Core markets outlook

It is always darkest before the dawn. As we close out one of the most difficult years for global fixed income in recent memory, we are finally seeing the light at the end of the inflation tunnel, with price rises in the US seemingly having peaked over the summer of 2022. If the buzzword in 2022 was “transitory”, we expect “pivot” to be the key word in 2023. We anticipate significant disinflation in the US, with the rise in the November 2022 headline CPI continuing to slow from a year earlier, to be followed by several subsequent months of further slowdownsin 2023. While we believe inflation is on a clear downtrend, we doubt the Federal Reserve (Fed) desires to change course lest it repeats its mistakes from the 1970s when it was seen to have pivoted too early. Meanwhile, inflation is likely to persist in Europe for several more months before the trend shifts in the first quarter of 2023 amid an expected economic contraction. Even though they are seemingly loathe to admit it, the Fed and the European Central Bank appear to have accepted that inflation will not be tamed without economic pain, as the risk of recession rises with higher rates and inverted yield curves. Deutsche Bank points out that any time inflation has declined by more than two percentage points, it has been accompanied by an inverse rise in the unemployment rate of major industrial economies. That said, economic realities have changed because of the pandemic. Boomers are exiting the labour force in increasing numbers and we are likely to continue seeing a persistent labour shortage for the foreseeable future.

We remain concerned about a potential global housing crunch; rather alarming price declines have already been observed in Sweden, where prices have fallen 14% from their peak in June 2022. In the US, where mortgage rates are around 7%, the residential real estate market has seized up with refinancing and purchase activities at lows not observed since the Global Financial Crisis. A housing downturn is already underway with estimates of price declines in the double-digits. A protracted global downturn in housing is a risk to growth as the wealth effect will cause a significant drag on consumer spending. However, housing equity remains relatively robust and the persistent labour shortage is seen limiting the impact on unemployment.

The dollar is likely to remain challenged in 2023 as we believe that the Fed will end its rate-hiking cycle in December of that year. Additionally, we think the Fed will likely have to pivot on quantitative tightening (QT). We anticipate it will halt its balance sheet unwinding sometime in the second quarter of 2023 as US banking reserves continue to decrease in line with the pace of QT; at this rate, reserves will also fall through the Fed’s stated minimum target of USD 2 trillion-2.5 trillion.

Regarding geopolitics, we expect China to remain an outlier as continuing COVID lockdowns coupled with growing civil unrest raise doubts over its ability to maintain a zero-COVID policy while the rest of the world moves on from restrictions. Russia is likely to remain a persistent threat. However, Ukraine appears to be making significant progress in retaking key positions previously occupied by Russia. If Ukraine continues to retake territory at the current pace, we could see a negotiated agreement by the middle of 2023.

Peak inflation could coincide with peak rates early in 2023, potentially allowing fixed income markets to generate both attractive carry returns and sizeable capital gains.

Emerging markets outlook

2022 was the year when a number of underlying tensions matured and combined to create an adverse environment for most asset classes, including emerging market (EM) debt. One key factor that contributed to the adverse environment was a belated yet precipitous reaction to runaway inflation and QT by developed market central banks. But perhaps most important event of all was the boiling over of the inherent instability of Russian President Vladimir Putin’s regime, which had devastating humanitarian and economic consequences. Indeed, Russia launched its (largely unsuccessful to date) full-scale invasion of Ukraine in February 2022. In reaction, the West imposed on Moscow financial and commercial sanctions at an unprecedented level with the intention of constraining the Russian economy and preventing its military from accessing Western technology. In response, Russia has weaponised its commodity supplies, basically cutting off gas to Europe. This, along with China’s difficulty in handling the pandemic and other remaining supply chain bottlenecks, has led to the greatest cost-of-living shock to grip the world in decades. The war in Ukraine has also caused food prices to rise. Indeed, Russia and Ukraine produce over a quarter of the world’s wheat between them. In emerging markets, where disposable incomes tend to be lower, a higher proportion of income is spent on food. Therefore the effects of food inflation were felt more, even triggering periods of social unrest in some African countries.

Unsurprisingly, EM Europe is currently the region with the weakest growth outlook, given their historically higher reliance on cheap Russian energy. In contrast, the largely commodity-exporting Middle East, South East Asia (Indonesia, Malaysia, Philippines, Vietnam etc.) and Latin America have benefited, even with the US Fed Funds rate expected to reach 5% in 2023. All in all, emerging market growth, while weak and well below the boom years of the mid-2000s, is forecast to remain resilient at 3.7%, above the level seen in 2019. As a result, the growth differential between EM and developed markets is set to pick up in both 2023 and 2024 to levels last seen in 2016. Slightly belowtrend growth and elevated commodity prices are expected to generally narrow EM current account balances in 2023. Also, inflation could be peaking, and central banks are ending their hiking cycles, offering some optimism for EM rates investors. On the downside, persisting fiscal deficits will continue to lead to higher EM debt ratios at a time when financial conditions are likely to remain restrictive.

