Summary

- US Treasury (UST) yields held in a relatively tight range in April, with mid-dated Treasury bonds outperforming. At the end of the month, the benchmark 2-year and 10-year UST yields were at 4.01% and 3.43% respectively, about 2 basis points (bps) and 5 bps lower compared to end-March.

- Central banks in the region left their monetary policy rates unchanged, while inflationary pressures mostly moderated in March.

- Against a backdrop of a more stable bond market, we prefer relatively higher-yielding Philippine, Indian and Indonesian government bonds. As for currencies, we expect the Thai baht and Indonesian rupiah to continue outperforming regional peers.

- Asian credits gained 0.89% in April, as credit spreads tightened and UST yields fell. Asian high-grade (HG) credit rose 1.19%, while Asian high-yield (HY) credit fell 0.76%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay robust, albeit slightly weaker than in 2022. Indian and ASEAN economies, supported by a rebound in tourism and domestic re-openings, are expected to fare better than their export-dependent North Asian counterparts. In all, we expect Asian credit spreads to stay range-bound in the near-term, supported by strong regional fundamentals and fading of extreme fears in the global financial system.

Asian rates and FX

Market review

US Treasuries trade in a relatively tight range in April

Following a volatile month in March, UST yields held in a relatively tight range in April, with mid-dated Treasury bonds outperforming. UST yields fell initially, prompted largely by US economic data that came short of market expectations. Yields were exposed to some upward pressure after US March employment data revealed nonfarm payrolls increased by a higher-than-expected 236,000, and February’s figure was revised higher by 15,000. The rise in yields persisted despite softer US headline March consumer price index (CPI) print as the core CPI remained firm. Subsequently, minutes from the March Federal Open Market Committee meeting revealed that the central bank discussed the possibility of keeping rates unchanged on the back of recent bank collapses. A subsequent retracement in yields took place after revisions to US annual retail sales suggested a weaker path for consumer spending from the start of the year. US regional bank concerns came back in focus towards end-April, adding to the downward pressure on UST yields. The rally in US duration subsequently stalled as investors stayed largely sidelined ahead of the US Federal Reserve (Fed) meeting in the first week of May. At end-April, the benchmark 2-year and 10-year UST yields were at 4.01% and 3.43%, respectively, about 2 bps and 5 bps lower compared to end-March.

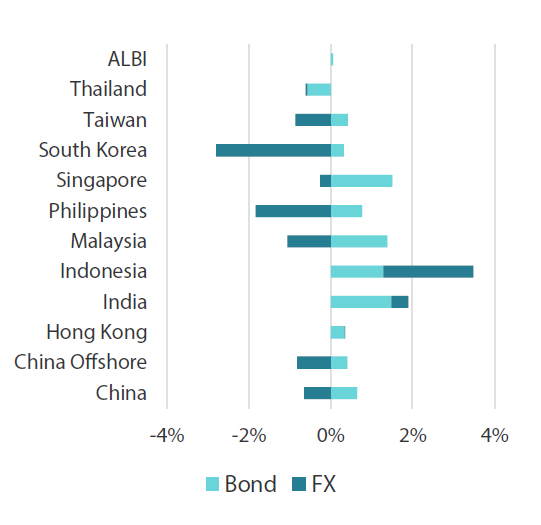

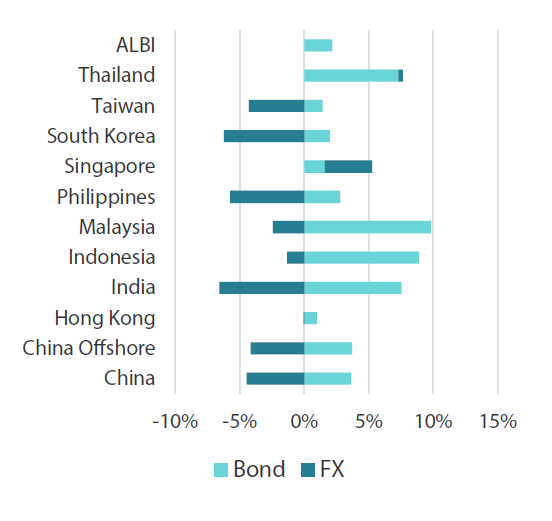

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 April 2023 | For the year ending 30 April 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 April 2023.

