Summary

- It was a volatile month for US Treasuries (USTs). At the end of the month, the benchmark 2-year and 10-year UST yields were at 4.03% and 3.47%, respectively, about 79 basis points (bps) and 45 bps lower compared to end-February.

- Central banks in the region continued to take divergent monetary paths, while key gauges of overall price pressures in the region mostly moderated in February.

- Against a backdrop of a more stable bond market, we prefer relatively higher-yielding Philippine, India and Indonesian government bonds. In addition, there appears to be early signs suggesting that inflationary pressures in these countries have likely peaked, which we see providing further support for these bonds. As for currencies, we expect the Thai baht and Indonesian rupiah to outperform regional peers.

- Asian credits gained 0.90% in March, with positive returns entirely driven by the rally in UST bonds as credit spreads widened about 37 bps. Asian high-grade (HG) credit rose 1.51%, while Asian high-yield (HY) credit retreated 2.31%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay robust, albeit slightly weaker than in 2022. In all, we expect Asian credit spreads to stay range-bound in the near-term, supported by strong regional fundamentals and fading of extreme fears in the global financial system, while developed economies’ recession concerns and lingering caution about unforeseen risks may hinder more notable spread tightening from here.

Asian rates and FX

Market review

US Treasuries rally in March

It was a volatile month for USTs, with yields initially extending their move higher. Resilience in US growth and inflation, together with hawkish remarks from the US Federal Reserve (Fed) chair, pushed 2-year UST yields to new cycle highs. However, the collapse of Silicon Valley Bank (SVB) prompted an abrupt reversal in sentiment and a significant retracement in UST yields. To prevent panic from spreading through the banking system, US authorities unveiled a sweeping intervention programme. As investors scoured for signs of contagion in the global banking industry, shares and bonds of global banks, including Credit Suisse (CS), plunged. Troubles for the Swiss lender quickly escalated to critical levels. To avert a sudden and disorderly collapse of CS, the Swiss government raced to broker a takeover by UBS. The complete write-down of CS Additional Tier 1 (AT1) bonds—a key feature of the deal—initially triggered an outsized negative reaction in the financial community. A semblance of calm was subsequently restored in markets, following assurances by major banking regulators that AT1 securities are placed above common equity instruments in their jurisdictions. Despite the ongoing turmoil in the banking sector, the Fed raised the Fed Funds Rate by 25 basis points (bps). However, the Fed’s accompanying statement suggested that it is likely to proceed more cautiously hereon. Separately, US policymakers moved to reassure markets worried over uninsured bank deposits. Towards the month-end, news that First Citizens Bank agreed to acquire SVB’s assets eased stress across markets. At end-March, the benchmark 2-year and 10-year UST yields were at 4.03% and 3.47%, respectively, about 79 bps and 45 bps lower compared to end-February.

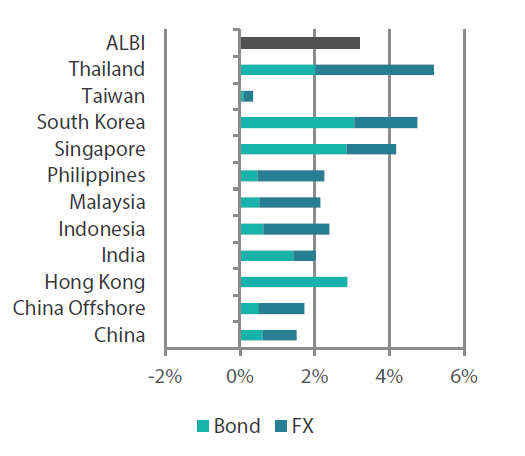

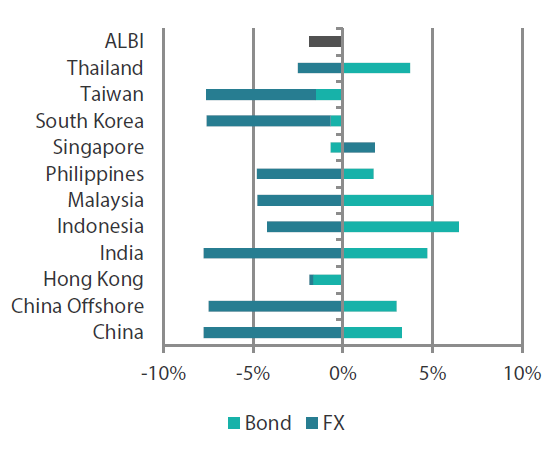

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 March 2023 | For one year ending 31 March 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 March 2023

