Summary

- We believe that the benign macro backdrop should remain supportive for credit fundamentals in 2023. The fiscal deficits of Asian economies are expected to gradually narrow as the need for pandemic support decreases. India and ASEAN economies, supported by a revival in tourism and domestic re-openings, are expected to fare better than their export-dependent North Asian peers. The growth/inflation trade-off resulting from a rebound in China’s domestic demand and a modest pickup in global external demand could lead to a better outcome for Asia.

- We believe there is room for Asia credit spreads to tighten in the early part of 2023 given global investors’ light positioning, as well as the potential for fresh capital and risk allocation to the asset class at the start of the year. This comes against the backdrop of some positive catalysts, including a potential slowdown in rate hikes by the Federal Reserve (Fed) and policy shifts by China in certain key areas including COVID-19, the property sector and internet platforms.

- The key downside risks to Asian credit in 2023 include inflation across major economies being more persistent than expected, backtracking of China’s easing policies on COVID and its property sector, and local funding and credit market stress. One or more of these downside risks materialising may cause Asia credit spreads to widen from current levels.

2023 Asian Credit Outlook

Fundamentals

Macro

The year 2022 delivered adverse economic conditions that led to a surge in inflation, prompting a hawkish shift from global central banks. This in turn resulted in tightening of financial conditions and a dramatic rise in the US dollar. With the significant tightening of real yields, the loss of momentum by the US housing market and a slowdown in some longer leading indicators are signalling a broader slowdown of the economy. These factors, together with US dollar strength weighing on import prices, support the view of downside pressure to inflation increasing. Global markets await the Fed’s pivot and most are convinced the initial phase of this could be near. In addition, monetary policy outlook is expected to persist as the primary driver of global rates moves in 2023. We believe that a Fed pivot will prompt a decline in global bond yields.

Over in Asia, inflation remains above the upper tolerance of most central banks. As the Fed decelerates the pace of tightening, demand for the US dollar together with inflation expectations will likely soften. This will in turn provide room for monetary authorities in the region to temper the pace of interest rate hikes or even pause monetary policy tightening for those central banks which have so far been relatively more aggressive with policy tightening.

Looking ahead to 2023, economic growth is likely to start on the weak side. As opposed to recent years, fiscal stimulus may no longer be a dominant factor driving growth in the region in 2023 with most economies having opened their borders, coupled with the prospect of slowing global manufacturing cycle and past monetary tightening weigh on activity. Hence, we anticipate fiscal deficits of the region’s countries to gradually narrow as the need for pandemic support decreases. China’s zero-COVID policy stance will be one of the wild cards in terms of the region’s growth outlook for 2023. In our view, China’s relaxation of its zero-COVID policy will likely be gradual in the very near term, with significant policy loosening and a full reopening only possible later in 2023, following the country’s 14th National People’s Congress. Both India and Indonesia could see a recovery in domestic demand involving a pickup in capital expenditure, aided by healthy balance sheets and a mix of supportive policies. Thailand and Philippines are expected to benefit from a stronger rebound in tourism activity in 2023. Commodity exporters like Malaysia may also continue to benefit from positive terms of trade thanks to elevated commodity prices. Export-oriented economies like South Korea and Taiwan—and to a lesser extent Hong Kong and Singapore—are likely to show a more delayed recovery as external demand conditions could remain weak in 1H2023. In 2H2023, China’s domestic demand rebound and a modest pickup in global external demand could provide key support. The growth/inflation trade-off resulting from a rebound in China’s domestic demand and a modest pickup in global external demand could lead to a better outcome for Asia.

Asian central banks drew on their large foreign exchanges reserves to help prop up their currencies amid the relentless rise in the US dollar in 2022. Despite the decline in reserves, most Asian countries continue to have adequate coverage. There could be some form of increased fiscal support for Thailand, Indonesia and India in 2023. Thailand is expected to hold general elections in May 2023, while Indonesia and India are scheduled to hold national elections the year after. Nevertheless, the impact is likely to be minimal. Meanwhile, China should remain in focus March 2023 when changes to the top posts at various government agencies, notably the premiership and central bank, are to be announced.