Inflationary pressures mostly ease in March

Easing food inflation prompted inflationary pressures to moderate in March. India’s headline CPI saw a significantly deceleration—to 5.66% year-on-year (YoY) from 6.44%—on the back of slowing fuel and light (e.g. electricity expenses) and food inflation. Malaysia’s 3.4% YoY headline annual inflation rate in March was lower than its February print, as food and beverage price inflation eased. In Thailand, both headline and core CPI prints were weaker than expected, coming in at 2.83% and 1.75%, respectively. Similarly, overall inflation eased for the second consecutive month, as private transport, accommodation and core inflation fell. Elsewhere, inflationary pressures in the Philippines decelerated, with headline CPI moderating to 7.6% YoY from 8.6%.

Central banks stick to their monetary policy rates

Bank Indonesia (BI) declared that its current policy rate is “sufficient” to ensure core inflation remains in check. BI also retained its growth forecast, but it now expects headline inflation to return to its 2–4% target in August—sooner than previously projected, while core inflation is projected to hover around current levels for the rest of the year. The Reserve Bank of India’s (RBI) Monetary Policy Committee unanimously voted to leave the policy rate unchanged at 6.50%. In addition, RBI retained its “withdrawal of accommodation” stance, lifted its fiscal year 2024 (FY24) growth projection and marginally lowered its FY24 inflation forecast. Similarly, Bank of Korea (BOK) left the policy rate unchanged and declared its intention to keep policy restrictive to combat inflation, despite expectations that growth will slow more than previously expected this year. Nonetheless, BOK Governor Rhee Chang-yong ruled out the possibility of cutting interest rates before inflation showed clearer signs of easing. Elsewhere, the Monetary Authority of Singapore (MAS) unexpectedly kept its foreign exchange policy unchanged, noting that the current path of appreciation is “sufficiently tight and appropriate for securing medium-term price stability”. Although the MAS expects core inflation to stay high over the next few months, it projects inflationary pressures to slow more “discernibly” in the latter half of the year.

China records robust growth in the first quarter of 2023; Politburo maintains a pro-growth tone

China’s economic activity registered a 4.50% YoY growth in the first three months of 2023, performing better than the 4.0% expected by markets. The robust recovery was prompted largely by strength in services and consumption as Chinese policymakers lifted COVID-19 controls. The better-than-expected reading supported expectations that full-year growth is broadly on track to meet the government’s goal of expanding by “about 5%”. Towards month-end, the Politburo gathered to review China’s first-quarter performance and set the policy tone for the coming months. According to a report by Xinhua News Agency, leaders acknowledged an improved economic outlook following robust growth in the first quarter. Nonetheless, they recognise the need to further boost demand to ensure a sustained recovery. Among other things, the Politburo reaffirmed the call for a strengthening of fiscal policy, a more “forceful” and targeted monetary policy and further efforts to attract foreign investment.

Market outlook

Prefer Philippine, India and Indonesia bonds

Global rates markets have stabilised and market concerns, which initially centred on apprehension towards more rate hikes, have pivoted to a potential overflow of bank woes into the wider economy. This has prompted a significant shift lower in market pricing of the Fed rate trajectory and terminal rate expectations. Against a backdrop of a more stable bond market, we prefer relatively higher-yielding Philippine, Indian and Indonesian government bonds. In addition, there are early signs suggesting that inflationary pressures in these countries may have peaked, which we see providing further support to these bonds.

Thai baht and Indonesian rupiah favoured

On currencies, we continue to expect the Thai baht and Indonesian rupiah to outperform regional peers. Expectations that Thailand’s current account will rebound to a healthy surplus on the return of Chinese tourists bodes well for the baht. Meanwhile, the positive outlook for Indonesia’s foreign direct investment—backed by the government’s long-term plan of becoming a manufacturing hub for electric vehicle batteries—is expected to benefit demand for the rupiah.

