Summary

- US Treasuries (USTs) initially traded weaker on further signs of resilient US growth, higher funding needs and a downgrade of the country’s debt rating by Fitch Ratings. Subsequently, heavy Treasury bond supply, stronger-than-expected producer price index (PPI) data and hawkish rhetoric from US Federal Reserve (Fed) officials sustained the upward pressure on yields, while weak Chinese data provided some offset. At end-August, the benchmark 2-year and 10-year yields were at 4.87% and 4.11%, down 1.4 basis points (bps) and up 14.7 bps, respectively, compared to end-July.

- Within Asia, Indian and Indonesian bonds are likely to fare relatively better than their regional peers, in our view. We expect their attractive carry, positive macro backdrop and policy credibility to support these bonds. As for currencies, expectations that US interest rates may have reached their peak could weigh on US dollar sentiment, favouring Asian currencies in return. We have a favourable view of the Thai baht, Indonesian rupiah, South Korean won and the Singapore dollar against such a backdrop.

- Asian credits retreated 0.92% in August, as credit spreads widened by 20 bps and UST yields rose. Asian high-grade (HG) credit lost 0.50%, while Asian high-yield (HY) credit retreated 3.47%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay resilient, although slower economic growth appears to loom over the horizon. Asian banking systems remain strong, with their stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead. However, given the slightly weaker macroeconomic backdrop and uncertainties ahead, coupled with geopolitical tensions and the Fed’s policy path, in our view the valuation of Asia HG credit looks slightly stretched compared to both historical levels and developed market spreads.

Asian rates and FX

Market review

UST yields rise anew in August

USTs traded weaker in early August on further signs of resilient US growth, higher funding needs and a downgrade of the country’s debt rating by Fitch Ratings. Subsequently, heavy Treasury bond supply, stronger-than-expected PPI data and hawkish rhetoric from Fed officials sustained the upward pressure on yields, while weak Chinese data provided some offset. UST yields rose further upon the release of minutes of the Fed’s July policy meeting revealed concerns around a possible inflation resurgence. Market focus turned to the Jackson Hole Symposium thereafter, with USTs finding some stability as Fed Chair Jerome Powell declared the central bank would “proceed carefully” in any further move, albeit acknowledging that inflation “remains too high”. Towards the month-end, softer-than-expected domestic data prompted UST yields to partially reverse the move higher seen since the start of the month. At end-August, the benchmark 2-year and 10-year yields were at 4.87% and 4.11%, down 1.4 bps and up 14.7 bps, respectively, compared to end-July.

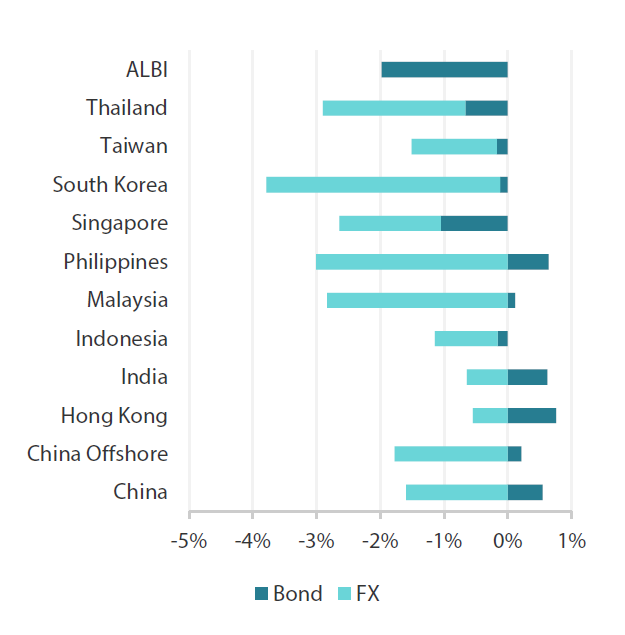

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 August 2023 | For the year ending 31 August 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 August 2023.

