Sustainable fixed income

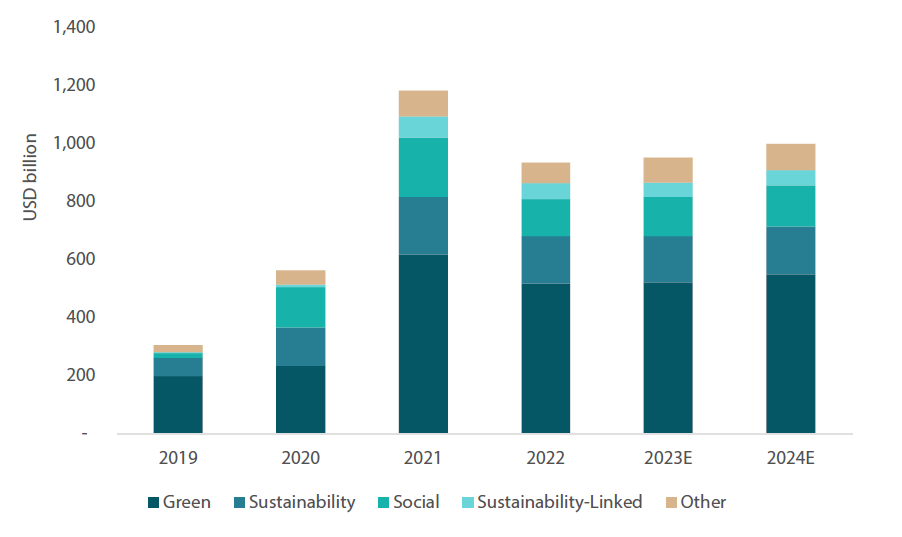

The scale and the maturity of the sustainability fixed income universe mean that any investor taking a “best in universe” approach when constructing a diversified fixed income portfolio would have to consider this segment, as it represents around 15% of global fixed income issuance. Moreover, that percentage looks set to increase significantly. We anticipate that across all fixed income asset classes (including municipals), sustainable bond issuance should exceed US dollar (USD) 900 billion in 2024. There is also potential for an even further significant uptick in issuance, particularly in the second half of 2024, which could result in a record-breaking year, as both corporate entities and sovereign agencies seek to capitalise on the more favourable lower interest rate environment.

Chart 1: Green, sustainability and social bond issuance

Source: Nikko AM, Bloomberg ICMA labelled bonds with Use of Proceeds field as of December 2023

Despite the positive outlook for sustainable bond issuance, it is important to note that the market landscape for sustainable bonds still poses certain challenges, among them the political environment in the US. Environmental, Social, and Governance (ESG) considerations have become a third rail of US politics, and an anti-ESG movement is being leveraged as a campaign platform by the Republican Party. This has led some corporations to exercise caution when undertaking ESG initiatives or promoting sustainable bond issuance. However, we think that this pause will give companies the opportunity to refinance capital at lower interest rates further down the road.

It is worth noting that the green energy sector struggled in 2023, partly due to rising interest rates and inflation impacting the cost of capital and materials. Consequently, some green energy exchange traded funds (ETFs) have experienced significant declines. However, despite these challenges, we believe that, from an economic perspective, onshore wind and solar power remain cost-effective options for energy production compared to fossil fuels.

Looking to 2024 and beyond, a wave of regulations is on the horizon, aimed at enhancing transparency and curbing the risk of “greenwashing” in sustainable finance. One example is the Corporate Sustainability Reporting Directive (CSRD) in Europe, finalised in 2023 and taking effect in 2024. Under the CSRD, large public companies will be required to start collecting sustainability data, with the first disclosures expected in their 2025 annual reports. In subsequent years, the CSRD will expand its coverage to include more companies that do business in Europe, including those with subsidiaries in the Eurozone. Non-compliance with these regulations could result in fines.

Despite the potential regulatory challenges, the sustainable bond market is poised for significant growth. The base case anticipates an issuance of USD 900 billion to USD 1 trillion annually, with the current market size at approximately USD 4 trillion. It is conceivable that, even with conservative growth estimates, the market could reach USD 10 trillion by 2030. This market expansion is likely to be driven by the increasing awareness of the economic benefits and job creation associated with sustainable finance, making it politically challenging to curtail green energy finance efforts.

Moreover, the surge in private capital investment in renewable energy is driven by straightforward economic considerations, and the attractiveness of solar and onshore wind from a financial perspective is undeniable. The cost-effectiveness of these energy sources, coupled with the potential for stable and profitable returns, is a compelling reason for private capital to continue to flow into the sector.

