China's reform agenda for its financial sector focuses on boosting RMB's global role, liberalising its capital markets, increasing its sophistication and depth, and improving financial regulation.

The need to generate growth in a slowing economy is partly behind the reforms, but so is the desire to integrate Chinese markets with their global counterparts in order to elevate China’s stature as a global player.

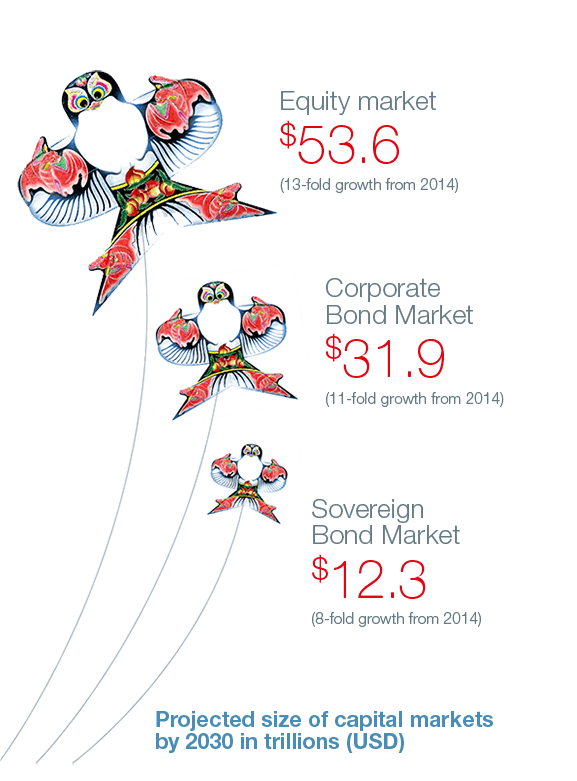

By 2030, China would be second only to the U.S. in all the major asset classes. Projected to hit US$98 trillion, the market is too large to ignore for global investors.

Source : The Financialist, by Credit Suisse, 22 July 2014.

Source : The Financialist, by Credit Suisse, 22 July 2014.