Market Access for Foreign Investors

Three programmes currently allow foreign investors to invest in China’s capital markets:

- The Qualified Foreign Institutional Investor (QFII) programme

- The Renminbi Qualified Foreign Institutional Investor (RQFII) programme

- Shanghai - Hong Kong Stock Connect

What is QFII?

The Qualified Foreign Institutional Investor (QFII) scheme was established in 2002 to allow foreign institutional investors to invest in equities and bonds listed on China’s domestic stock exchanges, using foreign currency (mainly US dollars) obtained outside mainland China.

What is RQFII?

Announced in 2011, the Renminbi Qualified Foreign Institutional Investor (RQFII) programme gives foreign investors access to the domestic markets using RMB funding obtained from outside mainland China — unlike the QFII program, which requires that foreign currency be converted into RMB for settlement.

What is Shanghai - Hong Kong Stock Connect?

Initiated only in November 2014, this programme allows foreign individual investors to buy ‘A’ shares listed on the Shanghai Stock Exchange via the Hong Kong Stock Exchange.

China Interbank Bond Market Access for Financial Institutions

The interbank bond market programme, set up in 2010, gives foreign investors direct access to the onshore interbank bond market within a People’s Bank of China-assigned quota. As of November 2015, the quota stood at about RMB600 billion, assigned to 138 investors, according to the central bank. The programme also offers the most flexibility as it imposes less restrictions as compared to the RQFII and QFII quota. However, the programme was limited to six types of foreign investors, namely foreign central banks, sovereign wealth funds, Renminbi clearing banks, Renminbi settlement banks, supra-nationals and insurance companies.

On 24 February 2016, the People’s Bank of China (PBoC) announced that the interbank bond market will open up to allow more eligible foreign institutional investors to participate. Foreign institutional investors will now include a wider group of foreign financial institutions including commercial banks, insurance companies, securities companies, fund management companies and other asset management institutions, investment products issued by these institutions to clients, and other medium and long term institutional investors approved by the PBoC. This means foreign investors will not be restricted by QFII / RQFII quota when investing in the onshore interbank bond market.

Source: Moody’s FAQ on The Opening Up of China’s Interbank Bond Market, 3 March 2016 and The People’s Bank of China, 23 March 2016

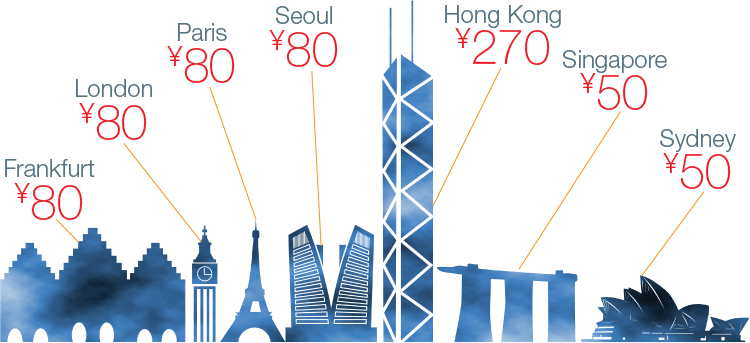

Total RQFII Quota RMB 970 Billion

In billions of RMB

Figures shown above only include listed markets with approved RQFIIsNumber of RQFII License Holders: 157 (and still growing)

- Frankfurt 1

- London 13

- Paris 3

- Seoul 20

- Hong Kong 99

- Singapore 20

- Sydney 1

- Canada 1

Source: SAFE, January 2016.