Changing Shape of China’s Economy.

Since 1978, China has marched to the banner of gaige kaifang — “reform and openness.”

Starting from a weak base, superlative double-digit growth came fast and easy, created by grafting capitalist market mechanisms and credit-fueled investments onto its Marxist structure.

By 2007, however, the erudite former Premier Wen Jiabao conceded: “Our growth is unsteady, unbalanced, uncoordinated, and unsustainable.”

It is not inconceivable that Wen’s farsighted wisdom was the bellwether for reforms that shaped China’s new growth model. In early 2015, Premier Li Keqiang announced: “The New Year is a crucial year for deepening all-round reforms.”

“The New Year is a

crucial year for

deepening all-round

reforms.”

~ Premier Li Keqiang

Setting ‘The New Normal’

During the National People’s Congress annual session on 5 March 2016, Premier Li Keqiang mentioned in a government work report that China sets its GDP growth rate for 2016 at a range between 6.5% -7%.

Source :

National Bureau of Statistics of China and The State Council of The People’s Republic of China, extracted as of 5 March 2016

Slowing Down, Moving Forward

Li acknowledged downward pressure on the economy against the backdrop of weaker global growth. China will be tapping on its growth brakes as it shifts the economy’s dependence on investment and export towards a more sustainable consumption-led growth.

The ‘New Normal’

– 3 Reasons for Optimism:

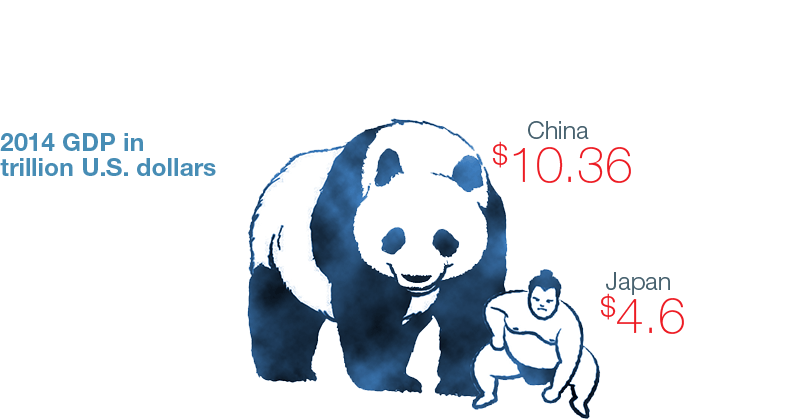

China's economy remains the 2nd largest in the world, dwarfing almost all other markets worldwide.

Source : World Bank, 16 July 2015.

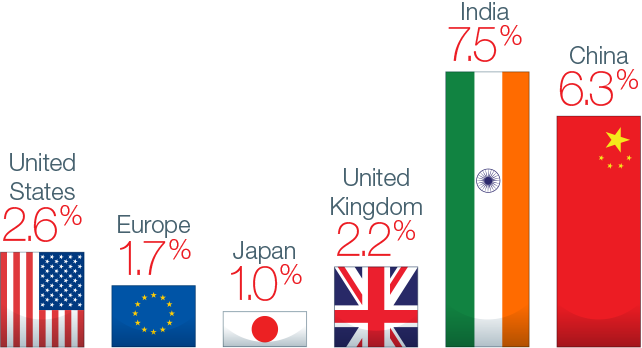

Even with the new, subdued forecasts, China’s growth would still tower over almost all other markets worldwide and remain among the world’s fastest-growing large economies.

IMF Economic Growth Projections 2016

Source : International Monetary Fund – World Economic Outlook Update, January 2016

China’s burgeoning middle class will underpin a sustainable consumption-led growth for decades to come.

Rising retail sales in China from 2010 to 2015

Retail sales in 100 million RMB

Source : National Bureau of Statistics of China, January 2016

“China’s future economic success will be fueled by a growing private sector that will inevitably propel China up the innovation curve and fast track its citizens beyond the ‘middle income trap’. This is a dynamic that has played out before in some of Asia’s more mature economies, and the indications are the same for China. We advise Middle East investors seeking viable long-term assets to recognize and capitalize on China’s new economic frontiers.”

~ Yu-Ming Wang, Deputy President, Global Head of Investment and Chief Investment Officer - International