Credit

With 2022 almost over, we believe that the cycle’s peak in credit quality may be behind us. Overall, corporate credit profiles deteriorated, with debt-to-capital and leverage ratios rising and liquidity positions tightening—albeit from very strong levels. The aggressive US hiking cycle has fuelled concerns about the ability of corporate borrowers to adjust to a higher-for-longer cost of funding environment. Unlike the past few hiking cycles, during which Fed and other central banks tightened financial conditions in response to a combination of firming inflation and robust economic growth, the ongoing tightening cycle is unfolding against a backdrop of decelerating growth and persistently high inflation.

However, there is some difference between North Asia and the rest of the region. China and Hong Kong saw lower earnings and weaker credit profile while other regions had strong growth, led by economies with higher exposure to energy and commodities such as Thailand, Malaysia and India. China corporates saw earnings decline with the exception of oil and gas majors but Asia high-yield (HY) saw slower overall earnings growth. Nevertheless, credit profile outside China HY property saw improvement, due to lower debt growth from more disciplined debt management amid the economic slowdown.

The benign macro backdrop is expected to remain supportive for credit fundamentals in 2023. Rising rates will no doubt increase debt service burdens for Asia corporates. But the impact on credit fundamentals is seen as manageable across most countries and sectors, although some divergence is likely. Overall debt levels, gearing and leverage are not likely to pick up meaningfully as many sectors, in particular China real estate, remain focused on deleveraging and managing liquidity. Furthermore, even fundamentally strong Asian high-grade (HG) companies are likely to moderate their capital expenditure as well.

Commodity prices are likely to remain favourable for stronger energy companies, thus supporting earnings in upstream industries such as oil & gas and metals & mining, with expectations of moderate to higher EBITDA and stable debt levels leading to moderate to lower leverage. Nevertheless, high yield names could be more vulnerable to more volatility in prices amid global recession concerns. Fundamentals for technology companies should remain stable, supported by a strong user base and recently loosened regulations stimulating economic growth. On the other hand, hardware companies may face some deterioration in fundamentals due to weaker demand. Tourism-oriented service companies such as airlines, airports and mall and hotel operators could experience growth given the re-opening of borders and a low base of comparison. Indian corporates are expected to continue seeing strong re-opening demand across sectors. While increasing raw materials costs and higher inflation have weighed on margins, growth in general have led to lower leverage.

China real estate developers are expected to experience declining revenues and lower EDBITA margins. The sector may continue to face weak sales, and liquidity pressure could keep impacting the weaker developers. However, there have been signs of Chinese authorities stepping in to stabilise funding access amidst the focus on project delivery and market sentiment in an attempt to prevent an overcorrection which in turn could trigger systemic risks. More demand-oriented expansive support from the authorities may be needed to bring about any meaningful recovery in new home sales. In Macau gaming, a recovery in gross gaming revenues likely depends on an expected return of group tours which could be slow at first but may pick up towards the summer of 2023.

In general, the asset qualities of Asian banks are likely to be stable or improve in 2023 as economic activity normalises under a full economic reopening in most regions. Amid higher interest rates, we think that moderate increases in credit costs within any single sector/industry would be manageable in 2023. Small and medium size enterprise (SME) loans and personal loans may weaken amid higher interest rates. Nevertheless, some Chinese financials may face challenges; continued asset quality deterioration is expected to be cushioned by a still adequate capital buffer and decent profit. Thai banks could see some pockets of weakness with asset qualities remaining under pressure despite supportive policies.

We expect a more positive tone towards reopening by China to support credit fundamentals. This should benefit the rest of Asia, partially offsetting the impact from a potential slowdown in the US. We expect to see greater differentiation between Asia HG and Asia HY, as well as within Asia HY. Within Asia HG, spreads are expected to be range bound with a tightening bias. On the HY side, the differentiation within sectors will likely continue in 2023. In the near term, we expect China’s property sector and company fundamentals to remain weak, but they also present opportunities in select sections of the market. In the medium term, we expect urbanisation and household formation to improve the sector’s outlook. We continue to prefer higher quality developers as they may benefit more directly from any easing of government policies. Furthermore, the health of the Macau gaming sector as well as China’s consumer and real estate sectors is expected to be heavily dependent on how China’s zero-COVID policy plays out. Asian HY corporate default rate is expected to moderate to 10.0% in 2023 from 16.0% YTD in 2022; the Chinese property sector has already experienced two years of significant default rates although going forward, much depends on the developments around several highly distressed real estate companies and the timing of any default events.