Bank of Thailand hikes rates; other central banks leave their respective policy rates unchanged

Central banks in South Korea, India, Indonesia and the Philippines left their respective policy rates unchanged, while the Bank of Thailand tightened its monetary policy further. According to the Thai central bank, the 25-bps hike to its benchmark interest rate goes beyond keeping “inflation sustainably within the target range”, but also pre-empts “the build-up of financial imbalances that could arise in a low-for-long interest rate” and preserves “policy space”. During the month, Bank Indonesia announced the launch of a new liquidity absorption money market instrument that will be issued starting mid-September, while the Reserve Bank of India (RBI) ordered banks to temporarily set aside more cash to mop up excess liquidity.

Price pressures moderate further in July

Consumer prices in Malaysia rose 2.0% year-on-year (YoY) in July compared to 2.4% in June, owing partly to a high base in 2022. Although headline inflation in Thailand edged up to 0.38% YoY (from 0.23%) in July, excluding food and energy prices, core inflation actually decelerated to 0.86% (from 1.32%). In Singapore, the headline consumer price index (CPI) moderated to 4.1% YoY from 4.5%, reflecting a drop in private transport inflation, along with lower core inflation. In the Philippines, slower increases in utility and food costs prompted the rise in the headline CPI to ease for the sixth straight month to 4.7% in July. In contrast, the headline CPI in India rose to a 15-month high of 7.44% YoY, breaching the upper end of the RBI’s target range, prompted largely by higher vegetable prices. However, excluding prices of food and fuel, India’s core inflation moderated to 4.9% in July from 5.1% in June.

2Q23 growth accelerates in India and Indonesia but softens in Malaysia, Thailand and the Philippines

In YoY terms GDP growth in the second quarter of 2023 (2Q23) accelerated in India and Indonesia but decelerated in Malaysia, Thailand and the Philippines. A significant pick-up in private consumption boosted growth in India, while strong household and government spending in Indonesia offset a contraction in exports over the April to June period. In contrast, growth in the Philippines was dragged by higher commodity prices and slower government and consumer spending, whereas the slowdown in exports weighed on economic activity in Malaysia.

China reports another string of disappointing data; key rates cut, stimulus measures announced

Chinese consumer prices slipped into deflationary territory in July after flatlining in June. Despite government efforts to encourage lending, credit demand remained weak, with July total social financing coming in at less than half of consensus expectations. Meanwhile, activity data revealed that policy tools have so far been ineffective at rekindling growth, as numbers were broadly weaker than expected. On top of this, China’s deepening housing problems and news of missed payments on some shadow banking-linked trust products further spooked the markets.

In response to the significantly weak data, the Chinese central bank lowered several policy rates by 10 to 15 bps. Throughout the month, the government also announced measures aimed to revive the economy and boost investor confidence. However, sentiment remained weak as regulators stuck to a targeted approach. Towards the month-end, policymakers announced bolder and clearer property easing measures—widening the definition of first-time home buyers, lowering the minimum down-payment requirements for first and second-time home buyers and cutting rates on existing mortgages.

Market outlook

Prefer Indian and Indonesian bonds

The Fed’s current monetary policy tightening cycle is coming to—if not already at—a close, in our view. Nonetheless, the US economy’s resilience coupled with a modest decline in domestic inflation has prompted the markets to expect the Fed to keep borrowing rates elevated for a prolonged period. We believe that this higher-for-longer US rates narrative is likely to support a preference for bonds that offer higher carry or those of higher-yielding countries with good fundamentals.

Within Asia, Indian and Indonesian bonds may fare relatively better than regional peers. Their attractive carry, together with the positive macro backdrop and policy credibility, are expected to support Indian and Indonesian bonds. In addition, we expect the recent bounce in Indian inflation to be temporary. We also see domestic price pressures stabilising from here, barring further significant weather disruptions caused by the El Nino phenomenon. Meanwhile, Indonesia’s new Bank Indonesia Rupiah Securities instrument could boost foreign inflows and reduce selling pressure on short- and mid-tenor bonds.

