Q2 performance summary

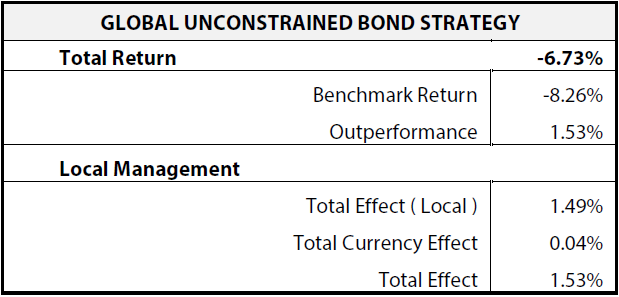

The strong relative performance continued during Q2 while the environment for fixed income remained under pressure from central bank monetary policy tightening. During Q2 the strategy returned a positive 1.53% in relative performance while absolute performance was negative 6.73%. The benchmark return was negative 8.26% The bulk of the relative performance came from the local price effect, 1.49%, while currency views were modest at 0.04%.

Global Unconstrained Bond Strategy Q2 performance |

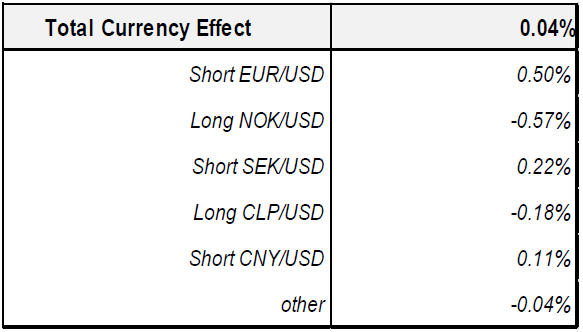

Total currency effect on relative performance |

|

|

|

Source Nikko AM, as at 30 June 2022

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on a representative account of the Global Unconstrained Bond strategy. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future returns. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

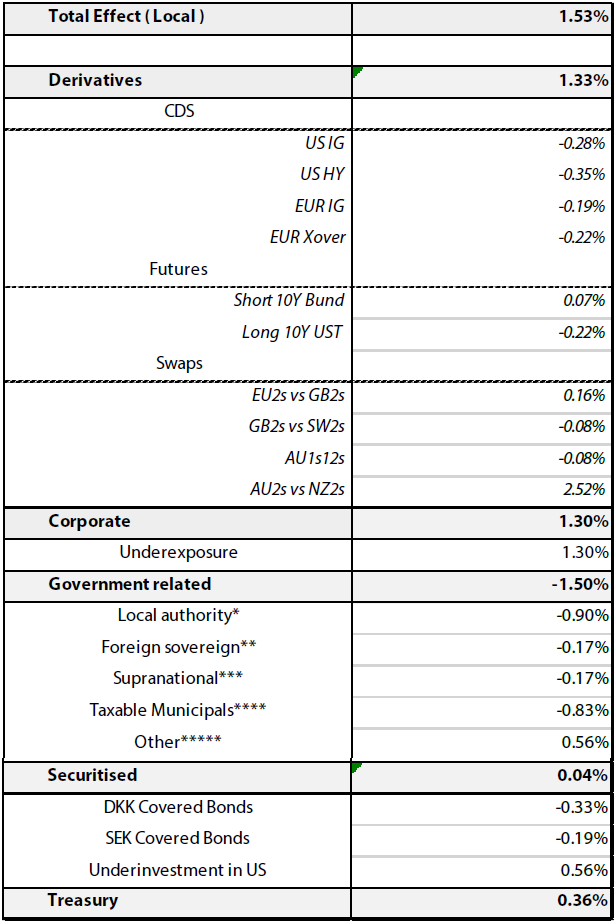

Total effect in detail

* Canadian provinces, New Zealand local government funding agency

* Canadian provinces, New Zealand local government funding agency

** EM external debt*** Asia, EBRD, IFC

**** State of California & New York

*****Underexposure to EUR/GBP/AUD denominated issues

Source Nikko AM, as at 30 June 2022. This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Returns are based on a representative account of the Global Unconstrained Bond strategy. The benchmark for this strategy is the Bloomberg Barclays Global Aggregate Bond Index The copyright and intellectual rights to the index displayed above are the sole property of the index provider. Returns for calculation periods in excess of one year are annualised, but those for the periods of less than one year are not annualised. Numbers in the table may not sum to total due to rounding. The Firm claims compliance with the Global Investment Performance Standards (GIPS ®) and has prepared and presented this report in compliance with the GIPS. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Past performance does not guarantee future returns. To obtain a GIPS Composite Report, please contact This email address is being protected from spambots. You need JavaScript enabled to view it..