Valuations

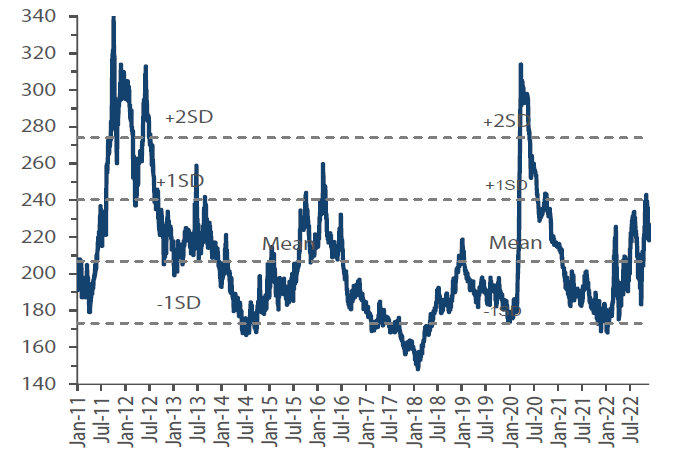

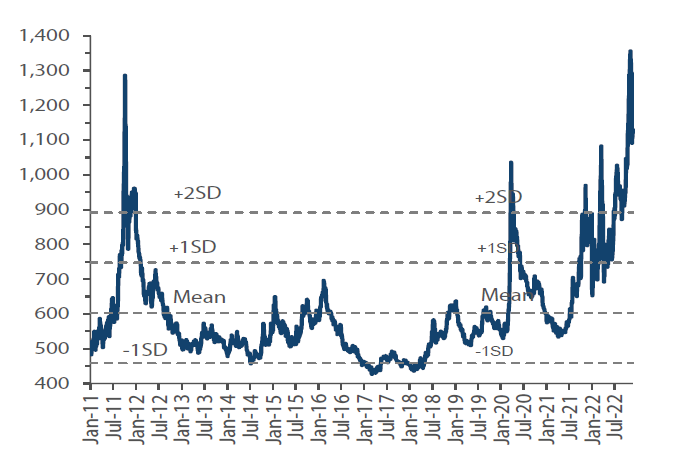

Asia credit spreads widened in 2022, with Asia HY significantly underperforming Asia HG for the second year running. Weaker global risk sentiment in response to the relentless rise in inflation and hawkish central banks contributed to the widening in Asia credit spreads, even though macro and corporate credit fundamentals across most of Asia, with the notable exception of the China property sector, were resilient through the year. The collapse of the China property sector with primary housing sales falling precipitously and most privately-owned developers shut out of the capital markets both onshore and offshore, led to rising distress and defaults, with the pressure spreading to even the strongest investment grade issuers. China’s perseverance with its zero-COVID strategy and resulting lockdowns and severe movement restrictions also weighed on consumption and private sector confidence more broadly. The announcement of some fine tuning measures to optimize COVID controls and a more comprehensive policy package to support the property sector in November 2022 helped pare back some of the year-to-date weakness, but spreads remain meaningfully wider on the year. The unprecedented spread widening of China HY real estate, coupled with the fragile global risk sentiment, led overall Asia HY spread surging 578 basis points (bps) to 1,272 bps, from 694 bps at end-2021. The Asia HG spread, meanwhile, widened only 43 bps from end-2021 to 218 bps, which is just above its historical mean.

The current Asia HY spread is no doubt attractive in our view, both relative to its own historical levels as well as to Asia HG. However, meaningful spread tightening would require some easing of global financial conditions in 2023, in addition to follow-through on China’s exit from zero-COVID and more expansive support for the property sector, in particular demand-oriented measures to revive new home sales.

Within Asia HG, there has been some decompression by rating quality in 2022 due to the weaker risk environment with concerns about the macroeconomic outlook also impacting some weaker BBB-rated credits. As a result, the BBB-rated spread differential over A-rated has widened to 108 bps currently, from 85 bps at end-2021, and above the last five-year average of 89 bps. As the current spread already incorporated some downside risks, there is scope for rating compression within Asia HG in the latter part of 2023 assuming a mild recession scenario in the US and Europe, coupled with further relaxation of COVID measures and decent growth recovery in China.