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Thailand and the Philippines raise rates while Malaysia and Indonesia stand pat

Central banks in the region continued to take divergent monetary paths. Monetary authorities in Thailand and the Philippines each raised their respective policy rates by 25 bps. The Bangko Sentral ng Pilipinas (BSP) also revised down its inflation forecasts for this year and next year to 6% (from 6.1%) and 2.9% (from 3.1%), respectively, noting that the balance of risks continues to “tilt heavily towards the upside”. Looking ahead, BSP Governor Felipe Medalla stressed that anchoring inflation expectations remains the central bank’s top priority. Meanwhile, Bank Indonesia (BI) and Bank Negara Malaysia (BNM) left interest rates unchanged. According to BNM, its monetary policy stance remains supportive of economic growth. Separately, BI reiterated that the current level of the policy rate is “sufficient” to ensure core inflation remains in check.

Inflationary pressures mostly ease in February

Key gauges of overall price pressures in the region mostly moderated in February. The rise in the headline consumer price index (CPI) numbers in South Korea, India, Singapore, Thailand and the Philippines decelerated. In contrast, the rise in the overall inflation rate in Indonesia accelerated, while the headline CPI in Malaysia was unchanged. The Philippines’ 8.6% YoY headline annual inflation rate was lower than the January print as higher food inflation was offset by lower transport inflation. Overall inflation in Thailand eased significantly—to 3.79% from 5.02%—as food and energy inflation moderated. In Singapore, the lower headline print was driven largely by easing private transport inflation although accommodation inflation also edged lower. Meanwhile, overall CPI in Indonesia accelerated to 5.47% YoY in February, up from 5.28% in January, on the back of higher food inflation.

China sets a growth target of “around 5%” in 2023

China’s National People’s Congress convened for its annual session on 5 March. China’s premier announced a GDP growth target of “around 5%” in 2023—lower than many external forecasts. Fiscal policy looks less accommodative relative to both market expectations and the 2022 budget. The guidance on monetary policy was largely unchanged, with the guidance for M2 and credit growth generally aligned with nominal GDP growth. Meanwhile, inflationary pressures are projected to remain benign, with the government projecting overall CPI to register “around 3%”. Similar to previous years, the recommendations set forth in the Work Report were broad directions and high-level. Details are likely be unveiled after the new government leaders are in place. China reshuffled its government leadership in 2023. President Xi Jinping was handed an unprecedented third term, Li Qiang was named the new premier and People’s Bank of China Governor Yi Gang retained his post.

Market outlook

Prefer Philippine, India and Indonesia bonds

Global rates markets have stabilised as banking sector fears ebbed. Meanwhile, market concerns, which initially centred on apprehension towards more rate hikes, pivoted to bank woes and have now shifted to the wider economy. This has prompted a significant shift lower in market pricing of the Fed rate trajectory and terminal rate expectations. Against a backdrop of a more stable bond market, we prefer relatively higher-yielding Philippine, India and Indonesian government bonds. In addition, there are early signs suggesting that inflationary pressures in these countries may have peaked, which we see providing further support to these bonds.

Thai baht and Indonesian rupiah favoured

On currencies, we expect the Thai baht and Indonesian rupiah to outperform regional peers. Expectations that Thailand’s current account will rebound to a healthy surplus on the return of Chinese tourists bodes well for the baht. Meanwhile, the positive outlook for Indonesia’s foreign direct investment—backed by the government’s long-term plan of becoming a manufacturing hub for electric vehicle batteries—is expected to benefit demand for the rupiah.

Asian credits

Market review

Asian credits end higher as USTs rally

Asian credits gained 0.90% in March, with positive returns entirely driven by the rally in UST bonds as credit spreads widened about 37 bps. Weak risk tone led Asian high-grade (HG) credits to outperform Asian high-yield (HY). Asian HG credit returned +1.51%, despite spreads widening about 26 bps, as UST yields fell. Meanwhile, Asian HY credit retreated 2.31%, with spreads widening 124 bps.