Portfolio Positioning

During the period, government bond markets remained under heavy selling pressure as short-term interest rates continued to price an increased probability of imminent interest rate hikes, particularly by the US Federal Reserve (Fed), but also by other key developed market central banks, such as the Bank of Canada and Reserve Bank of Australia (RBA). In anticipation of the hawkish turn by the latter, the team implemented a relative value trade paying 2-year Australian dollar swaps versus receiving 2-year New Zealand dollar swaps. The spread differential between the two appeared particularly elevated in the historical context, and the rationale for the trade was further supported by the team’s fundamental view of an imminent repricing of short-term interest rate expectations in Australia, with the Reserve Bank of New Zealand (RBNZ), having moved earlier, more likely to temper hawkish expectations should the economy start to slow. Additionally, being under-invested in global corporate as well as global treasury bonds benefited the strategy’s relative performance, however, a higher allocation to the government related sector, notably in Canada, offset those gains.

Government bond yields have repriced significantly higher since the turn of the year as inflation pressures have amplified across most of the globe. Meanwhile, growth expectations have turned sharply lower. This ominous combination has been highly detrimental for financial assets. The key catalyst for these moves has been the Russian invasion of Ukraine which has exacerbated existing supply chain concerns. While previous concerns were predicated on COVID lockdowns in East Asia and the transit of consumer goods, particularly to the US West Coast; Russia’s unprovoked actions and the West’s sanctions response have jeopardised the supply of energy and grains, particularly for Europe and the surrounding regions.

As government bond yields continued to rise through April the team opportunistically increased duration within the portfolio to position for a rotation from price to growth concerns, with weaker demand expected to subsequently weigh on inflation. With hindsight the move was slightly premature as peak inflation in the US (as measured by the consumer price index) has been pushed out by several months due to the combination of higher food and energy prices, while a tight labour market has maintained upward pressure on the price of services. Nevertheless, valuations remain compelling for government bonds as real yields have turned positive for all but the shortest maturities, while expectations of monetary policy tightening appear extended relative to previous hiking cycles. The team also believes that seasonal factors are likely to be supportive for global bonds in the coming months with the summer months in the northern hemisphere typically associated with a relative preference for safe-haven assets as well as the potential for fresh rebalancing flows from institutional investors such as US and UK defined benefit pension schemes as well as Japanese institutions. Moreover, in recent weeks we have seen a meaningful decline in commodity prices due to a combination of improving supply chains and weaker end-demand which should translate into weaker inflation prints in the latter half of the year.

The team booked a significant profit on its relative 2-year swap position paying Australian rates versus receiving New Zealand rates following a narrowing of the rate differential in June. The RBA delivered the hawkish pivot that the team had long anticipated. However, given that the team still have conviction in the other leg of the trade, i.e., a dovish shift from the RBNZ which will likely predate other developed market central banks, the team initiated a new position to receive 2-year New Zealand rates. The rationale for this trade is the RBNZ’s hawkish pivot in 2021, which predates other developed central banks, and the subsequent economic weakness including high sensitivity to Chinese consumer demand and a nascent decline in domestic property prices.