Thai baht, Indonesian rupiah, South Korean won and Singapore dollar preferred

Expectations that US interest rates may have reached their peak could weigh on US dollar sentiment, favouring Asian currencies in return. Within the region, we have a favourable view of the Thai baht, Indonesian rupiah, South Korean won and the Singapore dollar.

Asian credits

Market review

Asian credits retreat in August

Asian credits retreated 0.92% in August, as credit spreads widened by 20 bps and UST yields rose. Asian HG credit outperformed its HY counterpart, returning -0.50% as spreads widened by about 10 bps. Asian HY credit retreated 3.47%, with spreads widening 119 bps, owing largely to significant weakness in Chinese property credits.

Asian credit spreads moved sharply higher in August, as concerns surrounding the Chinese economy intensified. Domestic consumer prices slipped into deflationary territory in July after flatlining in June. Despite government efforts to encourage lending, credit demand remained weak, with July total social financing coming in at less than half of consensus expectations. Meanwhile, activity data revealed that policy tools have so far been ineffective at rekindling growth, as numbers printed broadly weaker than expected. On top of this, China’s deepening housing problems and news of missed payments on some shadow banking-linked trust products further spooked markets, triggering outflows, particularly within Asia HY. In response to the significantly weak data, the Chinese central bank lowered several policy rates by 10 to 15 bps. Throughout the month, the government also announced measures aimed to revive the economy and boost investor confidence. However, sentiment remained weak as regulators stuck to a targeted approach. Towards the month-end, policymakers announced bolder and clearer property easing measures—widening the definition of first-time home buyers, lowering the minimum down-payment requirements for first- and second-time home buyers, and cutting rates on existing mortgages. Markets cheered the nationwide measures, prompting a significant rally in Chinese property credits.

Other Asian countries generally saw slower YoY growth in 2Q23. India and Indonesia were exceptions, with both countries seeing an acceleration in GDP growth over the period on account of relatively strong consumption. Separately, first-half financial results indicate robust credit fundamentals for Asian corporates, with the post-COVID normalisation continuing to benefit companies in the region. Cross-border travel resumption has been a boon for retail, services and hospitality-related industries. In banking, high interest rates are driving up banks’ profitability by boosting net interest margins while non-performing loan formations remain muted. In commodities, resource companies have built strong balance sheets and liquidity following years of deleveraging amid high prices. Despite these positives, the strong showing in financial performance was not felt equally across sectors. Weak access to funding and declining domestic demand continue to weigh on Chinese property developers, while pockets of weakness in the technology, media and telecom sector were evident as demand remained soft. Overall, spreads of all major country segments—save for Taiwan—widened. China, Macau and Hong Kong credits took a heavy hit as markets worried about the impact of a slower Chinese economy on them.

UST yields rose in early August on further signs of resilient US growth, higher funding needs and a downgrade of the country’s debt rating by Fitch Ratings. Subsequently, heavy Treasury bond supply together with stronger-than-expected PPI data and hawkish rhetoric from Fed officials sustained the upward pressure on yields, while weak Chinese data provided some offset. At the Jackson Hole Symposium, Fed Chair Jerome Powell declared the central bank would “proceed carefully” in any further move, albeit acknowledging that inflation “remains too high”. Thereafter, softer-than-expected domestic data prompted UST yields to partially reverse the move higher seen since the start of the month.

Primary market remains quiet in August

Weak risk sentiment across Asia kept most issuers sidelined, with just USD 3.69 billion being raised in the primary market in August. The HG space saw just three new issues amounting to USD 3.00 billion, including the USD 2.0 billion issue from China Life Insurance. Meanwhile, the HY space had four new issues amounting to USD 685 million.