Core markets outlook

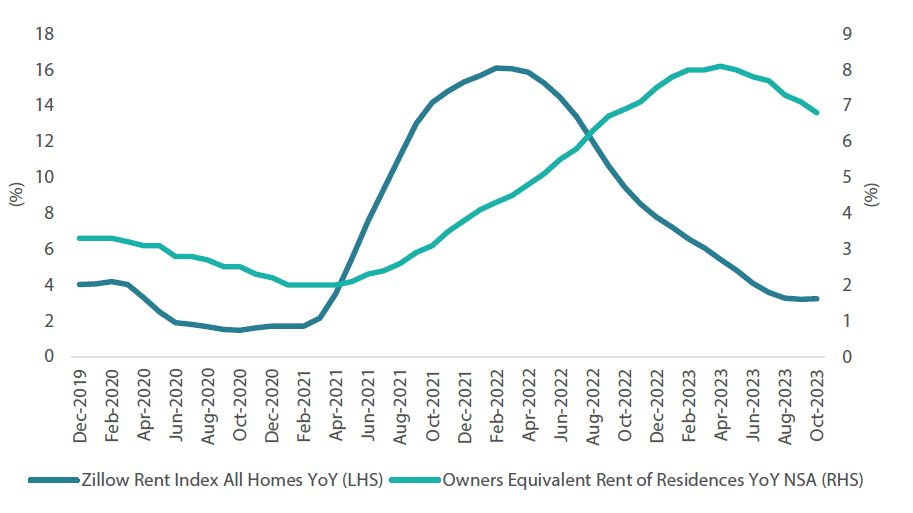

At the beginning of 2023, investors were focused almost solely on when inflation would be tamed. However, 2023 can only be described as a period of disinflation, and inflation is now on a path back towards central bank target levels. As we enter 2024, we expect this trend to continue. We see the housing portion of core inflation, in particular, as likely to cause overall core inflation to fall; this is evident from online indices such as the Zillow Observed Rent Index (ZORI) and the owners’ equivalent rent (OER) component of the consumer price index (CPI) (Chart 2). Both ZORI and OER have a lag of approximately 12 months between changes in housing costs and when they are reflected in the core inflation rate. Given this lag effect, we expect core inflation to decline dramatically in 2024.

Chart 2: Owners’ equivalent rent of residences vs Zillow rent year-over-year percentage change

Source: Bloomberg

As with every year, the Federal Reserve (Fed)’s actions and statements will be followed intently in 2024. It is worth noting that the Fed has never cut rates while core CPI inflation was above 2.7%. Yet, when looking at market-implied pricing for 2024, expectations point to rate cuts in roughly 25-basis-point increments during the second half of the year. This would be an unfamiliar action from the Fed, which usually cuts in 50-basis-point or greater increments. Should circumstances dictate a rate cut, we would expect the Fed to act aggressively. It appears to us that the market is not fully factoring this possibility into implied rates.

