China Fixed Income Market

Offshore RMB Bonds

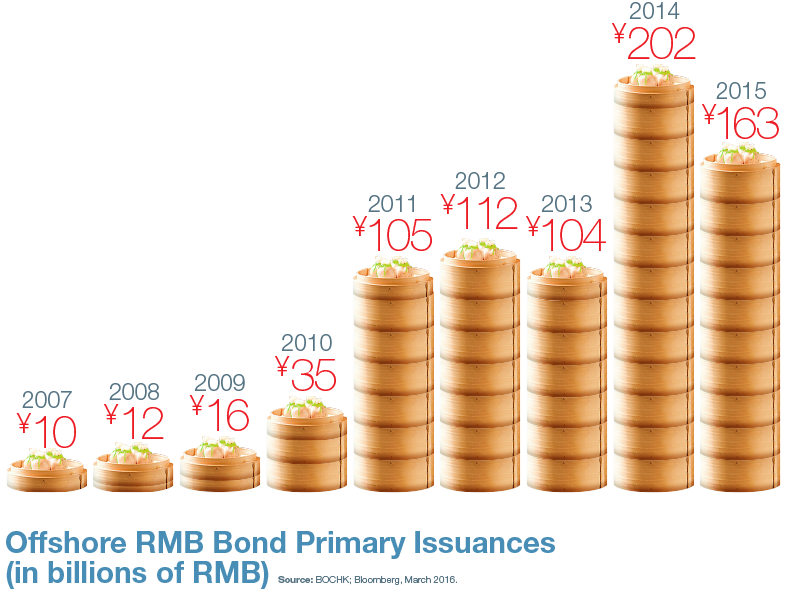

The offshore RMB (“dim sum”) bond market is small but has grown into a healthy market. Expanding offshore RMB bond issuance is one aspect of China’s aim to increase the international scope and potential of its corporate sector.

Dim Sum Rising

The depth and breadth of the offshore RMB bond market continue to develop substantially.

Dim Sum Bonds Info Menu:

2007First offshore RMB bond was issued by China Development Bank in Hong Kong in 2007.

McDonald’sIn 2010, McDonald's became the first foreign (non-financial) company to issue a dim sum bond.

Main IssuersMinistry of Finance, Chinese corporations, foreign institutions, MNCs, Hong Kong firms, and foreign local governments.

US$104 BillionMarket Capitalisation as of June 2014

Source : Income Partners, June 2014.

China Onshore Bonds

Direct exposure to China’s onshore bond markets has historically been out of reach for most foreign investors. With ongoing policies to relax its capital controls, China has opened its floodgates to foreign participation in its domestic capital markets. With the recent announcement of the opening up of China’s interbank bond market to foreign investors, most foreign investors will no longer be bounded by the QFII/RQFII investment quota restriction to invest in onshore.

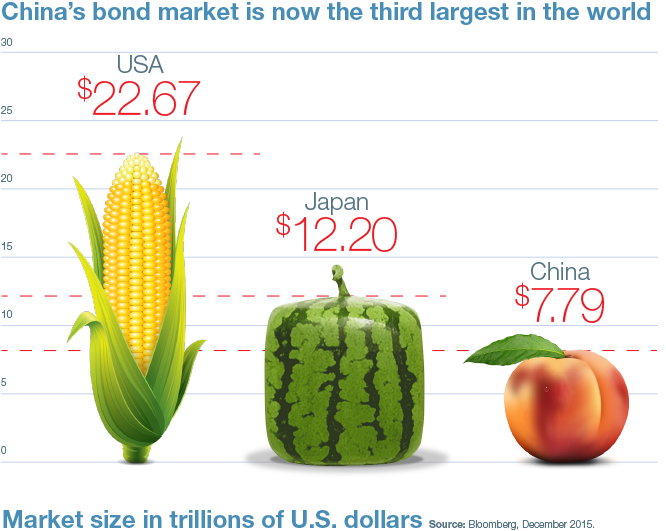

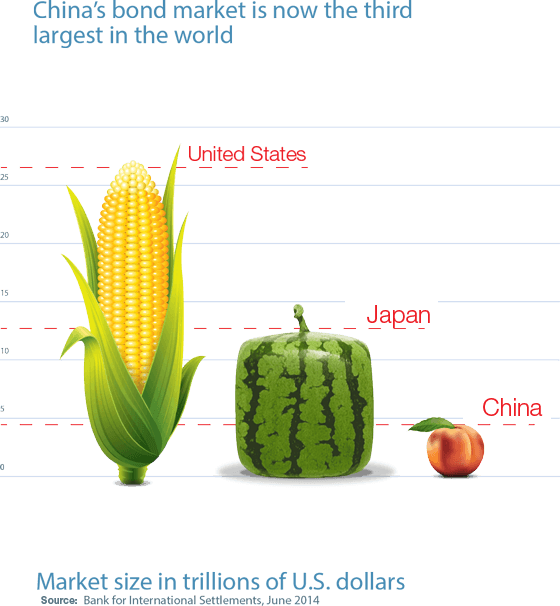

Size Matters:

19.23% Annual GrowthThe market has enjoyed an average annual growth rate of 19.23% in the last ten years, ending March 2015. Source : ADB, March 2015.

US$6.1 trillionUS$6.1 trillion market, according to Asian Bond Monitor, December 2015

3rd Largest3rd largest in the world after the US and Japan.

2X SizeAlmost 2X Shanghai’s US$2.9 trillion equity market.

60X BiggerChina’s onshore bond market is about 60 times bigger than dim sum bond market.

Greater Issuer MixIts significantly bigger size offers greater diversity in sector, issuer and tenor.

Source : BIS Quarterly Review; Standard Chartered, BNP Paribas, 2014.

Reasons to invest in China’s onshore bond market

TransparencyWith more international institutions now qualified to trade on the inter-bank bond market, they would bring to China more international investment experience, rating mechanisms and best practices.

Source : China's Capital Markets - The Changing Landscape, KPMG, June 2011.

Higher YieldsYield on the onshore 10-year government bond stood at about 2.87% as at 16 March 2016, compared with 1.91% for similar U.S. Treasuries, 0.31% for German Bunds and -0.08% for Japanese government bonds.

Source : Bloomberg, Nikko AM Asia, 16 March 2016

DiversificationPerformance and nature of China onshore bonds are vastly different from developed market bonds — offering portfolio diversification.

CurrencyRMB’s inclusion into the IMF Special Drawing Rights (SDRs) currency basket gives the RMB tremendous scope for long-term appreciation.

RMB Bonds still yield higher than most Developed Market Bonds

Source : Bloomberg, Nikko AM Asia, 16 March 2016