Asia credits spreads traded largely range-bound at the start of March, holding well despite the rise in Treasury yields. However, the demise of SVB caused an abrupt reversal in sentiment, sending spreads significantly wider. To reassure markets on the health of the banking system, US authorities unveiled a sweeping intervention programme. As investors looked for signs of contagion in the global banking industry, shares and bonds of global banks, including CS, plummeted. Troubles for the Swiss lender quickly escalated to critical levels. To avert a sudden and disorderly collapse of CS, the Swiss government raced to broker a takeover by UBS. The complete write-down of CS AT1 bonds—a key feature of the deal—initially triggered an outsized negative reaction in the financial community. A semblance of calm was subsequently restored in markets, following assurances by major banking regulators that AT1 securities are placed above common equity instruments in their jurisdictions. As global banking sector fears ebbed, sovereign bond and credit markets stabilised. Nonetheless, despite the rebound in risk tone in the last week of March, Asia credit spreads have now erased the cumulative tightening since the start of the year. Overall, spreads of all major country-segments widened in the month.

Primary market remains quiet in March

Primary market activity remained soft as fragile market sentiment led issuers to stay on the sidelines. The HG space saw 10 new issues amounting to about USD 7.4 billion, including the USD 2.5 billion three-tranche issue from Hyundai Capital America and USD 2.0 billion issue from China Taiping Insurance. Meanwhile, the HY space had just five new issues amounting to about USD 525 million.

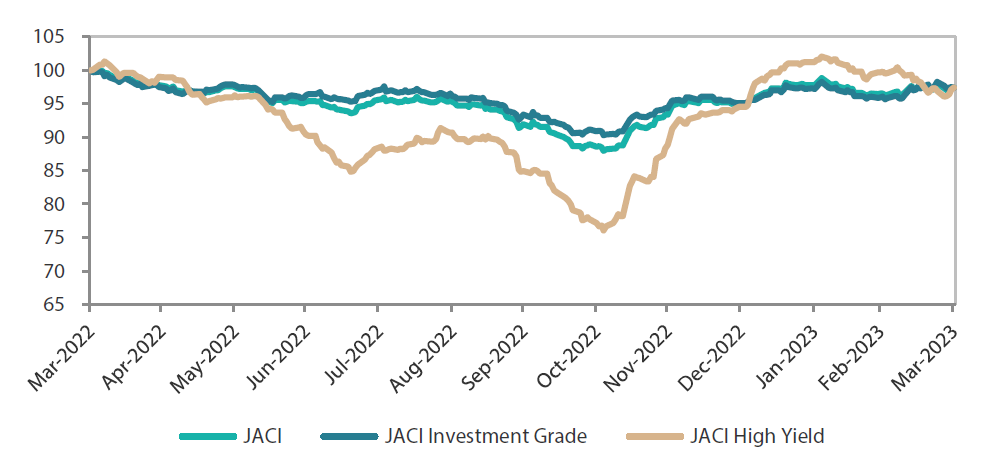

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 March 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 March 2023

Market outlook

Supportive technicals and resilient fundamentals expected to stay

We are entering a more uncertain phase with multiple cross currents, both regional and global, at play. The quick and decisive actions by regulators and central banks in the US and Europe to stabilise their respective banking sectors are positive for risk sentiment. We expect this to lead to a tightening of credit spreads, particularly within the subordinated financial segments, albeit gradually. However, even as the immediate contagion tail risks have been averted, we expect caution to linger about how recent events, in combination with the cumulative policy rate hikes so far, may affect other corners of the global financial system and create yet unforeseen risks. This will likely limit the degree of credit spread tightening and make it challenging for spreads to return to levels seen earlier in 2023. This is especially so when one considers the risk that the ensuing tightening in bank lending conditions could result in a more severe-than-anticipated recession in developed economies.

At the same time, however, China’s re-opening and supportive policy tone may continue to provide a critical counterweight to global macro weakness. Macro and corporate credit fundamentals across Asia ex-China are also expected to stay robust, albeit slightly weaker than in 2022. Indian and ASEAN economies, supported by a rebound in tourism and domestic re-openings, are seen faring better than their peers in export-dependent North Asia. In all, we expect Asian credit spreads to stay range-bound in the near-term, supported by strong regional fundamentals and fading of extreme fears in the global financial system, while developed economies’ recession concerns and lingering caution about unforeseen risks may hinder more notable spread tightening from here.