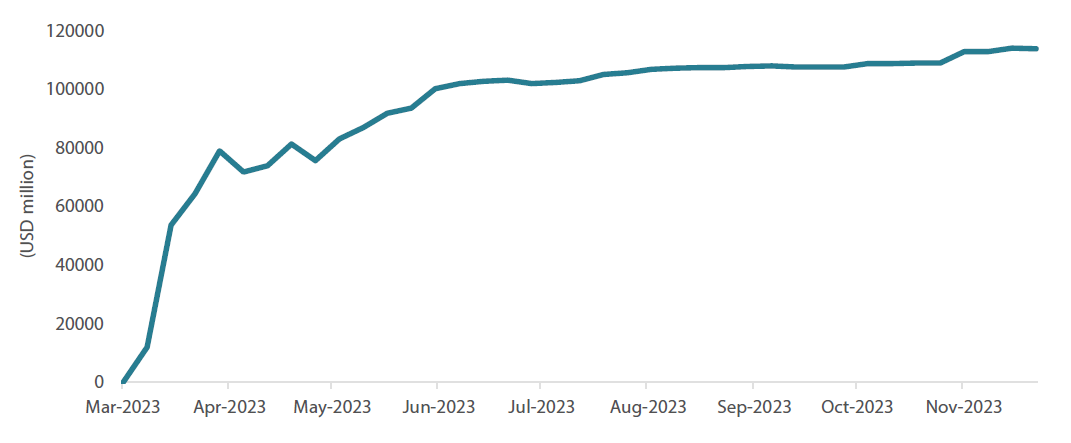

Looking into 2024, there are a few potential concerning developments. For example, in the second half of September 2023, the Fed’s Bank Term Funding Program (BTFP) became the largest federal credit facility. This was after loans to depository institutions that had been placed in Federal Deposit Insurance Corporation (FDIC) receivership dropped significantly. The surge in BTFP usage (Chart 3) suggests ongoing challenges and concerns in the commercial real estate sector, particularly in relation to loan defaults. We think default rates will continue to pick up in 2024, which could have far-reaching implications for the financial stability of banks and the broader economic system. Banks often have a substantial portion of their loan portfolios tied up in commercial real estate investments. These loans are typically structured with a fixed term, and a significant portion of outstanding loans are set to mature or “roll over” in 2024. Banks will need to decide whether to renew these loans or not. Therefore, the focus will be on hidden or less apparent losses inherent in bank loan structures, particularly in the context of long-dated and long-duration commercial real estate lending portfolios, especially among regional banks, which were an area of so much concern during the early months of 2023.

Chart 3: Fed Bank Term Funding Program

Source: Bloomberg

While the Fed and the FDIC acted decisively to prevent further systemic issues at that time, questions remain as to whether the Fed will choose to renew or continue the BTFP. If it chooses not to, it could trigger significant disruption in the financial system. Therefore, we anticipate that the Fed will be compelled to extend the facility to maintain banking sector stability.

It is also worth noting that before any interest rate cuts occur, we expect the Fed would need to step back from its quantitative tightening (QT) measures. In terms of timing, market indicators and implied expectations suggest that such a change in Fed policy could take place as early as the second quarter of 2024. This pause would be an important signal to the market and could influence expectations about the future path of interest rates.

The US yield curve has been inverted (when short-term interest rates are higher than long-term rates) approximately 12% of the time since 1980. Notably, the current yield curve inversion is the longest on record and approximately a quarter of this inversion period has occurred since the summer of 2022. Looking ahead, we expect the yield curve to move towards a “bull steepener” scenario, which implies that long-term interest rates will rise faster than short-term rates. In this context, we would anticipate potentially double-digit returns in investment-grade (IG) sovereigns and corporate credit. The two-year US Treasury yield could serve as a key indicator of market sentiment around future interest rate movements. Understanding these dynamics will be essential for investors hoping to navigate the fixed income market in 2024.

Returning to central bank activity, we expect the European Central Bank (ECB) and the Bank of England (BOE) will begin to reduce interest rates ahead of the Fed, especially given recent Purchasing Managers' Index (PMI) data suggesting weaker economic conditions in the Eurozone and the UK. On a relative basis, we expect a softer dollar early in 2024 before strengthening as regional weaknesses become more apparent. In Japan, we question the Bank of Japan (BOJ)'s ability to lift its yield curve control policy, especially when considering other central banks worldwide are expected to halt or reduce their QT efforts. We suspect the BOJ will find it challenging to raise interest rates beyond their current extremely low levels, thereby falling short of market expectations. We also think the BOJ may be out of sync with prevailing market expectations and global economic conditions. The current implied pricing in the market and the BOJ's policy path seem incongruent, particularly in the context of a global economic landscape marked by the possibility of recession.

In summary, we are approaching an inflexion point in the economic cycle, when rates are about to turn lower. Given the anticipated volatility in fixed income markets during this transition period, active management becomes crucial. Europe's economic slowdown relative to the US is one notable trend, and smaller countries such as New Zealand and Canada are also potential considerations due to their slowing economic conditions. We believe that the environment in 2024 will create opportunities for active management and relative value positioning across various countries and yield curves. We also think longer duration could be the optimal positioning for fixed income portfolios.

Credit markets outlook

Three crucial factors need to be accounted for when we discuss credit market positioning for 2024: the fundamentals of companies in our investment universe, the technical factors impacting the market and valuations in the global credit market.

Starting with fundamentals, over the last few quarters we have observed some deterioration in US credit. First and foremost, interest rate coverage ratios have come under pressure, which is not surprising given the shift in rates. Companies in Europe are usually more conservative when it comes to their financial policies and we have not yet noticed deterioration in Europe.

For the coming months, we expect fundamentals to remain stable, or to stabilise (in the US), as higher rates will only slowly feed into interest costs as a lot of companies have termed out debt in recent years and do not have a real need to issue more now. Nevertheless, we are currently more confident about the fundamentals of IG companies and prefer to be cautious on high yield (HY) issuers. The latter might be more affected by higher rates as many companies will have refinancing needs in 2024.

