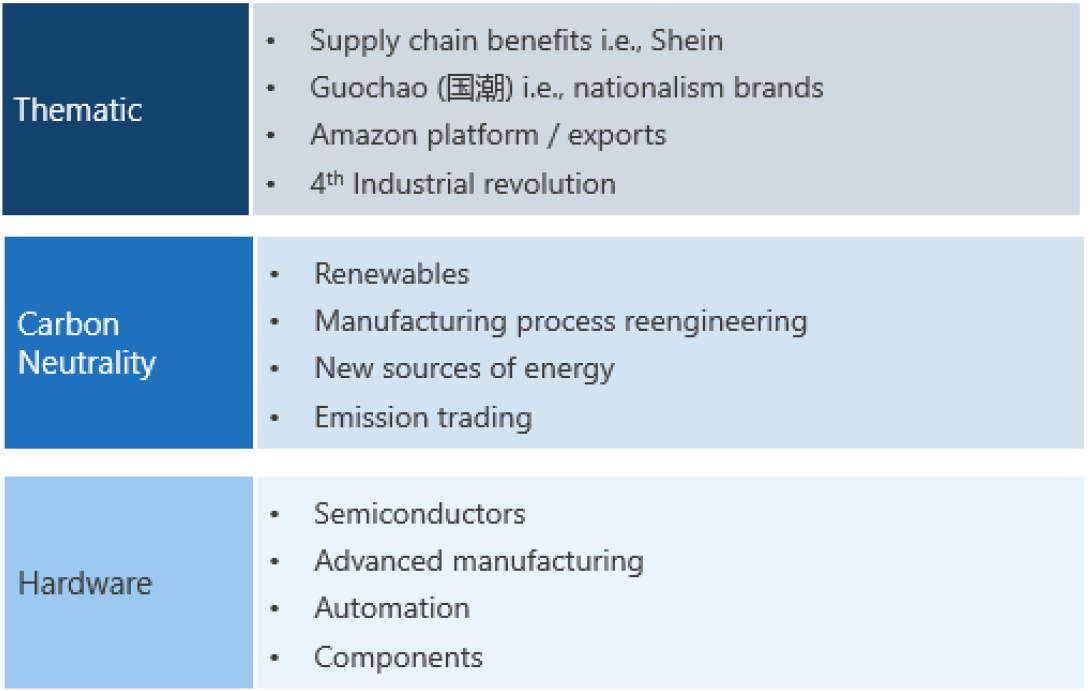

Lastly we maintain our view that focusing on the right sectors is crucial for investing in China. The Chinese economy has reached a size in which the quality of growth, rather than the scale of growth, will be in much greater focus. As a result, significant fine tuning will be required when it comes to capital allocation. This will mean that certain sectors will benefit from China’s growth while others end up suffering. Sectoral allocation and subsequent stock picking within sectors will be key to generating the required alpha, in our view.