| Chart 1: Asian High-Grade Spread | Chart 2: Asian High-Yield Spread | |

Source: J.P. Morgan, Bloomberg, as of 21 November 2022 |

Source: J.P. Morgan, Bloomberg, as of 21 November 2022 |

Technicals

We expect a favourable technical backdrop for Asian credit at the start of 2023. Global and regional investors wer cautious on Asia credit though most of 2022, particularly after perceived inaction by the Chinese authorities after the Party Congress in October 2022. The apparent policy shifts on COVID management, property sector and internet platforms triggered a sharp short-covering episode in November 2022, but global fund managers’ positioning in Asia credit likely remains light, with large cash buffers to be deployed once there is more visibility on key China policies as well as the Fed’s policy trajectory. The beginning of 2023 is also likely to bring fresh capital and risk allocation from long-term institutional investors such as insurance companies and pension funds seeking the historically attractive yields currently offered by high quality global fixed income products, such as Asia HG.

onshore funding alternatives (particularly in China and India) have resulted in very subdued primary issuance in Asia USD credit in 2022. With some of these drivers likely to reverse partially in 2023, particularly in the second half of the year, we expect slightly higher gross supply of around USD 150 billion to 180 billion. As with 2022, a large part of the gross issuance will be for refinancing, leaving net issuance at a manageable level of USD 25 billion to 50 billion. Chinese property US dollar bond issuances are likely to remain largely absent, while issuance from quality China state-owned enterprises (SOEs) and Indian corporates are likely to remain subdued. However, we expect higher issuance from South Korea (financials, quasi-sovereign, utilities) and steady supply from Indonesia and Philippines sovereign.

Strategy

We believe there is room for Asia credit spreads to tighten in the early part of 2023 given global investors’ light positioning, as well as the potential for fresh capital and risk allocation to the asset class at the start of the year. This comes against the backdrop of some positive catalysts, including a potential slowdown in Fed rate hikes and China’s policy shifts in certain key areas including COVID management, property sector and internet platforms. Once the initial wave of inflows and deployment are over, the evolution of Asia credit spreads could become more tentative and there could be more volatility from 2Q 2023 onwards depending on the developments of growth and inflation, and consequently monetary policy, in the developed markets.

In our base case, disinflation is likely to become a stronger narrative in the US as we move through 2023 as the lagged impact of monetary policy tightening on aggregate demand begins to be felt more keenly, while normalisation of global supply chains continues. Base effects, particularly for energy inflation, is expected to play a positive role as well. The US economy is likely to experience a mild recession sometime in 2023, although the timing is uncertain, with the resilience of consumer spending particularly difficult to predict. The balance of risk between a soft (very weak growth but no recession) and hard landing (more severe recession) scenarios seems even at this point. In our base case, UST yields should move lower gradually through 2023, with the yield curve steepening towards latter part of the year.

China’s policy shifts should support growth recovery in 2023, although risks around implementation and policy predictability remain. To be sure, China’s exit path from its zero-COVID approach is likely to be gradual and stop-start in nature given the population’s low natural immunity and the country’s moderately equipped healthcare system. China’s determination to follow through on the relaxation of COVID measures and expanding support to the property sector beyond just financing to demand oriented measures to revive new home sales growth is expected to be critical for sustaining positive investor sentiment towards China credits, both HG and HY. At the same, while geopolitical tensions seem to have stabilised following the meeting between US President Joe Biden and Chinese President Xi Jinping in Indonesia late in 2022, latent risks remain, particularly around technology and the Taiwan issue.

Macro and corporate credit fundamentals across Asia ex-China are expected to stay robust, albeit weaker given the softness in exports, tighter global financial conditions and higher domestic interest rates. India and ASEAN economies, supported by tourism rebound and domestic reopening, are expected to fare better than export dependent North Asia. Given the backdrop of declining UST yields and still resilient fundamentals, we expect Asia credit spreads to stay within a range after the initial tightening at the start of the year.

There are nevertheless downside risks to the base case scenario, key of which are more persistent than expected inflation across major economies which would lead to a more protracted hiking cycle and a higher terminal policy rate, a more severe economic downturn in the developed economies, backtracking of China’s easing policies on COVID and property sector, and local funding and credit market stress, such as the one experienced by South Korea in October and November 2022. The materialisation of one or more of these downside risks could lead to wider Asia credit spreads from current levels.