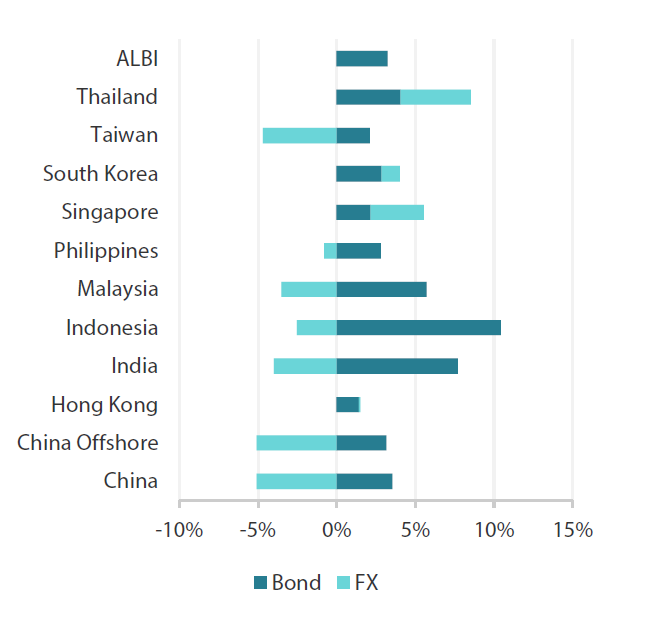

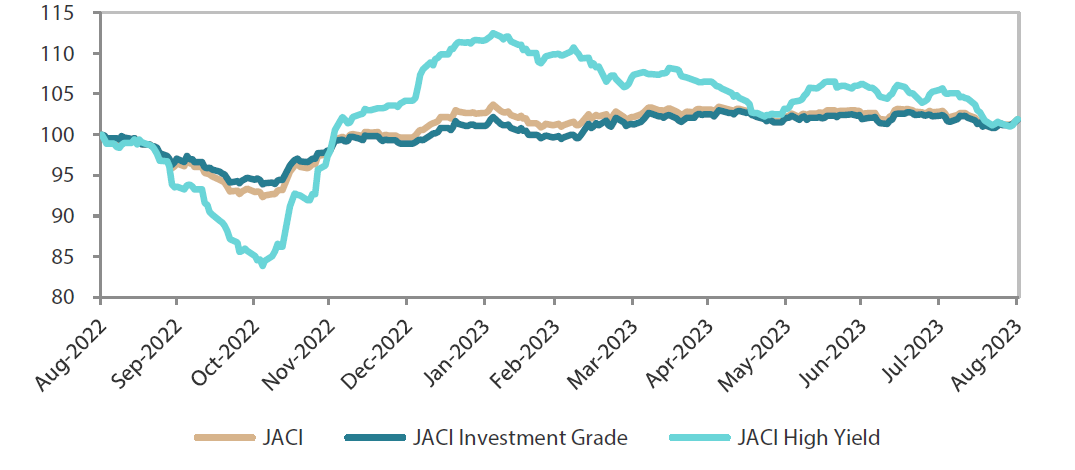

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 August 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 August 2023.

Market outlook

Asia macro and corporate credit fundamentals robust but valuation still somewhat stretched

The recent step-up in Chinese property easing measures could lift near-term sentiments as the nationwide policy measures mark a positive step in the right direction. However, we expect policymakers to roll out more aggressive measures, as concerns on contracting exports, geopolitical tensions and weak confidence in the private sector may continue to weigh on the economy and the sentiment of potential home buyers. Meanwhile, macro and corporate credit fundamentals across Asia ex-China are expected to stay resilient despite slower economic growth in the second half of 2023 and the first half of 2024 as the effects of past monetary policy tightening begin to weigh and pent-up demand for services fade. While non-financial corporates may experience a slight weakening in leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs, we believe there is adequate ratings buffer for most, especially the HG corporates. Asian banking systems remain strong, with a stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Given the slightly weaker macroeconomic backdrop and uncertainties ahead, including geopolitical tensions and the Fed’s policy path, the valuation of Asia IG credit continues to look slightly stretched versus both historical levels as well as developed market spreads. As such, we favour a more cautious view towards risk in the near-term.