Structural growth sectors

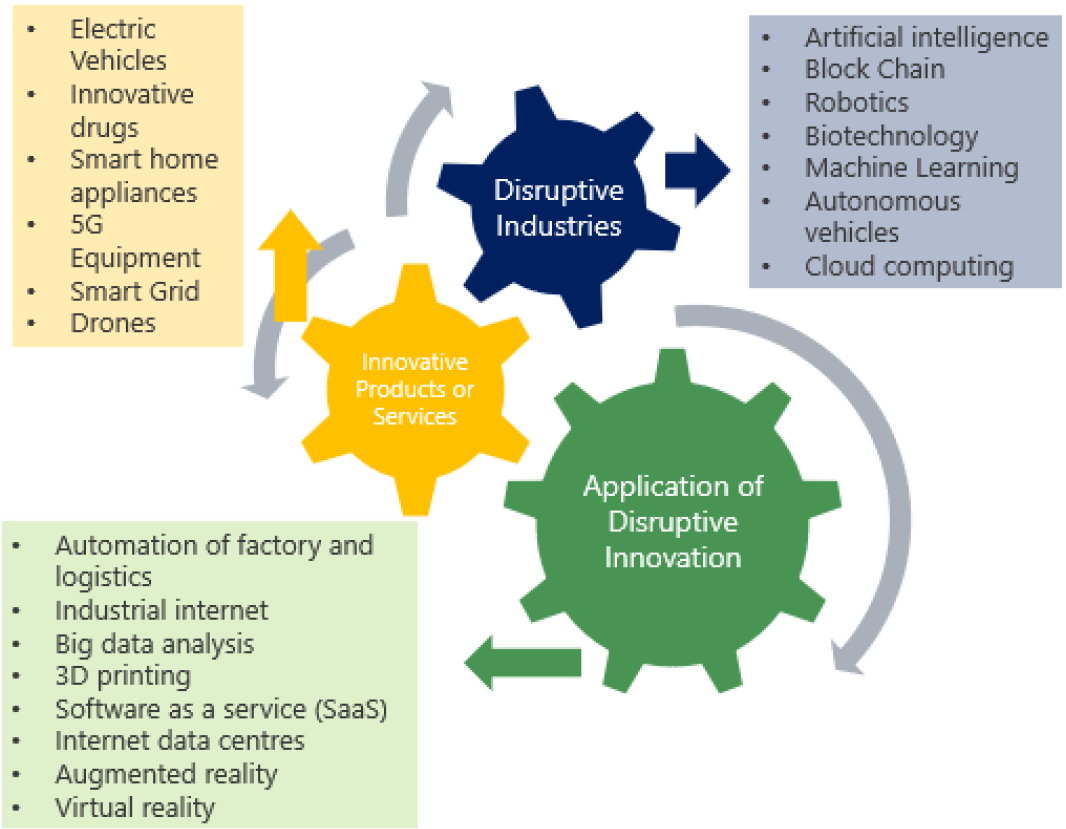

As negative headlines dominated 2021, investors may have largely overlooked the significant number of positive developments in China. The Chinese government has released many positive directives indicating their vision of the economy. These included initiatives directed towards ambitious renewables targets, the continued opening up of the financial sectors and support for a significant number of industries including, but not limited to, artificial intelligence, big data, software, electric vehicles, robotics, 5G and smart grid. We believe these areas could become the new leaders of China’s capital markets, representing investment themes for the next several decades . Our investment thesis is summarised in Chart 1. We also believed that China’s significant advantage in manufacturing (the country already accounts for roughly 19% of global manufacturing output, an all-time high) can be further enhanced as it leverages technology and automation to cement its dominant position in new industries while consolidating its market leadership in old industries.

Chart 1: Our investment thesis for China

Government pivot also a focal point

Even though “common prosperity” has been effectively enshrined in Chinese Communist Party philosophy (or mission statement), the term probably escaped most investors prior to 2021. As investors get around the concept of “common prosperity” and how it will affect the capital markets, it is important to know that China is not going backwards in term of economic development. What the country is seen trying to achieve is balancing economic growth and social stability. This includes keeping corporate profits and employee welfare on an even keel, allocating capital towards more social goods and increasing labour’s GDP share. This is an important philosophy to watch as government policies are likely to be geared towards achieving these goals instead of focusing on the growth at all cost objective. Although the objectives are very broad and difficult to quantify, we believe that if well executed, they could lead to a slower but higher quality, longer lasting growth for China. In the long run, China could be positioned towards gaining a better diversified economic structure.

Risks

China’s outlook may appear favourable thanks to its well-executed manufacturing capability and the government’s efforts to navigate the economy towards more sustainable long-term growth. However, it is hard to imagine a China investment thesis without any risks.

At the top of the list of potential risks is how is China going to reopen to the rest of the world as it continues to pursue its zero-COVID policy. Most countries are adopting a strategy of living with COVID-19 while China is adamant towards sticking to its zero-COVID stance. This presents a problem as China shouldn’t, and wouldn’t, be able to continue shutting itself off to the rest of the world without economic consequences. We are mindful that if China does reopen, the country might experience sharp short-term pain.

Another risk is geopolitics, which remains an element with the biggest uncertainty. Events related to Taiwan have repeatedly become a hot topic for investors as a potential conflict between Taipei and Beijing might end up involving the rest of the world. Our base case continues to be that as long as Taiwan avoids a blatant move towards independence, China is likely to stick to its current response.

The third risk factor for the capital markets is the upcoming 20th National Congress in Q4 2022. With such an important event coming up, the government is likely to accelerate its 14th five-year plan, which could be a double-edged sword. Investors will be able to look forward to a clear path of development but their enthusiasm might prove to be excessive, potentially leading to execution risks.

Lastly, the perennial property leverage issue that has been haunting China since 2011 could throw a spanner into the investment landscape. Despite the assurance by the government, the property sector still accounts for a good quarter of the economy and mismanagement in this area could lead to disastrous consequences.

Summary

In summary, we believe that the markets in China present significant opportunities and that it is important to be very selective. Beta is challenging as the leaders which had dominated the markets for the past six years are now struggling while the next market leaders will need time before they become big enough to have an impact. It is important to be mindful of the risks but not get swayed by headlines. We retain a heavier focus on onshore stocks, structural sectors and bottom-up stock picking.