Sector outlooks

Financials and non-bank financials

We expect robust capital reserves and strong provisions to underpin the stability of the banking sector despite the macroeconomic headwinds and lingering asset quality risk from restructured loans and loans under moratorium. High household debt (relative to GDP) in a rising rate environment indisputably brings debt servicing ability under the spotlight and raises asset quality deterioration concerns, particularly for Thailand. A bank’s provision for weaker asset quality would weigh on its profitability. As such, among the Thai banks we prefer large corporates over retail and SME banking. That said, economic disruption due to the pandemic has undeniably receded and further normalisation of business activities including tourism, which is a significant sector for Thailand, has been ongoing.

For the fundamentally stronger banks, particularly Singapore banks, the upside continues to be higher interest rates leading to higher net income margin and profitability. However, this benefit is moderated by lower non-interest income such as those from wealth management due to weak market conditions. However, there is much room for improvement in 2023 should inflation remain below expectations. We continue to expect low delinquencies at the Singapore and South Korean banks. However, loan growth is expected to be slow.

The key source of risk for Chinese and Hong Kong banks continues to be their exposure to mainland China’s property sector. While it remains premature to dismiss the risk on the back the various material supportive new policies for the property sector, a majority of the banks have manageable exposure in the low double-digit per cent handle with loans specifically for property development accounting for an even smaller part of the bank’s loan book as well as adequate capitalisation, except for a handful of joint-stock banks. As such, we remain comfortable with the major mainland China banks.

On to India, asset quality has been steadily improving as private sector banks clean up their books and enhance their underwriting and risk management capabilities. Loan growth is expected to persist on the back of an improving operating environment. Indonesian banks may be a bright spot on the back of strong loan growth within a strong economy translating into better profitability as they have ample liquidity. However, loans under moratorium or restructuring remain a lingering risk. For Philippines banks, high inflation is likely to dampen loan growth, thereby limiting the positive impact from higher rates on net interest margins.

Overall, the banking sector is resilient. With strong capital, adequate loan loss buffers, good profitability and robust liquidity, we continue to like banks and find it worthwhile to go down the capital structure of large players with strong fundamentals as non-call risk is perceived as minimal for these bonds.

For non-bank financial institutions (NBFIs), we see opportunities in the asset management companies (AMC) in mainland China as support for these companies remain intact. Elsewhere, insurance companies with significant operations in mainland China look to benefit from the reopening both from greater demand for travel insurance products as well as the return of in-person engagement with customers. However, this would have to be weigh against the mark-to-market losses on financial instruments insurance companies across the board experience amid the weak capital market conditions, leading to poor bottom-line—albeit unrealised. For India NBFIs, business operations are expected to continue to improve, translating to strong financial numbers.

Oil & gas

We expect oil prices to remain high and volatile heading into 2023. The counteracting forces of softer macroeconomic outlook and supply side disruptions arising from the Ukraine war are likely to result in volatile prices in the near term. Years of underinvestment into the sector have resulted in tightness in oil supply as was indicated by members of OPEC, which has fully restored oil production to pre-pandemic levels. Amidst low inventory levels, a better-than-expected economic recovery from China may place upward pressure on already high oil prices. Furthermore, the expected oil price caps to be implement by G7 countries on Russian oil adds an additional dimension of uncertainty towards the volatile oil market.

In the medium to long term, we see the outlook for oil prices being dictated by the structural shift from the global decarbonisation efforts. This will likely place a lid on hydrocarbon investments by global oil majors towards continued exploration and production activity. As notional demand for oil is likely to be inelastic in the initial years, the supply-side dynamics are likely to be the main drivers towards oil prices. In such a scenario, we expect oil prices to remain high and well supported.

In 2023, Asian upstream oil & gas companies are expected to continue benefiting from high oil prices, translating into strong profit and cash flow generation. However, we believe downstream oil refining companies are likely to face headwinds as the combination of high oil prices and softening demand outlook will weigh on the sector’s gross refining margins. Despite the mixed outlook for the sector, we expect the overall credit profile of companies within the sector to remain strong. Aside from strong standalone credit profiles, Asian oil & gas companies benefit from strong support from their respective sponsoring governments due to their strategic importance. We are market-weight on the Asian oil & gas sector.