Asian credits

Market review

Asian credits end higher in April

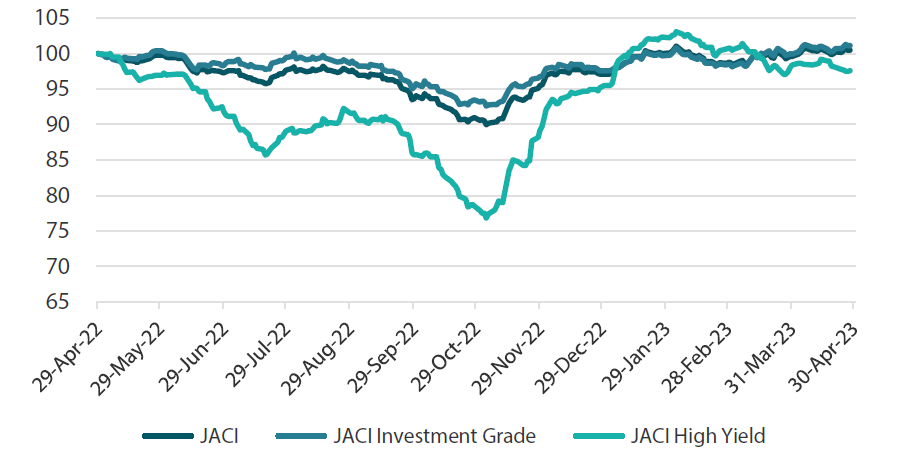

Asian credits gained 0.89% in April, as credit spreads tightened and UST yields fell. Asian HG credits outperformed Asian HY as the latter was weighed down by weakness in the Chinese property sector. Asian HG credits returned +1.19%, with spreads narrowing about 9 bps. Meanwhile, Asian HY credit declined 0.76%, as spreads widened 43 bps.

Asian credit spreads were range-bound in the first half of April on the back of mixed, but relatively benign, global macro news. Particularly, disappointing US economic data was largely offset by strong Chinese credit and export numbers. Mid-month, China recorded robust growth for the first quarter of 2023 with economic activity registering a solid 4.50% YoY rise. The better-than-expected reading supported forecasts that full-year growth is broadly on track to meet the government’s goal of expanding by “about 5%”. That said, concerns around the sustainability of China’s recovery, together with uncertainty over US monetary policy, weighed on sentiment over Asian credits, driving spreads to widen. Idiosyncratic news on the Chinese technology sector as well as some Chinese high-yield property companies triggered further weakness in those spaces. At the month-end, China’s Politburo gathered to review the country’s first-quarter performance and set the policy tone for coming months. Overall, policymakers maintained a pro-growth tone, calling for a strengthening of fiscal policy, a more “forceful” and targeted monetary policy and further efforts to attract foreign investment. By country, spreads of all major country-segments—save for China and Singapore—tightened in the month.

Primary market remains quiet in April

Primary market activity remained weak in April. The HG space saw 10 new issues amounting to about US dollar (USD) 6.32 billion, including the USD 2.5 billion two-tranche issue from CK Hutchison International. Meanwhile, the HY space had just three new issues amounting to about USD 650 million.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 April 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2023.

Market outlook

Supportive technicals and resilient fundamentals expected to stay

We entered a more uncertain phase with multiple cross currents, both regional and global, at play. There remain lingering concerns of banking sector stress in developed markets and ongoing caution about recent events. These, in combination with the cumulative policy rate hikes so far, may affect other corners of the global financial system and create yet unforeseen risks. Until we have better visibility on downside risk for the global economy, this will likely limit the degree of credit spread tightening and make it challenging for spreads to return to levels seen earlier in 2023. This is especially so when one considers the risk that the ensuing tightening in bank lending conditions could result in a more severe-than-anticipated recession in developed economies.

At the same time, however, China’s re-opening and supportive policy tone may continue to provide a critical counterweight to global macro weakness. Macro and corporate credit fundamentals across Asia ex-China are also expected to stay robust, albeit slightly weaker than in 2022. Indian and ASEAN economies, supported by a rebound in tourism and domestic re-openings, are expected to fare better than their peers in export-dependent North Asia. In all, we expect Asian credit spreads to stay range-bound in the near-term supported by strong regional fundamentals and fading of extreme fears in the global financial system, while developed economies’ recession concerns and lingering caution about unforeseen risks may hinder more notable spread tightening from here.