In Asia, we like India, Indonesia, Malaysia and the Philippines as these countries look set to remain resilient in terms of growth momentum, even surprising to the upside. We remain positive on Mexico for its close integration with the US economy and the robust flow of associated remittances. Mexico also has a low reliance on energy imports and relatively low levels of FX-denominated debt and could, therefore, be more resilient even if global growth is disappointing. Obviously, energy exporters such as the Gulf nations are set to benefit in terms of growth and external accounts from currently elevated fuel prices, offering EM investors some kind of safe haven within the asset class. Concerning Latin America, we expect Brazil and Uruguay to continue to benefit from high food and soft commodities prices. On the contrary, growth in Chile and Peru could remain depressed for a longer period given theirstrong trade ties with China. Hence, we currently have a favourable outlook of the local rates markets in these countries, but the benign view could extend into growth-driven assets (such as FX and credit) if China finally breaks its COVID-19 deadlock. In central Europe, we expect duration to outperform FX as most economies will likely face a recession, while inflation could fall from 1Q2023 onwards. Also, a weaker US dollar should support the euro and thus alleviate financial stability risks in the region and ultimately lead central banks to turn more dovish.

We could even see some EM central banks starting to ease their monetary policy in 2023 even though most look set to keep rates high for longer. Easing cycles could start in Latin America (Brazil, Chile, Colombia and Peru), the Czech Republic and India. The rest of EM Asia, having lagged its EM peers in lifting off, is expected to stay on hold in 2023.

Global credit outlook

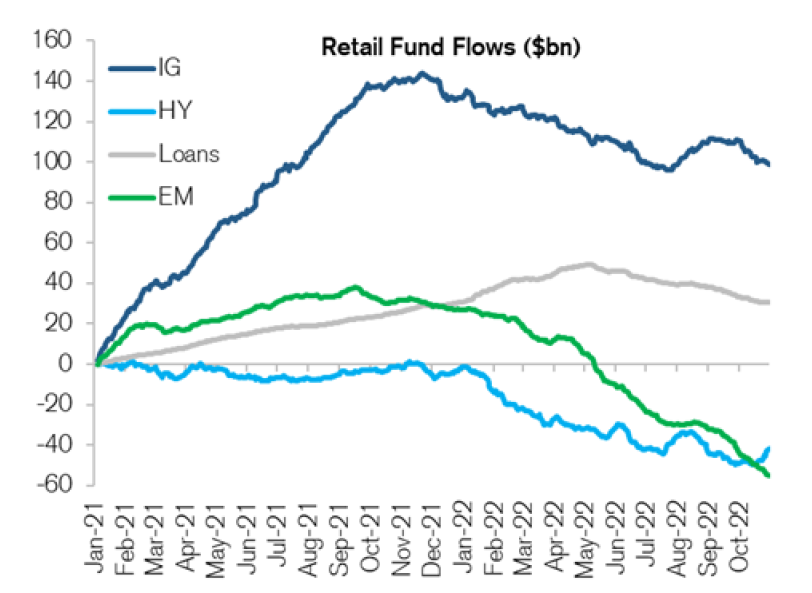

2022 has been a difficult year for global credit markets, with all fixed income segments posting negative total returns. Investment grade suffered more than high yield, as the former’s higher interest rate sensitivity added pressure on bond prices. The pressure on corporate bonds came from different directions with higher central bank rates across the globe being one of them. Other factors that impacted global credit markets in 2022 included a weak technical picture—as credit funds suffered record outflows—and fears towards inflation damaging corporate earnings.

In this environment, sectors which were highly rates sensitive, i.e. real estate, as well as sectors impacted by higher inflation and supply chain disruption, i.e. basic industries, felt most of the pressure. On the other hand, the energy sector was shielded from credit market volatility as most companies within the sector benefitted from stronger energy prices.

Spread curves flattened across the global credit markets in 2022, while shorter duration bonds still managed to deliver better total returns than their longer duration peers.

For the coming months, the crucial question is if corporate bonds will be able to stabilise and begin performing positively again and which areas of the market could outperform.

One pre-requisite for stabilisation is peak inflation being reached, which should also go hand in hand with a peak in interest rates; we expect this point to be reached in the first half of 2023. Thereafter we expect credit markets to focus on the attractive build up in risk premium which took place over the course 2022. Considering the current state of play, premiums in investment grade are even more attractive than high yield and therefore our investment focus will be on the former. The high yield space might see spreads widening over the coming weeks, therefore for the time being we have a more favourable view of investment grade. In particular, the short-end of the credit curve looks attractive for investors with a strong focus on total returns.

In terms of sectors, we expect hard-hit sectors like real estate to outperform along with a stabilisation in interest rates; we also see banks performing positively. Solid earnings reports have only provided banks with limited support in 2022 but we expect the situation to change over the coming months.

On the flip side, energy bonds look now expensive after being the top performing sector in 2022. We also view utilities with caution as companies in the sector might be negatively impacted by windfall taxes as governments globally try to replenish their budgets.

In 2023 we see limited headwinds from bond supply as most companies have termed out debt over the last few years and now have the freedom to wait until corporate bond spreads return to more favourable issuance spreads. However, one area of uncertainty will be the flow of funds. A key question is whether a stabilisation in performance of the asset class will also stop investors from withdrawing funds. Historically, fund flows have followed performance and therefore we remain optimistic that the outflows will end.

Source: Credit Suisse, EPFR

All in all, we approach 2023 optimistic after a difficult and volatile 2022 which saw most asset classes delivering negative performance numbers. As outlined above, we expect stability to return in 2023; we therefore view investment grade corporate bonds as particularly attractive, with focus on the short-end, real estate and banks.