In terms of FX positioning, the team preferred a higher allocation to the US dollar, particularly versus the euro, based on the monetary policy divergence favouring the former over the latter. More recently, we maintained our underweight to the euro proxies as the rise of geopolitical risk in Eastern Europe was expected to exert weakening pressure on the common market currency as well as the likes of Swedish krona. The trade overall generated a solid relative gain. In the commodity space, we maintained higher allocation to the oil related currencies such as the Norwegian krone. However, the latter continued to underperform, partially due to FX purchases in relation to the fiscal rule, but also due to its higher sensitivity to European demand, and the team ultimately decided to cut the exposure. In Latin America, we favoured an overweight allocation to the Chilean peso, however, the currency was negatively impacted by the concerns related to the China economic slowdown, which led to a sharp correction in copper prices, Chile’s main export commodity, severely undermining the country’s terms of trade and in turn putting weakening pressure on the currency. The underperformance of this trade was partially offset by the gains from an underweight allocation to the Chinese renminbi, which we expected to suffer from the ongoing Covid-related lockdowns in addition to concerns related to the country’s overleveraged property market.

Q3 outlook

In Europe, the team continues to question whether current interest rate hike expectations for the Eurozone appear justified. Expectations for the European Central Bank (ECB) to continue hiking through 2023 may prove too optimistic given the stagflationary environment in the continent, and associated risk of a recession in the coming quarters, which may trigger a rethink in the pace of normalisation, even as the ECB initiated an initial rate hike this month, as expected. As such the team continue to expect an underperformance of the euro. Fragmentation risks also continue to weigh on the common currency as recurrent Italian political disfunction raised its head once following prime minister Mario Draghi’s tendering of his resignation. Italy is set for snap elections in September, with a right-wing coalition likely to replace the current broad one. Nevertheless, the team believes that the recent weakness of Italian government bonds in response to these perceived risks appear tactically overdone and has repurchased Italian bonds the team tactically reduced in March then again in early June. Furthermore, while details of the ECB’s new Transmission Protection Instrument (TPI) initially underwhelmed—given lack of details and potentially significant conditions attached to the program—it should still provide a backstop in the case of further deterioration in peripheral risk.

Staying within Europe, following the sharp underperformance of Swedish rates in recent months, as the Riksbank has belatedly acknowledged the persistence of price pressures in the economy and pivoted towards a more hawkish path for interest rates, the team also believes that the expectations are somewhat optimistic given that Sweden is exposed to similar economic risks as the Eurozone. Meanwhile, given the magnitude of inflation pressures within the UK, with underlying wage pressures stemming from the tightest labour markets in a generation, adding to surging imported energy and food inflation, the Bank of England will likely need to respond more aggressively and persistently to increased price pressures should the anticipated slowdown in demand not materialise. As such the team has initiated a relative 2-year swap position paying UK rates versus receiving Swedish rates. This is in addition to the existing position in Swedish mortgage bonds as spreads over their respective government bonds remain elevated relative to mortgage bonds in both Denmark and the US.

Also, in Europe the team believes that the recent dampening of commodity price pressures should favour regional importers relative to exporters. As such the team decided to replace its overweight Norwegian krone exposure with Polish zloty. The Polish zloty also has the additional benefit of significantly higher carry following pre-emptive rate hikes from the Narodowy Bank Polski. In addition, the team has observed a material underperformance of Hungarian rates in recent weeks following an acceleration in domestic inflation pressures, exacerbated by relative currency weakness stemming from the country’s ongoing rift with the European Commission regarding the rule of law as well as opposition to Russian energy sanctions. The team has initiated a receiver position in 3-year Hungarian rates as the team believes that the recent repricing is unjustified given the extent of the hawkish moves already enacted by the Hungarian National Bank while tensions with the European Commission appear to be thawing.

Elsewhere in emerging markets the team have recently purchased some unhedged Mexican Government Bonds (MBonos) as the team expects a relatively soft landing in US consumption relative to other regions to benefit Mexico. Mexican rates also already embed a significant risk premium relative to the US despite a more benign inflation outlook. The team has also increased its exposure to FX-hedged South African bonds, given compelling valuations and attractive risk premium with fiscal risks overstated, in the team’s opinion.

Finally, given significantly improved valuations, with global corporate credit spreads above 500 basis points already at recessionary levels, the team has begun increasing its corporate credit exposure again, initially via shorter dated investment grade credit in Europe, but also in US investment grade credit, and more recently in European crossover credit. In addition to the compelling valuations the team also expects a more benign inflation environment in the latter half of the year, given the potential for relief in both energy of food supplies, to support corporate credit.