We expect that market technicals will remain stable in 2024, particularly should bond supply start to decline. During periods of weaker growth, companies generally have reduced capital expenditure needs, less appetite for mergers and acquisitions and lower pay-outs to shareholders. These factors should all reduce bond issuance in 2024, in our view. Furthermore, we expect some corporate treasurers to time the bond market and wait for lower rates before they tap it. While we expect the supply side for bonds to shrink, we see demand for bonds rising, given the attractive yield levels across the credit universe.

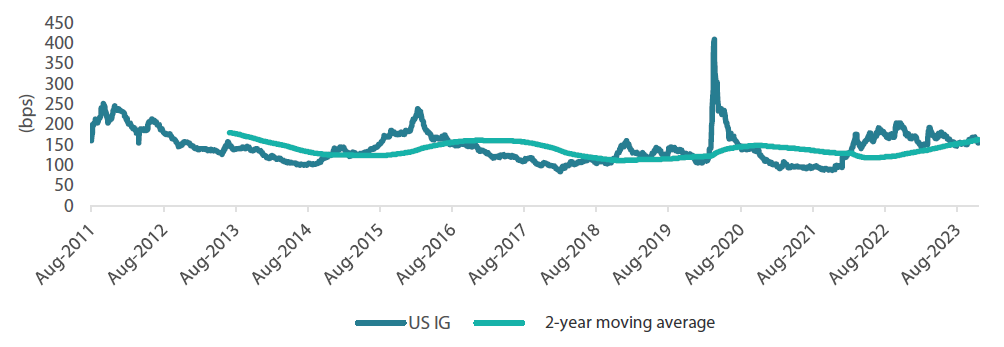

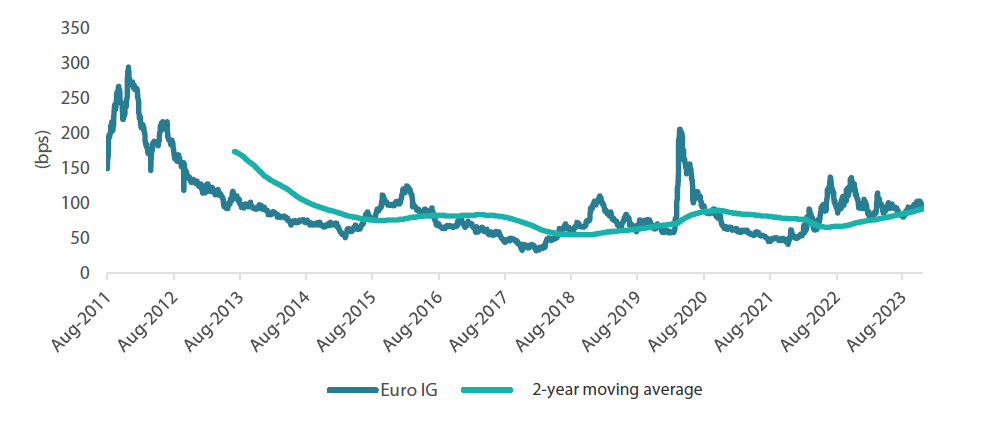

The third important aspect to consider when discussing credit market positioning in 2024 is valuation. At the moment, we would view credit market valuations in the US (Chart 4) and Europe (Chart 5) as fair, with both IG and HY bonds trading around long-term averages. However, all-in-yields are at an historic high level, which creates strong demand for the asset class from “buy-and-maintain” bond holders, including pensions and endowment funds.

Chart 4: US Investment grade credit spreads

Source: Bloomberg as at 20 November 2023

Chart 5: Euro investment grade credit spreads

Source: Bloomberg as at 20 November 2023

We expect credit market fundamentals and technicals to remain benign while spread valuations can at least be described as fair. This leads us to a positive view for credit in 2024. Nevertheless, we have a strong preference for IG over HY. We also have a preference for Europe over the US, as we expect European issuers to approach 2024 with more conservative balance sheets compared to their US peers.

For total-return focused strategies, our favourite part of the credit curve remains the short end. For those strategies focused on relative performance rather than total returns, we think 30-year bonds look most attractive. In terms of sector exposure, we continue to favour Tier 1 banks in the US and Europe after a strong earnings season where the effects of higher rates have continued to drive up profits. We feel more cautious on cyclical sectors, including energy and basic industries. We still view hybrid bonds as attractive with the extension risk for most issuers declining as the primary market for these bonds re-opens.

All in all, we expect 2024 to be a fruitful year with interest rates declining and spreads proving stable.