Technology

Chinese software companies have had a volatile performance in 2022 due to 1) an evolving domestic regulatory landscape, 2) weaker earnings and 3) rising geopolitical tensions. Heading into 2023, we see rising headline risk from Sino-US tensions while expecting continued easing tone from domestic regulations as China pivots to support its economy. Fundamentals wise, the sector’s earnings recovery may largely hinge on domestic COVID policy. Acknowledging potential downside pressure on earnings, we are cognizant that most dollar bond issuers have solid credit profiles. Furthermore, they have been swiftly executing cost control measures and reining in investment appetite. We have a neutral view of the space, which is supported by decent valuation and stable fundamentals although potential negative headlines remain a risk.

Asia hardware companies underperformed in 2022 as consumers cut discretionary spending amid inflationary pressure and economic uncertainties. We continue to see the downward pressure persisting into 2023. We expect marginal players to be pressured by volume declines and margin compression. However, industry leaders such as dollar bond issuers are better positioned to weather through the economic cycle as they are buffered by low balance sheet leverage and have been proactively reining in capital expenditure. Aside from fundamental pressure, hardware companies at the centre of US-China trade frictions, are facing increased regulatory risks from US technology restrictions. Currently, we do not expect recent US chip restrictions to greatly impact issuers. However, we cannot rule out the possibility of further escalations in the future. Despite wide valuations, we remain cautious on the sector given the uncertainties and will look for further signs of bottoming before turning constructive on the sector.

Telecommunication

Asian telecom operators experienced top line revenue recovery in 2022, driven by the gradual resumption of roaming services following border reopening in the region. We expect this trend to continue in 2023. Although industry competition dynamics varies across local markets, risks of price war and market share shifts are expected to be muted among the incumbent players. Capital expenditure is expected to remain high for the sector as companies are committed towards 5G network rollout and further investments into broadband networks. We expect the increased investments to be partially mitigated by proactive capital recycling efforts through disposal and monetisation of non-core assets, such as mobile tower networks. Overall, we expect most telecom operators in the region to maintain their prudent financial policy and stable credit profiles. We are neutral on the sector.

Real estate

We are cautious on the real estate sector overall as the high interest rate and weaker macroeconomic environment is likely to dampen property demand and prices.

We see value in mainland China property bonds but expect returns to be very volatile. The government has been easing property buying restrictions and introducing policy measures to boost funding to the sector. In particular, the measures announced in November 2022 are stronger and more coordinated than previous policies and are thus likely to be much more impactful. However, liquidity for developers remains very tight, and it is unclear if implementation of new funding would be fast and sizeable enough to meet near-term maturities. Consumer confidence in the sector is also very weak especially towards privately-owned developers, and this would likely remain a drag on property sales and prices.

Outside mainland China, we expect headwinds in Hong Kong and Indonesia, given the high interest rate and weaker macroeconomic environment is likely to dampen property demand, prices, and rental rates. We expect property firms in Singapore to be relatively resilient, with the sector benefitting from population inflows, strong rental demand and a shortage of residential supply.

Infrastructure & transportation

With further easing of border restrictions and quarantine requirements across Asia, we expect the recovery seen in aviation sector to continue in 2023. While a recessionary environment could potentially dampen the demand for business travels, we believe the pent-up demand coming from leisure travellers would be a greater force in play, especially with the possibility of returning outbound Chinese travellers across the region. Within aviation related issuers, we generally prefer airport operators over airlines given the shorter lead time and complexity to ramp up its operations as demand recovers.

On the backdrop of a slower growth outlook and heightened geopolitical tensions globally, we think the credit profile of seaport operators requires closer monitoring. The slowdown in trade activity across several developed and emerging markets caused by inflationary pressures and tightening credit conditions could potentially further weaken cargoes and containers volumes. Having said that, most of the seaport operators have a strong financial position to begin with and adequate financial flexibility to control their growth capex, when necessary. As such, we expect most of seaport operators’ credit profile to remain largely stable over the course of 2023.

Utilities

In 2022, fuel costs (such as coal and LNG) reached record high levels, largely caused by the ongoing Russia-Ukraine conflict. For net energy importing countries, the inability for full fuel cost pass-through under current tariff mechanisms have led some power producers to post record high operating losses in 2022. Given our expectation that fuel prices would remain high over the short- to-medium term, we think such operating losses could well persist into 2023. In addition, rising regulatory costs (such as carbon tax) and higher capital needs to grow their renewable energy mix would further weigh on the financial profiles. As such, within the utilities sector, we are generally less constructive of thermal power producers and have a favourable view of renewable power companies or companies with rising share of renewable power sources, given the tailwind for energy transition toward cleaner sources.